European equities set to open higher following a rebound stateside; Markets await UK GDP and comments by Fed dissenters - Newsquawk EU Market Open

- APAC stocks were predominantly higher following on from the mostly positive handover from Wall Street, where the S&P 500 and DJIA notched record closes, but the Nasdaq lagged on Oracle-related headwinds.

- US President Trump said they would help on security with Ukraine, and he thought they were close to a deal.

- US President Trump said that it is going to start on land soon regarding Venezuela; the US is reportedly preparing to seize more ships transporting Venezuelan oil.

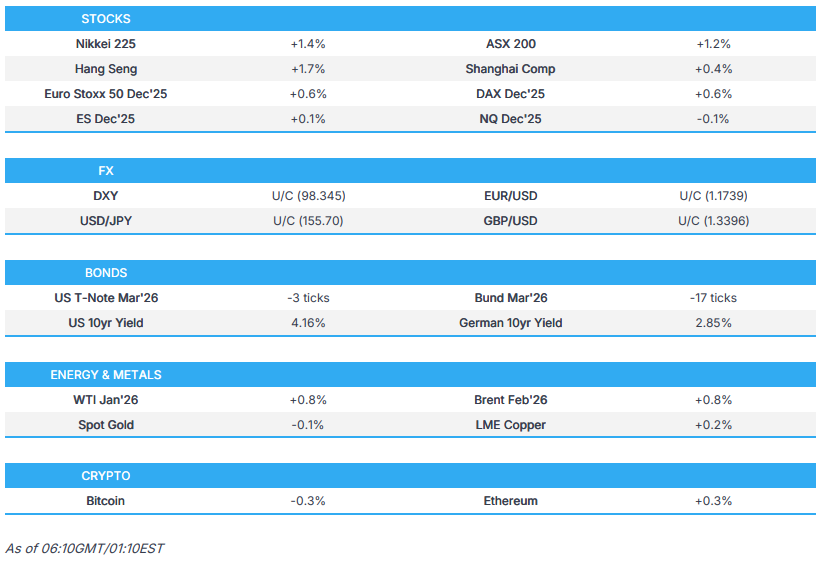

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.6% after the cash market closed with gains of 0.8% on Thursday.

- Looking ahead, highlights include UK GDP Estimate (Oct). Speakers include Fed's Paulson, Hammack, Goolsbee, Schmid, & Miran.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were choppy on Thursday, with the initial post-FOMC optimism fading the night before after Oracle (ORCL) earnings elicited concerns on its data centre build-out and debt after it raised its CapEx outlook. However, throughout the US session, there was a reversal of the overnight weakness with stocks grinding higher throughout the day to return to post-FOMC levels as Fed dovishness kept the markets going. Note, NDX still closed red as ORCL earnings weighed, but both the SPX and DJIA notched fresh record closes.

- SPX +0.21% at 6,901, NDX -0.35% at 25,687, DJI +1.34% at 48,704, RUT +1.21% at 2,591.

- Click here for a detailed summary.

TARIFFS/TRADE

- Indian PM Modi said he had a call with US President Trump on Thursday as New Delhi seeks relief from 50% US tariffs on some of the country's key exports to punish India for its Russian oil purchases.

- Indonesia's chief negotiator to the US said they agree to conclude what had been agreed in July, and Indonesia hopes to conclude tariff negotiations with the US by year-end, while Indonesia will send a delegation to Washington to continue tariff talks soon.

NOTABLE HEADLINES

- Fed regional bank presidents were reappointed in a unanimous vote, with new five-year terms beginning March 1st.

- US President Trump posted that "Prices are coming down FAST, Energy, Oil and Gasoline, are hitting five-year lows, and the Stock Market today just hit an All Time High. Tariffs are bringing in Hundreds of Billions of Dollars".

- US President Trump signed an executive order on AI, according to the White House website. Furthermore, a Trump administration aide said the executive order is to make sure AI can operate within a single national framework and that they are taking steps for a single national standard on AI.

- US President Trump said the WSJ has another ridiculous story that China is dominating us, and the world, in the production of electricity related to AI.

- White House said President Trump signed an order to increase oversight of and take action to restore public confidence in the proxy adviser industry.

- US President Trump is expected to push the government to dramatically loosen federal restrictions on marijuana.

- US Treasury Department is reportedly planning more access to corporate tax breaks for R&D, and an announcement may come as soon as next week.

- US government is to require AI vendors to measure political bias.

- Indiana's Republican-controlled Senate rejected the Congressional redistricting plan backed by President Trump.

APAC TRADE

EQUITIES

- APAC stocks were predominantly higher following on from the mostly positive handover from Wall St, where the S&P 500 and DJIA notched record closes, but the Nasdaq lagged on Oracle-related headwinds.

- ASX 200 rallied with mining, materials and financials leading the broad advances, with nearly all sectors in the green.

- Nikkei 225 advanced after Japan's Lower House recently approved the supplementary budget bill, with the index briefly returning to above the 51,000 level before fading some of the gains.

- Hang Seng and Shanghai Comp were somewhat mixed as the Hong Kong benchmark conformed to the upbeat mood in the region, although the mainland lagged despite the recent Central Economic Work Conference where it was stated that China is to make use of RRR and rate cuts flexibly, while China's pledge to implement an appropriately loose monetary policy, implement more proactive fiscal policy, and stabilise the property market with city-specific measures, failed to inspire.

- US equity futures were mixed with price action rangebound as they took a breather after the record closes stateside.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.6% after the cash market closed with gains of 0.8% on Thursday.

FX

- DXY was contained after softening yesterday in the aftermath of the recent Fed rate cut and with further headwinds from a jump in the latest initial jobless claims print, while participants await comments from several Fed speakers scheduled to speak later, including Paulson, Hammack, Goolsbee, Schmid and Miran.

- EUR/USD struggled for direction in the absence of any major catalysts and with a sparse data calendar for the bloc, outside of inflation revisions.

- GBP/USD traded sideways near the 1.3400 level ahead of incoming monthly GDP, industrial production and manufacturing output from the UK.

- USD/JPY continued its gradual rebound from the prior day's trough after finding support at the 155.00 level, but with upside capped by a lack of drivers.

- Antipodeans were confined within tight parameters alongside a quiet calendar and uneventful mood across the FX space.

- PBoC set USD/CNY mid-point at 7.0638 vs exp. 7.0843 (Prev. 7.0686).

FIXED INCOME

- 10yr UST futures traded rangebound overnight after the prior day's choppy mood and continued curve steepening in the aftermath of a jump in jobless claims.

- Bund futures remained subdued following the recent choppy performance and with few pertinent drivers to spur prices.

- 10yr JGB futures swung between gains and losses amid a very quiet calendar, with prices pressured as participants looked ahead to next week's BoJ meeting, where the central bank is expected to hike rates for the first time since January.

COMMODITIES

- Crude futures nursed losses after retreating throughout the prior day amid mixed geopolitical headlines, including the US imposing fresh Venezuela sanctions and with Ukraine handing over the updated peace plan to the US.

- Spot gold took a breather after rallying to a month high alongside another surge in silver to fresh record levels.

- Copper futures initially faded some of yesterday's gains with CME futures pulling back from a four-month peak, while Shanghai's most active copper contract played catch-up and hit a new record high.

CRYPTO

- Bitcoin was choppy and briefly dipped beneath the USD 92,000 level before clawing back most of the earlier losses.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Katayama said they will review various special measures for corporate tax.

GEOPOLITICS

MIDDLE EAST

- White House said a lot of quiet planning is underway for the next phase of the Gaza peace plan, and they will make announcements at an appropriate time.

RUSSIA-UKRAINE

- US President Trump said they would help on security with Ukraine, and he thought they were close to a deal, while he added that there is a meeting on Saturday, and they will attend if they think there is a good chance. Trump also commented that he has spoken to China and Russia about nuclear weapons.

OTHER

- US President Trump said that it is going to start on land soon regarding Venezuela.

- US is reportedly preparing to seize more ships transporting Venezuelan oil, in which action would target tankers that may have transported other sanctioned crude such as Iranian, while the seizure has led to a suspension of at least three shipments, according to Reuters sources.

- US Treasury issued fresh Venezuela-related sanctions in which it was reported to have sanctioned Venezuelan President Maduro's nephews and six ships carrying Venezuelan oil.

- US President Trump said he will have to make a couple of phone calls regarding Thailand and Cambodia. It was later reported that Thailand's PM said a call with US President Trump is set for 21.20 local time 14:20GMT/09:20EST.

EU/UK

NOTABLE HEADLINES

- European Commission reportedly considers the second phase of the safe loan scheme for defence projects.