European equity futures trade flat/higher after a mostly firmer APAC session; Trump due to speak later - Newsquawk EU Market Open

- APAC stocks were mostly higher following the positive handover from Wall Street, where all major indices gained amid outperformance in energy and a softer yield environment.

- US President Trump is scheduled to deliver remarks at a GOP member retreat at 10:00EST/15:00GMT on Tuesday and will participate in a meeting at 14.30EST/19:30GMT on Tuesday.

- Witnesses reportedly heard loud blasts near the Presidential Palace in Caracas, Venezuela, according to Bloomberg's Erik Wasson. There were then reports of a shooting near the Presidential Palace in Caracas, although the Venezuelan government said the situation was under control.

- NVIDIA (NVDA) CEO said there is strong demand from China for H200 chips, while he added that the Co. has applied for licenses to ship H200 chips to China, and the US government is working to process them.

- European equity futures indicate a mildly positive cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed with gains of 1.3% on Monday.

- Looking ahead, highlights include French CPI Prelim (Dec), German CPI Prelim (Dec), US S&P PMI Final (Dec), Speakers including ECB's Cipollone & Fed's Barkin, Fed Discount Rate Minutes, Supply from Germany & US.

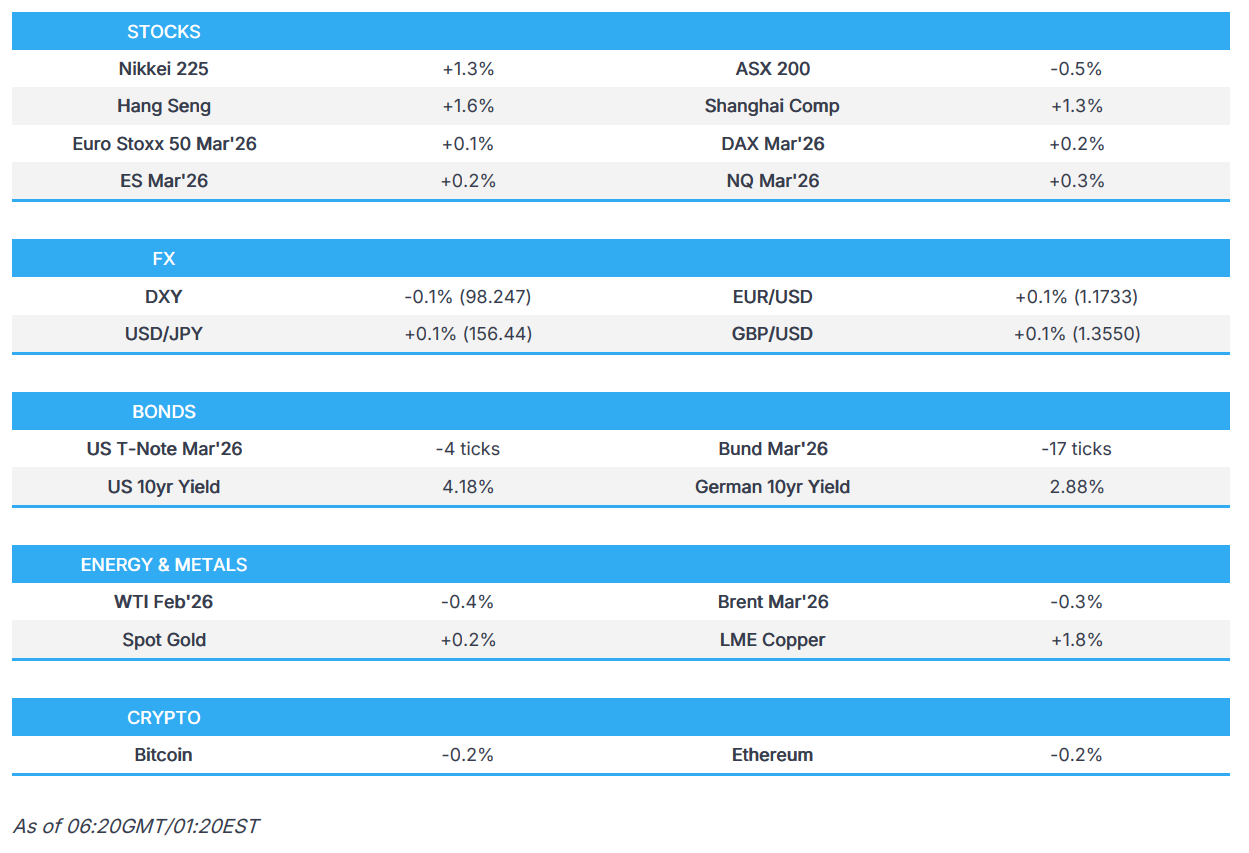

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks closed the day in the green, with outperformance in the energy sector as US oil companies and crude futures gained in the wake of the US strike on Venezuela and capture of Maduro, while the recent events have also opened up the question of whether the US will do an operation in another country, following punchy rhetoric from Trump on Colombia, Cuba and Mexico.

- Nonetheless, sectors mostly saw upside, although Utilities, Health, and Consumer Staples lagged, while yields declined as attention was also on data with an unexpected drop in the ISM Manufacturing PMI.

- SPX +0.64% at 6,902, NDX +0.77% at 25,401, DJI +1.23% at 48,977, RUT +1.58% at 2,548.

- Click here for a detailed summary.

TARIFFS/TRADE

- NVIDIA (NVDA) CEO said there is strong demand from China for H200 chips, while he added that the Co. has applied for licenses to ship H200 chips to China, and the US government is working to process them.

NOTABLE HEADLINES

- US President Trump is scheduled to deliver remarks at a GOP member retreat at 10:00EST/15:00GMT on Tuesday and will participate in a meeting at 14.30EST/19:30GMT on Tuesday.

- US Treasury reached agreements with more than 145 countries in the OECD/G20 Inclusive Framework to have US-headquartered companies remain subject to only US global minimum taxes while exempting them from Pillar Two..

APAC TRADE

EQUITIES

- APAC stocks were mostly higher following the positive handover from Wall Street, where all major indices gained amid outperformance in energy and a softer yield environment.

- ASX 200 was the laggard with the index dragged lower by weakness in defensives and the top weighted financial sector, while metal and mining stocks were boosted after the recent climb in underlying commodity prices and reports of an AUD 8.8bln takeover offer for BlueScope Steel.

- Nikkei 225 rallied at the open to back above the 52,000 level with the advances led by mining and tech-related stocks.

- Hang Seng and Shanghai Comp conformed to the predominantly upbeat mood, with outperformance in Hong Kong helped by strength in some property names and miners, while aluminium producer China Hongqiao Group led the advances as aluminium prices printed fresh three-year highs.

- US equity futures kept afloat but with upside capped as they paused following the prior day's rally.

- European equity futures indicate a mildly positive cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed with gains of 1.3% on Monday.

FX

- DXY remained subdued after ultimately weakening yesterday due to the disappointing ISM Manufacturing PMI data, which clouded over the initial haven demand seen in response to the US strike on Venezuela and the capture of President Maduro, while there were previous comments from Fed's Kashkari, who said the job market is cooling and inflation is still too high.

- EUR/USD eked mild gains after the prior day's gradual intraday recovery as the dollar was weighed by the soft ISM data and with very little newsflow from the bloc, while participants now await French and German consumer inflation figures.

- GBP/USD held on to recent spoils after returning to above the 1.3500 level in tandem with the strength in cyclical peers, although further upside was capped by resistance around the 1.3550 level and with little reaction seen from the slight acceleration in UK BRC Shop Price Index to 0.7% (Prev. 0.6%).

- USD/JPY traded indecisively amid a lack of tier-1 data from Japan and after the recent narrowing of US-Japan yield differentials post-ISM data.

- Antipodeans kept afloat after benefitting from the positive risk environment and upside in commodity prices.

- PBoC set USD/CNY mid-point at 7.0173 vs Exp. 6.9730 (Prev. 7.0230).

FIXED INCOME

- 10yr UST futures slightly eased back after yesterday's choppy performance in which prices ultimately gained following the soft ISM Manufacturing data, which showed a surprise deterioration in the headline figure.

- Bund futures retreated from the prior day's best levels with demand constrained overnight ahead of German inflation data and incoming supply.

- 10yr JGB futures initially continued its rebound from Monday's trough, but with most of the early upside reversed following the 10yr JGB auction which saw softer demand.

COMMODITIES

- Crude futures marginally pulled back after advancing throughout the prior US session as participants digested the US strike on Venezuela and Maduro's capture, while it was also reported that Saudi Aramco cut Asia OSPs to a premium of USD 0.30/bbl vs Oman/Dubai.

- US Energy Secretary Wright is to meet with oil executives about reviving Venezuela's energy sector following the capture of Maduro, according to Bloomberg citing sources. It was separately reported that the Trump admin had not held conversations with Exxon (XOM), Conoco (COP), or Chevron (CVX) about Venezuela before or since Maduro’s capture, according to reports citing four oil industry executives.

- US plans to interdict a tanker carrying Venezuelan oil, according to CBS.

- Saudi Arabia set February Arab Light crude oil OSP to Asia at plus USD 0.30/bbl vs Oman/Dubai average, to North West Europe at minus USD 0.35/bbl to ICE Brent settlement, and to the US at plus USD 2.20/bbl vs. ASCI.

- Spot gold remained firm after climbing to its highest in a week amid the ongoing geopolitical risks.

- Copper futures extended on recent advances with CME futures above the USD 6/lb level, while the benchmark LME copper contract rose to a fresh record high above USD 13,200/ton amid the ongoing Capstone Copper union strike at Mantoverde operations in Chile, which began on Friday.

CRYPTO

- Bitcoin was choppy overnight and failed to sustain a brief return above the USD 94,000 level.

NOTABLE ASIA-PAC HEADLINES

- China’s DeepSeek added an advanced ‘thinking’ feature to its chatbot amid buzz over the next model, according to SCMP.

GEOPOLITICS

VENEZUELA/LATIN AMERICA

- US President Trump said Venezuela has to be fixed before elections and that the US may subsidise an effort by oil companies to rebuild the country's energy infrastructure, while he added that they would not need lawmakers to act in order for him to send US troops back into Venezuela. Furthermore, Trump's advisor Miller said Venezuela is cooperating with the US and needs US permission to do any commerce.

- US President Trump has a list of demands for Venezuela's new leader including stopping oil sales to US rivals, according to POLITICO. US officials were said to have told Venezuela's Rodriguez that they want to see at least three moves from her, which are cracking down on drug flows, kicking out Iranian, Cuban and other operatives of countries or networks hostile to Washington, and stopping the sale of oil to US adversaries.

- CIA reportedly concluded that Venezuela's Maduro regime loyalists were best placed to lead Venezuela after Maduro, according to WSJ.

- Venezuela's UN envoy said the US carried out an illegitimate attack with no legal justification, and violated the UN Charter.

- Witnesses reportedly heard loud blasts near the Presidential Palace in Caracas, Venezuela, according to Bloomberg's Erik Wasson. There were then reports of a shooting near the Presidential Palace in Caracas, although the Venezuelan government said the situation was under control.

- US House Speaker Johnson said he is not expecting US troops on the ground in Venezuela.

- Colombia is to continue coordinating and cooperating with the US on fighting drug trafficking.

MIDDLE EAST

- Israeli PMI Netanyahu asked Russian President Putin to reassure Iran, "We will not attack them", according to Kann News.

- Israeli air force struck multiple sites in Lebanon on Monday and early Tuesday, ahead of a key disarmament meeting, according to POLITICO.

RUSSIA-UKRAINE

- Ukrainian President Zelensky posted that they are preparing for meetings in Europe this week and are in constant communication with US President Trump's team.

- Ukraine's Foreign Minister said Russia has been targeting American businesses systematically in Ukraine.

OTHER

- Greenland's PM Nielsen said they are working on strengthening the dialogue with allied countries and with NATO, while he added that they are not at a point where they are thinking that a takeover of their country might happen overnight.

EU/UK

NOTABLE HEADLINES

- Italy's government and Pirelli (PIRC IM) are searching for ways to end Sinochem's (600500 CH) involvement in the Milan-based tyre maker, which could be banned from the US due to Chinese chemical groups shareholding, according to FT.

DATA RECAP

- UK BRC Shop Price Index YY (Dec) 0.7% (Prev. 0.6%)