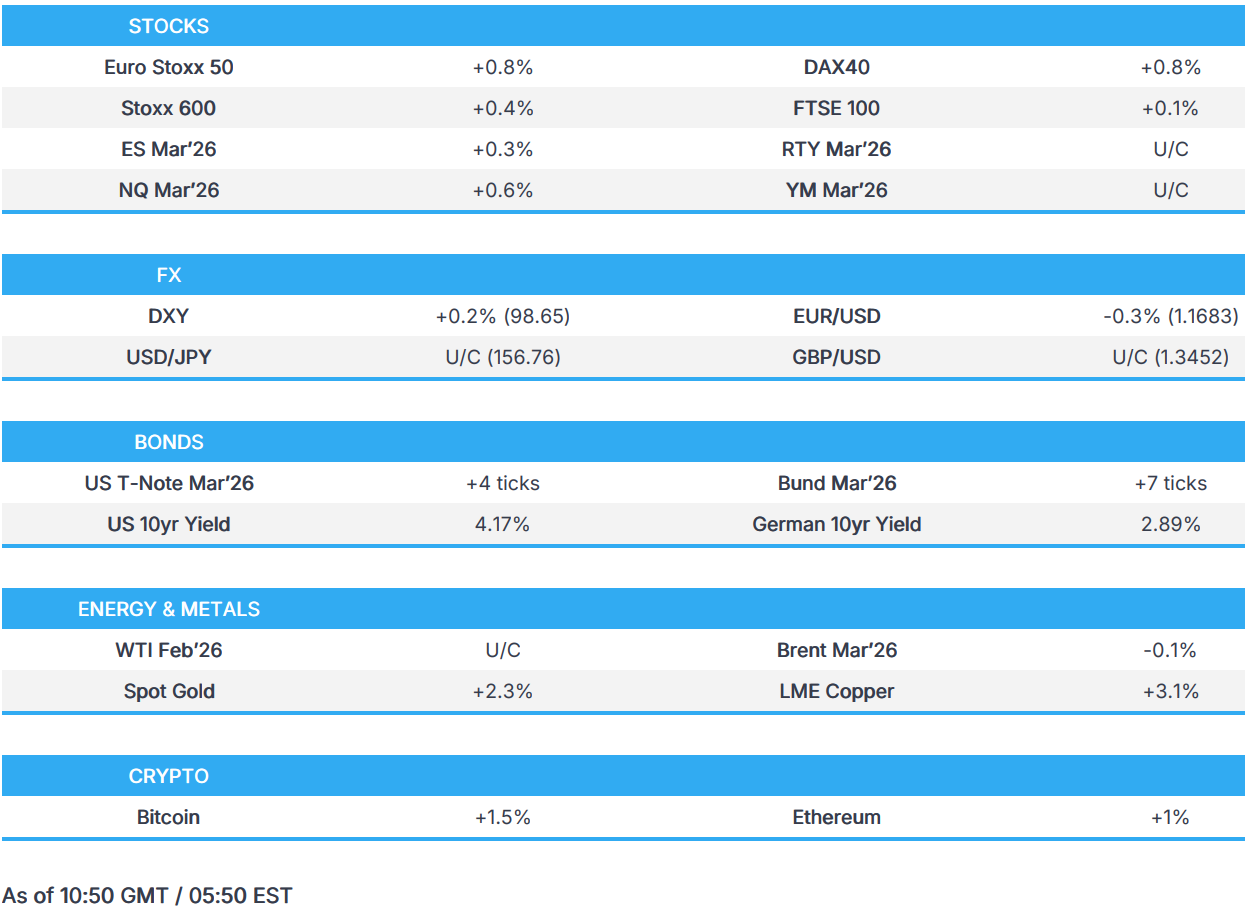

Crude benchmarks trade choppy following US strike on Venezuela; US equity futures are mixed but NQ outperforming - Newsquawk US Market Open

- US President Trump announced on Saturday that the US successfully carried out a large-scale strike against Venezuela, while he added that President Maduro and his wife were captured and flown out of Venezuela.

- US President Trump said they are ready to stage a second strike if necessary and had assumed a second wave was needed, but now probably not.

- US President Trump signalled the US could widen its focus in the region to Cuba, and he will be meeting with House Republicans in a closed-door meeting on Tuesday. Further, Trump said it “sounds good” to him regarding whether there will be an operation in Colombia.

- European bourses are broadly in the green; US equity futures are mixed, with outperformance in the NQ. ASML +3% named top pick at Bernstein.

- DXY firmer on haven appeal, G10s subdued across the board to various degrees; Global fixed income slightly firmer with non-geopolitical updates somewhat light, ISM ahead.

- Choppy price action in the crude complex as geopolitics remain in focus; XAU gain on safe-haven demand; Copper raises following strength in the semiconductor sector.

- Looking ahead, highlights include US ISM Manufacturing PMI (Dec).

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.4%) are broadly on a stronger footing this morning (ex-SMI), with sentiment seemingly boosted by the US strike on Venezuela. A move which has pressured energy prices, and perhaps boosts optimism surrounding cheaper oil for global firms.

- European sectors are mixed, with Tech, Industrials and Basic Resources forming the top three; Tech lifted by ASML, Industrials by defence names and Basic Resources benefits from stronger copper prices. Food Beverage & Tobacco lags, hampered by Nestle.

- ASML (+3%) has been boosted after Bernstein named the Co. as its top pick for 2026, citing a combination of accelerating memory investment and a more attractive valuation backdrop; its updated PT of EUR 1300/shr (prev. EUR 800/shr), implies a circa 30% gain from current levels.

- US equity futures (ES +0.3%, NQ +0.6%, RTY U/C) are mixed, but with outperformance in the tech-heavy NQ, following the strength seen in Europe. US energy names are soaring in pre-market trade with the likes of Chevron (+6.5%), Exxon (+3.5%) and Occidental (+1.5%) all stronger; the former outperforms given its existing exposure in the region.

- Foxconn (2354 TT) December Revenue TWD 862.9bln, +31.8% Y/Y (prev. +25.5% Y/Y). Q4'25 revenue exceeded out expectation of significant growth, causing a high base for Q1'26. With the continued ramp-up in AI rack shipments, the seasonality of this Q1 is expected to be near the upper end of the past 5-year range.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- Dollar benefitted overnight from the mild losses in its major peers and with some haven appeal following the US intervention in Venezuela, with President Trump stating that the US will 'run' Venezuela and 'fix oil infrastructure', while he also signalled potentially widening their focus in the region to Cuba and Colombia.

- "Given the uncertainty about how the next few days will pan out, investors will probably prefer the liquidity of the dollar", suggests the analysts at ING, whilst adding that "Away from Venezuela, the dollar could also be enjoying some delayed buying interest after the blow-out 4.3% quarter-on-quarter annualised US third quarter GDP figure released on 23 December."

- Aside from that, little to mention on FX during the European session thus far. JPY sees shallower losses than other peers on haven appeal, although the CHF has plumbed the depths, although no obvious catalysts to explain the downside. GBP narrowly outperforms the as the cross fell under 0.8700 for the first time since Oct 2025. AUD and NZD are both subdued by the Buck, although the AUD/NZD cross remains above 1.1600 amid firmer copper prices.

- Click for NY OpEx Details

FIXED INCOME

- A slightly firmer start for Bunds and USTs. All focus on the geopolitical situation re. Venezuela, with newsflow otherwise a little light.

- Bunds up to a 127.31 peak with gains of 20 ticks at best. However, the benchmark has since trimmed to unchanged but remains clear of the overnight 126.98 low. Within Europe, focus on Dutch pension reform as while the switch in the pension system has been long flagged, the full scale of the impact is not yet known.

- USTs similar, hit a 112-12 peak with strength of six ticks at best before fading to just above unchanged but above the 112-05 base.

- JGBs sold overnight as the 10yr yield hit another multi-year high amid outperformance in domestic stocks.

- Ahead, US ISM Manufacturing is the main scheduled event. However, any fresh updates on the geopolitical situation will undoubtedly take centre stage.

COMMODITIES

- Crude benchmarks was choppy in APAC trade, but then moved lower in the early portion of this morning, as traders digest the US strike on Venezuela and the capturing of President Maduro. US President Trump commented that they are going to run Venezuela and “get oil flowing like it should be”. This hints of further addition of oil into an already-oversupplied market, causing Brent to fall below USD 60/bbl. Since, the complex has trimmed earlier losses to now trade around unchanged; Brent Mar in a USD 59.75-61.24/bbl parameter.

- Spot XAU gapped higher, opening at USD 4357/oz, and continued to trend higher to an APAC session high of USD 4420/oz. Currently, XAU is trading at session highs of USD 4432/oz, with demand for safe havens rising, following the Venezuela strike, but also potential further rate cuts by the Fed and continued concerns over US fiscal debt

- 3M LME Copper gapped above the range formed in the past 2 trading sessions, opening at USD 12.68k/t and driving to a high of USD 12.88k/t as the APAC session got underway. The red metal consolidated before briefly extending to a new session high of USD 12.91k/t. However, price pulled back but 3M LME Copper remains above USD 12.8k/t and just shy of ATHs at USD 12.97k/t.

- OPEC+ agreed to keep the group’s output unchanged as expected following a brief meeting on Sunday.

- Venezuela's oil exports, which had dropped to a minimum amid the US blockade of sanctioned tankers, are said to now be paralysed as port captains have not received requests to authorise loaded ships to set sail, according to four sources close to operations cited by Reuters.

- Former top Chevron executive is raising USD 2bln for Venezuelan oil projects as investors race to heed Trump’s call to pour “billions of dollars” into the country, according to FT.

- Goldman Sachs said Venezuela's oil production could increase in the long term and that scope for higher Venezuelan oil output could eventually pressure prices, according to Bloomberg.

TRADE/TARIFFS

- US President Trump said could raise tariffs on India if they don't help on Russian oil issue.

- US President Trump blocked HieFo Corp's USD 3mln acquisition of assets in New Jersey-based aerospace and defence specialist Emcore on Friday and ordered HieFo to divest all interests and rights in Emcore assets due to national security and China-related concerns, according to Reuters.

- Irish PM Martin arrived in Beijing as part of a five-day visit aimed at boosting trade between the two countries, according to Chinese state media. There were later reports that Chinese President Xi said in a meeting with Ireland's PM that China and the EU should take a long-term view and adhere to the positioning of partnership, while Xi also commented that unilateral bullying is undermining the international order.

NOTABLE EUROPEAN HEADLINES

- UK PM Starmer said the UK should move to closer alignment with the European single market on an "issue-by-issue" basis if it is in the national interest, according to Reuters.

- Chinese President Xi said in a meeting with Ireland's PM that China and the EU should take a long-term view and adhere to the positioning of partnership and view, according to Xinhua.

NOTABLE EUROPEAN DATA RECAP

- UK BOE Consumer Credit (Nov) 2.077B GB vs. Exp. 1.1B GB (Prev. 1.119B GB, Rev. 1.713B GB).

- UK M4 Money Supply (Nov) 0.8% (Prev. -0.2%).

- UK Mortgage Approvals (Nov) 64.53k vs. Exp. 64.4k (Prev. 65.018k, Rev. 65.01k).

- UK Mortgage Lending (Nov) 4.49B GB vs. Exp. 4.5B GB (Prev. 4.273B GB, Rev. 4.156B GB).

- Swiss Manufacturing PMI (Dec) 45.8 (Prev. 49.7).

CENTRAL BANKS

- Bank of Japan Governor Ueda reiterates readiness to raise rates if economic outlook is achieved.

NOTABLE US HEADLINES

- Nomura CEO sees the Fed cutting rates twice this year.

- Fed’s Paulson (2026 voter) said she sees inflation moderating, the labour market stabilising and growth coming around 2% this year, while she added that if all of that happens, then some further adjustments to the Fed Funds Rate would likely be appropriate later in the year. Paulson said she views the current level of rates as still restrictive and sees a decent chance that they will end the year with inflation that is close to 2% on a run-rate basis, as tariff-related price adjustments will likely be completed. Furthermore, she stated that while the labour market is bending, it is not breaking and that the baseline outlook for the economy is pretty benign.

- White House is considering giving Homeland Security Adviser Stephen Miller a greater role in overseeing operations in post-Maduro Venezuela, according to Washington Post.

GEOPOLITICS

- US President Trump announced on Saturday that the US successfully carried out a large-scale strike against Venezuela, while he added that President Maduro and his wife were captured and flown out of Venezuela. Trump also commented that they are going to run Venezuela until such a time that they can do a safe, proper and judicious transition, while he added they are going to run Venezuela with a group and will get oil flowing like it should be, with Trump anticipating US oil producers spending billions in Venezuela.

- US President Trump said they are ready to stage a second strike if necessary and had assumed a second wave was needed, but now probably not. Furthermore, he said the US is not afraid of boots on the ground in Venezuela, and commented that they will be ‘reimbursed’ and will be selling large amounts of oil to other countries. It was separately reported that President Trump signalled the US could widen its focus in the region to Cuba, and he will be meeting with House Republicans in a closed-door meeting on Tuesday, following mixed reactions to the Venezuela attack including praise from top Republicans regarding the operation and questions by some lawmakers regarding the legal authority.

- US President Trump said it sounds good to him regarding whether there will be an operation in Colombia, while he added that Colombia is very sick as the country is being run by a sick man, but he won't be doing it very long. Trump also commented that Cuba looks like it is ready to fall and looks like 'its going down for the count'. Furthermore, Trump said if Venezuela doesn't behave, the US will do a second strike on Venezuela and noted that troops on the ground in Venezuela depend on how they act, while it was separately reported that Trump warned of dire consequences if Venezuela fails to meet US demands.

- Venezuela’s VP Rodriguez was granted temporary presidential powers, while she called for the return of Maduro and said the capture of Maduro has a ‘Zionist tint’. Furthermore, she said that they will not be anyone’s colony and that what is being done to Venezuela is barbaric.

- US Secretary of State Rubio and Defense Secretary Hegseth are among the Trump administration officials to brief some lawmakers regarding Venezuela on Monday, according to Punchbowl and The Hill.

- US Transportation Secretary Duffy said original restrictions around the Caribbean airspace were expiring and flights could resume.

- World leaders responded to the situation in Venezuela and largely called for restraint and an orderly transition to a legitimate government. Furthermore, German Chancellor Merz said the legal assessment of US strikes in Venezuela was complex, while Spanish PM Sanchez said they will not recognise a US intervention in Venezuela that violates international law, and UK PM Starmer said the UK sheds no tears about the end of Maduro's regime.

- China said the US should immediately release Venezuela’s Maduro and his wife and resolve the situation in Venezuela through dialogue and negotiation, according to Reuters. It was separately reported by Bloomberg that China was deeply shocked and strongly condemned the hegemonic acts by the US and that threaten peace and security in Latin America and the Caribbean region, while other allies of Venezuela’s allies including Brazil denounced the US attack, and Russia also criticised it as an 'unacceptable violation of the sovereignty of an independent state'.

- UN Security Council is to convene an emergency meeting on Monday to discuss the US operation in Venezuela.

RUSSIA-UKRAINE

- US President Trump said he is not thrilled with Russian President Putin regarding the war in Ukraine and said that too many people are dying, according to Bloomberg. Trump separately commented that there is no deadline on a Russia-Ukraine deal, while he thinks they will have a deal on Russia and Ukraine in the not-too-distant future.

- Moscow claims Ukraine is escalating drone attacks on Russia and has targeted Moscow with drones every day of 2026 so far, according to The Guardian.

- US President Trump said could raise tariffs on India if they don't help on Russian oil issue.

- US President Trump said it sounds good to him regarding whether there will be an operation on Colombia, adds Colombia is very sick as the country is being run by a sick man... but he won't be doing it very long. said:. If they don't behave, we will do a second strike on Venezuela, also noted that troops on the ground in Venezuela depend on how they act. No deadline on Russia-Ukraine deal. Think we'll have a deal on Russia and Ukraine in the not-too-distant future. Cuba looks like it is ready to fall and looks like 'its going down for the count'.

- Large-scale fire broke in the area of the "Energiya" plant in Russia's Lipetsk region following a drone attack.

MIDDLE EAST

- Iran’s Supreme Leader Khamenei labelled protestors ‘enemy mercenaries’, while he approved a crackdown and said that rioters must be put in their place, according to Iran International. It was separately reported by Reuters that US President Trump warned Iran on Friday that the US would come to the aid of protesters in Iran if security forces fired on them and said that the US is ‘locked and loaded and ready to go’. In relevant news, Iran’s Revolutionary Guards began a military exercise including missile launches and testing of air defence systems, according to correspondent Amichai Stein on X.

OTHERS

- Turkish President Erdogan said the return to the F-35 program is key to NATO security, according to Bloomberg.

CRYPTO

- Bitcoin is a little firmer this morning and trades above USD 92k, with Ethereum also gaining past USD 3.1k.

APAC TRADE

- APAC stocks were mostly higher as the region shrugged off the US strike on Venezuela and resumed last year's semiconductor-led rally which lifted the KOSPI to a record high, while TSMC shares also notched firm gains after Goldman Sachs raised its price target by 35% and its ADR's jumped late last week to become the sixth-largest company in the world by market cap.

- ASX 200 was flat as gains in mining and material stocks were counterbalanced by losses in the tech and consumer sectors.

- Nikkei 225 rallied on its first trading session of 2026 with notable strength in the heavy industries and semiconductor stocks.

- Hang Seng and Shanghai Comp traded mixed as the Hong Kong benchmark lagged and with the mainland buoyed on return from the New Year holiday closure, which saw the Shanghai Comp reclaim the 4,000 status, while participants digested the latest RatingDog Services PMI, which matched estimates at 52.0 (prev. 52.1) and the Composite figure slightly accelerated to 51.3 (prev. 51.2).

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Takaichi said will pursue economic growth relentlessly.

- Japanese PM Takaichi said 2026 can be a major turning point for Japan, adds Rapidus holds key to Japan's chip revival.

- Chinese President Xi said unilateral bullying is undermining international order, according to Bloomberg.

NOTABLE APAC DATA RECAP

- Chinese RatingDog Composite PMI (Dec) 51.3 (Prev. 51.2).

- Chinese RatingDog Services PMI (Dec) 52.0 vs. Exp. 52.0 (Prev. 52.1).

- Japanese S&P Global Manufacturing PMI Final SA (Dec) 50.0 (Prelim. 49.7).