European equity futures point to a slightly firmer open; US threatens to retaliate against EU companies over digital tax - Newsquawk EU Market Open

- US President Trump is to give an address to the nation on Wednesday night, live from the White House at 21:00EST (02:00GMT Thursday). White House Press Secretary said that Trump’s address will be about accomplishments, while he will talk about what's to come and maybe tease new year policies.

- US threatened to retaliate against EU companies over digital tax, while it will use 'every tool' to counter the EU digital tax and may consider fees and foreign services restrictions.

- US House China Panel wrote a letter to US Commerce Secretary Lutnick, stating that NVIDIA (NVDA) H200 chip sales to China risk US' advantage.

- US President Trump announced a blockade of sanctioned oil tankers entering and leaving Venezuela.

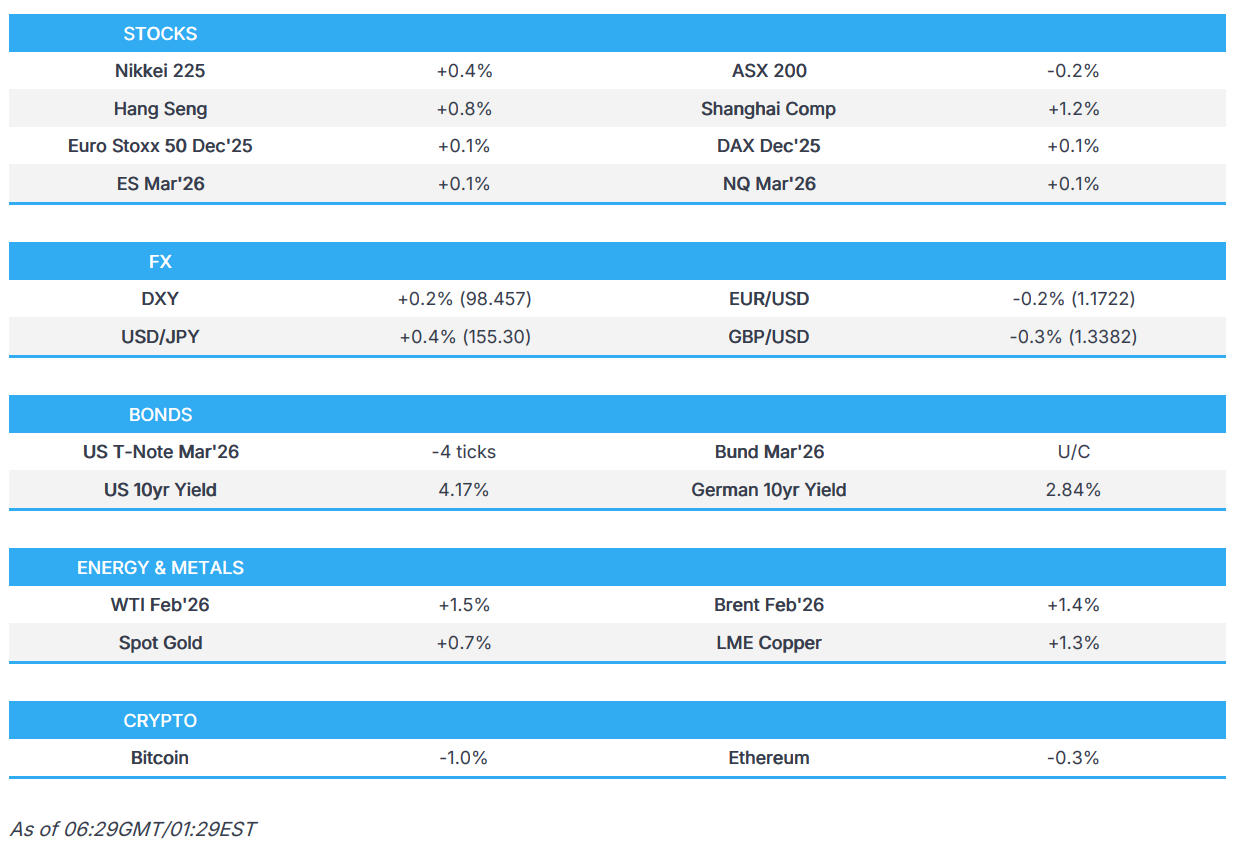

- APAC stocks were indecisive for most of the session; European equity futures indicate a slightly softer cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed with losses of 0.6% on Tuesday.

- Looking ahead, highlights include UK Inflation (Nov), German Ifo Survey (Dec), EZ CPI Final (Nov), NZD GDP (Q3), Speakers including Fed’s Waller, Williams & Bostic, Supply from US, Earnings from Micron.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed the day in the red, in a choppy session, beginning in the US morning in futures after delayed US data. Recapping, the US November payrolls report headline came in at above expected, with the unemployment rate jumping to 4.6% from 4.4%, with some of the move explained by the participation rate rising, but the household survey is also subject to a larger standard error than usual, and it may be this way for a few months. The Oct. headline fell 105k (exp. -25k), retail sales were soft but driven by a fall in auto sales, while S&P Global Flash PMIs disappointed.

- Akin to US indices, Treasuries saw two-way action, as they initially spiked higher amid a jump in the November unemployment rate, but quickly faded the move given the overall mixed bag of data.

- SPX -0.24% at 6,800, NDX +0.26% at 25,133, DJI -0.62% at 48,114, RUT -0.45% at 2,519.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump posted that "Numbers recently released show that TARIFFS have reduced the Trade Deficit of the United States by more than half. This is larger than anyone, except ME, projected, and will only get stronger in the near future. Everybody should pray that the United States Supreme Court has the Wisdom and Genius to allow Tariffs to GUARD our National Security, and our Financial Freedom!

- US House China Panel wrote a letter to US Commerce Secretary Lutnick, stating that NVIDIA (NVDA) H200 chip sales to China risk US' advantage.

- US threatened to retaliate against EU companies over digital tax, while it will use 'every tool' to counter the EU digital tax and may consider fees and foreign services restrictions.

- US and Japan are to consider projects that may tap the USD 550bln fund, according to Bloomberg.

- South Korea is to push for service sector FTA with China and CPTPP affiliation for export momentum, according to Yonhap.

- French President Macron called for an urgent rebalancing of EU-China relations in an FT op-ed, and said in order to finance the investment we need, Europe must leverage its pool of around EUR 30tln in savings. Macro also commented that the EU must stay open for China to invest in sectors where it is a leader and that China must address its internal imbalances.

NOTABLE HEADLINES

- US President Trump is to give an address to the nation on Wednesday night, live from the White House at 21:00EST (02:00GMT). White House Press Secretary said that Trump’s address will be about accomplishments, while he will talk about what's to come and maybe tease new year policies.

- US President Trump is set to interview Fed Governor Waller for the Chair role on Wednesday, while officials have cautioned that the process is fast-moving and that meetings can always be postponed or cancelled as the president continues to deliberate, according to WSJ.

- Trump officials privately raised doubts about Hassett for Fed chair, with his critics saying he has not been effective as head of the National Economic Council and is playing little part in driving policies, according to POLITICO.

- Fed's Goolsbee (2025 voter, hawkish dissenter) said the job market is cooling at a modest pace and as we go into 2026, he is optimistic the economy will sustain at a stabilised rate.

- Fed's Bostic (2027 voter) said price pressures are not just coming from tariffs and the Fed should not be hasty to declare victory. Bostic said he would have preferred to leave monetary policy where it was at the last Fed meeting and noted that further interest rate cuts would place monetary policy near or into accommodative territory, putting inflation and inflation expectations at risk. Furthermore, he said Tuesday's jobs report was a mixed picture and did not change the outlook much.

- White House is preparing an executive order that could limit stock buybacks, dividends and executive compensation for military contractors, according to Punchbowl. It was separately reported that the Trump administration is weighing an executive order to pressure defence contractors to spend less on stock buybacks and dividends and more on infrastructure and weapons production, according to Bloomberg.

- US President Trump is expected to sign an executive order as soon as this week that would fast-track reclassification of cannabis, according to NBC News.

APAC TRADE

EQUITIES

- APAC stocks were indecisive with the region lacking conviction following the uninspiring lead from Wall Street where price action was choppy as participants digested a deluge of mixed data releases.

- ASX 200 was subdued in the absence of bullish drivers and as gains in the mining, materials and resources sectors were offset by weakness in energy, defensives and financials.

- Nikkei 225 swung between gains and losses amid a choppy currency and as participants digested the better-than-expected Japanese machinery orders and exports data, but with upside limited as an anticipated BoJ rate hike looms.

- Hang Seng and Shanghai Comp initially traded indecisively in a narrow range with little fresh macro catalysts from China, and after the PBoC drained liquidity in its open market operations. The bourses later climbed to session highs.

- US equity futures were little changed following the choppy post-NFP performance.

- European equity futures indicate a slightly softer cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed with losses of 0.6% on Tuesday.

FX

- DXY mildly gained in an attempt to shrug off the prior day's choppy mood as participants had digested a slew of data releases, including mixed jobs data in which October jobs fell by 105k, although it was seemingly driven by a decline in the Federal government due to the shutdown. Conversely, the November NFP report showed a modest rebound in the headline of 64k, but the Unemployment Rate moved higher to 4.6% from 4.4%, while the BLS had issued a notice beforehand that it would contain a larger standard error.

- EUR/USD was rangebound following yesterday's two-way price action in which early momentum was thwarted by resistance at the 1.1800 level.

- GBP/USD faded some of its gains after recently outperforming on better-than-expected jobs and earnings data, while participants now await UK inflation figures.

- USD/JPY price action was choppy with initial downside following the recent narrowing of US-Japan yield differentials and after better-than-expected Japanese exports and machinery orders, although the pair then bounced back as sentiment in Japan gradually improved.

- Antipodeans lacked demand in the absence of any relevant tier-1 data and amid the overall mixed risk appetite.

- PBoC set USD/CNY mid-point at 7.0573 vs exp. 7.0386 (Prev. 7.0602).

FIXED INCOME

- 10yr UST futures marginally declined following yesterday's choppy price action amid the deluge of US data, including the jobs report, which was ultimately a mixed bag.

- Bund futures lacked direction following the prior day's indecisive performance and mixed German ZEW data.

- 10yr JGB futures remained subdued as the BoJ meeting approaches and following the mostly better-than-expected machinery orders and trade data from Japan.

COMMODITIES

- Crude futures gradually clawed back some of the prior day's losses with the rebound facilitated by the much larger-than-expected drawdown in weekly private sector headline crude stockpiles and US President Trump's announcement of a blockade of sanctioned oil tankers entering and leaving Venezuela.

- US Private Inventory Data (bbls): Crude -9.3mln (exp. -1.1mln), Distillate +2.5mln (exp. +1.2mln), Gasoline -4.8mln (exp. +2.1mln), Cushing -0.5mln.

- Spot gold edged higher after its recent return above the USD 4,300/oz level and as silver prices continued to rally to a fresh record high around USD 66/oz.

- Copper futures kept afloat but with further upside limited amid the mixed risk appetite in Asia and indecisiveness in its largest buyer, China.

CRYPTO

- Bitcoin trickled lower overnight and eventually dipped beneath the USD 87,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC injected CNY 46.8bln via 7-day reverse repos with the rate at 1.40% for a net drain of CNY 143bln.

- Japanese PM Takaichi said Japan needs to strengthen its capacity through proactive fiscal policy rather than excessive fiscal tightening, while she added that a sustainable fiscal policy and the social welfare system will be achieved by reflating the economy, improving corporate profits and raising household income through wage gains that boost tax revenues. Furthermore, she said fiscal spending will be strategic rather than a reckless expansion.

DATA RECAP

- Japanese Trade Balance Total Yen (Nov) 322.2B vs. Exp. 71.2B (Prev. -231.8B, Rev. -226.1B)

- Japanese Exports YY (Nov) 6.1% vs. Exp. 4.8% (Prev. 3.6%)

- Japanese Imports YY (Nov) 1.3% vs. Exp. 2.5% (Prev. 0.7%)

- Japanese Machinery Orders MM (Oct) 7.0% vs. Exp. -2.3% (Prev. 4.2%)

- Japanese Machinery Orders YY (Oct) 12.5% vs. Exp. 3.6% (Prev. 11.6%)

- Singapore Non-Oil Exports YY (Nov) 11.6% vs Exp. 7.0% (Prev. 22.2%)

GEOPOLITICS

MIDDLE EAST

- Israeli forces conducted raids in Al Tuffah and Al Zaytoun neighbourhoods east of Gaza City, according to Al Jazeera.

RUSSIA-UKRAINE

- Ukrainian drone attack on Russia's Krasnodar region injured two people and cut power to parts of the region, according to regional authorities.

OTHER NEWS

- US President Trump posted that "Venezuela is completely surrounded by the largest Armada ever assembled in the History of South America. It will only get bigger, and the shock to them will be like nothing they have ever seen before... the Venezuelan Regime has been designated a FOREIGN TERRORIST ORGANIZATION. Therefore, today, I am ordering A TOTAL AND COMPLETE BLOCKADE OF ALL SANCTIONED OIL TANKERS going into, and out of, Venezuela."

- Venezuela said it rejects the grotesque threat from US President Trump, while it added that the Trump blockade is absolutely irrational and violates free commerce and navigability, according to a government statement.

- US told China it is ready to defend interests in Indo-Pacific, according to Bloomberg.

- Taiwan's Defence Ministry said a Chinese aircraft carrier sailed through the Taiwan Strait on Tuesday.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer pushed back on the delayed defence spending plan and asked military chiefs to rework aspects of the defence investment plan, according to FT.

- Germany is set to approve EUR 50bln in military purchases, according to FT.