European equities point to a slightly weaker open ahead of BoC and FOMC rate announcements - Newsquawk EU Market Open

- APAC stocks were mostly subdued amid cautiousness ahead of today's Fed policy decision and dot plots, while the region also digested the latest Chinese inflation data.

- China is buying US soybeans again, but is reportedly falling short of the goal set by the Trump trade agreement, according to CNBC.

- US Trade Representative Greer said China's rare earths continue to flow and expects to sign more trade deals over the coming weeks.

- US President Trump is to kick off the final round of Fed Chair interviews this week, while senior administration officials said Kevin Hassett remains in pole position to succeed Powell as Fed Chair, according to the FT.

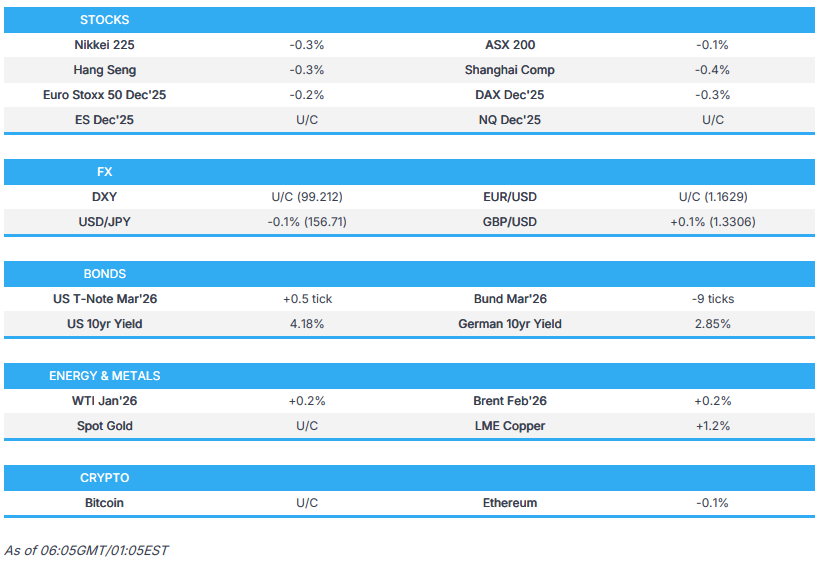

- European equity futures indicate a marginally lower cash market open with Euro Stoxx 50 futures down 0.2% after the cash market finished with losses of 0.1% on Tuesday.

- Looking ahead, highlights include Norwegian CPI (Nov), US Employment Costs (Q3), BoC/FOMC/BCB Rate Announcement. Speakers include BoE's Bailey, ECB's Lagarde, BoC's Macklem & Fed's Powell. Supply from the UK. Earnings from Oracle, Adobe & Synopsys.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were choppy on the eve of the FOMC, although the Russell 2000 outperformed and Dow Jones lagged, with weakness in the latter ensuing after JP Morgan's Lake gave some Q4 guidance - IB revenue up low single digits, and markets revenue up low teens. This pressured JPM shares and weighed on the Financial sector, while Energy, Consumer Staples, and Consumer Discretionary sectors outperformed.

- The attention was also on data, and T-Notes flattened in response to the September and October JOLTS report, which saw a notable increase, rising to 7.67mln in October from 7.23mln in August, which was well above the 7.15mln forecast, and saw traders pare rate cut bets in 2026, but December pricing was little changed.

- SPX -0.10% at 6,840, NDX +0.16% at 25,669, DJI -0.37% at 47,561, RUT +0.24% at 2,527.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said they have taken in hundreds of billions of dollars from tariffs, but added shortly after that it is actually trillions.

- US-Indonesia trade deal is at risk of collapse as USTR Greer believes Indonesia is backtracking on several commitments it made, while Indonesian officials have told Greer that Jakarta cannot agree to some binding commitments in the deal, according to FT. However, an Indonesian government source said Indonesia's tariff negotiation with the US is on track as per the leaders' joint statement, while an official also said that the trade negotiation with the US is still ongoing, with no specific issues arising during the negotiations.

- US Trade Representative Greer said the Trump administration has made it clear to South Africa that they need to address trade barriers if they want a better tariff situation with the US, while he is open to different treatment and possible exclusion of South Africa if the US renews the African Growth and Opportunity Act.

- US Trade Representative Greer said China's rare earths continue to flow and expects to sign more trade deals over the coming weeks.

- China is buying US soybeans again, but is reportedly falling short of the goal set by the Trump trade agreement, according to CNBC, while it noted that China has bought less than 3mln metric tons of soybeans since October, which is well short of the 12mln metric tons goal set by a trade deal with President Trump.

- China added domestic AI chips to its official procurement list for the first time, according to FT.

NOTABLE HEADLINES

- US President Trump is to kick off the final round of Fed Chair interviews this week, while senior administration officials said Kevin Hassett remains in pole position to succeed Powell as Fed Chair, according to FT. Trump later confirmed that he will be meeting with a couple of people for the Fed chair job and separately commented that he hears that Autopen might have signed the appointment of some of the Democrats on the Fed Board of Governors.

- White House Economic Adviser Hassett said as Fed chair, he would be apolitical, according to a Fox Business interview.

- US Senate Majority Leader Thune said the Senate will vote on the GOP plan to address healthcare subsidies on Thursday.

APAC TRADE

EQUITIES

- APAC stocks were mostly subdued amid cautiousness ahead of today's Fed policy decision and dot plots, while the region also digested the latest Chinese inflation data.

- ASX 200 was flat as weakness in tech, industrials, energy, health care and financials was counterbalanced by resilience in miners, materials and resources.

- Nikkei 225 initially rallied to above the 51,000 level following recent currency weakness, but then reversed course as yields briefly edged higher on BoJ rate hike risks.

- Hang Seng and Shanghai Comp retreated following mixed inflation data, which showed CPI Y/Y accelerated to its highest in almost two years, but PPI was softer-than-expected and showed a worsening deflation in factory gate prices. There were also several trade-related dampeners, including reports that China's US soybean purchases are falling short of targets, while it was also reported that China is set to limit access to NVIDIA's H200 chips despite export approval from US President Trump, and that chips exported to China will undergo a special security review.

- US equity futures lacked direction with participants tentative ahead of the FOMC, where market participants will be eyeing several moving parts, including the actual decision on rates, vote split, dot plots, post-meeting presser and Q&A.

- European equity futures indicate a marginally lower cash market open with Euro Stoxx 50 futures down 0.2% after the cash market finished with losses of 0.1% on Tuesday.

FX

- DXY traded rangebound amid a non-committal mood ahead of the looming FOMC policy announcement and after having mildly benefitted from the stronger-than-expected JOLTS data, which had very little impact on market pricing for today's meeting but spurred some unwinding of rate cut bets for 2026.

- EUR/USD was uneventful and stayed in a relatively tight range, with very few catalysts for the single currency.

- GBP/USD remained stuck near the 1.3300 focal point despite the recent slew of comments from BoE officials.

- USD/JPY took a breather after climbing yesterday to just shy of the 157.00 territory, which spurred more of the familiar jawboning by Japanese officials, while PPI data printed in line with estimates and had little impact on the currency.

- Antipodeans lacked direction in quiet FX trade and alongside the mostly subdued risk appetite ahead of the Fed policy announcement.

FIXED INCOME

- 10yr UST futures lingered near a 3-month low after the curve flattened as rising JOLTS spurred traders to pare some of their 2026 rate cut bets.

- Bund futures lacked demand following the recent choppy performance and absence of pertinent catalysts.

- 10yr JGB futures faded the prior day's late advances and reverted to flat territory at a sub-134.00 level after Japanese PPI data matched estimates.

COMMODITIES

- Crude futures attempted to nurse some of the prior day's losses but with the recovery hampered amid the cautious risk sentiment and following mixed weekly private sector inventory data, which showed a larger-than-expected draw in headline crude stockpiles and a much wider build in gasoline inventories.

- US Private Inventory Data (bbls): Crude -4.8mln (exp. -2.3mln), Distillate +1.0mln (exp. +1.9mln), Gasoline +7.0mln (exp. +2.8mln), Cushing -0.9mln.

- EIA STEO showed world oil demand outlook was slightly lowered for 2025 to 103.9mln BPD (prev. 104.1mln BPD), but the production outlook was raised to 106.2mln BPD (prev. 106mln BPD), while demand and production outlooks were unchanged for 2026. 2025 at 105.2mln BPD and 107.4mln BPD, respectively.

- Operations resumed at Libya's Zueitina, Ras Lanuf, Es Sider, and Brega oil terminals, according to Reuters citing sources.

- Spot gold was ultimately flat after failing to sustain the early momentum in the metals complex, which saw silver surge to a fresh record high north of USD 61/oz.

- Copper futures clawed back some of their recent losses but with further upside capped amid the pre-FOMC cautiousness.

CRYPTO

- Bitcoin was choppy overnight and oscillated through the USD 92,500 level in a relatively narrow range.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Takaichi said they are closely watching market moves when asked about rising yields. Takaichi also commented that it is important for currencies to move in a stable manner reflecting fundamentals and will take appropriate action for excessive and disorderly FX moves, while she added that a weak yen has both merits and demerits.

- RBNZ Governor Breman said the RBNZ has achieved a great deal towards the delivery of its mandated functions, while she added they are keeping a close look at data, including inflation and GDP. Breman also said there is no preset course for monetary policy and will adjust if they see the outlook for inflation change.

DATA RECAP

- Chinese CPI MM (Nov) -0.1% vs. Exp. 0.2% (Prev. 0.2%)

- Chinese CPI YY (Nov) 0.7% vs. Exp. 0.7% (Prev. 0.2%)

- Chinese PPI YY (Nov) -2.2% vs. Exp. -2.0% (Prev. -2.1%)

- Japanese Corp Goods Price MM (Nov) 0.3% vs. Exp. 0.3% (Prev. 0.4%, Rev. 0.5%)

- Japanese Corp Goods Price YY (Nov) 2.7% vs. Exp. 2.7% (Prev. 2.7%)

GEOPOLITICS

RUSSIA-UKRAINE

- US President Trump gave Ukrainian President Zelensky "days" to respond to the peace proposal, according to FT.

- Ukraine President Zelensky sees leader-level talks with the US next week, and said Ukraine is ready for an energy ceasefire if Russia agrees, while he wants to discuss restoration of Ukraine as part of peace plan preparation with the US. Zelensky also said they are ready to hold elections and ask US and European partners to guarantee security during the process, as well as noted that if security is guaranteed, elections could be held in the next 60-90 days.

- Ukrainian top commander Syrskyi said Ukrainian troops were able to take control of parts of Pokrovsk from mid-November and are now holding the northern parts of the city, while he added the situation in Pokrovsk is still difficult as Russians have amassed 156k troops and use rain and fog as cover.

OTHER

- US President Trump said he will have to make a call on Wednesday about Thailand and Cambodia, while he commented that the two countries are at it again.

- Japanese Defence Minister Koizumi said there is no truth that Japan also aimed radar at Chinese aircraft, while he added that China did not provide specific details about naval training exercises in communication with Japan's Maritime Self-Defense Force. Furthermore, he said Japan demands that China prevent the recurrence of dangerous acts which exceed the necessary range for safe aircraft operations.

EU/UK

NOTABLE HEADLINES

- French lawmakers back spending part of social-security budget, according to Bloomberg.

- ECB's Panetta sees a move away from the dollar as a key world currency, in which he stated that the world "may gradually drift towards a more multi-polar configuration".