Democrat Schumer threatens a partial government shutdown; USD/JPY extends below 154 on double intervention risks - Newsquawk US Market Open

- US Senate Minority Leader Schumer threatened a partial government shutdown over DHS funding following the fatal shooting of a Minneapolis man by a Border Patrol agent on Saturday.

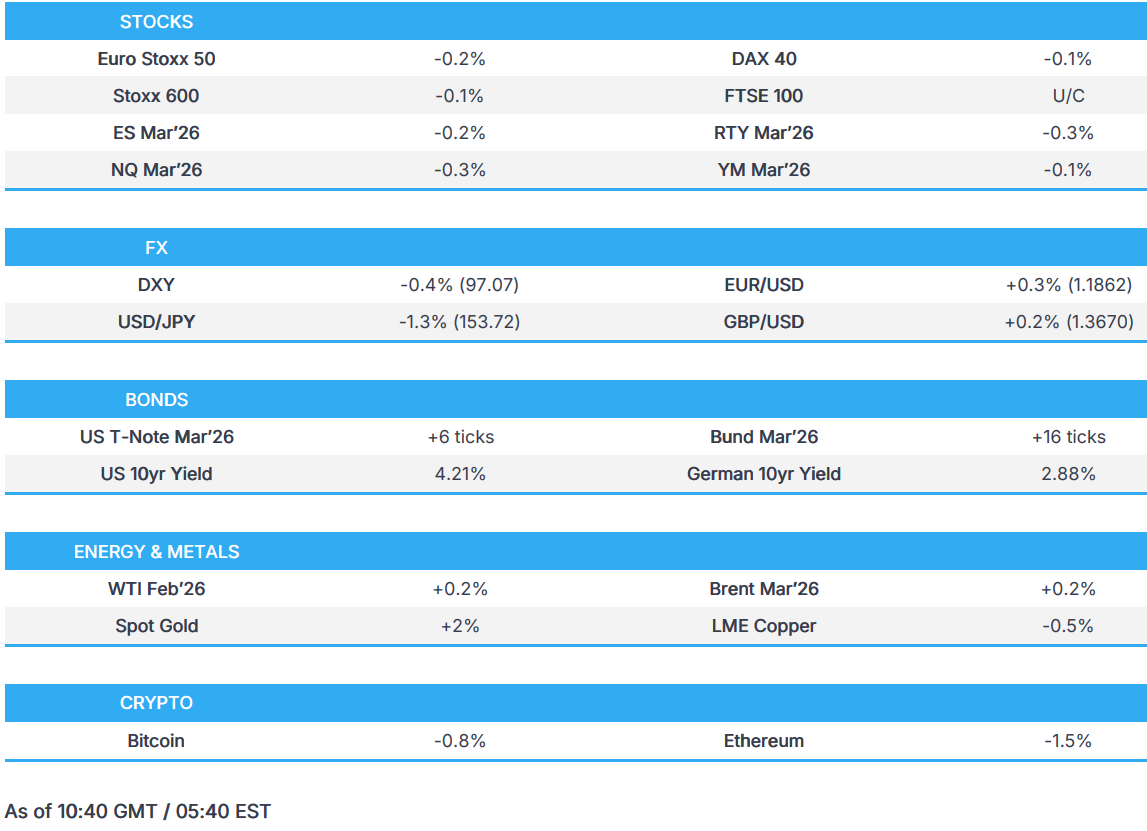

- European bourses are mostly on the backfoot; US equity futures are incrementally lower.

- JPY surges on double intervention risks, and after PM Takaichi warned that the government is ready to take action against speculative moves; DXY pressured.

- Global fixed income firmer as trade tensions rise, Gilts lead after Burnham was blocked, USTs count down to supply.

- Precious metals continue to trade at record levels with spot XAU extending beyond USD 5,000/oz; Crude prices trade rangebound as Nat Gas futures surge due to the Arctic storm.

- Looking ahead, highlights include US Chicago Fed National Activity Index (Oct/Nov), Durable Goods (Nov), Atlanta Fed GDP, Supply from the US.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.1%) opened on either side of the unchanged mark, before moving a little lower to now display a mixed/mostly negative picture.

- European sectors have opened mixed to slightly negative. Leading sectors are Basic Resources (+1.0%), Banks (+0.8%) and Energy (+0.6%). Basic Resources continues to be underpinned by strength in metal prices as gold and silver continue to gain strength as havens, whilst the energy sector has gained on the back of firmer crude prices. At the bottom of sectors reside, Travel & Leisure (-1.0%), Food Beverage & Tobacco (-0.9%) and Technology (-0.6%).

- US equity futures (ES -0.2% NQ -0.3% RTY -0.3%) have come under mild selling pressure in recent trade. Nothing fresh seemingly driving the downbeat sentiment, but perhaps as traders react to growing US-China tensions, after the US threatened Canada with a 100% tariff if it makes a trade deal with China.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY gapped lower at the open from Friday's 97.456 close, with the index off its worst and best levels at the time of writing, towards the middle of a 96.949-97.333 band. The index remains suppressed by the aforementioned JPY strength, alongside risks of a US government shutdown also increasing after Democrats said they will not support a funding package without changes to homeland security provisions.

- JPY is the standout gainer, bolstered by double intervention risk after Japanese PM Takaichi warned that the government is ready to take action against speculative moves amid a weakening currency and surge in bond yields, while it was reported on Friday that the New York Fed had conducted rate checks on USD/JPY. Analysts at ING succinctly highlight two reasons for Washington's involvement: "a) the weak yen was adding to last week's JGB sell-off and indirectly driving US Treasury yields higher. If there is any financial instrument more important than the stock market to the White House right now, it is US Treasuries. And b) the strong USD/JPY was potentially unwinding the work of US tariffs on Japan and giving Japanese manufacturers a competitive advantage." USD/JPY slumped from Friday's 155.74 close to a Monday trough at 153.40, slightly under the 100 DMA (153.54).

- EUR benefits from the USD weakness but trades off best levels after hitting resistance at 1.1898 (vs 1.1837 low) shortly after the resumption of trade. Little action was seen on the sub-par German Ifo report, and with the EZ docket also light ahead.

- CHF mildly gains due to its haven status amid the looming US government shutdown, alongside President Trump's 100% tariff threat on Canada if it makes a trade deal with China. On that note, USD/CAD trades on a softer footing amidst the aforementioned USD weakness, with the pair also dipping under the psychological 1.3700 mark to a 1.3675 low at the time of writing.

- Antipodeans trade on a firmer footing with AUD underpinned as spot gold briefly topped USD 5,100/oz earlier in the session. AUD reached a high of 0.6934 from a 0.6896 close on Friday.

- Click for NY OpEx Details

- Barclays month-end rebalancing model indicates no strong USD directional bias vs most majors, with a weak USD buying signal vs the EUR.

FIXED INCOME

- Fixed income benchmarks are in the green. USTs firmer by a handful of ticks, at the top-end of a 111-25 to 111-29+ band. The US session is relatively quiet, aside from 2yr supply ahead. Strength for fixed is perhaps a function of the slight equity pressure, which in turn can be explained at least in part by ongoing/renewed trade tensions relating to the US, Canada and China, after Trump's rhetoric. One other point of support might be the US conducting a rate check in the JPY on Friday, as this could be interpreted as a precursor to joint intervention; given the moves in long-end Japanese yields seen last week, and the global influence that had, any such action could target JGBs in addition to the Yen.

- Bunds are firmer, with gains of just over 20 ticks at best. Specifics for the bloc are a little light, with no move seen to German Ifo, which came in softer-than-expected for the climate figure, while the other components were mixed vs prev. For the EZ, the week is mainly waiting to see how the trade situation develops, with the EU meeting today to discuss unfreezing EU-US talks.

- Gilts outperform, gains of c. 30 ticks at a 91.56 high. Upside that is, primarily, being driven by the news that Greater Manchester Mayor Burnham will not be able to run for the vacant Labour MP seat. This blocks Burnham from launching a leadership challenge against PM Starmer, as some have speculated he might, despite Burnham himself suggesting Starmer is the best person to be PM currently. While welcomed by Gilts, the block has prompted significant backlash against PM Starmer from within the Labour Party, and as such, this narrative may return.

- Gulf Cooperation Council nations have issued c. USD 32.3bln of international bonds YTD, +25% Y/Y, Bloomberg reported.

- Japan sold JPY 299.9bln in 5yr Climate Transition Bonds b/c 3.49 (prev. 3.98), price at highest accepted yield 99.61 (prev. 99.53), highest accepted yield 1.684% (prev. 1.098%). Allotment for Bids at the Highest Accepted Yield 24.2857% (prev. 35.6363%).

COMMODITIES

- WTI Mar'26 continues to oscillate beyond USD 61/bbl while Brent Apr'26 rotates around USD 65/bbl, seemingly unaffected by the day's rise in Nat Gas prices, despite the gradual rise in crude prices in recent sessions due to concerns of supply disruptions.

- Henry Hub futures gapped beyond USD 6/MMBtu, its highest level since the start of the Ukraine war, while the Dutch TTF future nears EUR 42/MWh, following the Arctic storm in the US that has shut around 10% of production in the US. Prices of natural gas have been rising in recent days due to poor weather across Europe, Asia and now the US, freezing oil and natural gas wells, in addition to geopolitical concerns and accompanying supply concerns.

- Precious metals continue their historic bid higher, with spot gold trading beyond USD 5,000/oz and briefly extended above USD 5,100/oz, while spot silver trades just shy of USD 110/oz.

- 3M LME Copper is currently trading in the middle of the USD 12.52k-13.41k/t band that has been forming since the start of 2026 as supply/demand dynamics support the red metal. Supply disruptions were the main driver throughout 2025 but as the worries wane, demand has continued to grow due to AI demand.

- Ukraine's military said it struck a Russian oil refinery in Krasnodar region.

- China's Shanghai Futures Exchange to adjust price limits, margin ratios for copper and aluminium futures contracts from the 28th January closing settlement.

- Kazakhstan's Energy Ministry said that production is to be relaunched for the Tengiz oil field in the near future.

- EU has given final approval to the Russian gas ban; will entirely ban Russian LNG imports by 1st January 2027, and pipeline gas by 30th September 2027.

- Kazakhstan's Tengizchevroil is reportedly gradually restarting its Tengiz production.

- OPEC+ is likely to maintain its supply pause in March, Bloomberg reported citing delegates; adds that there is no need to respond to the events in Venezuela and Iran but a significant supply disruption would warrant a boost in output.

- PBoC Deputy Governor supports the development of Hong Kong's gold market, strengthening its offshore RMB market functions.

TRADE/TARIFFS

- India is to reduce tariffs on cars to 40% in a trade deal with EU, according to sources cited by Reuters.

- EU and India are reportedly to explore possibilities for India's participation in European defence initiatives.

NOTABLE EUROPEAN HEADLINES

- French Finance Ministry announces that France will hold a G-7 finance call on Tuesday.

- EU Commission to open proceedings against X's AI chatbot grok on Monday under the Digital Services Act, via Handelsblatt report, citing EU officials.

NOTABLE EUROPEAN DATA RECAP

- German Ifo Business Climate (Jan) 87.6 vs. Exp. 88.1 (Prev. 87.6).

- German Ifo Expectations (Jan) 89.5 (Prev. 89.7).

- German Ifo Current Conditions (Jan) 85.7 (Prev. 85.6).

- Spanish PPI YoY (Dec) Y/Y -3% (Prev. -2.5%).

CENTRAL BANKS

- BoJ accounts provided no clear signal of intervention in the JPY on Friday.

- PBoC Deputy Governor Zou affirms will continue efforts to enhance market connectivity between mainland and Hong Kong. Pledges continued backing and steady development of Hong Kong’s offshore RMB market. To coordinate with authorities to increase yearly offshore RMB government bond issuance.

- SNB has lowered the threshold factor for the remuneration of sight deposits of account holders subject to minimum reserve requirements from 16.5 to 15, as of 1st March.

NOTABLE US HEADLINES

- US President Trump said administration is reviewing everything about the Minneapolis shooting and that immigration enforcement officers will at some point leave the area, according to WSJ.

- Japanese top FX diplomat Mimura continues to decline to comment on FX intervention and can't comment on talk of rate checks, but said they are keeping in close contact with the US on FX.

- Japanese Finance Minister Katayama declined to comment on a report on Friday regarding the New York Fed conducting USD/JPY rate checks.

GEOPOLITICS

RUSSIA-UKRAINE

- Ukraine's military said it struck a Russian oil refinery in Krasnodar region.

- EU has given final approval to the Russian gas ban. Will entirely ban Russian LNG imports by 1st January 2027, and pipeline gas by 30th September 2027.

- Russian Presidential Envoy said Ukrainian President Zelensky is hindering peace by postponing the issue of land settlement, Al Arabiya reported.

- Russia's Kremlin said that constructive talks with Ukraine are underway, according to RIA.

MIDDLE EAST

- "Commander of Iran's Naval Forces: Armed Forces Fully Prepared to Protect the Country", Sky News Arabia reported.

- OPEC+ is likely to maintain its supply pause in March, Bloomberg reported citing delegates; adds that there is no need to respond to the events in Venezuela and Iran but a significant supply disruption would warrant a boost in output.

- Iranian Foreign Ministry Spokesperson said that Iran is stronger and more capable than ever before, and will certainly respond to any aggression with a broad and deterrent response.

OTHERS

- Chinese Commerce Ministry Official said China and the US maintained communication at various levels following the leaders' summit in South Korea. China and the US are to manage differences and promote stable trade ties.

CRYPTO

- Bitcoin is slightly lower and trades just shy of the USD 88k mark; Ethereum is a little lower and trades below USD 2.9k.

APAC TRADE

- APAC stocks were mostly subdued amid Japanese intervention concerns and US President Trump's latest tariff threat against Canada, in which he threatened to impose 100% tariffs if it makes a deal with China. Risk sentiment was also not helped by the Democrats threatening a partial government shutdown in revolt against the fatal shooting of an ICE protester in Minneapolis, while market conditions were somewhat quieter owing to the holiday closures in Australia and India.

- Nikkei 225 underperformed with the index pressured by a firmer currency amid US-Japan joint intervention concerns after Japanese PM Takaichi said the government is ready to take action against speculative moves, and with reports last Friday that the New York Fed conducted rate checks on USD/JPY.

- Hang Seng and Shanghai Comp were indecisive with demand contained amid reports that China is likely to target growth of 4.5% to 5% in 2026, while stocks also failed to benefit from news late last week that China told the biggest tech firms they can prep NVIDIA H200 orders.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Takaichi rules out combining BoJ ETF holdings, pension funds, and reserves to form a sovereign wealth fund.

- Japanese Chief Cabinet Secretary Kihara said the government will prepare a tentative budget if the FY26 Budget is unlikely to pass the Diet by the end of March.

- Japan's PM Takaichi said would like to achieve two-year suspension of 8% tax on food at the earliest date possible and submit relevant legislation in the fiscal 2026 Diet.

- China's Guangdong province targets 2026 GDP growth of 4.5%-5.0%.

NOTABLE APAC DATA RECAP

- Japanese Leading Economic Index Final (Nov) 109.9 vs. Exp. 110.5 (Prev. 109.8).

- Japanese Coincident Index Final (Nov) 114.9 (Prev. 115.9).