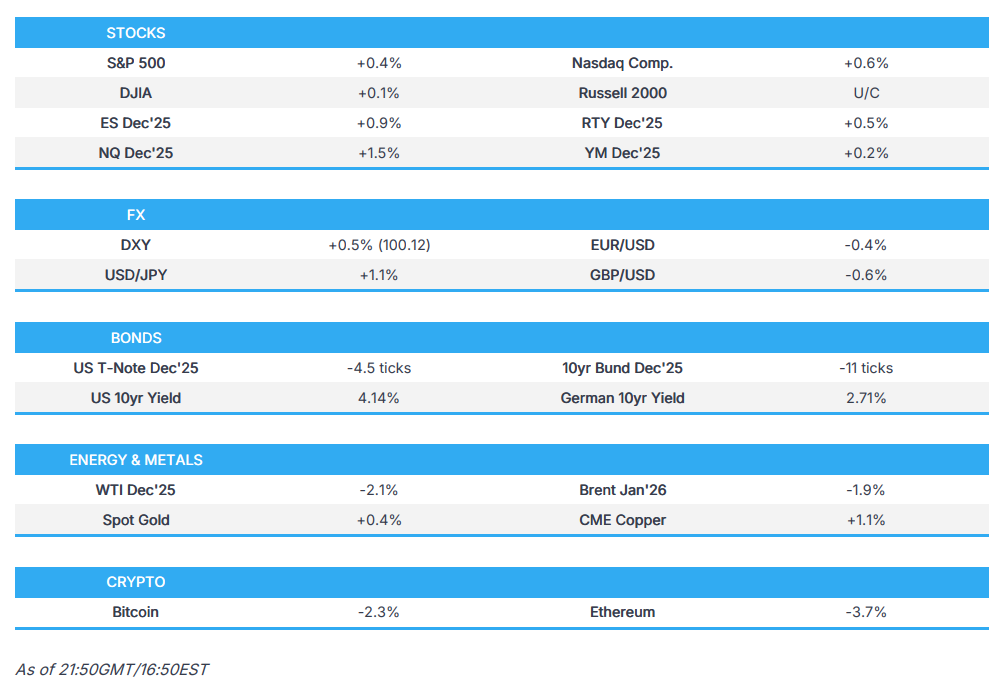

ES and NQ rise after strong NVIDIA earnings - Newsquawk Asia-Pac Market Open

- US stocks were choppy, but ultimately settled in the green as participants awaited NVIDIA earnings.

- ES and NQ surged as NVIDIA (NVDA) rose over 4% following strong earnings.

- The Dollar saw buying on Wednesday, and to the detriment of all G10 peers amid a notable hawkish repricing in Fed money markets.

- Markets now only assign a c. 26% chance of a 25bps cut in December (prev. 48%) after the new BLS data schedule shows the FOMC will not see the Nov. or Oct.

- Looking ahead, highlights include Japanese Foreign Bond Investment, Chinese LPR, and BoJ's Koeda.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks were choppy, but ultimately settled in the green as participants awaited NVIDIA earnings.

- SPX +0.38% at 6,642, NDX +0.56% at 24,641, DJI +0.10% at 46,139, RUT -0.04% at 2,348

- Click here for a detailed summary.

NVIDIA EARNINGS

- NVIDIA Corp (NVDA) Q3 2026 (USD): Adj. EPS 1.30 (exp. 1.24), Revenue 57.00bln (exp. 54.41bln), Q4 Revenue view 63.7-66.3bln (exp. 62.2bln). Data centre revenue 51.2bln (exp. 48.3bln). Gaming revenue 4.3bln (exp. 4.4bln). Gross margin 73.4% (exp. 73.5%, prev. guided 73-74%).

- Commentary: "Blackwell sales are off the charts, and cloud GPUs are sold out".

- Guidance: Q4 Revenue view 63.7-66.3bln (exp. 62.2bln). GAAP and non-GAAP gross margins are expected to be 74.8% and 75.0%, respectively, plus or minus 50bps. GAAP and non-GAAP operating expenses are expected to be approximately USD 6.7bln and USD 5.0bln, respectively. GAAP and non-GAAP other income and expense are expected to be an income of approximately USD 500mln, excluding gains and losses from non-marketable and publicly-held equity securities.

- Reaction: NVIDIA shares soared +4.2% after-hours, lifting ES (+0.9%) and NQ (+1.5%) in tandem.

TARIFFS/TRADE

- The Dutch government said it has suspended intervention at Nexperia as a show of goodwill, is positive about measures taken by China to ensure chip supply, and will continue engaging in constructive talks with China, according to Reuters citing sources.

- Key White House officials are pressing lawmakers on Capitol Hill to keep AI chip export restrictions to China out of the annual defense policy bill, according to four sources familiar with the matter, via Axios.

DELAYED DATA UPDATE

- The US November jobs report has been rescheduled for December 16th at 08:30 EST/13:30 GMT, with the October NFP to be released alongside November but without an unemployment rate. The BLS said the October 2025 Employment Situation Report has been cancelled, noting the Establishment Survey (NFP) data will be published with November’s release on December 16th, while Household Survey data (unemployment rate) could not be collected, via BLS.

FOMC MINUTES

- FOMC minutes revealed a divided committee on the appropriate pace of easing, with many favouring a 25bp cut, several preferring to hold rates, and one advocating a more forceful 50bp reduction. Supporters of a cut pointed to rising downside risks in employment and limited signs of renewed inflation pressures, while those opposed emphasized stalled progress toward the 2% target and insufficient confidence that inflation is on a sustainable path. Despite broad agreement that policy is moving gradually toward neutral, views diverged on how restrictive current settings remained.

- Most participants judged that further cuts are appropriate, but several did not see a December cut as likely, while some thought it could be appropriate if the economy evolves as expected. Concerns about inflation remained persistent, particularly in core non-housing services, expected tariff pass-through, and the risk that prolonged inflation overshoots could lift expectations. However, some noted that inflation excluding tariffs was close to target, and productivity gains or a softer labour market could help curb price pressures. Labour market conditions were seen as softening gradually, with structural factors such as AI-driven investment at play, and activity was moderate with strength concentrated in higher-income households.

- Most members supported concluding balance-sheet runoff by December 1st and favoured a larger Treasury bill share for flexibility. Several members warned that elevated asset valuations, especially in AI-related equities, left markets vulnerable to corrections. The minutes also touched on asset prices, highlighting the possibility of a disorderly fall in stock prices, especially if AI-related prospects are reassessed abruptly. After the minutes, money market pricing saw further rate cut bets pared, with just 6bps of easing priced, implying a 24% probability of a rate cut in December versus 7bps before the minutes. Rate cut bets had already begun to ease after the BLS delayed the October and November jobs reports to December 16th, after the December 10th FOMC. Pantheon Macroeconomics noted that while December remains uncertain, substantial easing is likely ahead.

NOTABLE HEADLINES

- US President Trump reiterated his criticisms of Fed Chair Powell, saying rates are too high, according to Reuters.

- BoC Deputy Governor Vincent said Canada’s weak productivity problem has become more urgent and is a systemic issue requiring a coordinated, economy-wide approach; he said the country is stuck in a vicious cycle where weak productivity makes it harder to meet challenges, shocks to the economy have become more frequent, and Canada is too vulnerable to their impacts. He added that when assessing inflation, the Bank places particular importance on the relationship between rising labour costs and productivity, according to Reuters.

DATA RECAP

- US International Trade USD (Aug) -59.6B vs. Exp. -61.0B (Prev. -78.3B, Rev. -78.2B)

- Manheim Used Vehicle Value Index (mid-Nov) 205; +1.1% across the first 15-days of November vs October, -0.2% Y/Y

FX

- The Dollar saw buying on Wednesday, and to the detriment of all G10 peers amid a notable hawkish repricing in Fed money markets, helping the Buck extend on earlier gains. Markets now only assign a c. 26% chance of a 25bps cut in December (prev. 48%) after the new BLS data schedule shows the FOMC will not see the Nov. or Oct.

- G10 FX saw losses across the board, and while most of it was Dollar-driven, there was some currency-specific newsflow; Yen saw notable weakness after the Japanese Finance Minister Katayama said she did not have specific discussions on FX with BoJ Governor Ueda.

- Cable traded between 1.3044-3155, with the Pound seeing weakness on UK CPI. Recapping, headline figures were in line with expectations whilst the services figures were cooler-than-expected.

FIXED INCOME

- T-Notes were slightly lower across the curve on Wednesday as traders pare rate cut bets, with BLS pushing back Oct and NFP job reports, while FOMC minutes lean hawkish.

- US sold USD 16bln of 20-year bonds; High Yield: 4.706% (prev. 4.506%, six-auction avg. 4.820%); WI: 4.704%. Tail: 0.2bps (prev. -1.2bps, six-auction avg. -0.3bps). Bid-to-Cover: 2.41x (prev. 2.73x, six-auction avg. 2.66x). Dealers: 11.4% (prev. 10.0%, six-auction avg. 11.9%). Directs: 29.2% (prev. 26.3%, six-auction avg. 22.7%). Indirects: 59.5% (prev. 63.6%, six-auction avg. 65.3%)

COMMODITIES

- Oil prices saw heavy selling on US’ proposed Ukraine/Russia peace plan.

- Russia’s Deputy PM Novak said Russia may reach its OPEC+ oil-output quota levels by year-end, noting it is steadily increasing output in November with growth slightly above October; he said Russia does not plan to voluntarily reduce output and is sticking to the OPEC+ agreement. He added sanctions against Rosneft and Lukoil have not affected Russia’s oil output, the discount on Russian oil will gradually decrease and soon reach its minimum once the market adjusts, and that Russia has fully compensated for prior overproduction under OPEC+. He said fuel prices have stabilised with retail prices starting to decline and maintained the 2025 oil-output projection at 510mln tonnes, according to Reuters.

DATA RECAP

- US EIA Weekly Crude Production Change (bbl) -28k (Prev. 211k)

- US EIA Weekly Crude Production 13.834M (Prev. 13.86M)

- US EIA Weekly Crude Production Change -0.2% (Prev. 1.55%)

- US EIA Weekly Refining Util w/e 0.6% vs. Exp. 0.8% (Prev. 3.4%)

- US EIA Weekly Gasoline Stk w/e 2.327M vs. Exp. -0.227M (Prev. -0.945M)

- US EIA Weekly Dist. Stocks w/e 0.171M vs. Exp. -1.215M (Prev. -0.637M)

- US EIA Weekly Crude Stocks w/e -3.426M vs. Exp. -0.603M (Prev. 6.413M)

- US EIA Wkly Crude Cushing w/e -0.698M (Prev. -0.346M)

GEOPOLITICAL

MIDDLE EAST

RUSSIA-UKRAINE

- US officials are reportedly close to unveiling a major new peace agreement with Russia to end the Ukraine conflict, with the deal expected to be agreed by all parties by end-November and possibly as soon as this week, via Politico.

- Russia is not holding contacts with US Special Envoy Witkoff, via RIA citing Peskov.

- US and Russian officials have drafted a new peace plan for Ukraine, with a sweeping 28-point proposal that would include territorial concessions and a rollback of American military assistance, according to FT.

- US proposals to end the war reportedly include Ukraine ceding territory and some weapons and reducing the size of its armed forces, with the US signalling to President Zelensky that he must accept the framework and its main points, according to Reuters citing sources.

- US President Trump's aides reportedly see no rush to levy the promised semiconductor tariffs, with the administration taking a more cautious approach to avoid tensions with China; no final decision has been made, though a White House and Commerce Department official disputed that the administration had adjusted its posture, according to Reuters citing sources.

EU/UK

NOTABLE HEADLINES

- The EU proposed delaying the timeline for applying high-risk AI rules to December 2027 from August 2026, according to Reuters.

- UK Chancellor Reeves is reportedly looking at ways to cut household energy bills, targeting a reduction of GBP 150–170 per year, with a cut to VAT on energy bills also under consideration, via Politico citing sources.

DATA RECAP

- UK CPI YY (Oct) 3.6% vs. Exp. 3.6% (Prev. 3.8%); MM (Oct) 0.4% vs. Exp. 0.4% (prev. 0.00%)

- UK Core CPI YY (Oct) 3.4% vs. Exp. 3.4% (Prev. 3.5%); CPI MM (Oct) 0.3% vs. Exp. 0.4% (prev. 0.00%)

- UK CPI Services YY (Oct) 4.50% vs. Exp. 4.60% (Prev. 4.70%); MM (Oct) 0.2% vs. Exp. 0.40% (Prev. -0.30%)

- UK ONS House Price Index: +2.6% in the 12-months to September

- EU Current Account SA, EUR (Sep) 23.1B (Prev. 11.9B)

- EU HICP Final YY (Oct) 2.1% vs. Exp. 2.1% (Prev. 2.1%)