European and US equity futures pressured amid heightening geopolitical tension between US and Iran - Newsquawk US Opening News

- Beijing is no longer seeking to make new advances into LatAm in the near term, WSJ sources report; instead, focus shifted towards if the Western Hemisphere belongs to the US, then the Taiwan Strait belongs to China, but this does not mean immediate action.

- WSJ source reports suggested that incentives under consideration by Chinese officials to woo the US into a strategic retreat from the Taiwan Strait include Beijing potentially agreeing to buy billions of USD in long-term Treasuries.

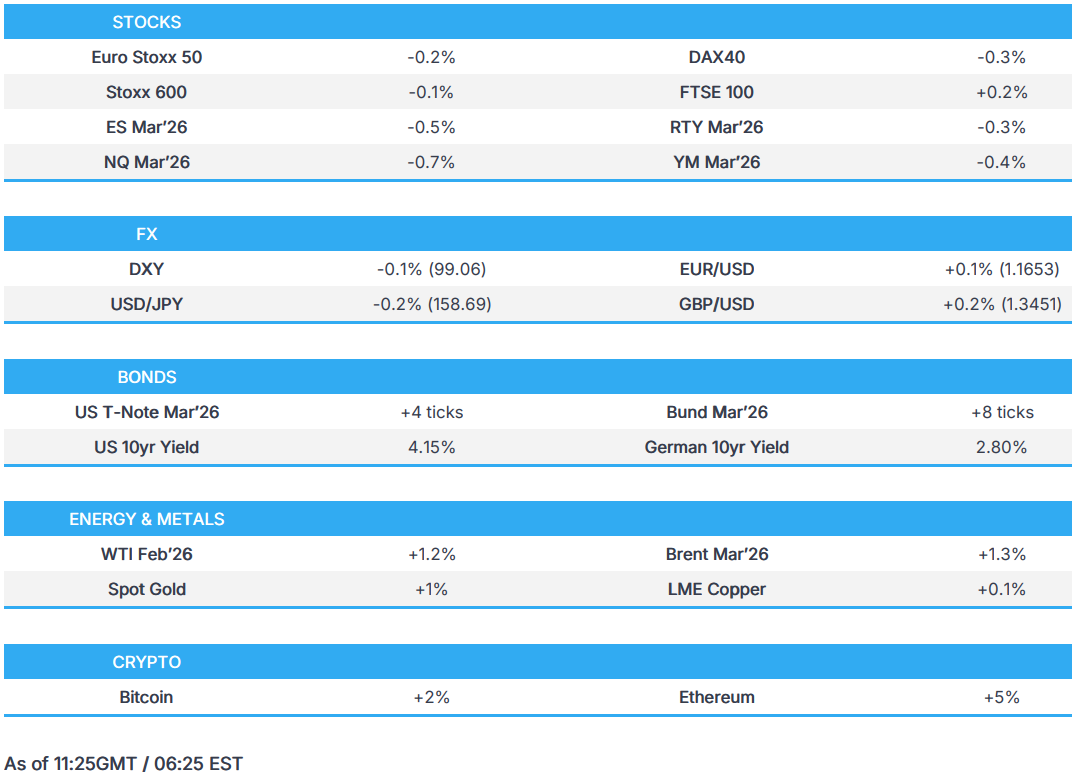

- European bourses opened higher but now broadly lower as the risk tone deteriorates on Iran rhetoric; US equity futures also in the red.

- DXY is slightly lower; JPY mildly gains on jawboning from several officials, including Katayama who said they will take the appropriate action to deal with excessive FX moves, nothing is excluded.

- Fixed benchmarks initially contained, but recently caught a bid to highs as the risk tone slips.

- Crude benchmarks at highs as Iran warns it will strike US bases if it is hit; Iran is at “highest level” of readiness.

- Looking ahead, Highlights include US PPI (Nov), Retail Sales (Nov), Atlanta Fed GDP, NBP Policy Announcement, Fed's Beige Book; Speakers include BoE's Ramsden, Fed's Paulson, Kashkari, Williams, Miran, Bostic; Earnings from Wells Fargo, Citi, Bank of America.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.1%) opened broadly on the front foot, but have since slipped mostly into the red as the risk tone slips, amid hawkish rhetoric out of Iran.

- European sectors are mixed. Healthcare leads alongside Utilities whilst Media and Travel & Leisure lags. The latter has been pressured after Barclays downgraded Lufthansa (-3%) and Air France (-4.5%).

- US equity futures were mixed, but have recently come under pressure to display a negative picture across indices; ES -0.4%, NQ -0.6%, RTY -0.2%. Dip in sentiment as markets digest remarks via Iran, which noted that it would strike US bases in the Middle East if the US attacked Iran. As such, reports suggest that some personnel have reportedly been told to leave Qatar's Al Udeid US airbase by Wednesday evening.

- China's customs authorities have reportedly told customs agents this week that NVIDIA's (NVDA) H200 AI chips are not allowed to enter China; unclear on the rulings constitute a formal ban or a temporary measure. Tech companies have been told by government officials to not purchase chips unless necessary.

- Tesla (TSLA) CEO, Musk announced on X that the Co. will stop selling FSD after 14th February and will only be available as a monthly subscription after.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is incrementally lower and trades within a narrow 99.02-99.24 range; the trough for the day is a handful of ticks below its 50 DMA at 99.04. Further pressure in the index could see a test of its 200 DMA at 98.79.

- Really not much driving things for the index this morning, but overnight the USD was pressured on a WSJ report which highlighted that the US had halted China’s plans to expand in LatAm, and instead sees the Taiwan Strait belonging to China. The piece added that China could incentivise the US to move away from the Strait by billions of dollars in long-term Treasuries.

- Other G10s are mixed against the USD, with modest strength seen in Antipodeans (attributed to strength in the metals complex), whilst the GBP also gains. For Sterling, BoE's Taylor spoke earlier, where he reiterated that he expects monetary policy to normalise at neutral “sooner rather than later”, adding that the BoE can see inflation at target in mid-2027 vs 2027 previously. No move to these remarks.

- USD/JPY has chopped and changed this morning, but the JPY is net-firmer vs USD amidst continued jawboning from Japanese officials and as geopolitical tensions increase. Earlier, Cabinet Secretary Kihara said they will take appropriate action to deal with excessive movements in FX – this largely echoed the remarks made by the Keidanren Chief in the prior session. Thereafter, Katayama spurred some modest strength in the JPY after she said that “nothing is excluded” in relation to dealing with FX moves, adding that she had FX talks with Bessent. As a reminder, Katayama recently said Bessent shares the same concerns about a weak JPY – a point which perhaps indicates some acceptance to intervention by the US-side. Thereafter, the FX Diplomat Mimura spurred another bout of strength in the JPY after he reiterated Katayama’s comments.

FIXED INCOME

- Initially a contained start to the European day for the fixed complex.

- However, the risk tone began to deteriorate on geopolitical newsflow. In brief, a Senior Iranian Official said that it would strike US bases in the Middle East if the US attacked Iran. As such, reports suggest that some personnel have reportedly been told to leave Qatar's Al Udeid US airbase by Wednesday evening.

- USTs (112-05+ to 112-13+) and Bunds (127.98 to 128.26) currently at the upper end of their respective ranges, given the risk tone.

- No real move in Bunds following a number of ECB appearances, and a German auction which passed without issue.

- Gilts opened with modest gains, reflecting the mild bullish bias in peers. Since, the benchmark has been choppy in 92.14 to 92.40 confines, but trades broadly in-line with the above. No move to remarks from BoE's Taylor, who stuck to his dovish script and largely echoed language from the December meeting; as a reminder, Taylor was in the majority who voted for a 25bps cut to 3.75%. UK supply was well received, sparking modest upside.

- Germany sells EUR 700.9mln vs exp. EUR 1bln 3.25% 2042 Bund, EUR 809mln vs exp. EUR 1bln 0.00% 2052 Bund, EUR 822mln vs exp. EUR 1bln 2.90% 2056 Bund & EUR vs exp.

COMMODITIES

- Crude benchmarks began the European session on the backfoot, scaling back from the upside seen in the prior session. However, a number of Iran related headlines have lifted the complex to into the green and to highs. In brief, a Senior Iranian Official said that it would strike US bases in the Middle East if the US attacked Iran. As such, reports suggest that some personnel have reportedly been told to leave Qatar's Al Udeid US airbase by Wednesday evening. WTI and Brent are currently at highs, posting gains of circa. USD 0.90/bbl.

- Precious metals continue their ascent to ATHs, as trend purchasing and geopols keep the complex bid. In more detail, spot gold made a fresh all-time peak at USD 4,639.89/oz, and has traded at elevated levels throughout the European morning. As for spot silver, the metal made a fresh ATH at USD 91.57/oz, before scaling back towards the USD 90/oz mark.

- Base metals also followed the trend seen across the precious metals complex overnight, with 3M LME Copper also making a fresh ATH beyond USD 13.4k/oz, but has since scaled back to currently trade flat on the session. Elsewhere, 3M LME tin hits a new record above USD 51k/t on strong Chinese investor demand.

- Indonesia could potentially approve a Nickel ore production quota of c. 260mln/MT in 2026, according to local reporting.

TRADE/TARIFFS

- EU lawmakers to meet at 08:00GMT to decide whether to postpone the vote on lifting tariffs on US industrial goods, Politico reported citing sources; a delay framed as a tactical response to the US' threat to annex Greenland.

- Indonesia is to raise its crude palm oil export level to 12.5%, effective from March.

- US President Trump, on China, said "I think we can open China markets to US goods".

- US Commerce Department said that Chinese companies must demonstrate sufficient security procedures in order to buy NVIDIA (NVDA) H200 chips.

- US posted licence review rule for chip exports to China and Macau; US eases the criteria to approve the NVIDIA (NVDA) H200 chip exports to China; NVIDIA H200 chips are covered by the export licence review rule.

NOTABLE EUROPEAN HEADLINES

- The option to allow the French budget, in its initial form, to pass without parliamentary approval has reportedly been under consideration for around ten days, Politico reported citing sources; the so-called "ordinance" option. A scenario reportedly favoured by President Macron. However, several sources add that while nothing has been ruled out, the option of Article 49.3 is the one actively under consideration at this moment.

CENTRAL BANKS

- Fed's Barkin (2027 voter) said that no single meeting is decisive and that errors can be corrected at the next meeting. Not seeing a strong business push to pass on price hikes. CPI data was encouraging. Shelter inflation is still biased due to missing October data. Businesses are more confident about tariff outcomes now than last April. Tariffs still create some cost and inflation pressure over time, but the timing is unclear.

- Fed's Barkin (2027 voter) said inflation is higher than our target but it doesn't seem to be accelerating just yet; unemployment has ticked up but not ticking out of control.

- BoJ Governor Ueda said Japan's economy continued to moderately recover in 2025 and the Bank will keep raising rates if economic outlook is realised.

- Japanese Chief Cabinet Secretary Kihara said the BoJ chooses which monetary tools to use and expects BoJ-Government co-operation to reach 2% inflation steadily.

- The Finance Markets Department of the BoJ will hold the meeting on market operations on February 26th. Will discuss recent market developments, BoJ operations, JGB market liquidity and functionality, and money markets.

- ECB's de Guindos said inflation is in a good place.

- ECB's Villeroy said if the budget deficit in France increased to more than 5% in 2026, then the country would enter the danger zone.

- ECB's Kazaks said the ECB is in a good place. Outlook risks are on both sides.

- BoE's Taylor said he "...expect monetary policy to normalise at neutral sooner rather than later, as I said in the December minutes". BoE sees inflation at target in mid-2026, judges this to be sustainable given cooling wage growth.

- Bank of Korea official reiterates USD/KRW exchange rate above 1,400 is misaligned with economic fundamentals, noted the need for policy measures to ease excessively pessimistic market sentiment.

NOTABLE US HEADLINES

- US' Witkoff and Kushner intend to visit Moscow, Russia soon and meet with President Putin, Bloomberg reported citing sources. Meeting could occur in January.

- US President Trump said that robots will be a major force and will help with jobs.

- US President Trump said the economy is booming, with the private sector growing by over 5% due to business investment. Adds that inflation trends are looking good and that "All the smart money knows the HOTTEST Economy in the World is the U.S.A".

- "Israel has been on particularly high security alert in recent hours, against the backdrop of the US president's dramatic statements regarding the protests in Iran", according to local press. The Israeli security assessment is that a US attack on Iran is not a question of if but when". "There are fears that Iran could attack Israel in response.".

GEOPOLITICS

RUSSIA-UKRAINE

- US' Witkoff and Kushner intend to visit Moscow, Russia soon and meet with President Putin, Bloomberg reported citing sources. Meeting could occur in January.

- European Commission President von der Leyen says funding to Ukraine for the 2026-27 period will be EUR 90bln. To be split into EUR 60bln for military and EUR 30bln for fiscal support.

MIDDLE EAST

- Senior Iranian Official said Tehran has warned regional nations that it will strike US bases in the region in the scenario that they are attacked by the US. Requested that regional leaders work to prevent an escalation. Direct communication between the US and Iran has been halted, due to the threats by US President Trump.

- "Israeli security sources: Israel is not a partner in any US plans to launch military action against Iran", Sky News Arabia reported citing local reported.

- The Trump admin on Wednesday is expected to announce the establishment of a peace council for Gaza and the establishment of a Palestinian government of technocrats that will run the Gaza Strip, Axios reported. "The Trump administration will also officially announce the appointment of former UN envoy Nickolay Mladenov as the representative of the Peace Council in the Gaza Strip and who will accompany the activities of the Palestinian technocrat government".

- US National Security Officials arrive at the White House as meeting begins to discuss Trump's options against Iran, CNN reported.

- The US State Department has warned US citizens to leave Iran and to consider departing by land to Turkey or Armenia if it is safe to do so.

- US President Trump said he is heading back to the White House and will look at Iran, adds that "Iran is on my mind" and will get death figures shortly. Will act accordingly on the protester death toll.

- "Israel has been on particularly high security alert in recent hours, against the backdrop of the US president's dramatic statements regarding the protests in Iran", according to local press. The Israeli security assessment is that a US attack on Iran is not a question of if but when". "There are fears that Iran could attack Israel in response.".

- The Trump administration believes that Iran has not yet reached the stage of weakness that makes US strikes decisive to topple the regime, NBC News reported.

OTHERS

- Some personnel have reportedly been told to leave Qatar's Al Udeid US airbase by Wednesday evening.

- Four Chinese ships reportedly entered Japan's waters near the Senkaku Islands, via Kyodo.

- Beijing is no longer seeking to make new advances into LatAm in the near term, WSJ sources report, instead focus shifted towards if the western hemisphere belongs to the US, then the Taiwan Strait belongs to China, but does not mean immediate action. Beijing is now playing defence, focused on avoiding a complete erasure from Venezuela’s oil reserves. This calculated retreat, according to sources, could reflect what China expects the US to do in the Taiwan Strait. Other incentives under consideration by Chinese officials, sources said, include Beijing potentially agreeing to buy billions of USD in long-term Treasurys.

- Venezuela's acting President Rodriguez plans to send an envoy to Washington to meet with senior US officials on Thursday.

- Venezuela Government has started releasing US citizens, Bloomberg reported.

- US Senators have introduced legislation to prevent the American military from occupying or annexing NATO territories including Greenland.

CRYPTO

- Bitcoin is on a firmer footing and trades towards USD 95k; Ethereum outperforms and back above USD 3.3k.

APAC TRADE

- Asia-Pac stocks traded mostly in the green, with the Nikkei 225 outperforming, while the ASX 200 lagged.

- ASX 200 initially started the session with gains and was up as much as 0.6% before reversing due to losses in Financials. This follows poor JPMorgan (JPM) earnings, in which EPS and revenue missed estimates.

- Nikkei 225 was the clear outperformer in Asia-Pac equities, up 1.7% and continuing to extend to fresh ATHs. This follows increased traction around reports that PM Takaichi is set to dissolve the Lower House and call a snap election in a bid to capitalise on her healthy poll numbers, reviving the so-called ‘Takaichi trade’.

- KOSPI traded choppily, with the South Korean equity market peaking at a new ATH of 4,716 before falling back into Tuesday’s trading range.

- Hang Seng and Shanghai Composite started the APAC session on the front foot and have failed to pull back meaningfully in the early hours of trade, with the Shanghai Composite trading at ATHs around 4,181. Shanghai Comp. later completely reversed its earlier gains following margin requirement adjustment.

NOTABLE ASIA-PAC HEADLINES

- China's Ministry of Science and Technology announces plan to strengthen financing and support mechanism for key tech sectors.

- China is reportedly to launch a new round of policy to boost employment, via CCTV.

- Samsung Electronics (005930 KS) is reportedly to close one of its three 8inch foundry fabs in Giheung during H2-2026, Lec reported citing sources. Intention is to phase out low-profit legacy processes and concentrate resources on 12inch production.

- Baidu (9888 HK) is reportedly looking into upgrading its Hong Kong listing to primary status, Bloomberg reported citing sources. A move that would provide it with more mainland China exposure.

NOTABLE APAC DATA RECAP

- Indian WPI Inflation YoY (Dec) Y/Y 0.83% vs. Exp. 0.30% (Prev. -0.32%).

- Indian WPI Food Index YoY (Dec) Y/Y 0.0% vs. Exp. -2.3% (Prev. -2.60% ).

- Indian WPI Manufacturing YoY (Dec) Y/Y 1.82% vs. Exp. 1.5% (Prev. 1.33%).

- Japanese Money Supply M2 YY (Dec) 1.7% (Prev. 1.8%).

- Japanese Money Supply M3 YY (Dec) 1.1% (Prev. 1.2%).

- Chinese Exports YoY (Dec) Y/Y 6.6% vs. Exp. 3% (Prev. 5.9%).

- Chinese Balance of Trade Yuan (Dec) 808.8B vs. Exp. 820B (Prev. 792.58B).

- Chinese Imports YoY (Dec) Y/Y 5.7% vs. Exp. 0.9% (Prev. 1.9%).

- Chinese Exports YoY Yuan-Denominated (Dec) Y/Y 6.1% (Prev. 5.7%).

- Chinese Imports YoY Yuan-Denominated (Dec) Y/Y 0.5% (Prev. 1.7%).

- Australian Building Permits MoM Final (Nov) M/M 15.2% vs. Exp. 15.2% (Prev. -6.1% ).

- Australian Building Permits YoY Final (Nov) Y/Y 20.2% vs. Exp. 20.2% (Prev. -1.1% ).

- Australian Private House Approvals MoM Final (Nov) M/M 1.3% vs. Exp. 1.3% (Prev. -1.3% ).