DXY is pressured as Chair Powell faces a criminal investigation; Banking names hit after Trump’s move for cap credit - Newsquawk US Opening News

- US Federal prosecutors have opened a criminal investigation into Fed Chair Powell over the central bank’s renovation of its Washington headquarters, and whether Powell lied to Congress about the scope of the project, NYT reported, citing officials.

- US President Trump said Iran has proposed negotiations after he threatened action against Tehran for the crackdown on protesters, AP News reported.

- US President Trump is to be briefed on Tuesday on "some kinetic and many non-kinetic" options in Iran, Politico reports, citing two administration officials.

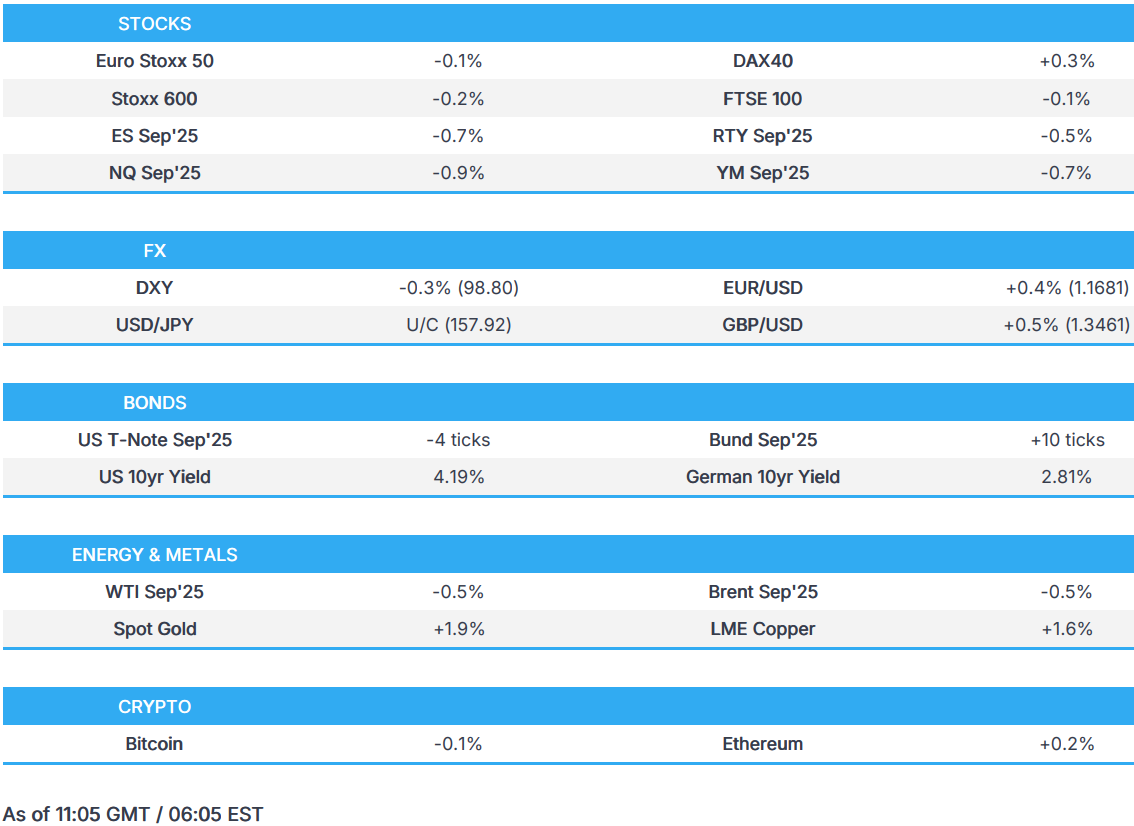

- European bourses are broadly in the red alongside pressure in US equity futures; Banking names hit after Trump’s move to cap credit card interest rates.

- DXY is pressured as Chair Powell faces a criminal investigation, NZD benefits from strength in the underlying metals prices.

- US yield curve steepens on the Fed independence challenge, supply ahead.

- Spot gold printed an ATH above USD 4.6k/oz, with upside driven by Fed independence woes and geopols; Crude is on the backfoot despite rising tensions re. Iran.

- Looking ahead, speakers include Fed's Bostic, and Barkin. Supply from the US.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European equities (STOXX 600 -0.2%) are trading mostly on the backfoot, in contrast to a mostly stronger APAC session. Sentiment appears to be subdued by Fed independence woes, after Federal prosecutors opened a criminal investigation into Chair Powell.

- European sectors are mixed. Leading sectors are Basic Resources (+0.6%), Food Beverage and Tobacco (+0.3%) and Retail (+0.3%). Basic Resources has been underpinned by stronger metal prices. On the downside, Autos (-0.9%), Banks (-0.9%) and Travel (-1.4%) lag, with the banking sector pressured by Trump’s credit card fee cap plan.

- US equity futures are lower in the pre-market, with downside in all major indices. Large US banking companies like JP Morgan (-2.4%), Citi (-3.6%) and Bank of America (-1.5%) have seen their shares slide in the pre-market due to Trump's credit card fee cap plan.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is under pressure this morning as Fed independence takes the limelight once again. Currently trading at the lower end of a 98.70-99.24 range, and just shy of its 200 DMA at 98.82. Further pressure for the index could see a test of its 100 DMA at 98.62.

- Downside for the USD this morning can be attributed to Fed independence woes. In brief, Federal prosecutors have opened up a criminal investigation into Fed Chair Powell over the central bank’s renovation of its Washington headquarters. As it stands, markets appear to be running with the “sell America” theme, with the USD & US equity futures lower and the curve steeper. The USD may also be pressured thanks to the affordability implications of Trump’s demand for credit card rates to be capped at 10%.

- JPY remains the only currency flat vs the USD, with USD/JPY currently trading within a 157.90 to 158.20 range. The JPY was pressured overnight amidst further reporting of PM Takaichi planning to dissolve the Lower House – as a reminder, this was first reported last Friday which spurred hefty upside in USD/JPY. Since, price action has stabilised with USD/JPY gradually moving back towards overnight troughs as the risk tone remains subdued.

- Other G10s are stronger against the USD to varying degrees. The Antipodeans are amongst the top performers, benefiting from the strength seen across the metals complex. The CHF appears to be the favoured haven this morning, and currently sits second in the G10 leaderboard.

FIXED INCOME

- Fixed benchmarks in proximity to the unchanged mark.

- Overnight, while modest, the bias was downward as the US yield curve steepens over Fed independence concerns and the narrative that a more dovish Fed now could lead to higher inflation and, by extension, higher rates further down the line.

- USTs at the low-end of a 112-02 to 112-11 band, posting losses of five ticks at most. Support resides at 111-31 from Friday, below that we look to 111-26 from late-August. By extension, the 10yr yield is at a 4.2% peak, just shy of last Friday's 4.21% high. Thereafter, we return to levels from early-September/late-August when 4.35% printed (18th Aug.).

- In Europe, action is much the same. Bunds were unchanged for much of the session, but now incrementally firmer in 127.82 to 128.10 parameters. Elsewhere, Gilts opened near-enough unchanged before coming under modest pressure, echoing the above. At the low-end of a 92.30-53 band with downside of 18 ticks at most.

- OATs await Wednesday's no-confidence motions against the French government re. Mercosur. On Wednesday, January 14th, two no-confidence motions will be placed against the government, one from the far-left (LFI) and another from the far-right (RN). Neither motion is expected to succeed, as LFI will not support RN and the Socialists (PS) will not support LFI. However, Politico has a line from a centrist official noting that "there could be an accident". Amidst this, the OAT-Bund 10yr yield spread remains just above the 71bps mark and at the top-end of the 69-72bps 2026 range. OATs themselves trade in line with fixed income peers, as the updates around Fed Chair Powell dominate, and as such are near enough flat.

COMMODITIES

- A softer start to the week for crude benchmarks, under modest pressure of c. 0.50/bbl at most to lows of USD 58.64/bbl and USD 62.89/bbl for WTI and Brent, respectively. Benchmarks spent APAC trade chopping in relatively wide bands in excess of USD 1.00/bbl. The complex began APAC firmer, peaking at USD 59.80/bbl and USD 64.00/bbl. Upside driven by increased geopolitical tensions, particularly relating to Iran. However, despite the escalatory remarks from POTUS that Iran is beginning to cross the line, the benchmarks failed to sustain early gains. Thereafter, they came under modest but notable pressure and slipped into the red.

- Spot gold opened on a slightly firmer footing, made a trough at USD 4,511.41/oz before gradually sauntering higher as the APAC session got underway. Thereafter, the yellow-metal surged beyond the USD 4.6k/oz mark, to make a fresh ATH at USD 4,601.19/oz. Since, spot gold has scaled back below USD 4.6k/oz, albeit it remains within a handful of dollars of that mark. Price action during European trade has been sideways.

- Upside for the yellow metal can be attributed to two points, which have attracted haven inflows. 1) Fed independence woes, and 2) heightened geopolitical tensions. Starting with the Fed, US Federal prosecutors have opened a criminal investigation into Fed Chair Powell over the central bank’s renovation of its Washington headquarters, and whether Powell lied to Congress about the scope of the project, NYT reported, citing officials. This has raised concerns among traders regarding the Fed's independence, given Trump's continued attempts to threaten Chair Powell's job.

- Base metals have followed the metals sentiment, with 3M LME Copper currently higher by around +1.7% and towards the upper end of a USD 13,086-13,233/t range. In Shanghai, tin hit its daily limit, rising 8% to CNY 376,920/ton to set a new ATH.

- Kazakhstan oil shipments from the Black Sea CPC terminal halted on Saturday, Bloomberg reported citing sources, this caused crude intake into the pipeline system to stop.

- Hunan Silver has restarted production on 12th January, following the completion of its maintenance plans.

- Australian Resources Minister King said Australia is to have an operational critical minerals reserve by year-end.

- Trafigura CEO expects to load first vessel for Venezuelan oil exports to the US next week.

- China buys at least 10 cargoes of US soybeans for April-May shipment, according to traders.

TRADE/TARIFFS

- India announces plans to conclude FTA with the EU during visit to the EU next week.

- EU Commission issues Guidance Document on submission of price undertaking offers for battery electric vehicles from China. "It covers various aspects to be addressed in a possible undertaking offer, including the minimum import price, sales channels, cross-compensation, and future investments in the EU.".

- China's Commerce Minister said the EU will release guidance document on submitting price commitment application, in regard to talks with EU on EV. EU will assess every price commitment application based on WTO rules.

- India's Trade Minister said they are in the 'final' stages, in regards to trade deal with Europe.

- China is resuming its soybean auctions after a three-week pause to free storage while continuing US purchases under the trade truce.

- The US is to host a meeting on rare earths this week, according to Bloomberg.

NOTABLE EUROPEAN DATA RECAP

- EU Sentix Index (Jan) -1.8 vs. Exp. -4.9 (Prev. -6.2)

- Swiss Consumer Confidence (Dec) -31 vs. Exp. -33 (Prev. -34).

CENTRAL BANKS

- Federal prosecutors have opened up a criminal investigation into Fed Chair Powell over the central bank’s renovation of its Washington headquarters and whether Powell lied to Congress about the scope of the project, NYT reported citing officials.

- Fed Chair Powell said DoJ served the Fed with subpoenas, threatening indictment; Powell said he will continue to do the job. Fed Chairman Powell said the Department of Justice is threatening a criminal indictment against him. The Fed Chairman said it is about his testimony in front of the Senate Banking Committee last June, but called this a pretext. The Fed Chairman thinks this is really about interest rates saying, "The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.".

- US President Trump denies involvement in the DoJ's issuance of federal subpoena to the Fed; issued subpoenas unrelated to interest rates.

- US Senator Tillis criticises the move against Fed Chair Powell, and said he will “oppose the confirmation of any nominee for the Fed—including the upcoming Fed Chair vacancy—until this legal matter is resolved.

- Goldman Sachs expects the Fed to deliver 25bps cuts in June and September (vs. prior forecast of cuts in March and June).

- ECB's Muller said there's no reason to ease further in the near term and that rates have been in the right place for some time. Rates, however, could edge higher in a few years.

- ECB's de Guindos said the USD is not behaving as a haven, at this point.

- ECB Bulletin: "Inside the food basket: what is behind recent food inflation?"; "Looking ahead, food inflation is expected to ease further, supported in the near term by easing selling price expectations".

- Former PBoC Director of Statistics and Analysis Department Songcheng expects the central bank to take "small steps" toward monetary easing in the near future, Shanghai Securities News reported citing a speech.

- SARB is reportedly working on a review of its Prime Lending Rate, via Bloomberg. This has historically been fixed at the policy rate +350bps.

NOTABLE US HEADLINES

- US GOP policymakers are reportedly getting behind a stock-trading clampdown which aims to alleviate concerns related to lawmakers profiting off insider information, via WSJ

- US President Trump is to meet with US Secretary of State Rubio at 15:30GMT/10:30EST.

- US President Trump said he is going to Detroit to talk about car factories opening up.

- US President Trump said he might veto extension of health insurance subsidies.

- US President Trump said jobs report today was an amazing report; on posting data early, they gave me some numbers, and when they do, I post.

- US President Trump said on January 30th, there may be another shutdown; we'll see.

- US President Trump said credit card companies will be in violation of law if they do not comply on interest rate cap by January 20th.

NOTABLE US EQUITY HEADLINES

- US President Trump said he might block Exxon (XOM) from drilling in Venezuela following comments by the Co.'s CEO, according to the WSJ.

- White House said it was displeased with Exxon’s (XOM) reaction; Officials hint that Exxon might be kept out with regards to Venezuela.

- Judge grants US FTC request to block Edwards Lifesciences Corp's (EW) acquisition of JenaValve Technology Inc, via court records.

GEOPOLITICS

RUSSIA-UKRAINE

- Ukraine President Zelensky said US President Trump should enter a free trade deal with Ukraine.

- Over the weekend, Ukraine targeted three drilling platforms in the Caspian Sea owned by Lukoil. Elsewhere, Russian troops struck a Ukrainian military-industrial and energy facilities, according to TASS.

MIDDLE EAST

- US President Trump said Iran has proposed negotiations after US leader threatened action on Tehran for crackdown on protesters, AP News reported.

- US President Trump said the military is considering very strong options on Iran.

- An increase in the number of US planes near Iranian airspace, according to Israel's Channel 14.

- US President Trump said Iran called to negotiate yesterday on nuclear, we may meet them.

- US President Trump said Iran has proposed negotiations after US leader threatened action on Tehran for crackdown on protesters, AP News reported.

- US President Trump said Iran called to negotiate yesterday on nuclear, we may meet them.

- An increase in the number of US planes near Iranian airspace, according to Israel's Channel 14.

- US President Trump said "Iran is starting to cross it [Trump's red line]".

- US President Trump said the military is considering very strong options on Iran.

- Iran, in letter to UN, said US is to blame for the transformation of peaceful process into violent subversive acts and widespread vandalism.

- Iranian Foreign Ministry spokesperson Baghaei said communication with the US Special Envoy is open. Adds, they are ready to negotiate on the basis of mutual respect.

- US President Trump said in contact with Iranian opposition leaders.

OTHERS

- German Finance Minister Klingbeil said the transatlantic relationship "is disintegrating", Die Zeit reported. Adds, We must further strengthen Europe, and we must do so much faster. The current pace is inadequate. European sovereignty now has top priority".

- State Department Spokesperson said US Secretary of State Rubio spoke with Mexican Foreign Secretary de la Fuente today about the need for stronger cooperation against narcoterrorists and trafficking of fentanyl and weapons.

- US President Trump posted a picture in which he is labelled "Acting President of Venezuela", via Truth Social.

- US President Trump said we are going to have Greenland, one way or another. We are talking about acquiring, not having short-term.

- US President Trump said working well with Venezuela's leadership. Meeting with Machado is on Tuesday or Wednesday.

- Trump administration officials are set to meet with Danish officials about Greenland on Wednesday, diplomatic sources tell CBS News. Multiple European diplomats said that they increasingly understand that America's commitment to the defence of Europe and NATO is no longer as ironclad as it has been over the past decades.

- Trump administration officials are set to meet with Danish officials about Greenland on Wednesday, diplomatic sources tell CBS News. Multiple European diplomats said that they increasingly understand that America's commitment to the defence of Europe and NATO is no longer as ironclad as it has been over the past decades.

- North Korea accused South Korea of provocation via a drone, via local press.

CRYPTO

- Bitcoin is a little lower and trades just above the USD 90k mark; Ethereum moves higher, to currently trade just above the USD 3.1k mark.

APAC TRADE

- APAC stocks were mostly in the green, following on from the positivity seen stateside during Friday's session. Japanese traders were away today amid a domestic holiday.

- ASX 200 saw gains of as much as 0.7% as the APAC session got underway but pared back slightly as XAU pulled back from new record highs. Despite spot XAU pulling back, gold miners outperformed, followed by consumer discretionary and energy.

- KOSPI was the Asian outperformer, with gains as much as 1.5% but the index completely reversed the move alongside further losses in tech-laden NQ.

- Hang Seng and Shanghai Comp conformed to the regional gains, although upside was capped amid a lack of major drivers for the bourses.

NOTABLE ASIA-PAC HEADLINES

- China Vanke (2202 HK) dollar bondholders have been advised to consider calling a default on the Cos noted, Bloomberg reported citing sources.

- China's MOFCOM says its key priorities are to strengthen legal frameworks, improve export controls, and enhance risk prevention to safeguard supply chain resilience and national security.

NOTABLE APAC DATA RECAP

- Australian Household Spending MoM (Nov) M/M 1.0% vs. Exp. 0.6% (Prev. 1.3% ).

- Australian ANZ-Indeed Job Advertisements MoM (Dec) M/M -0.5% vs. Exp. 0.5% (Prev. -0.8%).

- Australian Household Spending YoY (Nov) Y/Y 6.3% vs. Exp. 5.7% (Prev. 5.7% , Rev. 5.6% ).