AI 'Disruption' Fears Go Global: France's Dassault Crashes Most On Record After 'Weak Guide'

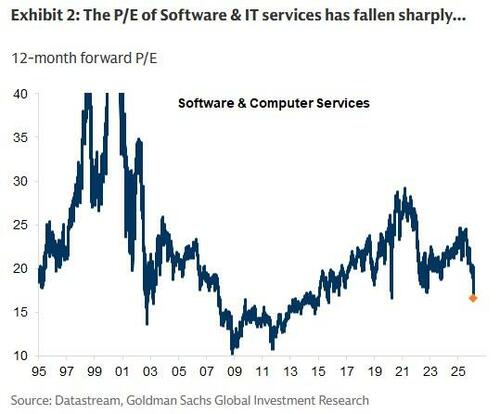

Dassault Systemes, which Nvidia has recently described as being at the epicenter of the "next frontier of artificial intelligence," suffered its largest intraday decline on record in Paris trading after issuing weaker-than-expected guidance. The miss reinforced the latest market narrative that some software firms are vulnerable to AI-driven disruption, a fear that has crushed software stocks in recent weeks.

Paris-based Dassault reported unaudited estimated financial results for the fourth quarter and guidance for the new year.

The focus among traders was on the company's guidance for 2026 sales growth of 3% to 5%, well below the 5.9% consensus among Wall Street analysts tracked by Bloomberg. The downgraded outlook was attributed to a softening automotive sector and shrinking life sciences activity.

Dassault also disclosed its annual run rate for the first time, a financial metric used in the software industry, but said growth was about 6% since the fourth quarter of 2023.

"In a software industry that has been accelerating to subscription/ recurring revenues, this is likely to be seen as underwhelming," Jefferies analyst Charles Brennan wrote in a note.

UBS analyst Michael Briest flagged in a note what he characterized as a "weak finish and a weak guide" for the software company.

Briest wrote:

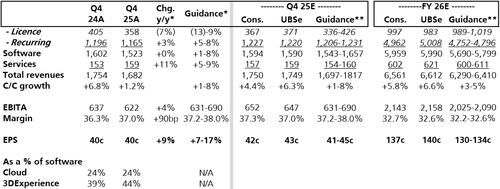

How did the results compare vs expectations?

A: Q4 revenues of €1,682m (cons. €1,750m) grew by 1.2% c/c (guidance 1-8%) and just 0.6% organically to €1,682m, with a weak Auto sector in Europe called out. Within this, total Software was flat at €1,523m (guidance 1-8%) with licences down 7% y/y to €358m and at the lower-end of guidance for (13)-9%, while recurring software grew by just 3% to €1,165m (guidance: +5-8%) with subscription up just 4% (guidance 8-12%) and support 2%. Q4 cloud revenues grew by 9% (Q3 25: +8%) but were up 38% for 3DX as Life Sciences fell by 4% y/y with Medidata impacted by lower study volumes. For the year, Medidata reported 1% growth in Direct Enterprise sales (70% of the total) - and would have been +6% excl. Moderna - but CRO volumes (30% of the total) fell by 5%. Q4's EBIT of €622m/37.0% was 5% below cons. of €652m/37.3% and light of guidance for 37.2-38.0%.

What were the most noteworthy areas in the results?

A: While Asia grew by 6% and the Americas 3%, Europe declined by 5% y/y in Q4. Life Sciences fell by 4% y/y (Q3: -3%). Mainstream 3D grew by 1% (Q3: +4%) despite "good growth" at Solidworks as CentricPLM weighed. 3DExperience revenues fell by 3% y/y (Q3: +16%). FCF for the year grew by 2% to €1,380m but would have been 5% excl. French tax effects albeit overall taxes paid were €32m lower y/y and DSOs rose to 117 vs 109 last year. Contract liabilities movements were also a slight outflow in the year we note. Headcount was down 0.2% y/y at 25,967. In a new KPI, ARR grew 6% y/y to €4,497 in Q4.

Has the company's outlook/guidance changed?

A: 2026 guidance is introduced for 3-5% c/c growth to €6,410m revenues at the high-end (VA cons. +5.8% to €6,561m) and assumes a $1.18 FX rate. This includes Software at 3-5% (cons. +5.5% c/c) and licences at (1)-2% (FY25: -6%). A margin of 32.2-32.6% is expected vs cons. at 32.7% and FY25's 32.0%. EPS should grow just 3-6% c/c to €1.30-1.34 (cons. €1.37). For Q1, total sales are expected to grow 1-5% to €1,541m at the high end (cons. €1,590m), with total software growing 1-5% (Q1 25: +5%), including licences at 0-8% y/y (Q1 25: -10%). Guidance is for a Q1 margin of 29.2-30.7% (cons. 31.9%). DS talks of "aligning the organisation to focus" on execution and a CMD is planned in November. Having set a goal to grow at least 7%pa from 2024-29, the guidance means DS now needs to grow 8.2-8.9% in 2027-29.

Via the UBS analyst: Figure 1: Dassault Q4 25 results summary (€m)

Shares in Paris posted their steepest decline on record, plunging 22%. The bull market peaked in 2021, and the liquidation phase has been ongoing since 2024. The next technical level to watch is the 76.4% Fibonacci retracement, around 15 euros.

Traders are sorting "AI winners vs. losers," pressuring companies seen as highly exposed, including peers such as Autodesk and Synopsys.

Dassault creates "virtual twins" using Nvidia models of complex machines, a field increasingly threatened by other AI "world models" that help systems navigate the physical world.

Software valuations have crashed.

But as we note in recent trading sessions:

Software Pops, Financials Flop As 'Bad' Data Sparks Bond Bid, Rate-Cut Hopes

'Off The Charts': Retail Is Buying-The-Dip In Software Stocks Like Never Before

Our Market Ear technicians say:

"Our vision is built on decades of industrial and scientific knowledge and know-how, and we are now building the capabilities to turn that vision into reality," CEO Pascal Daloz said in a statement, adding, "True transformation takes time, for our customers and for ourselves."