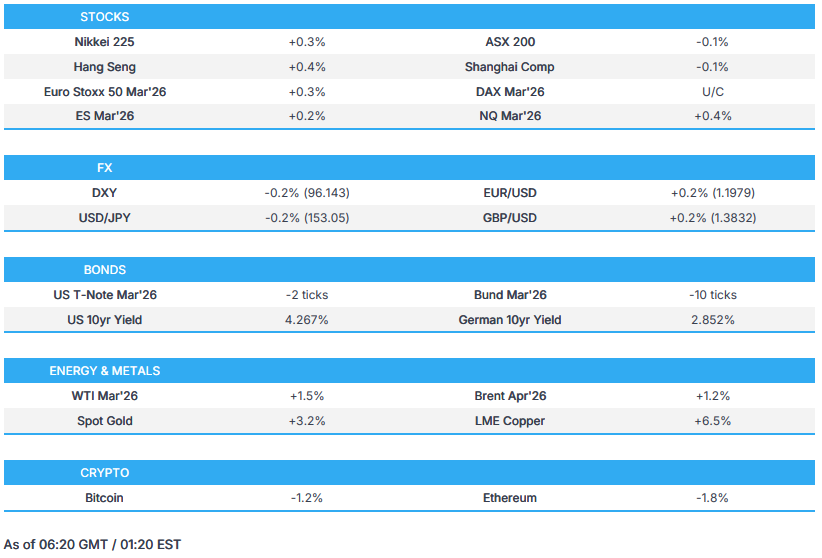

FOMC held rates steady, as expected, while US mega-cap earnings were mixed; DAX futures point unchanged following mixed SAP earnings - Newsquawk EU Market Open

- APAC stocks were mostly subdued, with sentiment in the region clouded following a lack of fireworks at the FOMC; mega-cap US earnings saw Meta (META) rise 6.6%, Microsoft (MSFT) slip 6%, while Tesla (TSLA) rose 1.9%.

- FOMC kept rates unchanged at 3.50-3.75%, as expected, with the vote split at 10-2 (Miran and Waller called for a 25bps rate cut).

- Fed Chair Powell said rates are in a plausible range of neutral and at the higher end of the range of neutral.

- US Senate Majority Leader Thune sees a possibility to avoid a shutdown by week’s end after Senate Minority Leader Schumer laid out Democrats' demands on ICE, CNN reported.

- Iranian Supreme Leader’s adviser totally dismissed the notion of "a limited strike" and said, "Any military action from the US, from any origin, at any level, will be considered the start of war".

- Looking ahead, include Spanish Retail Sales (Dec), EZ M3 (Dec), US Jobless Claims, Chicago Fed Labour Market Indicators (Jan), Japanese Industrial Production (Dec), Retail Sales (Dec) & Tokyo Core CPI (Jan), Riksbank Policy Announcement, CBRT Minutes (Jan), SARB Policy Announcement. Speakers include Norges Bank's Bech-Moen, Riksbank's Thedeen, and ECB's Cipollone. Supply from Italy & the US.

- Earnings from Apple, SanDisk, Visa, Western Digital, Mastercard, Caterpillar, Nasdaq, Blackstone, Lockheed Martin.

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were ultimately mixed on Wednesday, while sectors saw downside bias as Real Estate and Health lagged, in which the latter extended Tuesday's pronounced losses. Conversely, Energy and Tech sat atop the pile, with the former buoyed by gains in the crude complex amid punchy Trump remarks on Iran, while Tech strengthened ahead of Mag 7 earnings after-hours.

- Nonetheless, the key risk event during the session was the FOMC and accompanying press conference by Fed Chair Powell, which largely went as expected and saw little market move, as the Fed kept rates unchanged at 3.50%-3.75%, as expected, albeit with two dissenters (Waller, Miran), who voted for a 25bps reduction.

- SPX -0.01% at 6,978, NDX +0.32% at 26,023, DJI +0.02% at 49,016, RUT -0.49% at 2,654.

- Click here for a detailed summary.

FOMC

- FOMC kept rates unchanged at 3.50-3.75%, as expected, with the vote split at 10-2 (Miran and Waller called for a 25bps rate cut). FOMC said it will assess incoming data, the evolving outlook, and the balance of risks when considering further rate adjustments, while it will monitor labour market conditions, inflation pressures and expectations, and financial and international developments. Fed said it is prepared to adjust the stance of monetary policy if risks emerge impeding goal attainment and said future policy adjustments depend on incoming information and risk developments. The January statement revised the economic assessment by replacing “economic activity has been expanding at a moderate pace” with “expanding at a solid pace”, “job gains have slowed this year” with “job gains have remained low”, and “the unemployment rate has edged up” with it having “shown some signs of stabilisation”, while “inflation has moved up since earlier in the year and remains somewhat elevated” is simplified to “inflation remains somewhat elevated”. In its risk characterisation, December’s addition that the Committee “judges that downside risks to employment rose in recent months” was removed, leaving only that it is attentive to risks to both sides of the mandate. Furthermore, balance-sheet guidance that “reserve balances have declined to ample levels and [the Committee] will initiate purchases of shorter-term Treasury securities” was omitted entirely.

- Fed Chair Powell said in the post-meeting statement that the economy is on a firm footing and has been expanding at a solid pace, while job gains have remained low and consumer spending has been resilient. Powell also stated that inflation remains somewhat elevated and the current stance of policy is appropriate. Furthermore, he reiterated that the policy rate is in the range of neutral and decisions will be made on a meeting-by-meeting basis, as well as noted that policy is well set for further adjustments based on incoming data and balance of risks.

- Fed Chair Powell said in the Q&A that the case of Fed’s Cook is perhaps the most important case in the Fed’s legal history and that he has not come to a decision on whether he will remain a Governor when his term as Chair expires. Powell said they are getting through the data distortions from the shutdown, and distortions in data are no longer material. He also stated that the outlook for economic activity has clearly improved since the last meeting, and the Fed thought it would adjust language in the statement accordingly. Powell said incoming data shows clear improvement for the outlook, inflation performed about as expected, and that overall, it is a stronger forecast, as well as stated that the Fed is well positioned to face the risks to both sides of its mandate and has not made any decision on future meetings, with decisions to be made on a meeting-by-meeting basis, letting the data light the way. Powell also said rates are in a plausible range of neutral and at the higher end of the range of neutral, while he noted it could be loosely neutral or somewhat restrictive and that they will see the tariff effect on goods pricing peaking over this year; and if the Fed sees that, that would tell the Fed it can loosen policy. Furthermore, he said the Fed will always act to address when the economy moves further away from their goals, and no one has a base case that a rate hike is the next move, though the Fed never takes anything off the table.

TARIFFS/TRADE

- USTR Greer said regarding a meeting with Mexico's Economy Secretary that both sides recognised substantial progress in recent months and agreed to continue intensive engagement to address non-tariff barriers. Furthermore, they agreed to begin formal discussions on possible structural and strategic reforms in the context of the first USMCA joint review, while talks are on stricter rules of origin for key industrial goods, enhanced collaboration on critical minerals, and increased external trade policy alignment.

- Canada and South Korea signed an MoU intending to bring South Korean auto manufacturing and investment to Canada, according to The Globe and Mail, citing a document.

NOTABLE HEADLINES

- Fed has not yet complied with subpoenas as Powell probe continues, while it is not clear when the deadline is for the Fed to turn over documents demanded by the subpoena, according to CNBC.

- US President Trump and Senate Minority Leader Schumer were reported to move towards a possible deal to avert a shutdown and were discussing an agreement to split off homeland security funding from a broader spending package and negotiate new limits on immigration agents, according to The New York Times.

- US Senate Majority Leader Thune sees a possibility to avoid a shutdown by week’s end after Senate Minority Leader Schumer laid out Democrats' demands on ICE, according to CNN's Manu Raju.

NOTABLE US EARNINGS

- Meta Platforms Inc (META) Q4 2025 (USD) EPS 8.88 (exp. 8.19), Revenue 59.9bln (exp. 58.38bln). (META +6.6%)

- Microsoft Corporation (MSFT) Q2 2025 (USD): EPS 5.16 (exp. 3.92), Revenue 81.3bln (exp. 80.28bln). (MSFT -6.1%)

- Tesla Inc. (TSLA) Q4 2025 (USD): Adj. EPS 0.50 (exp. 0.45), Revenue 24.9bln (exp. 24.77bln). (TSLA +1.9%)

APAC TRADE

EQUITIES

- APAC stocks were mostly subdued with sentiment in the region clouded following a lack of fireworks at the FOMC, where the Fed kept rates unchanged at 3.50%-3.75%, as expected, while top- and bottom-line earnings beats from the likes of Meta, Microsoft and Tesla also failed to spur the broader risk appetite.

- ASX 200 marginally declined amid underperformance in telecoms and miners, while a surge in exports and import prices added to the inflationary risks and the case for an RBA rate hike next week.

- Nikkei 225 swung between gains and losses amid currency-related headwinds and earnings results.

- KOSPI saw two-way price action amid fluctuations in tech heavyweights Samsung Electronics and SK Hynix despite both companies posting stellar earnings results.

- Hang Seng and Shanghai Comp were mixed with price action relatively flat amid a lack of fresh pertinent macro catalysts for China, although property names were supported after reports that several developers are no longer required to submit the monthly “three red lines” indicators, which are debt metrics introduced in 2021 to curb builders' financial leverage.

- US equity futures struggled for direction following the mixed reaction to the earnings beats from the first of the Mag 7 results.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed with losses of 1.0% on Wednesday.

FX

- DXY was marginally lower after gaining yesterday, with strength seen throughout the prior day heading into the FOMC announcement, before paring some of the advances in the aftermath of the decision in which the Fed unsurprisingly maintained its rates at 3.50%-3.75% through a 10-2 vote split with Miran and Waller calling for a 25bps rate cut. There was a lack of major surprises and fireworks from the meeting and presser, although Powell noted that rates are at the higher end of the range of neutral, and if they see the tariff effect on goods pricing peaking over this year, that would tell the Fed it can loosen policy.

- EUR/USD regained some composure after recently pulling back from the 1.2000 handle, while there were several comments from ECB officials, but these had little impact, including from Schnabel, who said rates are in a good place and expected to remain at current levels for an extended period.

- GBP/USD gradually edged higher after reclaiming the 1.3800 status, while newsflow from the UK was light as PM Starmer visited Beijing and met with Chinese President Xi Jinping in an effort to reset bilateral relations.

- USD/JPY trickled lower and retested the 153.00 level to the downside amid the subdued mood despite the big tech earnings beat.

- Antipodeans remained afloat with outperformance in AUD/USD following firmer export and import price data from Australia, as well as continued upside in commodity prices.

- PBoC set USD/CNY mid-point at 6.9771 vs exp. 6.9521 (Prev. 6.9755).

- Brazilian Central Bank kept the Selic Rate at 15.00%, as expected, but said it will start cutting rates at the next meeting.

FIXED INCOME

- 10yr UST futures were choppy post-FOMC and with demand contained ahead of more supply, including a 7yr note auction.

- Bund futures traded little changed in the absence of any major fresh catalysts from the bloc and after the latest ECB rhetoric provided little to shift the dial.

- 10yr JGB futures gave back some of the prior day's gains but with downside stemmed amid a quiet calendar and mixed risk sentiment.

COMMODITIES

- Crude futures remained firmer after gaining yesterday alongside punchy Trump rhetoric on Iran and with sources noting that Trump is considering a new large-scale strike on Iran, although no decision has been made, while the latest EIA inventory report showed a larger-than-expected draw in headline crude stockpiles.

- Spot gold resumed its stellar rally and climbed to a fresh record high just shy of the USD 5600/oz level, with momentum seen in the aftermath of the FOMC despite the lack of major surprises from the Fed.

- Copper futures rallied after breaking back above the USD 6/lb level, while LME futures posted a record high above USD 14,000/ton.

- US Treasury Secretary Bessent said increased Venezuelan crude oil supply means lower fuel prices and that proceeds from the sale of Venezuelan oil will return to Venezuelans. In relevant news, the US is handing over a seized oil tanker to Venezuela.

- Motiva restarted a large coker at the Port Arthur, Texas refinery.

CRYPTO

- Bitcoin retreated overnight and briefly dipped beneath the USD 88,000 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi said to UK PM Starmer that the UK-China relationship in recent years had seen “twists and turns that did not serve the interests of our countries”. Xi also commented that China stands ready to develop with the UK a long-term and consistent strategic partnership, while he stated that more dialogue between the UK and China was “imperative”.

- HKMA maintains its base rate at 4.00%, as expected.

- Monetary Authority of Singapore kept the prevailing rate of appreciation of the SGD NEER policy band, while it made no change to the width and the level that the band is centred, as expected. MAS said the output gap will be positive for the year as a whole and that growth this year is expected to remain resilient, while it expects 2026 GDP growth to ease Y/Y.

- Japan's ruling LDP could gain a majority of the 465 seats in the February 8th lower house election, up from 198, according to a new Nikkei poll which was conducted immediately after the election announcement.

DATA RECAP

- Australian Export Prices QoQ (Q4) Q/Q 3.2% (Prev. -0.9%)

- Australian Import Prices QoQ (Q4) Q/Q 0.9% vs. Exp. -0.2% (Prev. -0.4%)

- New Zealand ANZ Business Confidence (Jan) 64.1 (Prev. 73.6)

- New Zealand ANZ Activity Outlook (Jan) 51.6 (Prev. 60.9)

GEOPOLITICS

MIDDLE EAST

- CNN sources said US President Trump is considering a new large-scale strike on Iran as no progress has been made in nuclear talks, although he has not yet made a final decision on a new major military strike against Iran, while Trump's military options include airstrikes and targeting of Iranian leaders and security officials.

- US and EU officials said they have put three demands in front of Iran, including a permanent end to all enrichment of uranium, limits on the range/number of ballistic missiles, and an end to all support for proxy groups in the Middle East. Furthermore, it was stated that negotiations have made no progress in the past weeks, and there are no indications that the Iranians are preparing to give in to Trump’s demands.

- Iran's representative to the UN said Iran informed the Council it faces a clear US threat to use force against it, while the envoy said Washington will bear responsibility for any uncontrolled consequences resulting from any acts of aggression.

- Iranian Supreme Leader’s adviser totally dismissed the notion of "a limited strike" and said "Any military action from US, from any origin, at any level, will be considered the start of war". Furthermore, it was stated that "The response will be immediate, all out and unprecedented targeting the aggressor, the heart of Tel Aviv and all who support the aggressor".

- Iran's Foreign Minister said Tehran has always welcomed a fair nuclear deal which ensures Iran's rights and guarantees no nuclear weapons.

RUSSIA-UKRAINE

- US Secretary of State Rubio said there is active work to try to bridge the issue of Donbas in Ukraine talks, while he added there might be a US presence in the Ukraine talks in Abu Dhabi this weekend, but it won't be Witkoff and Kushner.

EU/UK

NOTABLE HEADLINES

- ECB's Schnabel said rates are in a good place and expected to remain at current levels for an extended period.

NOTABLE EUROPEAN EQUITY NEWS

- STMicroelectronics (STM FP) Q4 2025 (EUR): Revenue 3.33bln (exp. 3.28bln), Gross margin 35.2% (exp. 35.1%); Guides Q1 2026 Revenue 3.04bln (exp. 2.94bln), Guides Q1 2026 gross margin at 33.7% (exp. 33.3%).

- Roche (ROG SW) FY25 (CHF) Revenue 61.5bln (exp. 61.5bln), Core EPS 19.46 (exp. 19.66), Core Op. Profit 21.8bln (exp. 21.8bln); Sees 2026 sales growth in min single digit range, expects to further increase dividend in CHF.

- SAP (SAP GY) Q4 2025 (EUR): Non-IFRS Revenue 9.68bln (exp. 9.74bln). Cloud Revenue 5.61bln (exp. 5.64bln). Cloud backlog +25% Y/Y (exp. 24.8%). Announced up to EUR 10bln buyback.