Jobs Shocker: Sept Payrolls Print Above All Forecasts, But Unemployment Rate Hits 4 Year High

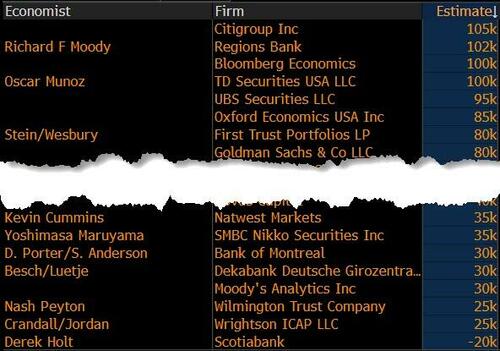

In our preview of today's jobs report, we showed that the range of estimates is (extremely) broad, from 105K on the upper end, to just -20K on the lower.

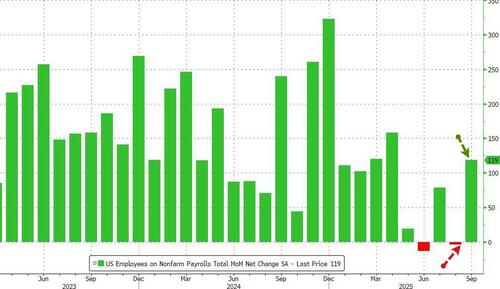

We also said that if today's jobs number is atrocious, the Fed would once again be viewed as being behind the curve. So perhaps working in conjunction with the newly returned BLS employees, the outgoing Fed chair snuck in a pointer or two, and in an attempt to avert allegations of blowing up the economy, moments ago the BLS reported that the (delayed) September number came in a stronger than all estimates 119k jobs...

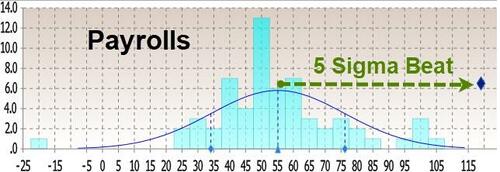

... a 5 sigma beat to the median estimate...

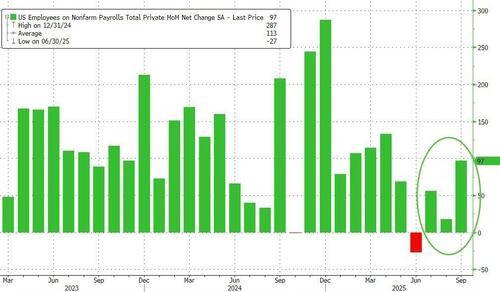

... which however followed yet another downward revision, as the total nonfarm payroll employment for July was revised down by 7,000, from +79,000 to +72,000, and the change for August was revised down by 26,000, from +22,000 to -4,000 (so much for Goldman's thesis August would be replaced sharply higher).

With these revisions, employment in July and August combined is 33,000 lower than previously reported, and continues the trend of relentless downward revisions.

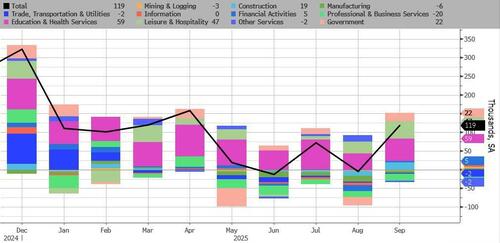

Looking at the composition of jobs, Professional & Business Services saw the biggest job losses while Education & Health Services and Leisure & Hospitality saw the biggest job gains. Some more details by sector:

- Health care added 43,000 jobs, about the same as the average monthly gain of 42,000 over the prior 12 months.

- Employment in food services and drinking places continued to trend up in September (+37,000).

- In September, social assistance employment continued to trend up (+14,000), reflecting continued job growth in individual and family services (+20,000).

- Employment in transportation and warehousing declined by 25,000 in September as job losses occurred in warehousing and storage (-11,000) and couriers and messengers (-7,000).

- Federal government employment continued to decline in September (-3,000) and is down by 97,000 since reaching a peak in January.

- Employment showed little or no change over the month in other major industries, including mining, quarrying, and oil and gas extraction; construction; manufacturing; wholesale trade; retail trade; information; financial activities; professional and business services; and other services.

And visually:

Manufacturing jobs fell for the sixth straight month...

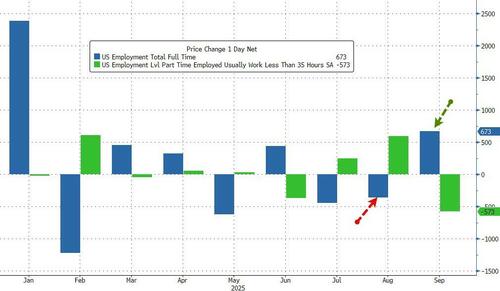

After August's surge in part-time jobs (decline in full-time), September flipped the script with a surge in full-time jobs as part-time jobs tumbled...

Private employers added 97k jobs in September...

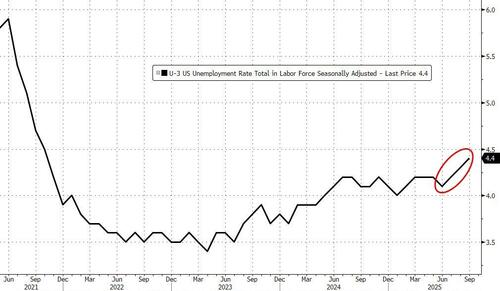

Yet even as the payrolls came in red hot, more than offsetting this euphoria was the jump in the US unemployment rate to 4.4% in September, its highest in four years...

Led by Black unemployment...

The participation rate rose for the second month in a row...

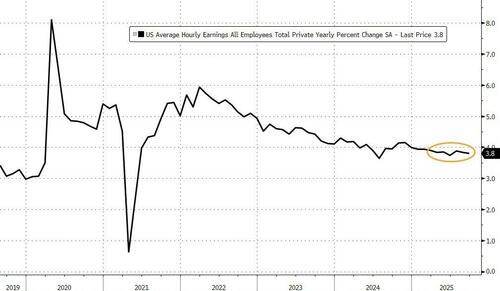

But earnings growth slowed in September...

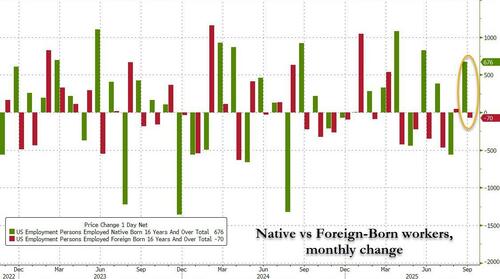

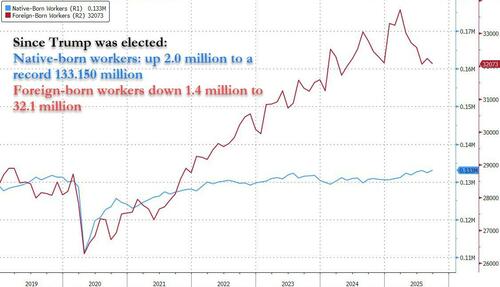

Saving the best for last, the number of native-born workers in Sept surged by 676K, while foreign-born workers tumbled by 70K.

And some context: since March, or when Trump effectively became president, the number of foreign-born workers (mostly illegal aliens) has plunged by 1.422 million, while native-born workers have increased by 1.964 million to a record 133.15 million.

Putting this all together, rate-cut odds are higher following the jump in the unemployment rate...

Now, what will FedSpeak do now?