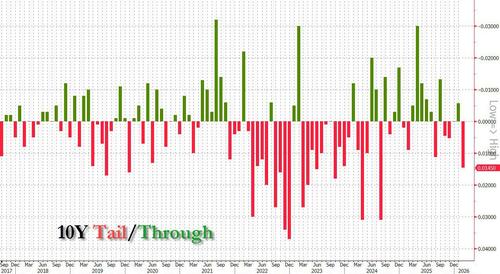

Dreadful 10Y Auction Sees Biggest Tail Since 2024, Foreign Demand Slides

After yesterday's mediocre 3Y auction (which saw a drop in foreign demand offset by record direct bid), moments ago the Treasury concluded the sale of 10Y benchmark paper, and despite a cheerful preview by the Bloomberg MLIV team (which appears to be wrong every time it tries to handicap the outcome), today's auction was absolutely dreadful.

Starting at the top, the high yield of 4.177% was almost unchanged from last month's 4.173% and the 4.175% the month before. More importantly, it tailed the When Issued 4.163% by 1.4bps, the biggest tail since August 2024.

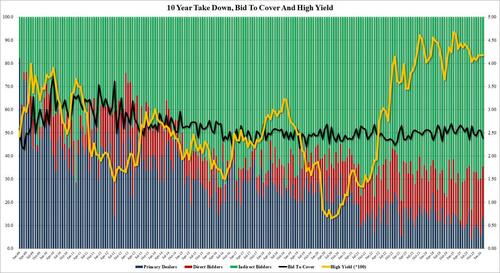

The bid to cover dropped to 2.388, the lowest since August 2025. It would have been even worse had the Fed's SOMA not tendered for $11.9BN of the issue (up from $11.35BN in January).

The internals were also ugly, as Indirects slumped to just 64.5%, the lowest since August 2025 (and clearly well below the six month average of 70.2%). And with Directs also sliding to 22.1% from 24.5% in January (a far cray from yesterday's record Directs), Dealers were left holding 13.54%, the most since - you guessed it - August 2025.

Overall, this was a very disappointing 10Y auction, easily the worst refunding in over a year, and subjectively the ugliest sale of benchmark paper since 2024. And that explains why despite today's latest slam in momentum which is crushing bitcoin and high beta names, the 10Y has since rebounded and rose 2bps from 4.15% to 4.17% after the ugly auction.