European & US equity futures trade higher as the TACO trade takes effect - Newsquawk US Opening News

- The proposal by NATO's Rutte does not include the transfer of overall sovereignty, Axios reported citing sources; the plan includes the increase of security in Greenland and NATO activity in the Arctic.

- PBoC Governor Pan says China has room this year to cut RRR and interest rates, pledging flexible use of tools.

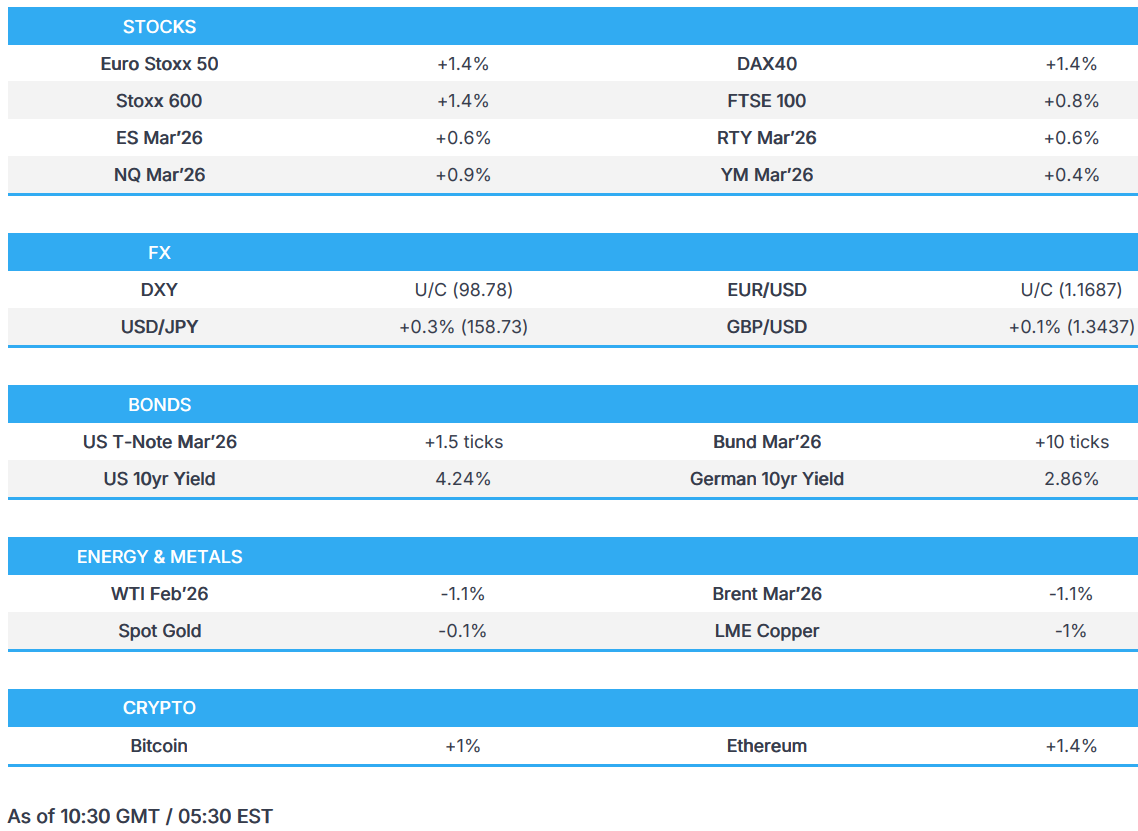

- European & US equity futures trade higher as the TACO trade takes effect, after Trump cancels tariffs on European countries.

- DXY is flat, Aussie outperforms post-jobs data whilst the JPY lags.

- Fixed benchmarks steady, awaiting to see if the TACO narrative holds, Gilts lead after PSNB.

- Crude benchmarks move lower as near-term risk premia is scaled back; XAU edges a touch lower.

- Looking ahead, US GDP/PCE Final (Q3), Jobless Claims (w/e 17th Jan), New Zealand CPI (Q4), Japanese CPI (Dec), EZ Consumer Confidence Flash (Jan), ECB Minutes (Dec), CBRT Policy Announcement, Supply from the US.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European equities (STOXX 600 +1.3%) are firmer across the board. Sentiment has tracked tailwinds from APAC and Wall St which traded higher after market sentiment was kept at ease following Trump’s Davos speech where he vowed to not use military action against NATO allies and later withdrew tariff plans on some European countries.

- European sectors are all in the green. Autos takes the top spot, boosted by gains in Volkswagen (+5%) and Michelin (+3.3%) after providing positive trading updates.

- US equity futures are firmer (ES+0.6% NQ +0.8%, RTY +0.6%), following the positive risk tone seen across global peers. Ahead, key earnings include Intel, Procter & Gamble, Freeport McMoRan, Ge Aerospace and Abbott.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is currently flat and trades within a narrow 98.72 to 98.82 range; the low for the day coincides with its 200 DMA. Some further pressure in the index could see the test of its 100 DMA (98.69).

- Focus this morning has been solely on US President Trump, who provided updates on both Greenland and the Fed. Starting with the former, Trump mentioned that he had a very productive meeting with NATO's Rutte, and they have formed a framework for a future deal. Notably, Trump announced that the scheduled tariffs on eight European countries would not go ahead – leading to a familiar “TACO” trade to take place across markets. Elsewhere, on the Fed, Trump said he would like to keep NEC Director Hassett when he is, and now has two or three left in mind for the Chair role. This follows familiar commentary from last Friday, which spurred some strength in the Dollar as markets come to terms with a potentially less dovish appointment; Polymarket odds show Warsh (44%) as the favourite, Rieder (31%) and then Waller (14%).

- G10s are broadly firmer against the Dollar; Antipodeans lead with clear outperformance in the AUD after a hotter-than-expected jobs report. Elsewhere, the JPY is the G10 underperformer this morning, and trades within a 158.17 to 158.89 range; high for the day marks a WTD peak, though still shy of its YTD high at 159.45. Overnight pressure in the JPY was attributed to December exports/trade balance missing expectations. Since, the JPY was mildly strengthened on reports that Japan now forecasts the primary balance to be in a deficit (prev. forecast surplus) in FY26. At face value, a negative, but perhaps given the relatively small deficit amount, eases recent fiscal-related fears.

- Finally, Norges Bank kept rates steady at its January meeting and largely reiterated the commentary/guidance from the December confab. As such, there was little reaction in EUR/NOK.

FIXED INCOME

- A relatively contained start for fixed income after a tumultuous first few sessions of the week.

- As it stands, the complex is awaiting geopolitical updates from the numerous meetings and briefings scheduled for today, the first of which is due now at the Peace Board signing with President Trump. From these, we look for clarity that the TACO narrative around Greenland is correct, and if the reporting around a deal like the one the UK has with Cyprus is correct.

- For fixed, this leaves USTs and Bunds firmer with gains of three and 13 ticks respectively. Just eclipsing Wednesday's 111-22 best for USTs, while Bunds have a little way to go to first recoup the 128.00 figure and then get to Wednesday's 128.25 high.

- Gilts outperform, on the back of a smaller-than-expected level of UK borrowing in December. The latest PSNB figure of GBP 11.6bln was around GBP 2.5bln below consensus. Despite the elevated level and still precarious state of UK finances, the December print has been enough to lift Gilts by 39 ticks at best to a 92.12 peak, eclipsing Wednesday's 92.04 best but still shy of the 92.51 WTD peak from Monday.

COMMODITIES

- Crude is on the backfoot, as the TACO trade takes the sting out of a near-term escalation on Greenland. However, we still wait to see details on how the deal will be done and exactly what the US will walk away with and demand; initial reporting suggests it will be similar to the UK-Cyprus arrangement. Further pressure also stemming from the Private inventory report, which posted a larger-than-expected headline crude build. WTI and Brent down to USD 60/bbl and USD 64.57/bbl, lower by c. USD 0.60/bbl.

- European gas is on the back foot, lower by around a EUR/MWh for Dutch TTF. However, this comes after the benchmark extended to a EUR 41.92/MWh peak early doors, a move driven by US NatGas settling higher by some 25% on Wednesday, alongside continued focus on the European & APAC cold spell.

- Spot gold has been tarnished by the removal of near-term risk premia by Trump's tariff U-turn. However, the numerous geopolitical meetings and opportunities for commentary today mean a return of premia is a real possibility. As it stands, XAU is holding at USD 4822/oz, having recovered from the USD 4772/oz overnight low but pushed lower once again in recent trade after the PBoC commentary that they will be increasing their supervision of the gold market.

- US Energy Secretary Wright said global oil production would need to more than double to meet rising demand and prevent energy poverty.

- US President Trump is reportedly personally controlling the release of funds generated from Venezuela's oil, Semafor reported citing an official.

- PBoC to reportedly strengthen supervision of the gold market, via Xinhua.

- Japanese copper smelters reportedly remain in discussions over charges for 2026 with miners.

- China's UBS SDIC silver futures fund will be suspended form market open until 10:30 am local time (2:30am GM) on the 23rd January.

- MMG (1208 HK) reported Q4 copper production of 108.6k/T of output, -7% Y/Y.

- Goldman Sachs raises its year-end gold price target to USD 5,400/oz (prev. USD 4,900/oz).

- US Private Inventory Data (bbls): Crude +3.0mln (exp. +1.8mln), Distillate -0.03mln (exp. -0.2mln), Gasoline +6.2mln (exp. +2.5mln), Cushing +1.2mln.

TRADE/TARIFFS

- Switzerland's Parmelin via X said he had a very constructive talks with USTR Greer.

- UK Business Secretary Kyle said the European customs unions is not currently on the radar of the UK government.

- China's Commerce Ministry said China is concerned with the EU excluding some of Chinese tech suppliers.

NOTABLE EUROPEAN HEADLINES

- German Chancellor Merz said there needs to be significant defence investment.

NOTABLE EUROPEAN DATA RECAP

- UK PSNB Ex Banks (Dec) 11.58B vs. Exp. 14B (Prev. 10.94B, Rev. From 11.65B).

CENTRAL BANKS

- PBoC Governor Pan said China has room this year to cut RRR and interest rates, pledging flexible use of tools.

- Norges Bank Interest Rate Decision 4.00% vs. Exp. 4.00% (Prev. 4.00%); "... if the economy evolves broadly as currently envisaged, the policy rate will be reduced further in the course of the year.".

NOTABLE US HEADLINES

- US House GOP leaders are struggling to strike a deal with Republican hard-liners tonight that would allow the final government funding package to advance, Politico reported. "The Rules Committee recessed Wednesday evening without a solution. Senior Rs hope to reconvene the panel by 9 pm".

GEOPOLITICS

RUSSIA-UKRAINE

- Russia's Kremlin said meeting between US envoy Witkoff and Russian President Putin will be after 7-8pm Moscow time.

- US President Trump and Ukrainian President Zelensky are set to meet at 12:00 GMT, via a Spokesman.

- US envoy Witkoff said a lot of progress has been made on Ukraine, getting to the end. Believes tariff free zone would be a gamechanger.

- Ukraine's top negotiator Umerov said he met with US envoys Witkoff and Kushner, discussed security guarantees and post-war reconstruction.

MIDDLE EAST

- A Palestinian source said there is an understanding between Hamas and the US administration that the organization will hand over its weapons and tunnel maps in exchange for recognition as a political organisation, via Sky news.

- US ambassador said all options are on the table [on Iran] and President Trump will keep his promise.

- Israeli military source quoted by local press: "The US military is mobilizing large capabilities in the region in preparation for the possibility of a large-scale confrontation with Iran", Sky News Arabia reported. "Concern in Tel Aviv that Washington will strike Iran hard at first and then withdraw its forces quickly and leave Israel facing a new reality on the ground". "Tel Aviv doubts the ability of the United States to find a real alternative to the Iranian regime in the event of its overthrow".

OTHERS

- The Trump administration is actively seeking regime change in Cuba by the end of 2026, the WSJ reported citing sources; the administration assess Cuba's economy as weak following the capture of Venezuela's Maduro.

- The proposal by NATO's Rutte does not include the transfer of overall sovereignty, Axios reported citing sources; the plan includes the increase of security in Greenland and NATO activity in the Arctic.

- NATO's Secretary General Rutte said the issue of Greenland remaining with Denmark did not come up in his conversation with President Trump.

- NATO's Rutte said there is still a lot of work to be done for the Greenland deal, AFP reported.

- US President Trump’s deal for Greenland is said to involve small pockets of land, according to NYT.

- Greenland deal is reportedly to involve small pockets of land, the NYT reported.

- German Finance Minister, on US President Trump's Greenland deal, said have to wait and not get hopes up too soon.

CRYPTO

- Bitcoin is a little firmer this morning and trades just shy of the USD 90k mark; Ethereum also trades higher, and back above USD 3k.

APAC TRADE

- APAC stocks traded entirely in the green, tracking the rebound on Wall Street after President Trump withdrew plans for additional tariffs on EU countries.

- ASX 200 opened around +0.8%, lifted by the improved global tone after US tariff removal, though the index later dipped following a hotter-than-expected Australian jobs report.

- Nikkei 225 posted firm gains of nearly 2%, snapping a five-day losing streak as chipmakers and financials advanced and JGBs stabilised.

- Hang Seng and Shanghai Comp the laggards, despite a brief recovery tech and easing trade-tension concerns after the US rollback of tariffs.

NOTABLE ASIA-PAC HEADLINES

- Australia's Nationals Leader said coalition can no longer continue.

NOTABLE APAC DATA RECAP

- Japanese 3-Month Bill Auction 0.7277% (Prev. 0.7079%).

- Japanese Imports YoY (Dec) Y/Y 5.3% vs. Exp. 3.6% (Prev. 1.3%).

- Japanese Foreign Bond Investment (Jan/17) -361.4B (Prev. 91.2B).

- Japanese Exports YoY (Dec) Y/Y 5.1% vs. Exp. 6.1% (Prev. 6.1%).

- Japanese Balance of Trade (Dec) 105.7B vs. Exp. 357B (Prev. 316.7B).

- Japanese Stock Investment by Foreigners (Jan/17) 874.0B (Prev. 1141.6B).

- Australian Unemployment Rate (Dec) 4.1% vs. Exp. 4.4% (Prev. 4.3%).

- Australian Employment Change (Dec) 65.2K vs. Exp. 30K (Prev. -21.3K).

- Australian Participation Rate (Dec) 66.7% vs. Exp. 66.8% (Prev. 66.7%).

- Australian Full Time Employment Change (Dec) 54.8K (Prev. -56.5K).

- Australian Part Time Employment Chg (Dec) 10.4K (Prev. 35.2K).