European equity futures point to a flat open; BoE speakers ahead - Newsquawk European Opening News

- US posted a licence review rule for chip exports to China and Macau; US eased the criteria to approve the NVIDIA (NVDA) H200 chip exports to China; NVIDIA H200 chips are covered by the export licence review rule.

- Beijing is no longer seeking to make new advances into LatAm in the near term, WSJ sources report; instead, focus shifted towards if the Western Hemisphere belongs to the US, then the Taiwan Strait belongs to China, but this does not mean immediate action.

- WSJ source reports suggested that incentives under consideration by Chinese officials to woo the US into a strategic retreat from the Taiwan Strait include Beijing potentially agreeing to buy billions of USD in long-term Treasurys.

- Chinese equities fell following an announcement by the stock exchanges that they are to adjust the margin requirements so the margin ratio does not fall below 100%.

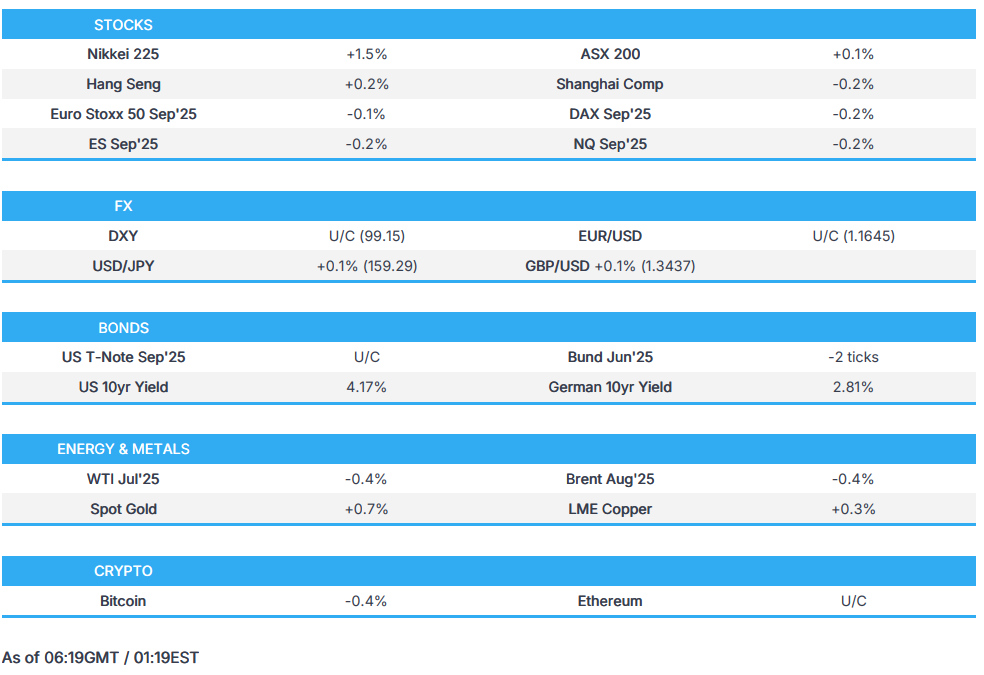

- European equity futures are indicative of a slightly positive open, with the Euro Stoxx 50 future +0.1% after cash closed +0.2% on Friday.

- Looking ahead, Highlights include US PPI (Nov), Retail Sales (Nov), Atlanta Fed GDP, NBP Policy Announcement, Fed's Beige Book; Speakers include BoE's Taylor, Ramsden, ECB's de Guindos, Fed's Paulson, Kashkari, Williams, Miran, Bostic; Supply from the UK & Germany; Earnings from Wells Fargo, Citi, Bank of America.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed in the red on Tuesday with the initial rally seen after the soft-leaning CPI faded. Downside was led by the Dow, while Russell and Equal Weight S&P were flattish with SPX and NDX closing lower by 0.2%. Sectors were more mixed with Energy and Defensives leading the gains, whilst Financials and Consumer Discretionary lagged.

- The downside in Financials was led by the big banks after JPM was hit post earnings, weighing on peers - hence Dow underperformance, too, and also not the best start to the Q4 '25 earnings season. Meanwhile, the upside in Energy stocks largely tracked crude prices higher due to ongoing geopolitical concerns, mainly around Iran. President Trump has advised US citizens in Iran to "get out", whilst also telling Iranian protesters that "help is on its way".

- SPX -0.22% at 6,962, NDX -0.18% at 25,742, DJI -0.82% at 49,182, RUT -0.02% at 2,635.

- Click here for a detailed summary.

TRADE/TARIFFS

- US President Trump, on China, said "I think we can open China markets to US goods".

- US Commerce Department said that Chinese companies must demonstrate sufficient security procedures in order to buy NVIDIA (NVDA) H200 chips.

- US posted licence review rule for chip exports to China and Macau; US eases the criteria to approve the NVIDIA (NVDA) H200 chip exports to China; NVIDIA H200 chips are covered by the export licence review rule.

- US President Trump reiterated he will figure something out if they do not win the tariff case.

- US President Trump, on USMCA, said Canada wants it, but we don't need it.

- Indonesia is to raise its crude palm oil export level to 12.5%, effective from March.

NOTABLE HEADLINES

- US President Trump said that robots will be a major force and will help with jobs.

- US President Trump said the economy is booming, with the private sector growing by over 5% due to business investment. Adds that inflation trends are looking good and that "All the smart money knows the HOTTEST Economy in the World is the U.S.A".

- US President Trump reiterated 10% credit card rate cap proposal for one year. On housing, Trump said more affordability plans are coming in weeks and will share housing policy details at Davos. He praised the impact of the USD 200bln mortgage bond buy and said that lowering mortgage rates would be easier if the Fed were helping.

- US President Trump reiterated he wants the market to go up on good news, not go down; said growth potential is unlimited, wants a Fed Chair who lowers rates when the market goes up, said current Fed kills every rally. Will drive oil prices even lower.

- US lawmakers reportedly move again to revive Trump-supported credit card competition bill (CCCA).

- FHFA Director Pulte, in a WSJ interview, said the industry has purposely kept prices high and called on it to help lower them, hinting at penalties for companies that do not help the administration's push.

- Netflix (NFLX) weighs amending Warner Bros. (WBD) bid to make it all cash, Bloomberg reported.

- Trump Administration appears to have ended its US trade probe into pharmaceutical imports, according to End Point News. The Department of Commerce appears to have concluded its Section 232 investigation into Pharmaceutical imports, according to a new document reviewed by Endpoints News.

- House Republican leaders voted to allow votes on two amendments to the latest government funding package, Politico reported.

CENTRAL BANKS

- Fed's Barkin (2027 voter) said that no single meeting is decisive and that errors can be corrected at the next meeting. Adds, that he is not seeing a strong business push to pass on price hikes and that the CPI data was encouraging, however, shelter inflation is still biased due to missing October data. Businesses are more confident about tariff outcomes now than last April. Tariffs still create some cost and inflation pressure over time, but the timing is unclear. Fed's Barkin later stated that inflation is higher than our target but it doesn't seem to be accelerating just yet; unemployment has ticked up but not ticking out of control.

- Fed Chair Powell reportedly sent senators details on the USD 2.5bln Fed project following his testimony, FT reported.

- US President Trump said we have a bad Fed Chair; Fed Chair pick expected in the next few weeks.

- BoJ Governor Ueda said Japan's economy continued to moderately recover in 2025 and the Bank will keep raising rates if economic outlook is realised.

- Japanese Chief Cabinet Secretary Kihara said the BoJ chooses which monetary tools to use and expects BoJ-Government co-operation to reach 2% inflation steadily.

- The Finance Markets Department of the BoJ will hold the meeting on market operations on February 26th. Will discuss recent market developments, BoJ operations, JGB market liquidity and functionality, and money markets.

- Bank of Korea official reiterates USD/KRW exchange rate above 1,400 is misaligned with economic fundamentals, and notes the need for policy measures to ease excessively pessimistic market sentiment

APAC TRADE

EQUITIES

- Asia-Pac stocks traded mostly in the green, with the Nikkei 225 outperforming, while the ASX 200 lagged.

- ASX 200 initially started the session with gains and was up as much as 0.6% before reversing due to losses in Financials. This follows poor JPMorgan (JPM) earnings, in which EPS and revenue missed estimates.

- Nikkei 225 was the clear outperformer in Asia-Pac equities, up 1.7% and continuing to extend to fresh ATHs. This follows increased traction around reports that PM Takaichi is set to dissolve the Lower House and call a snap election in a bid to capitalise on her healthy poll numbers, reviving the so-called ‘Takaichi trade’.

- KOSPI traded choppily, with the South Korean equity market peaking at a new ATH of 4,716 before falling back into Tuesday’s trading range.

- Hang Seng and Shanghai Composite started the APAC session on the front foot and have failed to pull back meaningfully in the early hours of trade, with the Shanghai Composite trading at ATHs around 4,181. Shanghai Comp. later completely reversed its earlier gains following margin requirement adjustment.

- US equity futures were trading in the opposite direction to their Asia-Pac counterparts, with the ES and NQ both down 0.2%.

- European equity futures are indicative of an uneventful open, with the Euro Stoxx 50 future U/C after cash closed +0.2% on Friday.

FX

- DXY briefly extended Tuesday’s gains, peaking at 99.25, before reversing and returning below 99.20 following stronger Chinese trade data. This also came alongside WSJ source reports that incentives under consideration by Chinese officials to woo the US into a strategic retreat from the Taiwan Strait include Beijing potentially agreeing to buy billions of USD in long-term Treasurys.

- EUR/USD traded flat, oscillating in a 1.1636–1.1646 range as traders prepare for US PPI and Retail Sales.

- GBP/USD outperformed its European counterpart, gradually bid higher from a trough of 1.3418 to session highs of 1.3440, aided by a weaker dollar.

- USD/JPY comfortably held above 159.00 but traded choppily throughout the Asia-Pac session with no clear direction. After selling off to a trough of 159.09 in early trade, the pair reversed and extended to a peak of 159.46 before paring back most of the move.

- The Antipodeans outperformed their G7 peers, with AUD/USD up 0.3% while NZD/USD lags slightly up 0.2%, aided by strength across the metals space, with spot silver and 3M LME copper reaching new ATHs.

- CNY traded strongly against the greenback following the Chinese trade data, with exports and the trade balance (in USD terms) beating market estimates.

FIXED INCOME

- 10yr UST futures traded in a tight 2.5 tick range as Treasuries digest the cooler-than-expected CPI print. Despite the cooler data, USTs have pared back most of the move as markets await US PPI and retail sales. No move was seen on WSJ source reports that incentives under consideration by Chinese officials to woo the US into a strategic retreat from the Taiwan Strait include Beijing potentially agreeing to buy billions of USD in long-term Treasurys.

- Bund futures pulled back slightly from the 128.13 session high formed in Tuesday’s session, falling to a trough of 127.98 before returning above the 128.00 handle.

- 10yr JGB futures oscillated in a 131.72-131.97 band as traders digest the implications of the potential dissolution of the Lower House. Following the weak 5-year auction, in which the b/c printed at 3.08x (prev. 3.17x), JGBs dipped 10 ticks but remain within prior bounds.

- Japan sold JPY 2.5tln 5yr JGBs; b/c 3.08x (prev. 3.17x), average yield 1.63% (prev. 1.435%); demand weaker than 12-month average. Lowest accepted price 99.77 (prev. 99.80). Weighted average price 99.82 (prev. 99.84).Tail in price 0.05 (prev. 0.04).

- Australia sold AUD 1bln 4.25% 2036 AGB; b/c 3.19x, average yield 4.7623%.

- US sold USD 22bln of 30-year bonds; Stop through 0.8bps. High Yield: 4.825% (prev. 4.773%, six-auction avg. 4.759%): WI 4.833%. Tail: -0.8bps (prev. -0.1bps, six-auction avg. 0.5bps). Bid-to-Cover: 2.42x (prev. 2.36x, six-auction avg. 2.34x). Dealers: 11.9% (prev. 11.2%, six-auction avg. 12.4%). Directs: 21.3% (prev. 23.5%, six-auction avg. 23.9%). Indirects: 66.77% (prev. 65.4%, six-auction avg. 63.7%).

COMMODITIES

- Crude futures traded range-bound throughout the Asia-Pac session amid a lack of updates from the meeting on options regarding Iran. WTI Feb’26 hovers at the lower end of its USD 60.80-61.20/bbl range while Brent Mar’26 holds above USD 65/bbl.

- Precious metals continued their historic trend higher, with spot silver reaching USD 90/oz for the first time, while spot gold extended to a new ATH of USD 4640/oz after the yellow metal pulled back to a trough of USD 4570/oz late in Tuesday’s US session.

- Base metals followed the trend seen in precious metals, with 3M LME copper reaching a new ATH of USD 13.41k/t while benchmark 3M LME tin hits a new record above USD 51k/t on strong Chinese investor demand.

- US Private Inventory Data (bbls): Crude +5.28mln(exp. +0.419mln), Distillate +4.34mln (exp. +0.129mln), Gasoline +8.23mln (exp. +0.242mln), Cushing +0.95mln (prev. +0.7mln).

- US Energy Secretary Wright said US would happily partner with Iran on oil if regime ends.

- Brazil's Petrobras (PBR) CEO said the Tupi oilfield hit 1mln BPD production last Friday.

- President Trump said he would like the price of oil USD 53/bbl, via Fox's Ed Lawrence.

- Venezuela reportedly starts reversing oil output cuts as exports resume, according to reports.

- EIA STEO: World Oil Demand 2026: 104.8mln bpd (prev. 105.2mln bpd); 2027: 106.1mln bpd.

- Third oil supertanker about to depart from Venezuela, to carry crude to Caribbean storage, via shipping data.

- Kazakhstan confirms there was a temporary decline in oil shipments through the marine terminal in December via CPC due to drone attacks.

CRYPTO

- Bitcoin extended Tuesday's gains as the cryptocurrency trades above USD 95,000.

NOTABLE ASIA-PAC HEADLINES

- South Korean Finance Minister said volatility is increasing in the FX market and will seek near-term responses to ease volatility and make efforts to improve economic fundamentals.

- China's stock exchanges are to adjust margin requirements so the margin ratio does not fall below 100% (prev. 80%), effective January 19th.

- Alibaba (BABA/ 9988 HK) said the Qwen app launch event will be held at 10:00 on January 15 (Beijing time) / 02:00GMT.

- Hanwha Corp (000880 KS) is to spin off its retail, hotel, robotics, and other firms into separate units.

- Japanese Chief Cabinet Secretary Kihara said the dissolution of the Lower House is for the PM to decide.

- China’s MIIT Minister Li announces plans to expand auto consumption and boost vehicle trade-in program. To enhance supply chain autonomy, advance key industry development and accelerate breakthroughs in solid-state batteries and advanced autonomous driving. To regulate industry competition and strengthen cost and price monitoring.

- China insurers review investment rules as consultation period ends, CSJ reported.

- Japanese PM Takaichi reportedly mulls a February 8th snap election, Yomiuri reported. "By shortening the number of days between dissolution and voting, the government hopes to minimise the impact on Diet deliberations on the fiscal 2026 budget bill." "Going forward, election management committees in each prefecture are expected to accelerate preparations for the February 8th election, but the election date may be delayed depending on the state of preparations."

- Japanese PM Takaichi is to inform intent to dissolve parliament on Wednesday, Nikkei reported.

NOTABLE APAC DATA

- Chinese Exports YoY (Dec) Y/Y 6.6% vs. Exp. 3% (Prev. 5.9%).

- Chinese Balance of Trade Yuan (Dec) 808.8B vs. Exp. 820B (Prev. 792.58B).

- Chinese Imports YoY (Dec) Y/Y 5.7% vs. Exp. 0.9% (Prev. 1.9%).

- Chinese Exports YoY Yuan-Denominated (Dec) Y/Y 6.1% (Prev. 5.7%).

- Chinese Imports YoY Yuan-Denominated (Dec) Y/Y 0.5% (Prev. 1.7%).

- Australian Building Permits YoY Final (Nov) Y/Y 20.2% vs. Exp. 20.2% (Prev. -1.1%).

- Australian Building Permits MoM Final (Nov) M/M 15.2% vs. Exp. 15.2% (Prev. -6.1%).

- Australian Private House Approvals MoM Final (Nov) M/M 1.3% vs. Exp. 1.3% (Prev. -1.3%).

- New Zealand ANZ Commodity Price (Dec) M/M: -2.1% (prev. –1.6%).

- Japanese Money Supply M2 YY (Dec) 1.7% (Prev. 1.8%).

- Japanese Money Supply M3 YY (Dec) 1.1% (Prev. 1.2%).

- Republic of Korea Unemployment Rate (Dec) 4% vs. Exp. 2.7% (Prev. 2.7%).

- US Monthly Budget Statement (Dec) -145.0B vs. Exp. -150B (Prev. -173.0B, Rev. -173B).

GEOPOLITICS

MIDDLE EAST

- The Trump admin on Wednesday is expected to announce the establishment of a peace council for Gaza and the establishment of a Palestinian government of technocrats that will run the Gaza Strip, Axios reported. "The Trump administration will also officially announce the appointment of former UN envoy Nickolay Mladenov as the representative of the Peace Council in the Gaza Strip and who will accompany the activities of the Palestinian technocrat government".

- The US State Department has warned US citizens to leave Iran and to consider departing by land to Turkey or Armenia if it is safe to do so.

- US President Trump said he is heading back to the White House and will look at Iran, adds that "Iran is on my mind" and will get death figures shortly. Will act accordingly on the protester death toll.

- "Israel has been on particularly high security alert in recent hours, against the backdrop of the US president's dramatic statements regarding the protests in Iran", according to local press. The Israeli security assessment is that a US attack on Iran is not a question of if but when. "There are fears that Iran could attack Israel in response."

- The Trump administration believes that Iran has not yet reached the stage of weakness that makes US strikes decisive to topple the regime, NBC News reported.

- US President Trump said the US will take very strong action if Iran hangs protesters, CBS News reported; adds the endgame is to win.

- "Israeli security sources: Israel is not a partner in any US plans to launch military action against Iran", Sky News Arabia reports citing local reports.

- Iran Defense Minister said they will respond to any US aggression.

- Secretary of State Marco Rubio said in closed-door meetings in recent days that, at this stage, the administration is looking at non-kinetic responses to help the protesters, according to Axios citing a source with direct knowledge.

- US President Trump's envoy secretly met Iran's exiled crown prince, Reza Pahlavi, to discuss the Iran protests; Pahlavi is trying to position himself to step in as a "transitional" leader if the regime falls, via Axios.

- US President Trump when asked about help on the way to Iran, said you are going to find out; good idea if Americans evacuate from Iran.

- Heads of Trump's National Security Council reportedly held talks today on topic of Iran. Trump did not participate, according to Axios.

OTHERS

- Beijing is no longer seeking to make new advances into LatAm in the near term, WSJ sources report, instead focus shifted towards if the western hemisphere belongs to the US, then the Taiwan Strait belongs to China, but does not mean immediate action. Beijing is now playing defence, focused on avoiding a complete erasure from Venezuela’s oil reserves. This calculated retreat, according to sources, could reflect what China expects the US to do in the Taiwan Strait. Other incentives under consideration by Chinese officials, sources said, include Beijing potentially agreeing to buy billions of USD in long-term Treasurys.

- Venezuela's acting President Rodriguez plans to send an envoy to Washington to meet with senior US officials on Thursday.

- "Pentagon: We support any decision that President Trump will make... We are ready to carry out Trump's orders anytime, anywhere", Al Arabiya reported.

- Venezuela Government has started releasing US citizens, Bloomberg reported.

- US Senators have introduced legislation to prevent the American military from occupying or annexing NATO territories including Greenland.

- US President Trump, on Greenland, said the Premier faces problems over sticking with Denmark.

- US President Trump said the US will start hitting drug-runners by land.

- A senior administration official said U.S. action on Greenland could happen within "weeks or months", according to USA Today; President Trump's preferred option is to buy the minerals-rich island, but other diplomatic means are being considered.

- South Korea Blue House said President Lee has ordered a review of restoring a military agreement with North Korea, News1 reports