European equity futures point to a softer open; FOMC cut rates by 25bps with a more dovish vote split than expected - Newsquawk EU Market Open

- FOMC cut rates by 25bps to 3.50-3.75%, as expected, while the vote split was 9-3, as Miran voted for a 50bps cut. Goolsbee and Schmid voted for unchanged.

- Fed said it is to assess incoming data, evolving outlook and balance of risks in considering the extent and timing of further adjustment (tweaked from “in considering additional adjustments”), and it will monitor implications of incoming information for the economic outlook.

- Powell said adjustments to rates since September should help stabilise the labour market and keep pressure down on inflation, while the Fed is well positioned to determine adjustments to rates, and rates are now in a plausible range of neutral.

- Powell also noted there is a lot of data due before the next meeting, and the Fed can wait and see how the economy evolves when asked about whether the 'risk management' phase of rate cuts is over.

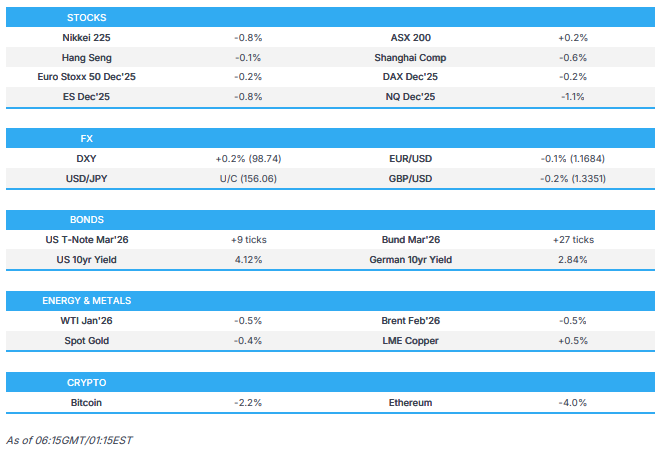

- APAC stocks were ultimately subdued after failing to sustain the early positive momentum from the dovishly perceived FOMC; US equity futures gave back their post-FOMC spoils as tech/AI concerns were stoked following a slump in Oracle shares.

- European equity futures indicate a softer cash market open with Euro Stoxx 50 futures down 0.1% after the cash market closed with losses of 0.2% on Wednesday.

- Looking ahead, highlights include Swedish CPI (Nov), US Initial Jobless Claims (6 Dec, w/e), SNB/CBRT Rate Announcements, IEA OMR, OPEC MOMR, Speakers including SNB's Schlegel, BoE's Bailey, ECB's de Guindos, Supply from Italy & US, Earnings from Broadcom, Costco & lululemon.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks and Treasuries ended the day with gains, while the Dollar was sold after a surprisingly dovish FOMC and Powell press conference. Briefly recapping, the Fed cut rates by 25bps to 3.5-3.75%, as expected, but in a dovish 9-3 vote split - Goolsbee and Schmid voted to leave rates unchanged, while Miran wanted a larger 50bps reduction. Heading into the meeting, as many as 4 hawkish dissenters were touted. In the following presser, Powell largely put more emphasis on the labour side of the mandate vs inflation, but he did acknowledge that rates are in a plausible range of neutral. Looking to January, he noted the Fed has not made a decision yet, they will wait and see how the data comes in, stressing there is a lot of data due to come.

- SPX +0.67% at 6,887, NDX +0.42% at 25,776, DJI +1.05% at 48,058, RUT +1.32% at 2,560.

- Click here for a detailed summary.

FOMC

- FOMC cut rates by 25bps to 3.50-3.75%, as expected, while the vote split was 9-3, as Miran voted for a 50bps cut. Goolsbee and Schmid voted for unchanged. Fed is to assess incoming data, evolving outlook and balance of risks in considering the extent and timing of further adjustment (tweaked from “in considering additional adjustments”), and it will monitor implications of incoming information for the economic outlook. Fed said it is prepared to adjust the policy stance if risks emerge impeding the goal attainment and noted Fed assessments are to consider labour market conditions, inflation pressures, inflation expectations, financial and international developments. Furthermore, it said job gains slowed, and unemployment edged up through September, while inflation moved up since earlier in the year and remains somewhat elevated. Fed also said it will start technical buying of Treasury bills to manage market liquidity, in which the initial round will total around USD 40bln in Treasury bills per month to help manage market liquidity levels. In its updated SEP, the Fed Funds projections were essentially unchanged, signalling steady expectations for a gradual return toward the longer-run rate.

- The 2025 dot plot composition shows six members' projected rates at the end of 2025 at 3.75-4.00%, indicating that four non-voters would have voted to keep rates on hold at today's meeting if they had voting rights. Fed Funds Rate projections showed 2025 at 3.625% (exp. 3.625%, prev. 3.625%), 2026 at 3.375% (exp. 3.375%, prev. 3.375%), 2027 at 3.125% (exp. 3.125%, prev. 3.125%), 2028 at 3.125% (exp. 3.125%, prev. 3.125%), and Longer Run at 3.00% (exp. 3.125%, prev. 3.00%).

- Fed Chair Powell said in the post-meeting statement that the outlook for employment and inflation has not changed much from the October meeting, while he stated near-term risks to inflation are tilted to the upside, employment risks are tilted to the downside, and the balance of risks has shifted. Powell said adjustments to rates since September should help stabilise the labour market and keep pressure down on inflation, while the Fed is well positioned to determine adjustments to rates, and rates are now in a plausible range of neutral. Powell also commented that reserve management purchases may remain elevated for a few months to alleviate money market pressures, but are expected to decline thereafter.

- Fed Chair Powell said in the Q&A when asked about policy statement tweaks, stated that rates are now in a broad range of neutral, and tweaks mean the Fed will carefully evaluate incoming data, with the Fed well positioned to see how the economy evolves. Powell also noted there is a lot of data due before the next meeting and the Fed can wait and see how the economy evolves when asked about whether the 'risk management' phase of rate cuts is over. Powell also commented that inflation is a touch softer with evidence growing that services inflation has come down, and goods inflation is entirely due to tariffs, while it does not feel like a hot economy and noted that when both policy goals are at risks, policy should be at neutral, but added he has not made a decision on January policy, and will wait and see. Furthermore, he stated the Fed has reached 'ample reserves' faster than it thought it would and wants to have ample reserves on April 15th tax day, as well as noted that frontloading the next few months of purchases is to get through the tax season.

TARIFFS/TRADE

- USTR took action under section 301 of the Trade Act of 1974 against Nicaragua and will impose a tariff that is phased-in over two years on all goods not subject to the existing trade agreement, while he added that the tariff will be set at zero on 1st January 2026 and increase to 10% in 2027, and to 15% in 2028.

- UK pledges an additional GBP 1.5bln for NHS medicines as part of Trump tariff deal, according to FT.

- Britain is to reform the system to speed up investigations into unfair trade practices and is to sharpen trade defences by giving the trade secretary power to direct investigations, according to draft government guidance.

- Mexico approves wide-ranging tariffs of up to 50% on China, according to Bloomberg. China's Commerce Ministry later commented regarding Mexico's tariffs that it will closely monitor the implementation and will further evaluate the impact, while it added that the measures harm the interests of relevant trade partners, including China.

- India's CEA chief economic advisor said most trade issues with the US have been sorted out and will be surprised if there is no deal with the US by March.

NOTABLE HEADLINES

- US President Trump said growth doesn't mean inflation, but added it is okay if there is inflation and they can slow it down, while he commented that he doesn't see why they can't have 20% or 25% GDP growth. Furthermore, he said markets should continue to go up with great results and if the market goes up, we should encourage it to go up more.

- US President Trump said he is meeting with former Fed Governor Warsh and commented that rates should be the lowest in the world.

- NEC Director Hassett said the Fed has plenty of room to cut rates and probably will need to do some more, while he added that data could support a 50bps cut and they could definitely get to 50, or even more. Hassett also said a 25bps cut would be a small step in the right direction and that President Trump will make the Fed Chair choice in a week or two.

- US House of Representatives voted 312-112 to pass the USD 901bln defence spending bill.

APAC TRADE

EQUITIES

- APAC stocks were ultimately subdued after failing to sustain the early positive momentum from the dovishly perceived FOMC where the Fed lowered rates by 25bps to between 3.50-3.75%, as expected, but with a less hawkish tilt than what Wall Street had anticipated, although much of the gains were eventually wiped out as a slump in Oracle post-earnings stoked tech and AI-related concerns.

- ASX 200 eked mild gains but with upside limited by the latest jobs data, which showed a surprise contraction in jobs that was solely due to a drop in full-time work.

- Nikkei 225 reversed its opening gains and more amid pressure from a firmer currency and as AI-exposed stocks were hit, including SoftBank.

- Hang Seng and Shanghai Comp gradually retreated with the mainland not helped by another liquidity drain by the PBoC, while trade-related uncertainty lingered, with China said to have held urgent discussions with major domestic tech firms on Wednesday about whether to permit purchases of NVIDIA’s H200 processors.

- US equity futures gave back their post-FOMC spoils as tech/AI concerns were stoked following a slump in Oracle shares, which dropped by a double-digit percentage in the aftermath of its earnings results as it underwhelmed on revenue and raised its FY26 capex guidance to about USD 50bln from USD 35bln.

- European equity futures indicate a softer cash market open with Euro Stoxx 50 futures down 0.1% after the cash market closed with losses of 0.2% on Wednesday.

FX

- DXY saw some slight reprieve overnight after retreating yesterday in reaction to the FOMC meeting, where the Fed cut the FFR by 25bps to 3.50-3.75% as widely anticipated, while there was a surprisingly dovish vote split as only 2 FOMC voters favoured to leave rates unchanged, against many expecting 4. The Fed also argued that downside risks to employment had risen and acknowledged the move higher in the Unemployment Rate in September, while Fed Chair Powell echoed the dovish theme at the press conference, where he noted the job growth overcount is around 60k per month and that he does not feel like the economy is hot.

- EUR/USD benefitted from the dollar pressure in the aftermath of the FOMC, but is off intraday highs after failing to sustain its brief return to 1.1700 territory.

- GBP/USD held on to most of the prior day's gains but with upside capped by resistance just shy of the 1.3400 level and amid a lack of major UK-specific drivers.

- USD/JPY initially retreated amid the recent narrowing of US-Japan yield differentials, while there were recent comments from former BoJ official Hayakawa, who said the BoJ may hike rates four times by 2027, although it later bounced off lows with some support seen at the 155.50 level.

- Antipodeans faded their recent gains as risk appetite began to wane, and with AUD/USD not helped by mixed jobs data, including a surprise contraction to headline Employment Change.

- PBoC set USD/CNY mid-point at 7.0686 vs exp. 7.0525 (Prev. 7.0753).

FIXED INCOME

- 10yr UST futures remained afloat after bull steepening in the aftermath of the FOMC meeting, where the Fed cut rates and turned out to be a lot less hawkish than what Wall Street had largely been expecting, with just two members voting to keep rates unchanged, while the Fed also announced it will start technical buying of Treasury bills to manage market liquidity.

- Bund futures gradually edged higher as global bond markets got an uplift from the Fed, but with upside capped following the recent choppy performance and after the latest comments from ECB officials provided very little incrementally.

- 10yr JGB futures tracked gains in global peers, with the advances also facilitated by increased demand at the 20-year JGB auction.

COMMODITIES

- Crude futures were indecisive and eventually faded the gains seen from reports that the US seized a sanctioned oil tanker off the coast of Venezuela.

- Kuwait set January 2026 OSP for its super light crude to Asia at USD 0.90/bbl below Oman/Dubai average.

- Spot gold saw two-way price action in which it initially extended on its post-FOMC gains owing to the dovishly perceived Fed and alongside upside in metal prices, which was led again by a surge in silver, although the moves were gradually pared with the metals complex clouded alongside the tech-related headwinds in stocks.

- Copper futures initially rallied with prices underpinned in the aftermath of the dovish Fed, but then gave back some of the gains as risk appetite waned.

- Chile's Codelco copper production fell 14.3% Y/Y in October to 111k tons and Escondida copper production rose 11.7% to 120.6k tons, while Collahuasi production fell 29.3% to 35k tons.

CRYPTO

- Bitcoin retreated overnight alongside the tech-related concerns and briefly dipped below the USD 90k level.

NOTABLE ASIA-PAC HEADLINES

- HKMA cut its base rate by 25bps to 4.00%, as expected, and in lockstep with the Fed.

DATA RECAP

- Australian Employment (Nov) -21.3k vs. Exp. 20.0k (Prev. 42.2k, Rev. 41.1k)

- Australian Full Time Employment (Nov) -56.5k (Prev. 55.3k)

- Australian Unemployment Rate (Nov) 4.3% vs. Exp. 4.4% (Prev. 4.3%)

- Australian Participation Rate (Nov) 66.7% vs. Exp. 67.0% (Prev. 67.0%)

GEOPOLITICS

MIDDLE EAST

- US officials discussed hitting the UN Palestinian refugee agency with terrorism-related sanctions, according to sources cited by Reuters.

- US State Department condemned the Houthis' ongoing unlawful detention of current and former local staff of US missions to Yemen.

RUSSIA-UKRAINE

- Ukraine sent a revised peace plan to Washington as US President Trump held a call with European leaders, according to Bloomberg.

- US President Trump said regarding the Ukraine call with European leaders, that they discussed in pretty strong words and would like the US to go to a meeting in Europe on the weekend, while they will make a determination based on what they come back with, and noted a meeting with Zelensky and the US is what is being requested.

- Discussions between the US and EU over tougher sanctions on Russia are ongoing, according to EU officials.

- Ukrainian navy drones in the Black Sea struck the "Dashan" vessel that is part of Russia's shadow fleet, while the attack led to the tanker being disabled.

OTHER

- US seized an oil tanker off the coast of Venezuela, while President Trump said the vessel was seized for a very good reason, and Attorney General Bondi said the oil tanker was used to transport sanctioned oil from Venezuela and Iran. Furthermore, Guyana's government said the oil tanker seized by the US was falsely flying a Guyana flag and that it will take action against the unauthorised use of the Guyanese flag.

EU/UK

NOTABLE HEADLINES

- ECB's Makhlouf said he is confident that medium-term inflation will be at 2%.

DATA RECAP

- UK RICS Housing Survey (Nov) -16.0 vs. Exp. -21.0 (Prev. -19.0)