DXY falters on reports of potential BoJ hike; European equity futures pointing to a softer open - Newsquawk European Opening News

- A White House Official said the chip announcement on Wednesday was 'phase one' action and there could be other announcements, pending ongoing negotiations with other countries and companies.

- Japanese Finance Minister Katayama said FX intervention is a potential option under the US-Japan agreement and expressed readiness to take decisive action while keeping all options on the table.

- DXY continued to fall from the 99.40 peak made early in the APAC session; USD/JPY extended Thursday’s weakness after further jawboning from Finance Minister Katayama and a Reuters report that the BoJ could hike as soon as April due to inflation effects from a weaker yen. The pair briefly dipped below 158 before paring some of the move.

- European equity futures point to a softer open, with the Euro Stoxx 50 future down 0.3% after Thursday’s cash session closed up 0.6%.

- Looking ahead, Highlights include German CPI Final (Dec), US Industrial Production (Dec), Speakers include BoE's Bailey, Fed's Collins, Jefferson, Bowman, Jefferson, Earnings from State Street, PNC Financial Services

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks saw gains, albeit coming off highs through the US afternoon and into close, as an initial stellar report from TSMC provided tailwinds to the tech sector and broader semiconductor names; peak gains were not sustained. Despite the pullback seen in the US afternoon, Tech still saw strength, and sectors saw an upside bias. Utilities and Industrials outperformed, while Energy and Health lagged.

- SPX +0.26% at 6,944, NDX +0.32% at 25,547, DJI +0.60% at 49,442, RUT +0.86% at 2,675

- Click here for a detailed summary.

TRADE/TARIFFS

- A White House Official said the chip announcement on Wednesday was 'phase one' action and there could be other announcements, pending ongoing negotiations with other countries and companies.

- US President Trump is to lower tariffs to 15% on goods from Taiwan; Taiwan pledges USD 250bln each in chip investment and credit guarantees.

- US Commerce Secretary Lutnick said TSMC (TSM) can bring in more semiconductors and wafers while building US capacity; if companies don't build in US, tariff likely to be 100%; Trump visit to China in April still on.

- US President Trump, via Truth Social, said the US has never done better and said tariffs are the main reason, hundreds of billions of dollars have been taken with virtually no inflation and national security has never been as strong as today.

- Top Republican on the House China Committee Moolenaar sends a letter seeking more info on the memory chip shortage and asked about NVIDIA (NVDA) H200 chips. Moolenaar said that tight memory chip supplies will constrain the number of US export licenses for Nvidia to sell its H200 AI processors to Chinese customers.

- US Commerce Secretary Lutnick said not concerned that China trade talks will be derailed by Taiwan trade deal or tariffs on goods from countries doing business with Iran.

- Chinese President Xi met with Canadian PM Carney, CCTV reported.

CENTRAL BANKS

- Fed's Schmid (2028 voter) said little reason to cut rates; prefer to keep monetary policy modestly restrictive; inflation is too hot. Cutting rates could worsen inflation without helping employment much. He also added that full employment likely between 3.5-4.5%.

- Fed's Paulson (2026 voter) is comfortable holding rates steady at next Fed meeting; labour market risks a little bit higher than risks of sticky inflation. “I want monetary policy restrictiveness to be playing a role to get us all the way back to 2%.”

- White House Press Secretary Leavitt said US President Trump is in the decision-making phase on the Fed chair, Trump will make decision in the next couple of weeks, but he likes a few people for Fed Chair.

- Fed's Daly (2027 voter) said projections for growth are solid; incoming data looks promising. There is still a lot of uncertainty, with risks to both sides of our mandated goals.

- Fed's Barkin (2026 voter) said today the economy has two engines: AI and the rich; hard to put weight on data in past three months.

- Fed Governor Barr said DoJ probe is an assault on the independence of the Fed; Fed is acting only for economic reasons and according to its congressional mandate. Barr said benchmark interest rates are at the right level, equally balancing risks to inflation and the job market.

- BoJ is seen as likely to raise its FY26 economic and inflation forecasts, Reuters reported citing sources; the report adds that some BoJ policymakers see scope to raise interest rates as soon as April due to the inflationary effect of a weaker JPY.

- ECB's Lane said that there is no immediate debate on interest rates if current conditions persist and that current rates are set to establish a baseline for years ahead.

- NBP Governor Kotecki, in a Bloomberg interview, said it is becoming increasingly clear that there is room for further rapid interest rate cuts.

NOTABLE US EQUITY HEADLINES

- The BBC is set to announce a major content deal with YouTube (GOOGL) to produce programmes for the platform, the FT reports citing people close to the talks.

APAC TRADE

EQUITIES

- APAC stocks traded mostly in the green, supported by strength in the tech sector after strong TSMC earnings lifted sentiment across the region.

- ASX 200 opened with slight gains and is on track for its biggest weekly advance in seven weeks, led by IT and financials. Positive US bank earnings from Morgan Stanley and Goldman Sachs also helped improve sentiment.

- Nikkei 225 traded middle-of-the-pack, chopping around 54,000 amid continued uncertainty surrounding the new opposition party. Additional pressure came from JPY strength after Bloomberg highlighted concerns about the economic impact of a weaker yen.

- KOSPI outperformed and is set for a third consecutive weekly gain, buoyed by the renewed AI-driven tech rally. TSMC’s results fed through to major Korean names, with Samsung (+3.1%) and LG Electronics (+4.0%) among the standout movers.

- Hang Seng and Shanghai Comp initially posted gains of up to 0.5% but later pared back, with the indices slipping into negative territory.

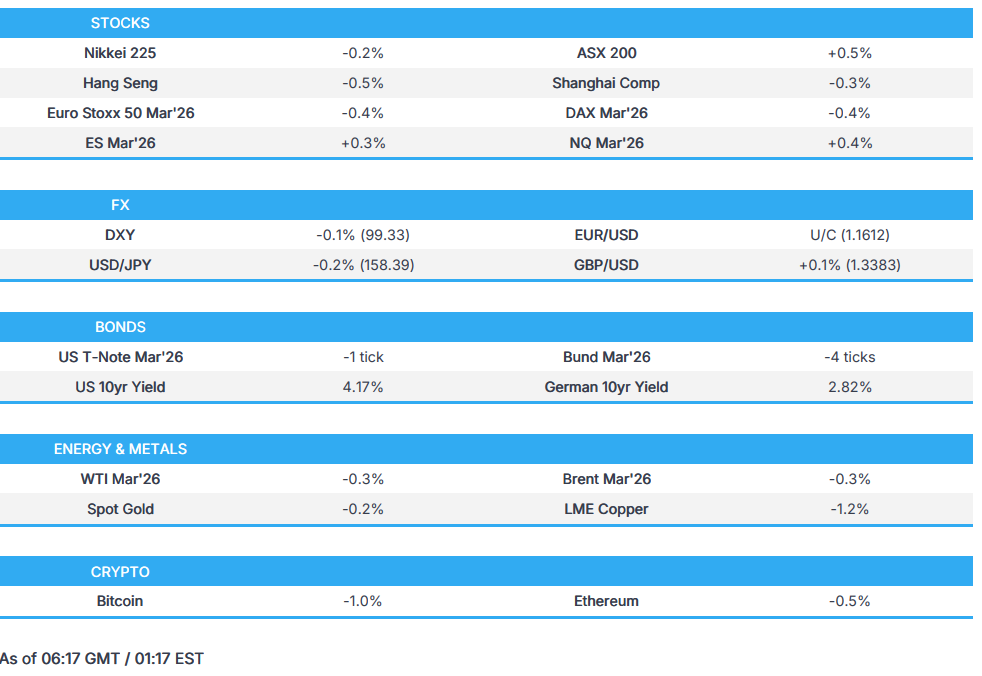

- US equity futures saw a modest rebound from the pullback off all-time highs, led by the Nasdaq 100 (+0.4%), supported by strong tech performance across APAC.

- European equity futures point to a softer open, with the Euro Stoxx 50 future down 0.3% after Thursday’s cash session closed up 0.6%.

FX

- DXY continued to fall from the 99.40 peak made early in the APAC session, pressured by yen strength following comments from Japanese Finance Minister Katayama.

- EUR/USD oscillated in a tight 1.1603–1.1614 range amid a lack of clear drivers, with markets awaiting final German CPI.

- GBP/USD stayed below 1.34 but traded with slight gains through the Asia-Pac session, largely as a function of yen strength weighing on the dollar.

- USD/JPY extended Thursday’s weakness after further jawboning from Finance Minister Katayama and a Reuters report that the BoJ could hike as soon as April due to inflation effects from a weaker yen. The pair briefly dipped below 158 before paring some of the move.

- Antipodeans traded with modest gains despite softness in Chinese equities and metals, supported by broader USD weakness.

- PBoC set USD/CNY mid-point at 7.0078 vs exp. 6.9722 (prev. 7.0064).

FIXED INCOME

- 10yr UST futures oscillated in a tight 3-tick range as the benchmark consolidated after Thursday’s strong US claims data, which drove front-end yields higher and prompted a bear-flattening of the curve.

- Bund futures held above 128.30 after multiple failed attempts on Thursday to sustain a break below that level.

- 10yr JGB futures traded muted before falling lower to a trough of 131.13 as Japanese markets reopened following the hawkish Reuters report suggesting the BoJ could hike as early as April, earlier than market expectations.

- Australia sold AUD 700mln 3.25% 2029 bonds: b/c 4.52x, avg. yield 4.1099%.

COMMODITIES

- Crude futures traded steadily lower, with WTI Mar’26 slipping below USD 59/bbl and Brent Mar’26 hovering around USD 63.50/bbl despite limited geopolitical developments.

- Spot gold extended its recent APAC weakness, falling back below USD 4,600/oz from a session high of USD 4,621/oz, while spot silver also softened, briefly dipping back under USD 90/oz after partially recovering in Thursday’s US session.

- Copper futures retreated at the start of the final trading day of the week as China cracked down on high-frequency trading by removing servers from data centres. 3M LME copper fell from USD 13.16k/t to a USD 12.95k/t trough and remained near session lows, while Shanghai metals also weakened, with nickel down as much as 3%.

- Heavy rainfall in northeast Australia has triggered floods which are hampering mine operations, with some coal miners declaring force majeure on portions of their shipments or potential delays to customers.

- Venezuelan interim President Rodriquez said the government is proposing reforms to the oil industry.

- US Energy Secretary Wright said US is getting a 30% higher price for Venezuelan oil than three weeks ago; Venezuela's oil production will drive the price of oil down.

- Colombian President Petro said he will begin to lower the price of gasoline.

CRYPTO

- Bitcoin traded in a narrow range on either side of USD 95,500 in a quiet session.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Katayama said FX intervention is a potential option under the US-Japan agreement and expresses readiness to take decisive action while keeping all options on the table.

- China clamps down on high-speed traders by removing data servers, Bloomberg reported.

- Mitsubishi (8058 JT) is to buy Aethon for USD 5.2bln.

DATA RECAP

- Japanese Stock Investment by Foreigners (Jan/10) 1.14tln (Prev. 124.9bln).

- Japanese Foreign Bond Investment (Jan/10) 101.1bln (Prev. -223.6bln).

GEOPOLITICS

RUSSIA-UKRAINE

- The European Commission is drafting a proposal to replace the EU accession system with a two-tier model that could fast-track Ukraine's entry in any peace deal to end Russia's invasion, the FT reports.

MIDDLE EAST

- US President Trump said that, with support from Egypt, Turkey and Qatar, he is pushing for a comprehensive demilitarisation deal requiring Hamas to surrender all weapons and dismantle all tunnels. He warned Hamas to immediately meet its commitments, including returning the final body to Israel, or face severe consequences.

- Iran's Deputy UN Envoy said Iran seeks neither escalation nor confrontation; warns that any form of aggression, whether direct or indirect, will prompt a strong and lawful response.

- At least one US aircraft carrier is moving to the Middle East, Fox News reported citing military sources; the US military is preparing a range of options regarding Iran.

- US envoy to UN said Iran said it's ready for dialogue with the US, but its actions say otherwise.

- US President Trump was reportedly told that an attack on Iran would not guarantee the collapse of the regime and could spark a wider conflict, according to WSJ. Will monitor how Iran handles protestors before deciding on scope of potential attack.

- White House said Trump and his team have told Iran if killing continues, there will be grave consequences; 800 executions were halted in Iran; all options remain on the table for Iran.

- Israel PM Netanyahu reportedly asked US President Trump on Wednesday to delay an attack on Iran, according to NYT.

- US President Trump said "we've saved a lot of lives" as Iran signals it won't execute protesters and said no decision yet on action against Iran.

- US President Trump announces the formation of the Board of Peace, with members to be announced shortly.

OTHERS

- Japan and the US are to discuss raising interceptor missile output, Kyodo reported.

EU/UK

NOTABLE HEADLINES

- The ONS has drawn up contingency plans to delay the launch of its new labour market survey by 6 months, Bloomberg reports citing people familiar with the matter.