European equity futures positive; ahead, BoE's Bailey to speak and US CPI - Newsquawk European Opening News

- Trump admin nears a deal with Taiwan; trade deal would cut tariffs and include a commitment from TSMC (TSM) to build more manufacturing plants in the US.

- USD/JPY initially saw weakness following comments by Japan’s FinMin Katayama stating that US Treasury Secretary Bessent shares the concerns over the weak JPY; PM Takaichi confirmed her intent to hold snap elections, Kyodo reports.

- US President Trump has been briefed on a range of military and covert options against Iran, according to CBS News; however, no final decision has been made, and diplomatic channels remain open.

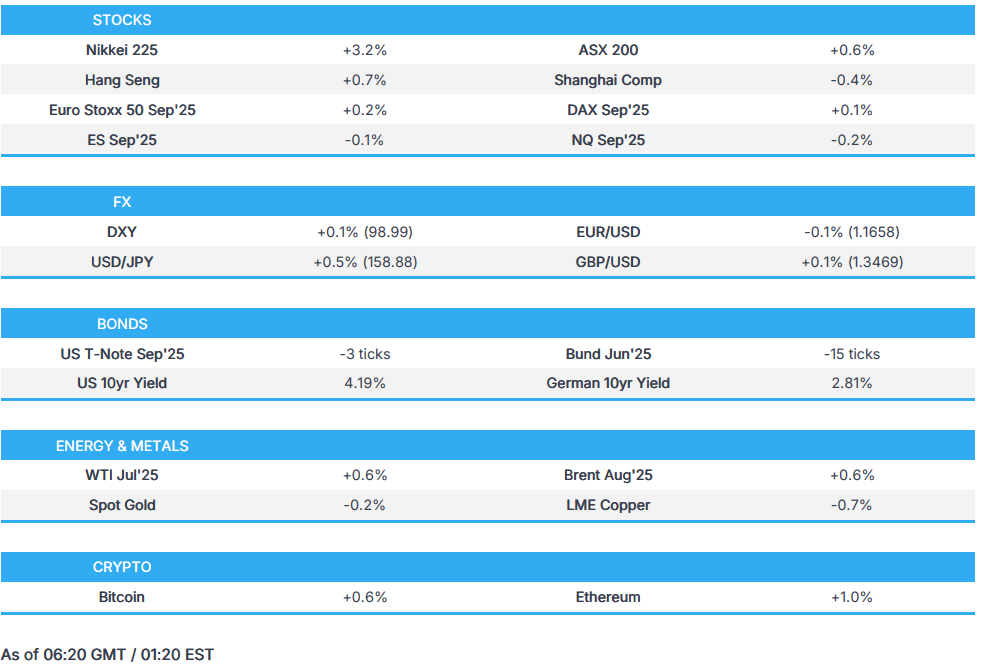

- European equity futures are indicative of a positive open with the Euro Stoxx 50 future +0.2% after cash closed +0.3% on Monday.

- Looking ahead, highlights include US NFIB (Dec), US CPI (Dec), Average Weekly Prelim Estimate ADP, EIA STEO, Speakers include BoE's Bailey, Fed’s Barkin and Musalem. Supply from the UK, Italy, Germany, US. Earnings from JPMorgan, Delta Air, Bank of New York Mellon.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks managed to close in the green, seeing gradual strength throughout the session, paring the weakness seen overnight. The Russell outperformed while sectors were mixed. Consumer Staples led the gains, largely due to Walmart (WMT) rising on news that it is to be added to the Nasdaq 100 index. Financials lagged, however, on Trump's aim at credit card fees, calling on them to be capped - which hit banks ahead of earnings. Elsewhere, focus lay largely on Fed independence threats after the DoJ investigation into Fed Chair Powell over building renovation costs.

- SPX +0.16% at 6.977, NDX +0.08% at 25,788, DJI +0.17% at 49,590, RUT +0.44% at 2,636

- Click here for a detailed summary.

TRADE/TARIFFS

- US President Trump said any countries doing business with Iran are to pay a 25% tariff on any or all business being done with the US.

- Taiwan officials said 'some' consensus has been reached with the US on a trade deal.

- Trump admin nears a deal with Taiwan; trade deal would cut tariffs and include a commitment from TSMC (TSM), to build more manufacturing plants in the US. TSMC to build at least five more Arizona Semiconductor facilities under new US deal. US-Taiwan trade deal to reduce tariffs on the island's exports to 15%.

- Japanese Finance Minister Katayama said there were some detailed proposals on rare earth supply chains during the meeting with the US. A potential price floor on rare earths was discussed.

- US Treasury Secretary Bessent posted that he was pleased to hear a strong, shared desire to quickly address key vulnerabilities in critical minerals supply chains; "I am optimistic that nations will pursue prudent derisking over decoupling".

NOTABLE HEADLINES

- US President Trump reportedly unhappy about AG Pam Bondi's performance and has repeatedly complained to aides, according to WSJ citing sources.

- US President Trump posted "I never want Americans to pay higher electricity bills because of Data Centers", said Microsoft (MSFT) will make a major change this week to make sure Americans do not "pick up the tab" for their power consumption.

- House Republican leaders intend to put the next funding package up for a vote on Wednesday night, according to Politico citing sources.

- NVIDIA (NVDA) said we do not require upfront payment and would never require customers to pay for products they do not receive.

- AbbVie (ABBV) has signed an agreement with the Trump administration, securing a tariff exemption.

CENTRAL BANKS

- Fed's Williams (Voter, Neutral) said monetary policy is well positioned amid a favourable outlook and that policy is now closer to neutral, well-positioned ahead of January rate decision; expect that we’ll see [the labour market] stabilize this year. In the Q&A, Fed's Williams reiterated that he expects improved labour market demand. Confident the Fed will return inflation to 2%. Jobs market is unusual with low hiring, low firing. Lastly, he stated that the Fed is not under strong influence to change rates.

- Blackrock's Rick Rieder said stories on meeting with US President Trump on Fed role are reasonably accurate; thinks that the Fed seat is independent; Fed has to get rates down to 3%, via CNBC interview.

- House Speaker Johnson said he intends to let the Fed Chair Powell investigation play out and not jump to any conclusions. Need to bring more natgas online, producing electricity to help meet demand.

- US Treasury Secretary Bessent reportedly told Trump late Sunday that Federal investigation into Powell "made a mess" and could be bad for financial markets, via Axios. Bessent didn't question the need for a Powell investigation and wasn't defending the Fed Chair in his talk with Trump. Bessent "thought that when the president named a new Fed chair, that Powell would go. But now that's not going to happen," another source said. "Now [Powell is] dug in. This really made a mess of things."

- ECB's Villeroy said "fanciful" to think ECB could raise key rate this year and a fall in the Dollar is possible if Fed independence is challenged.

APAC TRADE

EQUITIES

- Asia-Pac stocks followed on from Monday’s gains, with equities mostly in the green.

- ASX 200 started the session on the front foot, +0.4%, before extending gains and currently trading just shy of session highs at 8835. With spot XAU trading near ATHs, this has aided sectors such as metals and mining (2.0%) to continue Monday’s gains.

- Nikkei 225 returned from its long weekend with a gap higher, resulting in the index opening with gains as much as 3.7% and forming new ATHs. This comes amid a weaker JPY and growing speculation of PM Takaichi dissolving parliament. Japanese media noted that the LDP was looking to capitalise on Takaichi's high approval ratings.

- KOSPI opened Tuesday’s trade at ATHs and oscillated at highs before peaking at 4681 and slightly paring back, but remains comfortably in the green.

- Hang Seng and Shanghai Comp. opened in line with the broader sentiment, with the former surging higher, aided by gains in Gigadevice (3986 HK). The latter is the laggard across Asia-Pacific equities, trading with slight gains of 0.2%.

- US equity futures continued to pull back from ATHs, with losses led by big-tech (NQ -0.3%) while S&P 500 futures return to 7000.

- European equity futures are indicative of a positive open with the Euro Stoxx 50 future +0.2% after cash closed +0.3% on Monday.

FX

- DXY continued to grind back higher towards 99.00, as continued weakness in the JPY helps the greenback pare back some of the losses seen in Monday’s session following heightened worries over Fed independence.

- EUR/USD continued to grind lower, finding a trough at 1.1656, but remaining in tight ranges as the market awaits the US CPI report.

- GBP/USD was oscillating in a tight 13 pip range from 1.3463 to 1.3477. BRC retail sales ticked lower to 1.0% Y/Y from 1.2%, but this failed to spark a reaction in cable.

- USD/JPY initially saw weakness following comments by Japan’s FinMin Katayama stating that US Treasury Secretary Bessent shares the concerns over the weak JPY, signalling potential intervention on the horizon. However, the speculation on whether PM Takaichi may dissolve parliament may, in part, be driving recent price action, with USD/JPY reversing higher and peaking at 158.50.

- Antipodeans continued to be the outperformers, with NZD/USD and AUD/USD both seeing gains of 0.1%, as these high-beta currencies continue to track the performance of XAU, despite the yellow metal trading -0.2%.

- CNH experienced modest weakness following a weaker CNY fixing vs expectations for a stronger fix.

- PBoC set USD/CNY mid-point at 7.0103 vs exp. 6.9734 (Prev. 6.9849)

FIXED INCOME

- UST Futures were muted, following on from the rangebound price action in Monday’s US cash session. This comes as markets wait for the December CPI report. Market expectations signal that headline inflation will hold at 2.7% while core inflation is expected to tick higher to 2.7% from 2.6%.

- Bund Futures oscillated in a tight 5 tick range before ticking lower slowly despite light newsflow. Looking ahead, a 5-year Bobl auction and US CPI could bring in some volatility into the German debt space.

- JGB Futures reopened and fell by as much as 71 ticks following the speculation that PM Takaichi may dissolve parliament and call an election, as recent polls show improved confidence in the PM. JGBs pared back at least half the move as the APAC session continued, with Japanese 10-year debt around 132.10.

- Australia sold AUD 300mln 4.75% 2054 AGB; b/c 2.34x (prev. 2.85x), average yield 5.1953% (prev. 5.0603%).

- US sold USD 39bln of 10-year notes; stop-through 0.7bps. High Yield: 4.173% (prev. 4.175%, six-auction avg. 4.169%). WI: 4.180%. Tail: -0.7bps (prev. 0.0bps, six-auction avg. 0.1bps). Bid-to-Cover: 2.55x (prev. 2.55x, six-auction avg. 2.51x). Dealers: 5.9% (prev. 8.8%, six-auction avg. 9.9%). Directs: 24.5% (prev. 21.0%, six-auction avg. 20.6%). Indirects: 69.6% (prev. 70.2%, six-auction avg. 69.5%).

- US sold USD 58bln of 3-year notes; stops through 0.1bps. High Yield: 3.609% (prev. 3.614%, six-auction avg. 3.636%): WI 3.610%. Tail: -0.1bps (prev. -0.8bps, six-auction avg. -0.4bps). Bid-to-Cover: 2.65x (prev. 2.64x, six-auction avg. 2.65x). Dealers: 14% (prev. 9.0%, six-auction avg. 12.0%). Directs: 29.5% (prev. 19.0%, six-auction avg. 24.6%). Indirects: 56.5% (prev. 72.0%, six-auction avg. 63.3%).

- US sold USD 86bln of 3-month bills at 3.570%, b/c 2.79x.

- US sold 6-month bills at high rate 3.490%, b/c 3.17x.

COMMODITIES

- Crude futures oscillated in tight ranges amid a lack of geopolitical updates regarding the US-Iran situation. CBS News did report that US President Trump has been briefed on military and covert options against Iran, but no final decision has been made.

- Precious Metals (XAU, XAG) pulled back from their record highs reached in Monday’s session as traders take some profit ahead of the US CPI report. After peaking at a new ATH of USD 4630/oz, spot XAU pulled back and has found resistance back below USD 4600/oz.

- Base Metals traded mixed, with 3M LME Copper posted modest gains before seeing a modest pullback alongside performance in China, but remained above USD 13k/t. This comes amid worries that the recent gains in copper may sharply pull back if demand for the metal slows in 2026.

- Citi said its 3-month price target for gold and silver is now USD 5000/oz and USD 100/oz respectively.

- US reportedly allows Mexico to provide oil to Cuba despite Trump's vow to cut off supply, according to CBS News.

- Interior Secretary Burgum thinks seeing historic shift where OPEC's power is going to be diminished - CNBC. If start seeing low oil prices it is an opportunity to fill the SPR.

- Talks at Chilean copper mine Mantoverde remain stalled as strike continues to affect production.

CRYPTO

- Bitcoin holds above USD 91,000 amid a pullback in equities stateside.

NOTABLE ASIA-PAC HEADLINES

- Japan PM Takaichi confirms her intent to hold snap elections, Kyodo reports.

- China says it opposes unilateral sanctions and "long-arm jurisdiction", following the 25% tariff on US trade for countries doing business with Iran.

- Japanese Finance Minister Katayama said she shared concerns with US Treasury Secretary Bessent over weak JPY.

- Japanese Defense Minister Koizumi says assessments are ongoing into the impact of China's decision to restrict exports to Japan of dual-use items for military purposes.

- Japan's Economy Minister Kiuchi states that PM Takaichi's administration maintains responsible, proactive policies while ensuring fiscal discipline and avoiding reckless spending. Furthermore, Kiuchi says that we are not in a state to declare exit from deflation right now.

- South Korea's financial regulator said that local insurers will have to maintain enhanced capital ratio requirements starting in 2027 in a move to strengthen the capital quality, according to Yonhap.

- China Vanke (2202 HK) proposes to further extend grace period for repayment to 90 trading days from 30.

- South Korea Finance Ministry Official said we are considering issuing FX stabilisation bonds as early as January to build FX reserves.

- China examines foreign ETF trades after Jane Street India probe, Bloomberg reported.

- SK Hynix (000660 KS) is to spend KRW 19tln on South Korea chip packaging facilities, Bloomberg reported.

- SK Hynix (000660 KS) has decided to stick with its advanced MR-MUF process for the 16-stack HBM4 instead of adopting fluxless bonding following an evaluation that fell short of expectations.

- Korea Zinc (010130 KS) signs a rare earths partnership agreement with Alta Resource Technologies.

- Samsung Electronics (005930 KS) is to supply automotive 5G modems to Tesla (TSLA).

- German Finance Minister said they do not have time to lose on rare earths; will be central topic under G7 French Presidency. Many open questions remain after G7 rare earths meeting. Price floor and partnerships were discussed as options to secure rare earths. There was no reaction from China to the G7 meeting. Discussion on price floors has just started, we need to check details.

NOTABLE APAC DATA

- Japanese Current Account (Nov) 3.674tln vs Exp. 3.594tln (Prev. 2.834tln, Rev. 2.834tln).

- Japanese Bank Lending YoY (Dec) Y/Y 4.4% vs. Exp. 4.1% (Prev. 4.2%).

- Australian Westpac Consumer Confidence Index (Jan) 92.9 vs. Exp. 97 (Prev. 94.5).

- Australian Westpac Consumer Confidence Change (Jan) -1.7% vs. Exp. 2.6% (Prev. -9.0%, Rev. -9%).

- New Zealand NZIER Capacity Utilization (Q4) 89.8% vs. Exp. 89.3% (Prev. 89.1%).

GEOPOLITICS

RUSSIA-UKRAINE

- Russian drones hit two foreign-flagged vessels near Ukraine's port of Chornomorsk on Monday, according to source reports.

- Kyiv Mayor said the Russians are attacking the capital with ballistic missiles and that explosions are being heard.

MIDDLE EAST

- US President Trump has been briefed on a range of military and covert options against Iran, according to CBS News; however no final decision has been made and diplomatic channels remain open.

- "EU intends to impose new sanctions on Iran", Sky News Arabia reported.

- "Washington called on Dual U.S.-Iranian Citizens to Leave Iran", Al Arabiya reported.

- US President Trump is leaning towards striking Iran to punish the regime for killing protesters, but hasn't made a final decision and is exploring Iranian proposals for negotiations, a White House official with direct knowledge told Axios.

- Iranian authorities claim that the situation is 'under control'.

- The White House is weighing a last-ditch Iranian offer to engage in diplomacy over curbing its nuclear programme even as President Trump currently leans toward authorising fresh military strikes on Iran, WSJ reported citing officials. Vance leading effort by some aides to persuade Trump to engage in negotiations with Tehran.

- White House Press Secretary Leavitt said air strikes one of many options for Iran and Trump has interest in exploring Iranian messages. Trump is not afraid to use military force on Iran, but wants diplomacy.

- White House said Iran's public statements differ from private messages sent to the US.

- Iran reportedly ships USD 2.7bln worth of missiles to Russia, according to Bloomberg.

- Iranian Foreign Minister Araqji confirmed in a conversation with Al Jazeera that he was in contact with US Envoy Witkoff and that they were discussing the possibility of a meeting; "There are all kinds of ideas and we are testing them", Axios reported.

OTHERS

- At least two unsanctioned supertankers are departing Venezuelan waters carrying crude oil, according to reports citing TankerTrackers.

- White House Press Secretary said US will continue to seize tankers that will be heading from Venezuela without US permission. Continuing to iron out some energy deals on Venezuela. Venezuelan interim authorities agree to release political prisoners.

- White House officials said US President Trump will meet Venezuela's Machado on Thursday.

- White House Press Secretary said US President Trump has no set timeline for acquiring Greenland.

EU/UK

DATA RECAP

- UK BRC Retail Sales Y/Y (Dec) 1.0% (Prev. 1.2%)