2026 Looks Better For US Automakers Than Suppliers; Deutsche Bank

Deutsche Bank is looking at U.S. autos heading into the new year with a growing sense of separation between winners and laggards. In a new 2026 outlook note, Edison Yu and his team argue that while global auto demand remains uneven and suppliers face a tougher volume backdrop, U.S. automakers are entering the year with clearer earnings momentum, helped by better mix, lower EV losses, and a renewed ability to lean into their most profitable internal-combustion vehicles.

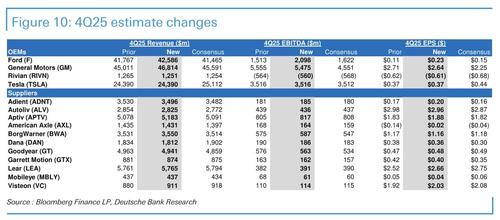

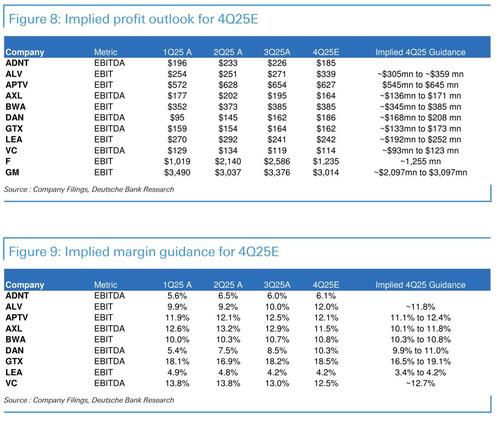

At a high level, the bank is cautious on global production growth despite more optimistic industry forecasts. Deutsche Bank sees downside risks tied mainly to China, where changes to government trade-in subsidies are expected to hit lower-priced vehicles hardest. While North America and Europe may improve modestly, the team does not believe those regions can fully offset a potential slowdown in China. As a result, suppliers are likely to guide conservatively for 2026, particularly in the first half of the year, even though fourth-quarter results should generally meet or exceed expectations.

In contrast, the setup for U.S. automakers looks more favorable. Deutsche Bank expects both GM and Ford to deliver solid fourth-quarter results and to grow EBIT by roughly $1–2 billion year over year in 2026. The key driver is not higher unit volumes, but a shift in mix. With regulatory pressure easing, automakers no longer need to restrict production of high-margin trucks and SUVs to meet fleet-wide emissions targets. That flexibility allows them to stock dealerships with more profitable trims, improving margins even if overall sales volumes remain flat or modestly lower.

The pullback from aggressive EV expansion is another important theme. Both Ford and GM have taken multi-billion-dollar write-downs tied to EV programs and battery investments. Deutsche Bank views these moves as painful but necessary resets that reduce future losses, depreciation, and overhead. By clearing out what the bank refers to as “stranded assets,” both companies enter 2026 with a cleaner cost base and a much easier earnings comparison year over year.

For EV-focused companies, the conversation shifts away from near-term vehicle volumes and toward technology execution. Deutsche Bank expects muted underlying volume growth for Tesla and Rivian, with investor attention increasingly centered on autonomy, software, and what the team describes as “physical AI.” For Tesla, that means proving real-world progress in unsupervised full self-driving and robotaxi deployment before earning additional valuation credit. For Rivian, 2026 is framed as a critical year, with the R2 launch needing to demonstrate not just scale, but improving competitiveness in autonomy.

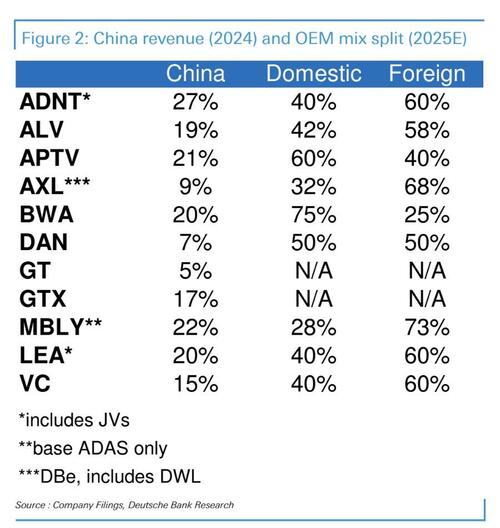

Suppliers face a more complicated picture. China stands out as the biggest wildcard, as revised subsidy rules disproportionately impact lower-priced vehicles and are expected to drive a year-over-year decline in passenger vehicle wholesales. While many global suppliers skew toward higher-end vehicles, which may help mix, Deutsche Bank still expects a net negative volume impact. BorgWarner is singled out as particularly exposed given its historical reliance on China for growth.

Another emerging risk is memory chips. The surge in AI data center demand has pulled wafer capacity away from automotive-grade DRAM, sending prices sharply higher. Deutsche Bank has not yet fully baked a DRAM-driven production hit into its forecasts, but flags it as a meaningful downside risk, especially for suppliers without strong inventory buffers or pricing protections. Some companies, like Aptiv, appear better insulated, while others may feel indirect pressure if vehicle production slows.

Stepping back, Deutsche Bank’s overarching message is that 2026 is shaping up to be less about selling more cars and more about selling the right ones, at the right margins, with tighter cost control. Automakers, particularly in the U.S., appear better positioned to navigate that environment than suppliers. ICE vehicles are once again doing the heavy lifting for profits, EV strategies are being reset to prioritize economics over ambition, and autonomy remains the long-term prize—but one that still requires proof.