The Fed, Electricity, And Affordability

By Peter Tchir of Academy Securities

The Fed, Electricity, And Affordability

Three distinct topics, but at the same time, they are almost (kind of) the same topic, or at least interconnected.

A Warsh Fed

We discussed Warsh on Friday (along with gold, Bitcoin, and the flippant use of “debasement”). Dismissing the “Warsh is a Hawk” narrative:

We are looking for 3 rate cuts by September. Not 300 bps, just 75 bps. That isn’t a heavy lift.

It is easier to be hawkish when you are not the person who risks sinking the economy into a recession. We’ve argued for ages that whoever becomes the Fed Chair immediately shifts two notches more dovish. Yes, inflation is painful, but by definition, it typically takes time, and is more of a “slow bleed” that is often masked in the early stages. Recession hits pretty hard, pretty quickly. You really think the Fed Chair errs towards fighting inflation rather than keeping the economy running smoothly? (They got it wrong in the other direction once). My working assumption is that it is more difficult to be the “inflation hawk” when you are going to get the primary blame for tanking the economy. When the President (and Bessent and Miran - more on him in a moment) all want you to cut. When your wife’s father is a pretty large donor to the admin. Imagine that Thanksgiving dinner conversation. “You didn’t cut, we lost the midterms because of that, please pass the gravy.”Miran spoke on Friday, and I swear he has been reading the T-Report as he argued about the reality of the neutral rate being lower than the current Fed believes (in aggregate). There are valid arguments for cutting. More importantly, he argued, as we have for years, that housing in CPI is lagged. It tells us things from 6 months to a year ago – not today.

When we all know (mathematically) that the data in CPI is wrong, why do we base decisions on it? We missed “transitory” because of this and we are at risk of missing a shift in inflation again.

“Hey Joe, why are you going outside without an umbrella?”

“Because my app says it’s not raining.”

“But you can see the rain, and you can hear the rain pounding on the roof!”

“Yeah, I’m going with the app, it’s probably right.”

As stupid as that conversation sounds, that is where I feel we are on some of this data. We did hit on both OER vs Zillow and Truflation vs CPI in last weekend’s T-report.

Reluctant to use the balance sheet. This one is tricky for me as I do believe QE tends to spur inflation. So, it is easy to see Warsh not wanting to use QE to control the yield curve. Having said that, Operation Twist is not viewed as balance sheet expansion by the Fed. Us mere mortals view Operation Twist as a form of QE because they take a lot of duration out of the market (selling bills to buy bonds). So that part of my view has not been removed. Even if he cuts, and the market becomes convinced that it was warranted (which I think it is), he might not have to do much to control the long-end of the curve. Will he do QE/Yield Curve Control? I’m less certain that is the ultimate endgame with him, but I still find it difficult to believe that we won’t take extraordinary measures to lower mortgage rates (more on that later), which are linked to the 10-year.

Coordination and Cooperation are coming. Another theme from last week (and prior reports) is that we should expect more coordination between the admin, the Treasury, and the Fed. Warsh’s choice fits that narrative well.

I think the market will come to terms with this, but I also think the “debasement” trade was so overdone, and there is more unwinding on that.

Electricity

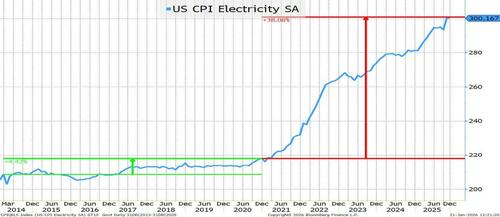

Same chart as last week.

The cost of electricity and the inability to produce enough electrons and get those electrons to where they need to be has evolved into one of the most important discussions in this country, and it is rapidly becoming the primary topic in other countries (ZH: as we first said long before everyone starting piggybacking last August)

In one year, this will be the most popular chart on this site pic.twitter.com/h93gWXMoNL

— zerohedge (@zerohedge) August 11, 2025

Everywhere you look there are bottlenecks:

Getting permission to build electricity generation facilities.

Getting the equipment and parts needed to build the facilities.

Getting the fuel source to wherever you are building the facilities (uranium and solar have some advantages here).

Getting the electricity to where it is being used. The grid leaves a lot to be desired. Positioning data centers that can tolerate higher latency, closer to energy sources, might be an alternative.

I cannot begin to describe how “electricity” sucks the air out of a room right now. Instant attention from the audience. Questions, concerns, thoughts, ideas, etc. I’d be shocked that if you mention electricity bills to any 10 people, you will not find at least one person instantly engaged!

The concern is bipartisan. The solution is ProSec.

Affordability

Today we will focus on “shelter” affordability. And maybe just a little on autos and healthcare.

While we won’t go into detail here, I think we need to address the subject of the working poor.

The Working Poor

I am sick of the “K”- shaped economy. First, I think at best it is k-shaped (the upper leg is much smaller than the leg heading down), but it probably is more of an i-shaped economy (little I).

This “letter shaped” discussion hides the ugly truth of the “working poor.” People with jobs who cannot make ends meet.

This isn’t just people at the poverty level (the calculation is bizarre). These are people with “normal” jobs who have/had a “normal” life with that job. Or at least they did 5 to 10 years ago. Now they are struggling to keep up a lifestyle that didn’t seem to be a reach/stretch just a few years ago.

I had a really interesting conversation with one of our clients and it really triggered that sort of a “eureka” moment.

He discussed trying to prepare his business for a “working poor” recession (not quite his words). This was in contrast to an unemployment-led recession.

We’ve had recessions caused by (or at least coinciding with) job losses. People lose their jobs and the economy heads into a recession.

Are we at risk of having a recession because people just cannot keep up their lifestyles even while keeping their jobs and getting raises?

I don’t have a strong view (honestly it just hit me this week during that conversation), but it meshes with a lot of concerns that I’ve had about consumption and the economy.

We will certainly think about this more, but it immediately backs into why affordability is such a major issue. And it is less about the rate of inflation (intellectual fluff) than the high cost of living (inflation never captured how expensive our lives have gotten).

Housing Affordability

Let’s hit a few things here, but start with one premise.

Lowering the average price of homes is NOT good. I lived the “Big Short” but hated the book and never got to the movie, because it made it seem like no one had a clue a bubble was forming. Lots of people saw the bubble, they just didn’t time it well enough to have capital left to risk when it all came tumbling down. If you remember the premise was along the lines of “the average price of homes in America has never gone down.” They did and we got the GFC. Crashing home prices isn’t going to help the economy or country. For so many Americans, their home is their largest store of value and I suspect not much has changed in less than 20 years, so I’d try to avoid driving prices down.

The one we’ve already talked about:

Electricity. Subsidies? Forcing hyperscalers to directly fund not just their energy needs, but also their communities? Who knows what is enforceable or plausible, but with the $$$ around hyperscalers they may make a “convenient” target for politicians looking for votes. The “pain” will be moderate, at least in the overall $$$ context, because we need the data center and AI growth to continue, but something around this could have widespread appeal in an election year.

In the meantime, hopefully we can build our way out of this more rapidly than many (including me) think we can.

One area we’ve touched on a bit in the past:

Mortgage interest. The lower the interest payments are, the more “affordable” the house is.

Reduce spreads on mortgages. Have agencies buy even more? Warsh would seem reluctant to do that with the Fed balance sheet, but this could happen outside his purview.

Lower Fed Funds. This could provide some immediate relief for those willing to take on floating rate mortgages.

Lower 10-year yields. The “Holy Grail” as it benefits mortgages while letting people get the comfort of a fixed rate rather than dealing with floating rate risks.

50-year mortgages? I think it is a “suboptimal” idea. You don’t lower the mortgage payment that much while creating all sorts of new risks for the borrower and the lender.

Portable mortgages? Some chatter about this, but that seems to add to inequality. Those with existing mortgages have an advantage in the market. I think this is a zero-sum game and not worth doing as it creates a lot of potential issues, while I struggle to see how it helps “create” housing. It might let some people move for job purposes, who feel stuck, but again, that is just shifting inventory around, not creating new inventory or reducing payments for someone else.

Job growth in cheaper locations. Not every city or area in the country has the same cost of buying a house (or living there). Some are clearly tied to the types of jobs that a community can support, but there is room, I believe, to see that “reindustrialization” (or ProSec™ as I prefer) can create new jobs in areas where the cost of housing and living can be more affordable, mitigating the risk of getting stuck as “working poor.”

For now, let’s treat this more “sensitive” subject as a corollary to jobs in cheaper locations. Venezuela and Mexican Cartels. There is ample reason to believe that Venezuela will be safer for the average citizen and that “normal” jobs (not drug-related jobs) will be created as investment in oil production (and rare earths/critical minerals) grows. That may cause some Venezuelan immigrants in the U.S. to return home. We haven’t yet seen any aggressive action against the Mexican cartels, but that is certainly on my bingo card ahead of the midterms. As many flee Mexico not just for jobs in America but also to avoid the horrible choice of “silver or lead” (join the cartel or get shot), we could see many return to Mexico if a better environment is created. U.S. companies would need clarity on tariffs, but they could invest in plants there too (again, in my vision of ProSec™ working with close neighbors and allies will play a role). For full disclosure, for “risk management” purposes, I’m starting the process of switching from a green card to citizenship. In any case, this could free up some housing availability in the U.S.

- Who’d have thought that moving to home insurance would be a “comfortable” step. Housing insurance increased 5% from 2014 until 2022. It is up 13% in 3 years! There are lots of reasons for this. The cost of repairs has increased. The time to do a repair has increased, which not only increases the direct cost, but it now also costs more for families that need to rent somewhere during repairs. These are market forces at work. Could the President “cap” insurance premium increases? This isn’t like Medicaid payments where the government is the payor, but on the other hand, could he cap credit card rates at 10%? I don’t think we should interfere with market forces, but I’m not the President, I’m not trying to win the midterms, and I wouldn’t cap credit card interest at 10%. As an investor, I’d keep an eye on this. As a lobbyist, I’d make sure the reasons for the increase are well understood and deemed fair. By the way, the auto insurance chart wasn’t as stable, but it has also grown rapidly.

Things associated with the cost of owning a home (the mortgage, the insurance premium, the utility bills) will all likely be focused on by the admin in their effort to drive “housing affordability” lower.

With auto ownership (including leasing) closely associated (at least in my mind) with home ownership, that is another area that could be identified by the admin for some special scrutiny in their efforts to reduce the cost of living WITHOUT lowering home prices.

I’d add the cost of prescriptions to the list of things the admin might target in the coming months to help reduce the amount people spend every month, where the target seems “easy” from a politician’s standpoint. Picking on babies and puppies is bad for getting re-elected, but I’m not sure the same applies to insurance companies, etc. As another client told me, look for Emerging Market Populace Policies to be enacted whether you like them or not, they make sense or not, or have ever even worked! It is the nature of the beast at the moment.

Bottom Line

Stay warm (again). I say this from California with all sincerity. I did manage to be in Palm Beach for 5 days last week and California for 9 day (this week and next) – so maybe I’m a pretty decent strategist after all.

I think electricity might be a problem here for crypto, AI, and the consumer. Hence maybe why we see a bit more weakness, and it has little or nothing to do with Warsh, just the realization that some other issues are real and positioning has become very bullish (or at least it was coming into Thursday).