Fed Chair Powell faces criminal investigation; European equity futures flat - Newsquawk European Opening News

- US Federal prosecutors have opened a criminal investigation into Fed Chair Powell over the central bank’s renovation of its Washington headquarters, and whether Powell lied to Congress about the scope of the project, NYT reported, citing officials.

- Fed Chair Powell said the DoJ served the Fed with subpoenas, threatening indictment; Powell said he will continue to do the job.

- US President Trump said Iran has proposed negotiations after he threatened action against Tehran for the crackdown on protesters, AP News reported.

- US President Trump is to be briefed on Tuesday on "some kinetic and many non-kinetic" options in Iran, Politico reports, citing two administration officials.

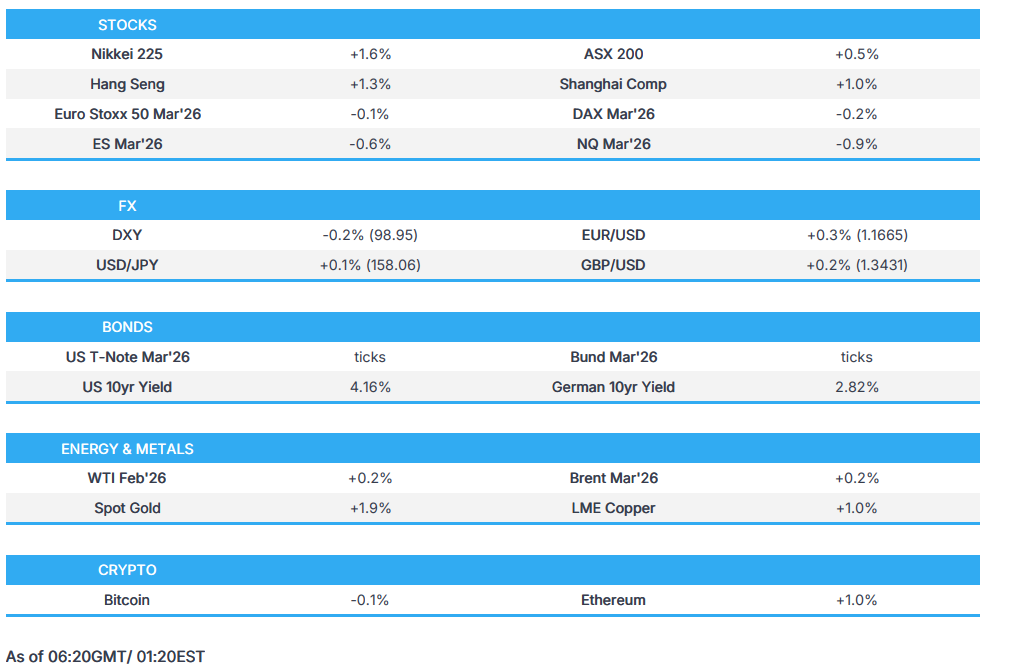

- APAC stocks were entirely in the green, following on from the positivity seen stateside during Friday's session. European equity futures are indicative of an uneventful open, with the Euro Stoxx 50 future flat after cash closed +1.6% on Friday.

- Looking ahead, highlights include Swiss Consumer Confidence (Dec), Speakers include ECB's de Guindos, Fed's Bostic, and Barkin. Supply from the US.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were bid to end the week with outperformance in the Nasdaq after the underperformance on Thursday with gains broad-based; Equal weight S&P +0.6%, and the majority of sectors closed green with materials and utilities outperforming, the former buoyed by metal prices and the latter buoyed by gains in Vistra (VST) and other nuclear power stocks after Meta (META) signed a deal with Vistra for its power.

- SPX +0.65% at 6,966, NDX +1.02% at 25,766, DJI +0.48% at 49,504, RUT +0.78% at 2,624

- Click here for a detailed summary.

TRADE/TARIFFS

- China is resuming its soybean auctions after a three-week pause to free storage while continuing US purchases under the trade truce.

- The US is to host a meeting on rare earths this week, according to Bloomberg.

- US Commerce Department drops plan to impose restrictions on Chinese-made drones, according to a filing.

- Japan's Finance Minister said Japan needs to take away China's power to 'weaponize' rare earths. "We want to create a [rare earth] market of proper democracies and market economies." "If we don't take away China's means" of monopolising and weaponising the metals, "it will become a constant threat in areas with nothing to do with security."

- On rare earths, Bessent is expected to urge G7 nations and others to increase their efforts to reduce their reliance on critical minerals from China, according to a senior official.

NOTABLE HEADLINES

- US President Trump said he is going to Detroit to talk about car factories opening up.

- US President Trump said he might veto extension of health insurance subsidies.

- US President Trump said the jobs report on Friday was an amazing report; on posting data early, they gave me some numbers, and when they do, I post.

- US President Trump said on January 30th, there may be another shutdown; we'll see.

- US President Trump said he might block Exxon (XOM) from drilling in Venezuela following comments by the Co.'s CEO, according to the WSJ. The White House said it was displeased with Exxon’s (XOM) reaction and that officials hint that Exxon might be kept out with regard to Venezuela.

- US President Trump said credit card companies will be in violation of law if they do not comply on interest rate cap by January 20th.

- US President Trump and US Commerce Secretary met with homebuilders seeking to increase construction.

- The DOJ announced on Friday that it is creating an AI task force to challenge state-level regulations, CBS reports, citing an internal memo. The task force aims to allow AI firms to "be free to innovate without cumbersome regulation".

- Walmart (WMT) partners with Google (GOOGL) to allow shoppers to purchase products through Gemini, according to a statement.

CENTRAL BANKS

- Federal prosecutors have opened up a criminal investigation into Fed Chair Powell over the central bank’s renovation of its Washington headquarters and whether Powell lied to Congress about the scope of the project, NYT reported citing officials.

- Fed Chair Powell said DoJ served the Fed with subpoenas, threatening indictment; Powell said he will continue to do the job.The Fed Chair said it is about his testimony in front of the Senate Banking Committee last June, but called this a pretext. The Fed Chairman thinks this is really about interest rates saying, "The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President."

- US President Trump denies involvement in the DoJ's issuance of a federal subpoena to the Fed; issued subpoenas unrelated to interest rates.

- US Senator Tillis criticises the move against Fed Chair Powell, and said he will “oppose the confirmation of any nominee for the Fed—including the upcoming Fed Chair vacancy—until this legal matter is resolved.

- Fed's Barkin (2027 voter) on Friday said the drop in the unemployment rate is welcome and that it may take until April for inflation data to be fully caught up.

- Fed's Bostic (Retiring) on Friday said high-end consumers have been spending, in many ways, US has long had a K-shaped economy; economy has been resilient, speaking via WLRN radio. Important they get inflation under control, inflation issues are still one of the economy's main challenges.

- Goldman Sachs expects the Fed to deliver 25bps cuts in June and September (prev. saw 25bps in both March and June).

- Morgan Stanley expects the Fed to cut by 25bps in both June and September (prev. saw 25bps in both January and April).

- Eurogroup receives six candidates to replace ECB VP de Guindos after May 2026; Centeno (Portugal), Kazaks (Latvia), Muller (Estonia), Rehn (Finland), Sadzius (Lithuania), Vujcic (Croatia). On 19th January, Eurogroup will discuss the candidates.

APAC TRADE

EQUITIES

- APAC stocks were mostly in the green, following on from the positivity seen stateside during Friday's session. Japanese traders were away today amid a domestic holiday.

- ASX 200 saw gains of as much as 0.7% as the APAC session got underway but pared back slightly as XAU pulled back from new record highs. Despite spot XAU pulling back, gold miners outperformed, followed by consumer discretionary and energy.

- KOSPI was the Asian outperformer, with gains as much as 1.5% but the index completely reversed the move alongside further losses in tech-laden NQ.

- Hang Seng and Shanghai Comp conformed to the regional gains, although upside was capped amid a lack of major drivers for the bourses.

- US equity futures were in the red across the board (ES -0.6%, NQ -1.0%), weighed by news of the subpoenas by federal prosecutors to Fed Chair Powell. Traders are also cognizant of the start of earnings season and US CPI this week.

- European equity futures are indicative of an flat/subdued open with the Euro Stoxx 50 future -0.1% after cash closed +1.6% on Friday.

FX

- DXY started the week on the backfoot, falling from a high of 99.25 to a trough of 98.85, as federal prosecutors opened a criminal investigation into Fed Chair Powell over the recent renovations of its headquarters. This puts further pressure on Fed independence as this has been put as a sign of the Trump administration trying to force Chair Powell out, despite President Trump denying any involvement.

- EUR/USD and GBP/USD started the week positively as a function of the dollar weakness seen across markets. This rebound follows the weakness seen throughout trade last week.

- USD/JPY has traded undecided throughout the APAC session, briefly extending beyond 158.00 and into touted intervention territory following further reporting of PM Takaichi planning to dissolve the Lower House, before selling off to a trough of 157.52 amid global risk-off flows at the time. The pair pared back the majority of its losses, now trading with slight gains of 0.1%.

- Antipodeans have benefited the most from the bid in the metals space.

- PBoC set USD/CNY mid-point at 7.0108 vs exp. 6.9849 (Prev. 7.0128)

FIXED INCOME

- 10yr UST futures traded rangebound in a 112'05-112'11 band as the Asia-Pac session got underway. Earlier upside was seen following the announcement of the subpoena against Fed Chair Powell, rising from trough to peak over the space of 45 minutes, before paring back the entirety of earlier gains and currently trading flat.

- Bund futures followed its US counterpart, rising from the open at 127.91 to a peak of 128.02, before falling back lower. Not much on the docket today in the European session, but markets will be waiting for US CPI and PPI.

COMMODITIES

- Crude futures oscillated in a wide c. USD 1.10/bbl band throughout the Asia-Pac session. WTI Feb'26 and Brent Mar'26 bid higher at the open and peaked at USD 59.80/bbl and USD 64.00/bbl respectively following the increased tensions in Iran and the possibility of US action in the area. Benchmarks fell lower despite President Trump stating that Iran is starting to cross the line and an increased number of US planes in Iranian airspace, with markets still focusing on the oversupply from the Venezuela saga. After troughing at USD 58.64/bbl and USD 62.89/bbl, benchmarks bounced and remained in earlier ranges.

- Precious Metals have continued their historic run, with spot XAU and XAG reaching new ATHs of USD 4601/oz and USD 84/oz, respectively amid rising geopolitical tensions, worries of Fed independence and an overall weaker dollar. XAU immediately bid higher from its open of USD 4545/oz and trended higher to its new ATH. The yellow metal slightly pulled back to a trough of USD 4562/oz before finding a base here.

- Base Metals were in line with the wider metals space, starting the week on the front foot, with 3M LME Copper gapping higher and currently +1.4% as APAC equities rise as they catch up from Friday's gains stateside. In Shanghai, tin did hit its daily limit, rising 8% to CNY 376,920/ton to set a new ATH.

- Australian Resources Minister King said Australia is to have an operational critical minerals reserve by year-end.

- Trafigura CEO expects to load first vessel for Venezuelan oil exports to the US next week.

- China buys at least 10 cargoes of US soybeans for April-May shipment, according to traders.

- US President Trump said the US, in coordination with Venezuela, seized an oil tanker which departed Venezuela without approval; the oil will be sold through the energy deal they have created.

- US President Trump said the largest oil companies are coming to the White House at 19:30 GMT / 14:30 EST for a meeting about Venezuela; A very big factor in this involvement will be the reduction of Oil Prices. Trump apologises to those oil companies that they cannot take today, but Secretary of Energy Wright, and Secretary of the Interior Burgum, will see them over the next week. Everyone is in daily contact. "A very big factor in this involvement will be the reduction of Oil Prices for the American People. Additionally, and perhaps most importantly of all, will be the stoppage of Drugs and Criminals coming into the United States of America".

- US Baker Hughes (9th Jan): Oil -3 at 409, Natgas -1 at 124, Total -2 at 544.

CRYPTO

- Bitcoin was choppy overnight and traded on either side of the 99k mark.

NOTABLE ASIA-PAC HEADLINES

- China Vanke (2202 HK) is to pitch bond delay plans amid restructuring talks. The Co. must submit revised proposals by Monday after creditors rejected earlier delay plans.

- Reliance (RELIANCE IS) halts cell-making plan after failed bid for China tech, Bloomberg reported.

- Ishin party leader Yoshimura says he met with Japan PM Takaichi on Friday and states that he would not be surprised if the PM calls for a snap election. This comes following media reports on Friday that PM Takaichi was considering an early general election.

- Chinese firms have applied to put more than 200,000 satellites in space as Beijing accuses SpaceX of crowding shared orbital resources, according to SCMP.

- China's MOFCOM says its key priorities are to strengthen legal frameworks, improve export controls, and enhance risk prevention to safeguard supply chain resilience and national security.

NOTABLE APAC DATA

- Australian Household Spending MoM (Nov) M/M 1.0% vs. Exp. 0.6% (Prev. 1.3% ).

- Australian ANZ-Indeed Job Advertisements MoM (Dec) M/M -0.5% vs. Exp. 0.5% (Prev. -0.8%).

- Australian Household Spending YoY (Nov) Y/Y 6.3% vs. Exp. 5.7% (Prev. 5.7%, Rev. 5.6% ).

GEOPOLITICS

RUSSIA-UKRAINE

- Ukraine President Zelensky said US President Trump should enter a free trade deal with Ukraine.

- Over the weekend, Ukraine targeted three drilling platforms in the Caspian Sea owned by Lukoil. Elsewhere, Russian troops struck a Ukrainian military-industrial and energy facilities, according to TASS.

MIDDLE EAST

- US President Trump said Iran has proposed negotiations after US leader threatened action on Tehran for crackdown on protesters, AP News reported.

- US President Trump said Iran called to negotiate yesterday on nuclear, we may meet them.

- US President Trump said in contact with Iranian opposition leaders.

- An increase in the number of US planes near Iranian airspace, according to Israel's Channel 14.

- US President Trump said "Iran is starting to cross it [Trump's red line]".

- US President Trump said the military is considering very strong options on Iran.

- Iran, in letter to UN, said US is to blame for the transformation of peaceful process into violent subversive acts and widespread vandalism.

- US President Trump said capturing Putin not necessary; we are watching Iran very closely; US will get involved if Iran started killing people, that doesn't mean boots on the ground. Iran is in big trouble. Don't want Russia or China going to Greenland. Not talking about money for Greenland yet. We'll do something on Greenland whether they like or not; will make a deal the easy way or hard way.

- Israel is considering a new round of clashes with Hamas as the militant group refuses to disarm, WSJ reports. Within the report, it states that the Israeli army has prepared plans for a new ground operation inside the areas controlled by Hamas in Gaza. Furthermore, Israeli PM Netanyahu has ordered the preparation of an emergency plan for Gaza due to doubts about the possibility of success in efforts to disarm Hamas.

US-VENEZUELA

- US President Trump posted a picture in which he is labelled "Acting President of Venezuela", via Truth Social.

- US President Trump said working well with Venezuela's leadership. Meeting with Machado is on Tuesday or Wednesday.

- US President Trump said US oil companies will have security guarantees; Venezuela seems to be an ally; tells oil companies they'll start with "even plate".

- US President Trump said they are getting along well with the interim government in Venezuela. Venezuela supplied 30mln barrels of oil to the US yesterday worth USD 4bln. Will make decision about which oil companies will go into Venezuela. US to immediately begin refining and selling up to 50mln bbls of Venezuelan oil. Giant oil companies will spend USD 100bln of their money. Will have another meeting next week.

- Venezuelan minister said Rodriguez not expected to leave country soon; Rodriguez will not carry out international trips in near future, must focus on domestic agenda.

- Venezuelan government said it has begun exploratory diplomatic phase with the US, with view to reestablishing diplomatic presence.

- US President Trump said he told China and Russia "we don't want them in Venezuela"; China can buy all the oil they want from the US and Venezuela. We'll be "open for business" almost immediately.

- US Treasury Secretary Bessent says the US is de-sanctioning the Venezuelan oil that is going to be sold. He adds that further sanctions may be removed next week. Furthermore, he states that the US is willing to convert Venezuela's SDRs to dollars to aid reconstruction and will meet with the World Bank and the IMF next week on the re-engagement with Venezuela.

- US President Trump signed an Executive Order declaring a National Emergency to safeguard Venezuelan oil revenue held in US Treasury accounts.

OTHERS

- US President Trump is to be briefed on Tuesday on "some kinetic and many non-kinetic" options in Iran, Politico reports citing two administration officials.

- US President Trump has now committed to some kind of US intervention in Iran, according to Jerusalem Post.

- US President Trump posted on Truth Social platform on Saturday, suggesting the US "stands ready to help" Iran as the country looks for freedom "like never before".

- US President Trump is to meet with US Secretary of State Rubio at 15:30 GMT/10:30 EST.

- White House Deputy Chief of Staff Miller posted on X " In ten days, justice will be restored. Fully and absolutely."

- State Department Spokesperson said US Secretary of State Rubio spoke with Mexican Foreign Secretary de la Fuente today about the need for stronger cooperation against narcoterrorists and trafficking of fentanyl and weapons.

- US President Trump said we are going to have Greenland, one way or another. We are talking about acquiring, not having short-term.

- Trump administration officials are set to meet with Danish officials about Greenland on Wednesday, diplomatic sources tell CBS News. Multiple European diplomats said that they increasingly understand that America's commitment to the defence of Europe and NATO is no longer as ironclad as it has been over the past decades.

- North Korea accused South Korea of provocation via a drone, via local press.

- US President Trump will meet with Colombian President Petro during the first week of February; said he is sure it will work out very well for Colombia and the USA, but cocaine and other drugs must be stopped from coming into the US.

- Greenland floats meeting US alone without Denmark, according to FT.

- The UK and Germany are pushing a joint NATO mission in Greenland to monitor and protect security interests in the Arctic region. To add, German Foreign Minster Wadephul said if there are security concerns in the North Atlantic, they must be discussed within the NATO framework.

- On Greenland, US President Trump has reportedly asked military commanders to prepare invasion plans, the Daily Mail reports.

- The US Central Command, CENTCOM, announced that the US and partner forces conducted a series of airstrikes on ISIS targets throughout Syria on the 10th January.

- On Cuba, US President Trump has urged Cuba to "make a deal" or face consequences, warning that the flow of Venezuelan oil and money would now stop.

EU/UK

NOTABLE HEADLINES

- France's budget minister warned that no budget will be adopted before March if the government is toppled in next week's vote of confidence. To add, French Finance Minister Lescure says President Macron would dissolve the National Assembly and call a snap election if the government falls.

- The EU is demanding a clause that any future British government pay significant financial compensation if it quits a post-Brexit "reset" deal, as part of a negotiation with UK PM Starmer, the FT reports, citing a draft text.