EU equity futures point to a weak open despite gains in Asia-Pac equities; BoJ raised rates as expected - Newsquawk EU Market Open

- APAC stocks were mostly higher as the region took impetus from the positive handover from Wall Street, where the major indices gained following softer CPI data and strong Micron earnings, while the attention overnight turned to the BoJ.

- USD/JPY edged higher alongside the positive risk appetite and despite the BoJ decision to hike rates, as widely expected, and with no mention of FX-related concerns.

- US President Trump’s administration initiated a multi-agency review of NVIDIA (NVDA) H200 licenses for sales to China, according to sources cited by Reuters.

- US President Trump is scheduled to make an announcement at 13:00EST/18:00GMT on Friday and will deliver remarks on the economy at 21:00EST/02:00GMT.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.4% after the cash market closed with gains of 1.1% on Thursday.

- Looking ahead, highlights include German GfK Consumer Sentiment (Jan), UK PSNB (Nov), UK Retail Sales (Nov), GfK Consumer Confidence (Dec), Canadian Retail Sales (Oct), EZ Consumer Confidence (Dec), US Employment Trends (Nov), and CBR Announcement. Speakers include BoJ’s Ueda, ECB’s Cipollone, Lane & Fed's Williams.

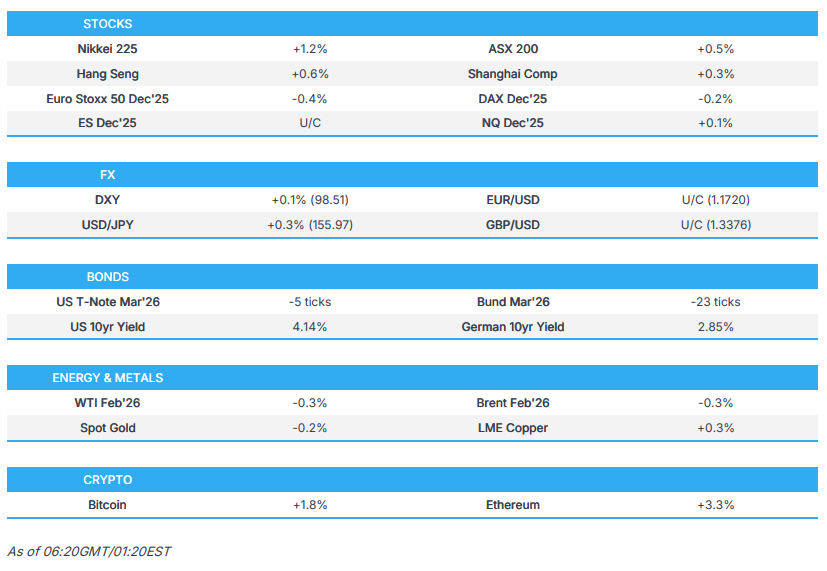

SNAPSHOT

- Note, on Friday 19th December, the desk will be closing at the earlier time of 18:05GMT/13:05EST after coverage of the Baker Hughes Rig Count.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were higher albeit in a choppy session on Thursday, as upside kicked off overnight, led by the Nasdaq after the stellar Micron (MU) earnings and guidance on Wednesday night, while reports that OpenAI is set to raise billions at a USD 750bln valuation also lifted sentiment, indicating strong investor appetite in the AI space, after some of fresh concerns last week following Broadcom and Oracle earnings. Stocks advanced further after the November US CPI came in notably softer than expected, albeit with some nuances around the government shutdown. The data also led to immediate upside in T-notes and gold, but this swiftly pared as the nuances were digested - stocks held their bid.

- In the US afternoon, notable pressure was seen in equities, gold, and crypto - albeit on no clear headline driver, with the majority of that downside paring before the closing bell.

- SPX +0.79% at 6,775, NDX +1.51% at 25,019, DJI +0.14% at 47,952, RUT +0.62% at 2,508.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump administration initiated a multi-agency review of NVIDIA (NVDA) H200 licenses for sales to China, according to sources cited by Reuters.US Commerce Secretary Lutnick spoke of Section 232 investigations into semiconductors and pharmaceuticals during a closed-door meeting with the Ways and Means Republicans today, according to Punchbowl citing sources.

- European Commission President von der Leyen told EU leaders at their summit on Thursday that the Mercosur trade won’t be signed as scheduled on Saturday and instead would wait until next month, according to Politico, citing two diplomats. Von der Leyen later stated that they reached out to Mercosur partners and agreed to slightly postpone the signing, but added that she is confident the EU has sufficient majority to approve the Mercosur trade deal.

- French President Macron said work must continue on the EU-Mercosur deal after the delay, as well as stated that the safeguards clause must be adopted by the EU Parliament and accepted by Mercosur nations, while he added that with new safeguard and mirror clauses to be implemented in January, it would be a "new" Mercosur-EU deal.

NOTABLE HEADLINES

- Fed's Goolsbee (2025 voter, dissenter) said the latest inflation data was favourable, and if clarity arrives that inflation is waning, then rates can come down, but he is uncomfortable about front-loading rate cuts. Goolsbee said he needs to see more sustained progress in cooling inflation, and that most measures of the job market have shown pretty steady cooling, as well as stated that rates can go down a fair bit as long as they know they're heading back to 2% inflation.

- US President Trump said he met with Waller yesterday, and he is great, while Trump is talking to three or four people regarding the Fed Chair and said Bowman is also great. Furthermore, he will announce the new Fed Chair over the next couple of weeks, maybe not before the new year.

- US President Trump is looking at declaring a national emergency on housing, while it was also reported that President Trump said there is practically no inflation now. Trump also signed an EO aiming to expedite reclassification of marijuana as schedule III substance.

- US President Trump is scheduled to make an announcement at 13:00EST/18:00GMT on Friday and will deliver remarks on the economy at 21:00EST/02:00GMT.

- US Homeland Security Secretary Noem said at President Trump's direction, she is immediately directing the USCIS to pause the DV1 program.

- US Democratic lawmakers requested a review of the Commerce Secretary's possible conflicts, according to NYT.

- US Senate Majority Leader Thune said the Democrats' three-year ACA extension will not pass the Senate.

- OpenAI is aiming to raise as much as USD 100bln in a fundraising round which could value it as much as USD 830bln, while OpenAI is expected to tap sovereign wealth funds to invest in the financing, according to WSJ.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher as the region took impetus from the positive handover from Wall Street, where the major indices gained following softer CPI data and strong Micron earnings, while the attention overnight turned to the BoJ, which unsurprisingly hiked rates for the first time since January.

- ASX 200 was underpinned by outperformance in tech and financials, but with gains capped as mining, resources and materials sat at the other end of the spectrum.

- Nikkei 225 rallied amid tech strength and with some banks supported as yields gained amid the widely-expected BoJ rate hike, in which the central bank raised its key rate by 25bps to 0.75%, which is the highest in 30 years.

- Hang Seng and Shanghai Comp conformed to the upbeat mood amid tech strength, and after the PBoC continued to opt for a double-pronged liquidity operation, while it was also reported that TikTok signed a deal to sell its US entity to a joint venture controlled by American investors.

- US equity futures trade steadily after the prior day's positive but choppy performance on Wall St.

- European equity futures indicate a lower cash market open with Euro Stoxx 50 futures down 0.4% after the cash market closed with gains of 1.1% on Thursday.

FX

- DXY was rangebound after a recent bout of US data in which participants ultimately looked past the softer-than-expected US CPI data, given the likely distortions from the government shutdown, while other data points included initial claims, which fell in line with expectations, and continued claims remain at elevated levels, but below the consensus. There were also comments from Fed's Goolsbee, who stated that the latest inflation data was favourable, and if clarity arrives that inflation is waning, then rates can come down, but he is uncomfortable about front-loading rate cuts.

- EUR/USD lacked conviction after giving back the initial gains seen following the ECB announcement to keep rates unchanged, which was as expected, but did see the 2026 projections revised up for inflation and growth. Furthermore, Bloomberg sources later stated the ECB officials expected the easing cycle to be most likely finished based on said upward revisions, while sources cited by Reuters noted that policymakers see growth and inflation risks as balanced and expect to keep rates on hold, but had no appetite to take a rate cut off the table on Thursday.

- GBP/USD was flat overnight after a failure to sustain the early support seen following the prior day's hawkish BoE rate cut.

- USD/JPY edged higher alongside the positive risk appetite and despite the BoJ decision to hike rates, as widely expected, and with no mention of FX-related concerns, while the latest Japanese CPI data matched estimates across all components and had little impact on the domestic currency.

- Antipodeans traded indecisively with little reaction seen to the New Zealand trade data and improved business surveys.

- PBoC set USD/CNY mid-point at 7.0550 vs exp. 7.0378 (Prev. 7.0583).

- Mexican Interest Rate (Dec) 7.0% vs. Exp. 7.0% (Prev. 7.25%). Banxico stated that looking ahead, the Board will evaluate the timing for additional reference rate adjustments (prev. Board will evaluate reducing the reference rate).

FIXED INCOME

- 10yr UST futures faded the prior day's gains which were facilitated by softer-than-expected US CPI data and a strong 5-year TIPS auction.

- Bund futures lacked demand following the recent ECB and US data-triggered volatility, with downside pressure seen as JGBs slid on the BoJ decision.

- 10yr JGB futures were pressured and slipped beneath the 133.00 level in the aftermath of the BoJ hiking rates to their highest level in 30 years, which lifted the 10yr JGB yield by around 5bps to its highest since 1999 of 2.017%, and the 20yr yield gained by about 4bps to a fresh record high of 2.975%.

COMMODITIES

- Crude futures traded rangebound after marginally gaining yesterday in choppy trade following recent reports of the EU imposing additional sanctions on 41 vessels that are part of Russia's "shadow fleet", while the UK also made 24 designations under the Russian sanctions scheme.

- Spot gold lacked demand following the recent post-CPI whipsawing in which the precious metal spiked higher on the softer-than-expected US inflation print, before reversing course, as the data was likely to be distorted following the record-long US government shutdown.

- Copper futures gradually edged higher with early downside reversed amid the mostly positive risk appetite in the region.

CRYPTO

- Bitcoin advanced overnight alongside the tech strength and returned to above the USD 87,000 level.

NOTABLE ASIA-PAC HEADLINES

- BoJ hiked rates by 25bps, as widely anticipated, while it stated that real interest rates are expected to remain at significantly low levels and reiterated that it will continue to raise policy rate if the economy and prices move in line with forecast, in accordance with improvements in the economy and prices. It also repeated that it will conduct monetary policy as appropriate from the perspective of sustainably and stably achieving the 2% inflation target, as well as noted that wages and inflation are likely to continue rising moderately in tandem, and that the economy has recovered moderately, although some weakness is seen. BoJ also stated that consumer inflation is likely to fall below 2% towards the first half of the next fiscal year, then rise thereafter, and it is highly likely that the mechanism in which both wages and prices rise moderately will be maintained.

- TikTok signed a deal to sell its US entity to a joint venture controlled by American investors with the agreement set to close on January 22nd. Oracle (ORCL), Silver Lake and Abu Dhabi-based MGX will collectively own 45% of TikTok's US entity, while nearly one-third of the TikTok US will be held by affiliates of existing ByteDance investors, and nearly 20% will be retained by ByteDance, according to Axios.

DATA RECAP

- Japanese National CPI YY (Nov) 2.9% vs Exp. 2.9% (Prev. 3.0%)

- Japanese National CPI Ex. Fresh Food YY (Nov) 3.0% vs Exp. 3.0% (Prev. 3.0%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Nov) 3.0% vs Exp. 3.0% (Prev. 3.1%)

GEOPOLITICS

RUSSIA-UKRAINE

- US President Trump said regarding the Ukraine meeting that they are getting close and he hopes Ukraine moves quickly.

- EU's Costa said they have a deal to finance Ukraine and that the decision to provide EUR 90bln of support to Ukraine for 2026-2027 was approved. Costa said leaders agreed to roll over sanctions against Russia, while he added that Ukraine will only repay the EU loan once Russia pays reparations and the EU reserves its right to make use of the immobilised assets to repay the loan.

- German Chancellor Merz confirmed that Ukraine will receive an interest-free loan of EUR 90bln and said these funds are sufficient to cover Ukraine's military and budgetary needs for the next two years, while the EU will keep Russian assets frozen until Russia has compensated Ukraine. Merz also stated that they expressly reserve the right to use Russian assets for repayment if Russia fails to pay compensation in full compliance with international law.

- Russia's Dmitriev said regarding the EU summit decision that it was a 'major blow to EU warmongers led by failed Ursula' and that voices of reason in the EU blocked the illegal use of Russian reserves to fund Ukraine.

OTHER

- US President Trump said he has no problem telling Congress about any possible attack on Venezuela.

EU/UK

NOTABLE HEADLINES

- ECB policymakers see growth and inflation risks as balanced, some fear lower growth outcomes, while they expect to keep rates on hold but had no appetite to take a rate cut off the table on Thursday, according to sources cited by Reuters.

DATA RECAP

- UK GfK Consumer Confidence (Dec) -17.0 vs. Exp. -18.0 (Prev. -19.0)