European equities futures point to an uneventful open ahead of a flurry of rate decisions, which include the BoE and ECB - Newsquawk EU Market Open

- APAC stocks were mostly lower following on from the tech-led selling stateside and ahead of US inflation data and a slew of upcoming central bank decisions.

- US President Trump's primetime address to the nation made no mention of a US blockade against Venezuela or Russian sanctions.

- US President Trump said he will soon announce the next Fed chair and that the new Fed chair will believe in lowering interest rates by a lot.

- US equity futures traded rangebound with little reaction seen following President Trump's primetime address and as participants awaited US CPI data.

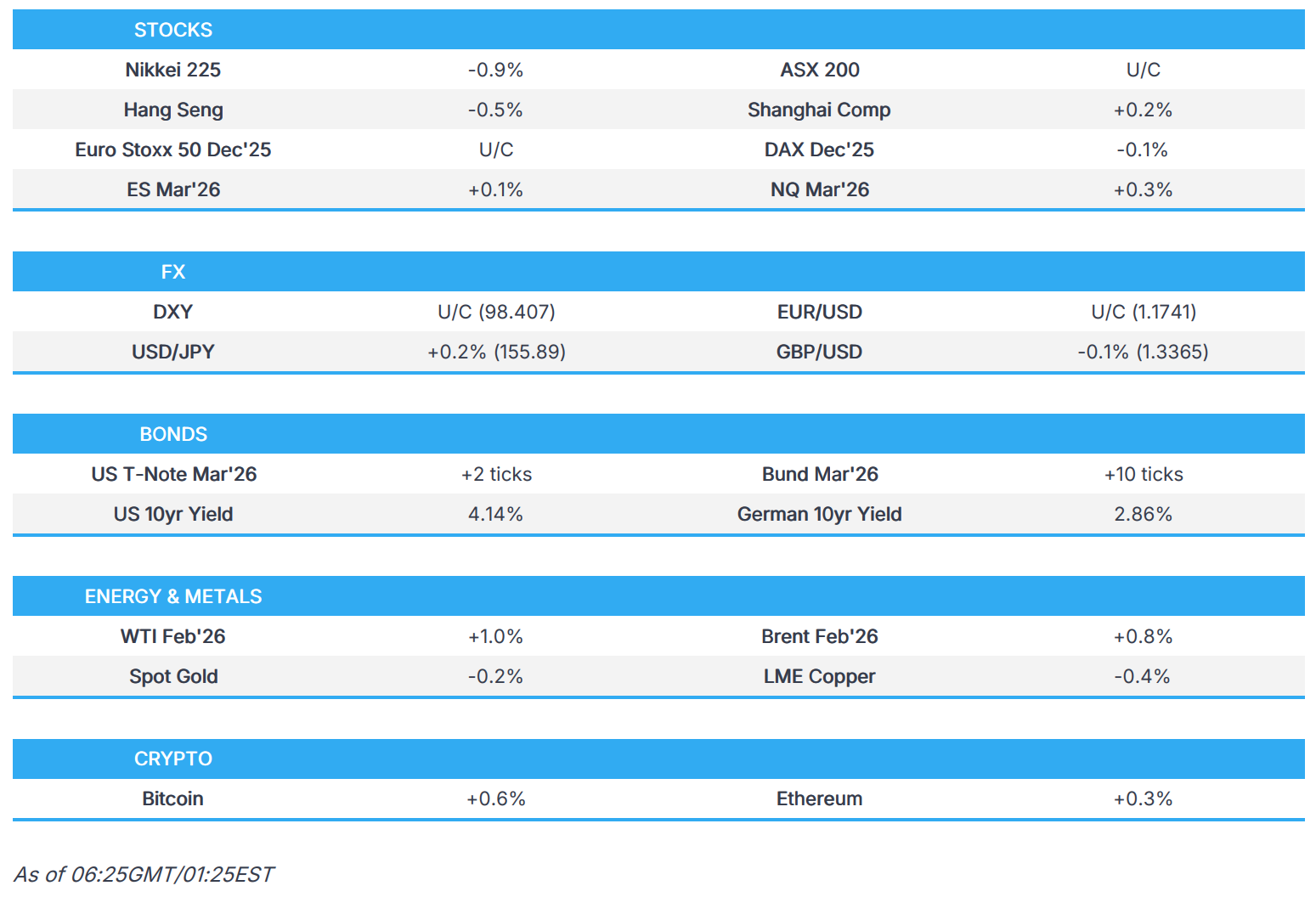

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 futures U/C after the cash market closed with losses of 0.6% on Wednesday.

- Looking ahead, highlights include US CPI (Nov), Jobless Claims (w/e 13 Dec), Philly Fed (Dec), Japanese CPI (Nov), NZ Trade Balance (Nov), ECB Announcement, BoE Announcement, Norges Bank Announcement, Riksbank Announcement, CNB Announcement, Banxico Announcement. Speakers include Norges Bank’s Bache, Riksbank’s Thedeen, ECB’s Lagarde & BoE’s Bailey, Supply from US, Earnings from Carnival, Nike & FedEx.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were hit on Wednesday, with the Nasdaq underperforming as the tech sector was sold following reports that Oracle's (ORCL) USD 10bln Michigan data centre deal is in limbo after funding talks with Blue Owl (OWL) stalled, and although Oracle said the equity deal is still on schedule, its shares still slid c. 5%. Meanwhile, chip names were weighed on (NVDA -3.9%, AMD -5.3%) by reports that Chinese researchers completed a working EUV prototype in early 2025 and are targeting 2028 for working chips, adding more competition in the tech space and reducing the need for chips from US companies in China. Furthermore, Google (GOOGL) was reportedly set to collaborate with Meta (META) to expand software support for AI chips, with the project aiming to make TPU run well on PyTorch as an alternative to NVIDIA (NVDA).

- SPX -1.16% at 6,721, NDX -1.93% at 24,648, DJI -0.47% at 47,886, RUT -1.07% at 2,492.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said they used to have the worst trade deals anywhere in the world and were laughed at, but they're not laughing anymore, while he added that much of the success has been due to tariffs and that one year ago, the country was dead and ready to fail, but now it's the hottest anywhere in the world.

NOTABLE HEADLINES

- Fed's Bostic (2027 voter, retiring) said GDP growth is solid and expects that trend to continue into next year, while he added it is less clear what will happen on the employment side.

- US President Trump said he will soon announce the next Fed chair and that the new Fed chair will believe in lowering interest rates by a lot, while Trump also stated that he will announce aggressive housing reforms in the new year and said more than a million service members will get a special dividend of USD 1,776 before Christmas.

- US President Trump was told by his former lawyer that the Constitution is ambiguous regarding the question of a third term, according to WSJ.

- US House voted 216-211 to pass the Republican health care bill without an extension of the ACA subsidy, which now goes to the Senate. It was separately reported that the Senate voted 77-22 to pass the USD 901bln bill setting defence policy and spending for the 2026 fiscal year, which goes to President Trump for signing.

- White House official said US President Trump is expected to address marijuana rescheduling on Thursday.

APAC TRADE

EQUITIES

- APAC stocks were mostly lower following on from the tech-led selling stateside and ahead of US inflation data and a slew of upcoming central bank decisions.

- ASX 200 was flat with the index constrained by weakness in energy, gold miners and industrials.

- Nikkei 225 briefly dipped beneath the 49,000 level amid tech woes and anticipation of a BoJ rate hike when the central bank concludes its 2-day policy meeting tomorrow.

- Hang Seng and Shanghai Comp were mixed as tech-related headwinds dampened risk sentiment in Hong Kong, although the mainland kept afloat after the PBoC's open market operations, in which it opted to utilise both 7- and 14-day reverse repos.

- US equity futures traded rangebound with little reaction seen following President Trump's primetime address and as participants awaited US CPI data, while the Emini Nasdaq 100 was marginally supported following Micron's earnings beat and strong outlook.

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 futures U/C after the cash market closed with losses of 0.6% on Wednesday.

FX

- DXY traded little changed with price action contained ahead of US CPI data due later today and following comments from a couple of Fed speakers, including Waller who stated that the Fed is 50bps-100bps over neutral and there is no rush to cut rates given the outlook, but added that they can continue to bring the rate down. Furthermore, the attention overnight turned to US President Trump's primetime address, where he announced more than a million service members will get a special dividend of USD 1,776 before Christmas and flagged aggressive housing reforms in the new year, but which had little impact on the currency.

- EUR/USD traded sideways beneath the 1.1750 level with a lack of catalysts as participants awaited the ECB meeting.

- GBP/USD struggled for direction after weakening yesterday on the softer-than-expected UK CPI data, which solidified the bets for a 25bps BoE rate cut later today.

- USD/JPY remained afloat after reversing the declines seen earlier in the week, despite the expectations of a looming BoJ rate hike as the central bank begins its 2-day conclave.

- Antipodeans marginally softened amid the lacklustre risk appetite and quiet overnight data calendar, while there was very little support seen following mixed New Zealand GDP data.

- PBoC set USD/CNY mid-point at 7.0583 vs exp. 7.0403 (Prev. 7.0573)

FIXED INCOME

- 10yr UST futures kept afloat but with the upside limited following yesterday's choppy performance amid commentary from Fed's Waller and an average 20-year bond auction, while participants await the incoming US inflation data.

- Bund futures rebounded off the prior day's trough in rangebound trade with few catalysts ahead of the ECB meeting.

- 10yr JGB futures edged higher amid the downbeat mood in risk assets, although gains were capped as the BoJ kick-started its 2-day policy meeting.

COMMODITIES

- Crude futures were initially boosted amid the US blockade against Venezuela and recent reports of potential new US energy sanctions on Russia, although futures later pared much of the gains alongside US President Trump's primetime address to the nation, given that there was no mention of the blockade or Russian sanctions.

- Qatar lowered the February term price for Al Shaheen oil to USD 0.53/bbl above Dubai.

- Dubai set official crude differential to GME Oman for March at USD 0.10/bbl discount.

- Venezuela is running out of oil storage space amid tanker curbs, with its main oil storage and tankers sitting at terminals quickly filling up and may be at maximum capacity in about 10 days, which could force state-owned Petróleos de Venezuela SA, whose production is close to 1mln bpd a day, to shut-in wells, according to Bloomberg.

- Israeli PM Netanyahu said he has approved the country's largest ever gas deal with Egypt valued at USD 35bln.

- Spot gold was lacklustre amid a steady dollar and with early weakness in other metal prices, including silver, which pulled back from record levels, before paring its losses.

- Copper futures saw early pressure amid the subdued risk appetite but has since bounced off intraday lows.

CRYPTO

- Bitcoin gradually edged higher after rebounding from a brief dip beneath the USD 86,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC injected CNY 88.3bln via 7-day reverse repos and CNY 100bln via 14-day reverse repos.

- China Securities Times wrote PBoC's rate cut room shrinks amid a shift of focus to policy mix, and that aggressive RRR cuts are less needed.

DATA RECAP

- New Zealand GDP Prod Based QQ SA (Q3) 1.1% vs. Exp. 0.9% (Prev. -0.9%, Rev. -1.0%)

- New Zealand GDP Prod Based YY SA (Q3) 1.3% vs. Exp. 1.3% (Prev. -0.6%, Rev. -1.1%)

GEOPOLITICS

RUSSIA-UKRAINE

- Ukrainian President Zelensky said Moscow clearly shows it is ready for war in 2026, and the US says Russia wants to end the war, but Moscow is sending opposite signals. Furthermore, he said the summit in Brussels should show there is no point for Russia to continue the war because Ukraine will have the financial means to defend itself.

- US and Russia are to hold talks on the Ukraine war in Miami this weekend, according to Politico. US Envoy Witkoff and President Trump’s son-in-law Kushner are to represent the US, while the plans remain in flux, but if they go ahead this weekend, the administration will present the outcome of the most recent round of discussions to Russian officials, who have not shifted much on their demands.

- Ukrainian attack damaged a ship in the southern Russian port of Rostov-on-Don, while there were deaths among the crew, according to the regional governor.

OTHER

- US military said it conducted a strike on a vessel in the eastern Pacific, which killed four men.

- Venezuela requested a UN Security Council meeting to discuss ongoing US aggression. It was separately reported that Venezuela's Navy were escorting vessels following the blockade threat, while Washington was aware of escorts and mulls course of action, according to NYT.

- Taiwan's Defence Ministry announced that the US government initiated a congressional notification procedure for arms sales to Taiwan totalling USD 11.1bln, while the Taiwan Presidential Office said they express sincere gratitude for the new US arms sale package and noted that Taiwan will continue to promote defence reforms, as well as demonstrate its determination to defend itself and safeguard peace through strength.

EU/UK

NOTABLE HEADLINES

- UK is to water down rules for financial benchmarks with most index providers to be exempt from UK regulations under a scaled-back regime, according to FT.