Europe Market Open: Venezuela to turn over 30-50mln barrels of oil to the US; European equity futures point to a mixed open - Newsquawk European Opening News

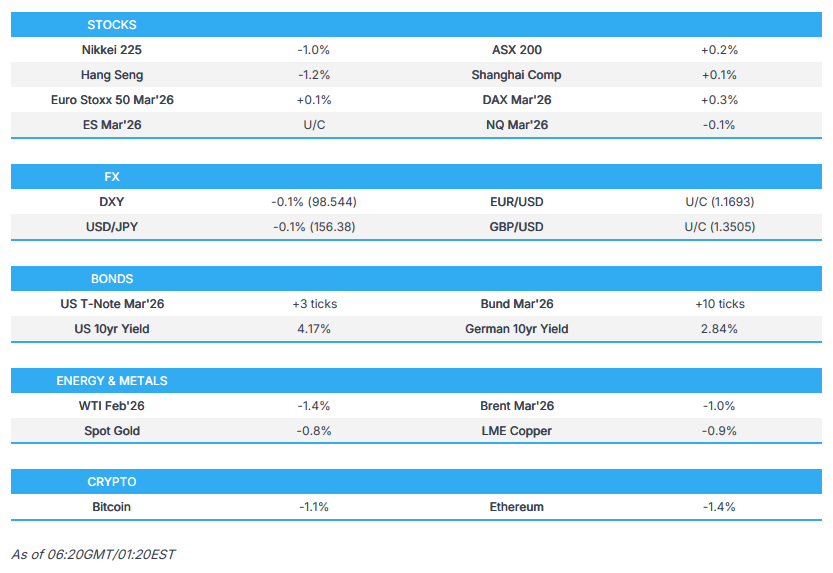

- APAC stocks traded somewhat mixed as momentum began to wane despite the fresh record levels on Wall Street.

- Nikkei 225 lagged amid Japan's frictions with China after the latter imposed export controls on dual-use items to Japan.

- Spot gold pulled back from resistance at the USD 4,500/oz level, with some mild selling pressure seen across the commodities complex.

- US President Trump announced that Venezuelan authorities will be turning over 30mln-50mln barrels of oil to the US.

- Russia sent a submarine to escort a tanker the US tried to seize off Venezuela, according to WSJ.

- Looking ahead, highlights include German Retail Sales (Nov), Italian CPI Prelim (Dec), Eurozone HICP Flash (Dec), US ADP, ISM Services PMI (Dec), JOLTS (Nov), Comments from Fed's Bowman, Supply from Germany & UK.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks advanced on Tuesday with broad-based gains as all indices closed higher, with the Russell and Equal Weight S&P outperforming. Sectors were also predominantly firmer with Health Care, Materials and Industrials leading the advances, while Energy and Communication Services were lower.

- NVIDIA (NVDA) closed in the red despite some optimistic commentary from the CEO and CFO, but with weakness still attributed to uncertainty around H200 China orders being approved. Energy stocks tracked crude prices lower, giving up some of Monday's gains in what has been a volatile start to the year for crude, with recent downside stemming from optimism surrounding Russia/Ukraine peace following a positive meeting on security guarantees between the US, EU and Ukraine, although we are still awaiting Russia's response.

- SPX +0.62% at 6,945, NDX +0.94% at 25,640, DJI +0.99% at 49,462, RUT +1.37% at 2,583.

- Click here for a detailed summary.

TARIFFS/TRADE

- Chinese Foreign Minister Wang Yi said China seeks discussions with the EU on a free trade agreement.

- Japanese Chief Cabinet Secretary Kihara said China's curbs targeting only Japan are regrettable, and they will consider the necessary response as they assess China's export curb details.

NOTABLE HEADLINES

- US President Trump said that if they do not win the midterms, he will be impeached. Trump also said that health insurance premiums are horrible, and he will meet with 14 insurance companies in a few days.

- Fed Discount Rate Minutes stated that in December, the FOMC approved a 25bps cut in rate on discounts and advances made under the primary credit programme, while it noted that the directors of Federal Reserve Banks of New York, Philadelphia, St. Louis and San Francisco had voted to establish a decrease in the primary credit rate.

APAC TRADE

EQUITIES

- APAC stocks traded somewhat mixed as momentum began to wane despite the fresh record levels on Wall Street.

- ASX 200 marginally gained amid strength in tech and defensives, while participants also digested monthly inflation data, which printed softer-than-expected but remained sticky.

- Nikkei 225 lagged amid Japan's frictions with China after the latter imposed export controls on dual-use items to Japan.

- Hang Seng and Shanghai Comp retreated with the Hong Kong benchmark pressured by losses in energy names and tech stocks following a decline in oil prices, and with platform names pressured by China announcing management measures for online platforms. Meanwhile, the mainland bourses kept afloat for most of the session but eventually faltered as the mood deteriorated and were also not helped by a substantial net liquidity drain of around CNY 500bln in the PBoC's open market operations.

- US equity futures lacked direction with index futures pausing following their recent rally.

- European equity futures indicate a marginally positive cash market open with Euro Stoxx 50 futures up 0.1% after the cash market eked gains of 0.1% on Tuesday.

FX

- DXY slightly softened and took a breather after the prior day's rebound, which was facilitated by Treasury yields, while catalysts for the dollar remained sparse ahead incoming labour market data beginning with ADP and JOLTS numbers later today, although there were some prior from Fed's Miran and Barkin in which the former reiterated his usual uber-dove tones, while the latter said that the current policy rate is within the range of neutral. DXY found overnight resistance at its 100 DMA (98.60).

- EUR/USD saw some slight reprieve after trickling lower yesterday, with the single currency not helped by a slew of data, including softer-than-expected German inflation and a miss on EZ Services and Composite PMIs, while participants await further economic releases including the latest EZ inflation figures.

- GBP/USD marginally rebounded after having tested the 1.3500 level to the downside on Tuesday, despite better-than-expected UK Services PMI data and reports that the government is talking to the hospitality sector about more support, while the calendar for the UK is light this week with no major tier-1 releases from the UK.

- USD/JPY lacked firm direction in the absence of any key data or fresh pertinent catalysts for the Japanese currency, and with mild pressure seen as risk appetite began to sour.

- Antipodeans ultimately strengthened with AUD/USD the outperformer after reversing the initial knee-jerk move lower seen following softer-than-expected monthly inflation, as the headline figure and the core reading all remained sticky and above the 2-3% target.

FIXED INCOME

- 10yr UST futures marginally rebounded after declining yesterday on corporate issuances and a record Fed Funds block sale, while the attention turns to several incoming data releases, including labour market proxies ahead of Friday's NFP report.

- Bund futures held on to the prior day's spoils following soft German inflation data, but with further upside limited as EUR 6bln of Bund issuances loom.

- 10yr JGB futures kept afloat in choppy price action amid the downbeat mood in Japan and the absence of relevant data.

COMMODITIES

- Crude futures declined following recent Ukraine-related optimism, and with selling further exacerbated after US President Trump announced that Venezuelan authorities will be turning over 30mln-50mln bbls of oil to the US.

- US President Trump posted "Interim Authorities in Venezuela will be turning over between 30 and 50 MILLION Barrels of High Quality, Sanctioned Oil, to the United States of America. This Oil will be sold at its Market Price, and that money will be controlled by me, as President of the United States of America, to ensure it is used to benefit the people of Venezuela and the United States! I have asked Energy Secretary Chris Wright to execute this plan, immediately. It will be taken by storage ships, and brought directly to unloading docks in the United States."

- US Energy Secretary Wright has been in contact with oil executives this week over the phone, and will be meeting face-to-face with executives from Wednesday, during which they will discuss Venezuela, according to FBN. Furthermore, oil CEOs were expected to visit the White House on Thursday for a meeting on Venezuela, although POLITICO later reported that President Trump is to meet with oil execs regarding Venezuela on Friday.

- US Private Inventory Data (bbls): Crude -2.8mln (exp. +0.5mln), Distillate +4.9mln (exp. +2.1mln), Gasoline +4.4mln (exp. +3.2mln), Cushing +0.7mln.

- Spot gold pulled back from resistance at the USD 4,500/oz level, with some mild selling pressure seen across the commodities complex as Shanghai and LME trade got underway.

- Copper futures tested the USD 6/lb level to the downside as risk momentum in the Asia-Pac region gradually waned.

CRYPTO

- Bitcoin retreated overnight with prices back beneath the USD 93,000 level.

NOTABLE ASIA-PAC HEADLINES

- China announced management measures for online platforms, with the market regulator stating that online platforms must not sell below cost or disrupt market competition.

DATA RECAP

- Australian CPI YY (Nov) 3.40% vs. Exp. 3.60% (Prev. 3.80%)

- Australian RBA Trimmed Mean CPI YY (Nov) 3.2% vs. Exp. 3.2% (Prev. 3.3% )

- Australian Building Permits MM (Nov P) 15.2% vs. Exp. 2.0% (Prev. -6.4%)

GEOPOLITICS

VENEZUELA

- US President Trump is pressing Venezuela to dismiss agents from China, Russia, Iran and Cuba, according to Axios.

- US President Trump's administration warned Venezuela's Interior Minister to cooperate or face potential targeting.

- Russia sent a submarine to escort a tanker the US tried to seize off Venezuela, according to WSJ.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said they had concrete discussions with the US on ceasefire monitoring, and the issue of territory still needs to be sorted, although some ideas on the territorial issue were discussed.

- Ukraine, France and Britain signed a declaration of intent on future multinational force deployment in Ukraine.

- US envoy Witkoff said the Paris coalition of the willing talks showed strong collaboration and made significant progress on key workstreams, including a bilateral security guarantee framework and a prosperity plan. He also stated that durable security guarantees and prosperity commitments are vital for Ukraine's peace, with talks continuing into Wednesday. Furthermore, Witkoff thinks they are largely finished on security guarantees and protocols, and are close to finishing off a robust prosperity agreement for Ukraine.

- EU's Costa said they held a productive meeting of the coalition of the willing to advance support for Ukraine, and the EU will contribute to security guarantees Ukraine needs for a long-lasting peace agreement, while he added that they will assist with civilian and military EU missions on the ground.

- UK PM Starmer said following a ceasefire, the UK and France will build military hubs in Ukraine.

- French President Macron said the US has clarified its role in Ukraine, including frontline monitoring and confirmed a US backstop.

- Italian PM Meloni said coalition members agreed on the need to sustain pressure on Russia, while she added that talks show unity among Ukraine, the US and the EU on a long-term security framework.

- Polish PM Tusk said there is no expectation for Polish troops to be deployed in Ukraine under security guarantees being discussed, and Ukraine is ready to compromise, or at least is talking seriously about a compromise. Furthermore, he said the task is to maintain full solidarity in transatlantic pressure on Russia, and that unity between Europe and the US seemed to be assured.

OTHER

- US Secretary of State Rubio told lawmakers that US President Trump aims to buy Greenland, and downplayed military action, according to WSJ.

- US senior official said the issue of a US acquisition of Greenland is "not going away" and President Trump is eager for a deal despite objections from NATO leaders, with Trump and his team discussing a range of options for acquiring Greenland and 'utilising the US military is always an option'. Furthermore, it was said that Trump and his advisers are discussing options, including purchasing the territory from Denmark or forming a compact of free association with the island, while he would like to acquire Greenland during his current term in office and has made it clear that acquiring Greenland is a 'national security priority'.

- China's Taiwan Affairs Office named two people to be punished for Taiwan independence activities, while it stated the people, as well as their relatives, are banned from entering the mainland, Hong Kong and Macau.

EU/UK

NOTABLE HEADLINES

- Italian PM Meloni plans an overhaul of Italy's voting system to aid a re-election bid, according to FT.