European equity futures point to a red Christmas open; Metals at new ATHs - Newsquawk EU Market Open

- APAC stocks kicked off the week with gains across the board as the region coat-tailed on the strength seen stateside. Tech outperformance continued across the region.

- US Coast Guard officials over the weekend tracked two oil tankers in international waters close to Venezuela, marking three tankers within the past week.

- Russia’s Kremlin said changes made by Ukrainians and Europeans to peace proposals did not bring agreements closer or add anything positive, IFAX reported.

- Israeli PM Netanyahu reportedly plans to brief US President Trump on possible new Iran strikes, according to NBC News.

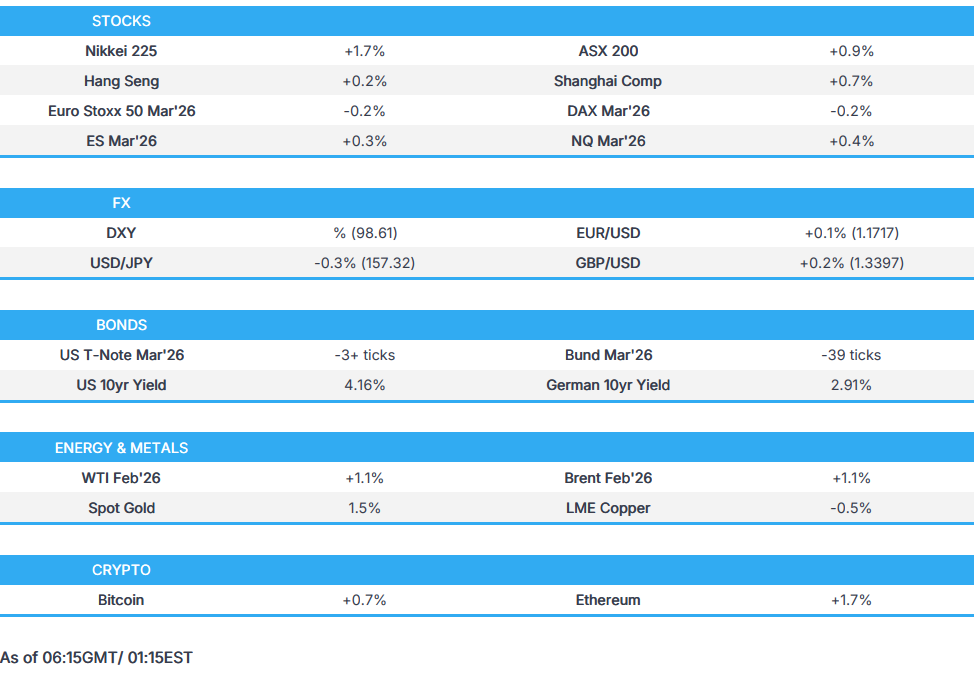

- European equity futures are indicative of a slightly softer cash open, with the Euro Stoxx 50 future down 0.2% after cash closed +0.3% on Friday.

- Looking ahead, highlights include Italian Producer Prices (Nov), Canadian Producer Prices (Nov), and supply from the US.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were bid on Friday, led by Tech, which drove Nasdaq outperformance amid strength in Oracle (ORCL) following reports that TikTok will sell its US entity. Haven sectors lagged, with Consumer Staples, Discretionary, and Utilities all underperforming; Discretionary was weighed by Nike (NKE), which plunged on weak China sales.

- SPX +0.88% at 6,834.50, NDX +1.31% at 23,307.62, DJI +0.38% at 48,134.89, RUT +0.86% at 2,529.42

- Click here for a detailed summary.

NOTABLE US HEADLINES

- Fed’s Hammack (2026 voter) said rates should be held steady into the spring after recent cuts, warning she was inflation-wary, noting November’s 2.7% CPI likely understated 12-month price growth due to data distortions, and suggesting the neutral interest rate was higher than commonly believed, the WSJ reported over the weekend.

- US President Trump on Friday said the only reason unemployment ticked up to 4.5% because we are reducing the government workforce by numbers that have never been seen before.

NOTABLE US EQUITY HEADLINES

- Apple (AAPL) will reportedly launch two new AI wearable devices next year, including AI glasses and AI AirPods, according to MoneyUDN, citing supply chain sources.

- Bill Ackman proposes taking SpaceX public via a novel SPARC structure, granting Tesla (TSLA) shareholders tradable rights to invest directly in the SpaceX IPO, democratising access and avoiding traditional underwriting fees. The deal could raise up to ~USD 150bln at a fixed valuation, eliminate dilution and fees, and potentially pave the way for a future xAI IPO.

- Apple (AAPL) advised some visa-holding employees not to travel outside the US due to delays at embassies, Business Insider reported. Additionally, Google (GOOGL) warned some visa-holding employees not to leave the US due to significant return delays of up to a year, Business Insider reported.

- US President Trump on Friday said he would call a meeting of insurance companies in the coming weeks to push them to cut prices and stay in the system.

- US President Trump on Friday announced deals with nine pharmaceutical companies to cut prices on most drugs sold through Medicaid and lower cash-pay prices, while committing to most-favoured-nation pricing for future drugs, according to Reuters. The companies also pledged more than USD 150bln in US manufacturing and R&D investment, agreed to remit some foreign revenues to offset US costs, and received relief from US tariffs in return.

TRADE/TARIFFS

- US lawmakers reportedly urged the Pentagon to add DeepSeek and Xiaomi (1810 HK) to the list of firms allegedly aiding the Chinese military, according to Reuters, citing a letter.

APAC TRADE

EQUITIES

- APAC stocks kicked off the week with gains across the board as the region coat-tailed on the strength seen stateside. Tech outperformance continued across the region.

- ASX 200 edged higher as miners tracked gains in gold prices, with the yellow metal buoyed by a weekend packed with geopolitics

- Nikkei 225 was the clear outperformer as it topped 50.5k as the index cheered the post-BoJ JPY weakness on Friday alongside the global tech rally, whilst simultaneously overlooking the continuing rise in JGB yields.

- KOSPI was underpinned by its tech sector and following a month-to-date rise in exports.

- Hang Seng and Shanghai Comp conformed to the risk tone but with upside shallower than the above peers, with the PBoC LPR left unchanged as expected, whilst reports on Friday suggested US lawmakers urged the Pentagon to add DeepSeek and Xiaomi to the list of firms allegedly aiding the Chinese military.

- US equity futures held a mild upward bias after opening with gains of a similar magnitude. NQ narrowly outperformed amid a continuation of the tech play from Friday.

- European equity futures are indicative of slightly softer cash open with the Euro Stoxx 50 future down 0.2% after cash closed +0.3% on Friday.

FX

- DXY traded in a narrow 98.583–98.699 band amid light newsflow as markets wind down for the holiday period.

- EUR/USD traded uneventfully and largely moved in tandem with the Dollar, holding above 1.1700 with limited Eurozone catalysts.

- GBP/USD also saw muted price action, repeatedly meeting resistance just under 1.3400, while EUR/GBP held flat around 0.8750.

- USD/JPY held within a tight 157.24–157.74 range, and reversed after hitting levels just shy of Friday’s 157.76 high. The pair waned off its best levels alongside the continuing rise in JGB yields. Verbal jawboning from officials did little to move the currency.

- Antipodeans held a mild upward bias, supported by broader risk appetite as APAC markets tracked Wall Street’s Friday gains, with tech names underpinning sentiment.

- CNH was steady after the PBoC maintained LPRs as expected.

- PBoC set USD/CNY mid-point at 7.0572 vs exp. 7.0407 (Prev. 7.0550).

FIXED INCOME

- 10yr UST futures traded slightly lower as broader risk appetite across the APAC region kept pressure on global fixed income, with activity subdued as markets began to wind down for the holidays.

- Bund futures remained under mild pressure following the global risk-on tone and in the wake of the JGB downside after Friday’s BoJ decision.

- 10yr JGB futures led losses as traders focused on growing fiscal risks in Japan now that the BoJ meeting has passed.

COMMODITIES

- Crude futures opened with modest gains and extended higher as markets digested several weekend geopolitical developments, with WTI attempting to mount USD 57/bbl after lifting from a USD 56.60/bbl low.

- Spot gold firmed after a flat open, grinding higher as traders assessed the weekend headlines, with the yellow metal printing above at USD 4,400/oz for the first time. Spot silver printed fresh record highs just under USD 68.50/oz, while platinum broke above USD 2,000/oz for the first time since 2008.

- Copper futures held an upward bias, supported by risk appetite, with 3M LME copper hovering just under USD 12k/t, though gains lagged the more pronounced strength in precious metals.

- Australia's Energy Minister Bowen announces plans for Australian gas reservation policy.

- Barclays said even if Venezuelan oil exports decline by 200k BPD, and would be unlikely to significantly affect global oil prices; maintained USD 65/bbl Brent forecast for 2026.

- Iraq’s state oil firm reaffirmed its commitment to the Kurdistan oil agreement, under which international oil companies in the region were required to hand over their output to the state. An official at Iraq’s state oil firm said the oil export deal between Baghdad and Erbil would continue without issues, Rudaw reported.

CRYPTO

- Bitcoin traded flat overnight under the USD 89k level following a relatively uneventful weekend of price action.

CENTRAL BANKS

- Chinese Loan Prime Rate 1Y (Dec) 3.00% vs. Exp. 3.00% (Prev. 3.00%);5Y (Dec) 3.50% vs. Exp. 3.50% (Prev. 3.50%).

NOTABLE ASIA-PAC HEADLINES

- China reportedly targets operating liabilities of local government financing vehicles to curb debt risks, according to Shanghai Securities News, citing analysts.

- PBoC injected CNY 67.3bln via 7-day reverse repos.

- Japanese Top Currency Diplomat Mimura said he is recently seeing one-sided, rapid moves; will take appropriate action against excessive moves; is concerned about forex moves.

- Japanese Chief Cabinet Secretary Kihara said he will not comment on the forex market; recently seeing one-sided, rapid moves; important for currencies to move in a stable manner reflecting fundamentals; will take appropriate action against excessive moves. Closely watching the impact of higher interest rates while cooperating with the BoJ.

DATA RECAP

- South Korea Dec 1–20 trade balance at provisional USD +3.82bln, customs agency said; exports +6.8% Y/Y; imports +0.7% Y/Y.

NOTABLE APAC EQUITY HEADLINES

- China’s cyberspace authority said it would regulate pricing behaviour on internet platforms under new regulations set to take effect from April 10.

- SoftBank (9984 JT) could tap undrawn margin loans backed by Arm Holdings shares, is working to take payments app PayPay public after delays from the US government shutdown and is looking to sell part of its stake in China’s Didi Global ahead of a Hong Kong IPO, Reuters sources said.

GEOPOLITICS

RUSSIA-UKRAINE

- The Kremlin said changes made by Ukrainians and Europeans to peace proposals did not bring agreements closer or add anything positive, IFAX reported. It said Dmitriev was still in Miami meeting with Americans and would report on the results upon his return to Moscow. Kremlin aide said a trilateral Russia–US–Ukraine meeting was not being discussed.

- US Special Envoy Witkoff said weekend meetings between US and Russian delegations were productive and constructive; Russia remains fully committed to achieving peace in Ukraine.

- US Special Envoy Witkoff said the Ukrainian delegation held productive meetings over three days in Florida with US and European partners, including a separate US–Ukraine meeting, with discussions focused on timelines and sequencing of next steps.

- Ukrainian President Zelensky said broader consultations with European partners should follow recent talks in the US.

- Ukrainian President Zelensky said allies had started to slow supplies of air defence missiles and said Kyiv should stand by the US as mediator on talks with Russia, commenting on French President Macron’s proposal.

- Ukrainian President Zelensky said the situation in the Odesa region was harsh after Russian strikes and said Russia was trying to restrict Ukraine’s access to the sea.

- Ukrainian President Zelensky said elections could not be held in Russian-occupied parts of Ukraine, could only take place once security was guaranteed, and said Kyiv was working with the US on a stable peace while preparing voting infrastructure for Ukrainians abroad, Reuters reported.

- Ukraine’s deputy prime minister said Russia attacked the Pivdennyi port and was deliberately targeting civilian logistics in the Odesa region.

- Russia’s Defence Ministry said Russian troops had captured Vysoke in Ukraine’s Sumy region and Svitlie in the Donetsk region, according to IFAX and TASS.

- Two vessels and two piers were damaged in Russia’s Krasnodar after a Ukrainian drone attack, regional authorities said; damage to piers led to a large fire in the area.

MIDDLE EAST

- Israeli PM Netanyahu reportedly plans to brief US President Trump on possible new Iran strikes, according to NBC News. Israeli officials believe Iran is expanding its ballistic missile program. They are preparing to make the case during an upcoming meeting with Trump that it poses a new threat. Israeli officials have announced a Dec. 29 meeting.

- Israeli officials warned the Trump administration over the weekend that an Iranian IRGC missile exercise could be preparations for a strike on Israel, according to Axios sources.

- Sources said the biggest risk is that a war between Israel and Iran will break out as a result of a miscalculation with each side thinking the other plans to attack and try to pre-empt it, according to Axios.

US-VENEZUELA

- US Coast Guard officials over the weekend tracked two oil tankers in international waters close to Venezuela, marking three tankers within the past week. An official suggested that the tanker is subject to sanctions, according to several media reports.

- The Venezuelan government rejected the seizure of a new vessel transporting oil, it said in a statement.

OTHERS

- North Korea said Japan’s ambition to possess nuclear weapons should be curbed, accusing Tokyo of showing intent by reviewing its three non-nuclear principles, state media KCNA reported.

- US President Trump announced on Truth Social Sunday that he is appointing Louisiana Gov. Jeff Landry as the US Special Envoy to Greenland. The White House says President Trump will make an announcement with Secretary of War Hegseth and Navy Secretary Phelan at 16:30 EST on Monday after receiving his intelligence briefing.

- On Friday, Thailand bombed Cambodian casinos it claims are being used as military sites, according to reports.