Crude benchmarks higher following a report on new Russian energy sanctions; Markets await an address by President Trump - Newsquawk US Market Open

- US President Trump is to give an address to the nation on Wednesday night, live from the White House at 21:00EST (02:00GMT Thursday). White House Press Secretary said that Trump’s address will be about accomplishments, while he will talk about what's to come and maybe tease new year policies.

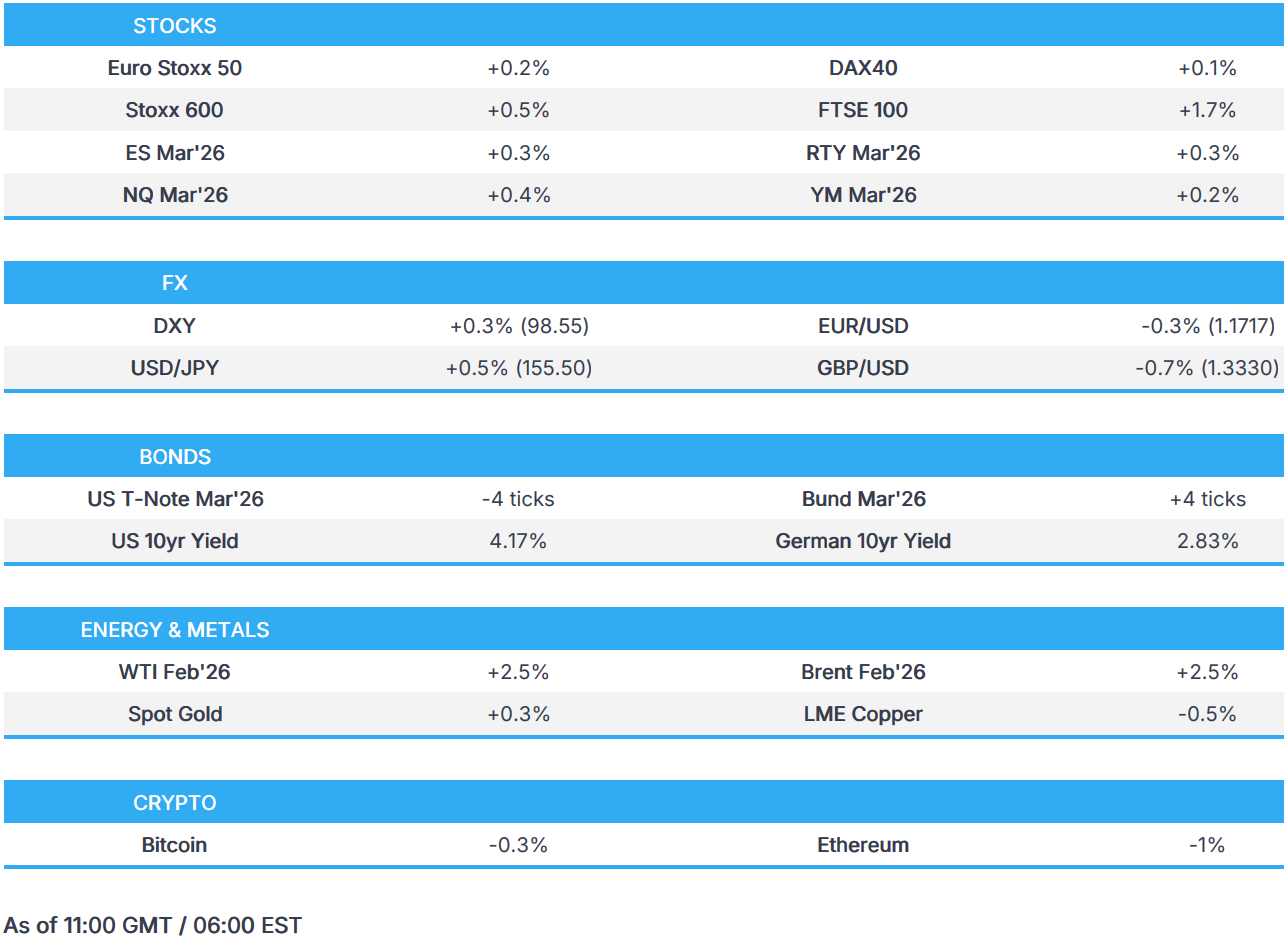

- European bourses are mostly stronger this morning, with US equity futures also posting modest upside.

- DXY is firmer, the GBP has been hit after the UK’s cooler-than-expected inflation report, which near-enough cements a BoE cut this week.

- Gilts outperform on the UK’s data whilst USTs hold a downward bias.

- Crude benchmarks reverse Tuesday's losses following the blockade of Venezuelan oil tankers and reports of new Russian energy sanctions if Russia rejects the peace deal; XAU and Copper trading with slight gains.

- Looking ahead, highlights include Fed's Waller, Williams & Bostic, Supply from US, Earnings from Micron, New Zealand GDP (Q3).

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

TRADE/TARIFFS

- The UK Government announces that they are to re-join the EU's Erasmus+ programme in 2027, with the deal including a 30% discount compared to the default terms. The UK and EU set a deadline to agree a food and drink trade deal and carbon markets linkage in 2026. Negotiations on electricity market integration has also been agreed. UK contribution will be about GBP 570mln for 2027.

- UK's EU Relations Minister Thomas-Symonds is expected to announce the UK will rejoin the Erasmus student exchange program at 12:30 GMT, according to POLITICO. The Times said UK was not able to negotiate as large a discount as it wanted from the GBP 120mln/yr that was announced.

- EU diplomats told POLITICO, regarding the Mercosur trade deal, "If a compromise emerges on safeguards, EU ambassadors are expected to vote on the overall deal (Mercosur) on Friday".

- South Korea is to push for service sector FTA with China and CPTPP affiliation for export momentum, according to Yonhap.

- China commerce ministry said the UN convention on cargo documents fully demonstrates China's determination and actions to uphold true multilateralism, and strive to provide public goods globally.

- US and Japan are to consider projects that may tap the USD 550bln fund, according to Bloomberg.

- US President Trump posted "Numbers recently released show that TARIFFS have reduced the Trade Deficit of the United States by more than half. This is larger than anyone, except ME, projected, and will only get stronger in the near future". Full post: "Numbers recently released show that TARIFFS have reduced the Trade Deficit of the United States by more than half. This is larger than anyone, except ME, projected, and will only get stronger in the near future. Everybody should pray that the United States Supreme Court has the Wisdom and Genius to allow Tariffs to GUARD our National Security, and our Financial Freedom! There are Evil, America hating Forces against us. We can not let them prevail. Thank you for your attention to this matter. MAKE AMERICA GREAT AGAIN!".

EUROPEAN TRADE

EQUITIES

- European equities are trading mostly firmer. The FTSE 100 (+1.4%) is the outperformer following cooler-than-expected CPI, which increased the odds of a December cut to near 100%.

- European sectors are mixed. Leading sectors are Basic Resources (+1.1%), Banks (+1.1%) and Energy (+1.1%). Sentiment for Basic Resources has been underpinned by an uptick in metal prices. Energy has been lifted by crude prices nursing the prior day's losses, fuelled by geopolitical tension between the US and Venezuela after US President Trump's announcement of a blockade of sanctioned oil tankers entering and leaving Venezuela. Furthermore, a Bloomberg report on potential Russian energy sanctions lifted crude to highs.

- US equity futures (ES +0.3% NQ +0.4% RTY +0.3%) are trading on a slightly firmer footing, following the strength in Europe. Of note for NVIDIA, US House China Panel wrote a letter to US Commerce Secretary Lutnick, stating that NVIDIA (NVDA) H200 chip sales to China risk US' advantage.

- OpenAI is in talks to raise at least USD 10bln from Amazon (AMZN) and use its AI chips, according to The Information.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- The USD is stronger against all G10FX peers following Tuesday's US data deluge, along with broad weakness across other majors, especially GBP and JPY. The session ahead sees comments from Fed second-in-command Williams, Fed Chair candidate Waller, and 2027 voter Bostic. There are no notable data releases until Thursday, November US CPI. DXY trades within a 98.17-98.64 range, with further gains in the greenback capped by its 100DMA at 98.62.

- EUR is a little lower vs the broadly stronger USD. The single currency was little moved following the German Ifo metrics (slightly shy of exp.) and EZ HICP Finals which remained unrevised. Currently within a 1.1704 to 1.1752 range.

- GBP underperforms vs G10 peers. Policymakers on Threadneedle Street this morning will welcome the cooler-than-expected UK inflation print for November, aligning with the BoE's view that inflation had peaked and coming in at 3.2% against the expected 3.5%, lower than October's 3.6% print. GBP, against the EUR and USD has been weakening since the 07:00 data, with further moves likely to encounter resistance at the 0.8795 and 1.33 levels respectively. Following the data, markets have moved to price an additional 10bps of easing in 2026, moving from 58bps (Tuesday) to 66bps. For the BoE confab on Thursday, expectations rose from c. 91% to a fully priced 25bps cut.

- USD/JPY is lower today. Despite better-than-expected Japanese exports and machinery orders, the stronger USD, firmer energy benchmarks (on the day), and technicals have weighed on the haven in light newsflow. Remarks from Japanese Government panel member Nagahama did little to move the JPY, he said the BoJ's monetary policy appears to be heavily influenced by FX moves. Since the beginning of the European session, and partially coinciding with the aforementioned comments, the pair breached the psychological 155 level, last crossed on Monday. As such, USD/JPY trades within 154.52-155.59 parameters. Levels to be aware of include 21 and 50DMAs, at 155.95 and 154.25, respectively.

- PBoC set USD/CNY mid-point at 7.0573 vs exp. 7.0386 (Prev. 7.0602).

FIXED INCOME

- Gilts are the clear outperformer this morning. Gapped higher by 73 ticks, boosted by a cooler-than-expected November CPI series. A release that cements a December cut with markets now assigning a 99% chance of such a move (vs 91% pre-release). Ahead of the data, sell-side analysts generally viewed a 5-4 vote split as the consensus; the release today could now see the split shift a bit more dovishly. The current hawks are Mann, Pill, Greene and Lombardelli; the latter has been viewed as the most likely candidate to join Bailey in cutting rates in December, with Chief Economist Pill perhaps the other member to watch. Back to price action, Gilts are currently higher by 50 ticks and at the lower end of a 91.38 to 91.78 range.

- USTs are a touch lower this morning, pulling back after ultimately settling in the green on Tuesday. Currently trading towards the lower end of a narrow 112-11 to 112-17+ range. Ahead, US data is lacking (CPI tomorrow); before that, the POTUS will deliver remarks where he could potentially outline new policies for the new year.

- Bunds were essentially unchanged throughout overnight trade, but then caught a bid following the release of the UK’s inflation report (see below). The German benchmark swung from troughs to peaks following the release, but have since scaled back towards the midpoint of a 127.53 to 127.79 range. No real move on the German Ifo data, which was broadly slightly shy of expectations, another disappointing release from the region. From an inflationary standpoint, a recent Bloomberg article suggested that the US is planning new energy sanctions on Russia, if they reject a peace deal with Ukraine. This sparked upside in the crude complex, putting the German benchmark under very slight pressure – albeit within ranges.

COMMODITIES

- Crude benchmarks have completely reversed the losses seen throughout Tuesday’s as the US blocks sanctioned oil tankers going in and out of Venezuela and recent reports, from Bloomberg sources, that the US are preparing new Russian energy sanctions if Russia rejects a Ukraine peace deal. Kremlin recently said that it had not yet seen the report, but highlighted that any sanctions will harm attempts to mend relations. As soon as the Bloomberg reports came out regarding new Russian energy sanctions, WTI lifted from USD 55.95 to a 56.74/bbl session high while Brent rose from USD 59.60 to a 60.40/bbl session high.

- Spot XAU continued to grind higher throughout the APAC session but remains well-contained within Friday’s range of USD 4257-5354/oz. After opening just above USD 4300/oz, XAU gradually traded higher and briefly extended beyond Tuesday’s high of USD 4335/oz, peaking at USD 4342/oz, before falling back into Tuesday’s range. XAG has, in recent sessions, dragged the yellow metal higher as investors look for cheaper alternatives to gold. XAG extended to a new ATH of USD 66.52/oz in the APAC session.

- 3M LME Copper bid higher throughout the Asia-Pac session, trending from USD 11.62k/t to a peak of USD 11.79k/t, in-line with the rest of the metals space. The red metal has slightly pulled back as the European session gets underway, dipping to a trough of USD 11.7k/t, but gains remain mostly in-tact as trade continues.

- Kazakhstan Deputy Energy Minister said Kazakhstan oil production in the first 11 months of 2025 totalled 91.9mln tons and exports were 73.4mln tons.

- Chevron Corp (CVX) spokesperson said operations in Venezuela continue without disruption following Trump's blockade order.

- US Private Inventory Data (bbls): Crude -9.3mln (exp. -1.1mln), Distillate +2.5mln (exp. +1.2mln), Gasoline -4.8mln (exp. +2.1mln), Cushing -0.5mln.

NOTABLE EUROPEAN HEADLINES

- EU Climate Commissioner said they are not exempting any countries from the Carbon levy, though the UK could be exempt but only after UK carbon market linked to EU's.

- EU Commission proposes extending carbon border levy to downstream steel and aluminium-heavy products. Would also apply it to imported washing machines and machinery. Carbon borders levy revenues from 2026-27 for fund to support EU industries. Proposes system to prevent circumvention of carbon border levy, including by applying default country emissions values if companies provide unreliable data.

- French Socialists (PS) have reportedly outlined conditions that would enable them to abstain instead of voting against the Finance Bill, via Politico citing various press; specific demands incl. EUR 10bln in additional spending via new financing streams.

- UK PM Starmer pushes back on delayed defence spending plan and has asked military chiefs to rework aspects of the defence investment plan, according to FT.

- Germany is set to approve EUR 50bln in military purchases, according to FT.

- New South Wales Premier Chris Minns said to recall state parliament to discuss legislation on firearms which will cap number of firearms that can be owned and will reclassify other types of guns, as well as reduce magazine capacity for shotgun.

NOTABLE EUROPEAN DATA RECAP

- UK CPI YY (Nov) 3.2% vs. Exp. 3.5% (Prev. 3.6%).

- UK CPI MM (Nov) -0.2% vs Exp. 0.0% (Prev. 0.4%); MM (Nov) -0.2% (Prev. 0.4%).

- UK Core CPI MM (Nov) -0.2% vs. Exp. 0.1% (Prev. 0.3%); Core CPI YY (Nov) 3.2% vs. Exp. 3.4% (Prev. 3.4%).

- UK CPI Services MM (Nov) -0.20% vs. Exp. 0.0% (Prev. 0.20%); Services YY (Nov) 4.40% vs. Exp. 4.50% (Prev. 4.50%).

- UK PPI Core Output YY NSA (Nov) 3.5% (Prev. 3.5%, Rev. 3.6%).

- UK PPI Core Output YY NSA (Nov) 3.5% (Prev. 3.5%).

- UK PPI Input Prices YY NSA (Nov) 1.1% (Prev. 0.5%).

- UK PPI Output Prices YY NSA (Nov) 3.4% (Prev. 3.6%).

- UK RPI YY (Nov) 3.8% vs. Exp. 4.2% (Prev. 4.3%).

- UK RPI MM (Nov) -0.5% (Prev. 0.3%).

- UK PPI Output Prices MM NSA (Nov) 0.1% (Rev. 0.1%).

- UK PPI Input Prices YY NSA (Nov) 1.1% (Prev. 0.5%, Rev. 0.8%).

- UK PPI Input Prices MM NSA (Nov) 0.3% (Prev. -0.3%).

- UK PPI Output Prices MM NSA (Nov) 0.1%.

- UK RPIX YY (Nov) 3.7% (Prev. 4.2%).

- UK RPI MM (Nov) -0.5% vs Exp. 0.0% (Prev. 0.3%).

- UK ONS House Price Index (Oct) +1.7% Y/Y. Private Rents (Nov) +4.4% Y/Y.

- German Ifo Current Conditions New (Dec) 85.6 vs. Exp. 85.8 (Prev. 85.6); Ifo Expectations New (Dec) 89.7 vs. Exp. 90.5 (Prev. 90.6); Ifo Business Climate New (Dec) 87.6 vs. Exp. 88.2 (Prev. 88.1).

- EU HICP Final YY (Nov) 2.1% vs. Exp. 2.2% (Prev. 2.2%); HICP Final MM (Nov) -0.3% vs. Exp. -0.3% (Prev. 0.2%)

NOTABLE US HEADLINES

- US President Trump is expected to sign an executive order as soon as this week that would fast-track reclassification of cannabis, according to NBC News.

- US told China it's ready to defend interests in Indo-Pacific, Bloomberg reported.

- Fed's Goolsbee (2025 voter, hawkish dissenter) said job market is cooling at a modest pace. Said: As we go into 2026, optimistic economy will sustain at stabilised rate.

- Trump officials privately raise doubts about Hassett for Fed chair, with his critics saying he has not been effective as head of the National Economic Council, playing little part in driving policies, according to POLITICO.

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Kremlin said it is not expecting US envoy Witkoff to come to Moscow this week. As soon as the US are ready, they will inform Moscow about their talks with Ukraine.

- US readies new Russian energy sanctions in the scenario that Russia rejects a Ukraine peace deal, according to Bloomberg sources; could potentially be announced as early as this week. Considering options such as targeting vessels in Russia’s "shadow fleet" of tankers used to transport Moscow’s oil. Crude benchmarks saw immediate upside. WTI lifted from USD 55.95 to a 56.68/bbl session high. Brent rose from USD 59.60 to a 60.33/bbl session high.

- Ukraine's military strikes Russian oil refinery in Krasnodar region.

- EU ambassadors convene at 08:00 GMT, to talk on frozen Russian assets; a diplomat told POLITICO it was "still quite early". Belgian Prime Minister De Wever is expected to float a legal workaround at Thursday’s summit that would allow joint EU borrowing for Ukraine, according to four diplomats. POLITICO writes that EU joint borrowing was first aired by ECB's Lagarde, and since received support from Italy, though the idea has since been disregarded with officials dismissing it as legally unviable.

- Ukrainian drone attack on Russia's Krasnodar region injures two people and cuts power to parts of the region, according to regional authorities.

MIDDLE EAST

- Israeli forces conduct raids in Al Tuffah and Al Zaytoun neighbourhoods east of Gaza City, according to Al Jazeera.

CRYPTO

- Bitcoin is essentially flat and trades around USD 86.5k; Ethereum is also steady and holds just above USD 2.9k.

APAC TRADE

- APAC stocks were indecisive with the region lacking conviction following the uninspiring lead from Wall Street where price action was choppy as participants digested a deluge of mixed data releases.

- ASX 200 was subdued in the absence of bullish drivers and as gains in the mining, materials and resources sectors were offset by weakness in energy, defensives and financials.

- Nikkei 225 swung between gains and losses amid a choppy currency and as participants digested the better-than-expected Japanese machinery orders and exports data, but with upside limited as an anticipated BoJ rate hike looms.

- Hang Seng and Shanghai Comp initially traded indecisively in a narrow range with little fresh macro catalysts from China, and after the PBoC drained liquidity in its open market operations. The bourses later climbed to session highs.

NOTABLE ASIA-PAC HEADLINES

- India's Finance Minister said bringing down India's debt to GDP ratio will be a core priority for the government for the next fiscal year, adds high debt to GDP ratio in some Indian states is a cause of worry.

- Japanese PM Takaichi said Japan needs to strengthen its capacity through proactive fiscal policy rather than excessive fiscal tightening. said:. Sustainable fiscal policy and the social welfare system will be achieved by reflating the economy, improving corporate profits and raising household income through wage gains that boost tax revenues. Fiscal spending will be strategic rather than a reckless expansion.

- Australia Treasurer Chalmers said FY27/28 budget deficit seen rising to AUD 32.6bln.

- Former BoJ Deputy Governor Wakatabe said BoJ must raise the neutral interest rate through fiscal policy and growth strategies, adds the neutral interest rate would rise if demand for funds increases. said:. If the neutral rate rises due to fiscal policy and growth strategies, it would be natural for the Bank of Japan to raise interest rates. The Bank of Japan should avoid premature rate hikes and excessive adjustment of monetary support given the level of the neutral rate. Sanaenomics carries over elements of Abenomics, but focuses more on strengthening the supply side of the economy.

- BoK Governor Rhee said will make sure outbound investment to US from a trade deal doesn't hurt Forex stability. said:Need to make MPS hedging strategies more flexible and less transparent to curb herd-like behaviour.

- Bank of Korea said 2026 inflation could exceed forecasts if KRW remains weak against USD.

- Confederation of Japan Automobile Workers’ Union president Kaneko said he’s concerned that a BoJ rate hike on Friday could weigh on companies’ ability to raise wages next fiscal year. said:“If the yen sharply strengthened after Friday’s decision, it could affect corporate sentiment”.

- South Korea forex authority said it resumes currency swap with the Bank of Korea.

NOTABLE APAC DATA RECAP

- Japanese Machinery Orders MM (Oct) 7.0% vs. Exp. -2.3% (Prev. 4.2%).

- Japanese Trade Balance Total Yen (Nov) 322.2B vs. Exp. 71.2B (Prev. -231.8B, Rev. -226.1B).

- Japanese Machinery Orders YY (Oct) 12.5% vs. Exp. 3.6% (Prev. 11.6%).

- Japanese Imports YY (Nov) 1.3% vs. Exp. 2.5% (Prev. 0.7%).

- Japanese Exports YY (Nov) 6.1% vs. Exp. 4.8% (Prev. 3.6%).

- Australian Westpac Leading Index MM (Nov) -0.04% (Prev. 0.11%, Rev. 0.10%).

- New Zealand Current Account Quarterly (Q3) -8.365B vs. Exp. -8.104B (Prev. -0.970B).

- New Zealand Current Account Annual (Q3) -15.370B vs. Exp. -14.800B (Prev. -15.956B).

- New Zealand Current Account/GDP (Q3) -3.5% vs. Exp. -3.4% (Prev. -3.7%).