FOMC Minutes Confirm 'Most' Fed Officials Expect More Rate-Cuts, Divisions Remain

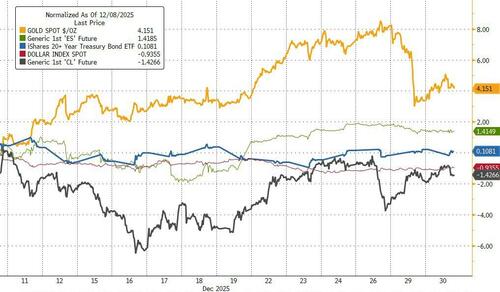

Since the last FOMC meeting on Dec 10th (which resulted in a more-dovish-than-expected 25bps rate cut along with 3 dissents), precious metals have been the biggest gainers (as the dollar weakened) while crude oil has been a laggard. Stocks small bid, bonds unch...

Source: Bloomberg

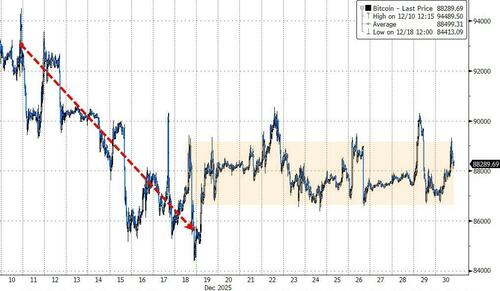

Crypto has notably decoupled from gold and stocks...

Source: Bloomberg

Rate-cut odds have risen significantly, most notably March...

Source: Bloomberg

With a very divided Fed having been exposed (the most dissents in 37 years), the outlook is unclear, but the demanding markets are not...

“I joke that the equity market is like a kid in a candy store, braving a sugar high for more policy accommodation, a more dovish Fed — but it doesn’t know what’s good for it,” said Amanda Agati, PNC Asset Management Group’s chief investment officer said on Bloomberg Television on Tuesday.

“The bond market is the adult in the room taking away the last lollipop. It is maybe the first time in observable market history that we’re seeing the market react to the deficit and debt level concern. I think there’s continued upward pressure on long yields, for sure.”

Given the lack of major catalysts and with news flow and trading volumes generally low, investors will focus on the Fed’s release of meeting minutes as the market remains notably more dovish than The Fed's Dots...

"Markets are looking to the minutes for clearer signals on the Federal Reserve's policy trajectory in 2026, at a time when year-end liquidity is thin, and price action may be amplified," Tickmill Group's Joseph Dahrieh says in a note.

If the minutes lean decisively towards further interest-rate cuts in 2026, this could weigh on the dollar and Treasury yields, he added.

A more balanced or cautious tone about rate cuts could provide near-term support.

"How divided?" and "What about 'Not QE'?"

So what did The Fed want us to know?

The minutes underscored the deep split on the 19-member policymaking committee over what constitutes the biggest threat to the economy: weak hiring or stubbornly-elevated inflation.

Most officials see additional interest rate cuts as appropriate if inflation declines over time as expected.

Yet, some officials made clear they believe rates should remain on hold “for some time” after the December gathering.

The minutes showed that even some Fed officials who supported the rate cut did so with reservations.

“A few of those who supported lowering the policy rate at this meeting indicated that the decision was finely balanced or that they could have supported keeping the target range unchanged,” the minutes said.

But, that statement suggests the division was not as deep as some have suggested.

The minutes continued to point to considerable differences among policymakers over whether inflation or unemployment posed the greater peril to the US economy.

“Most participants noted that a move toward a more neutral policy stance would help forestall the possibility of a major deterioration in labor market conditions,” the minutes noted.

At the same time, it continued, “several participants pointed to the risk of higher inflation becoming entrenched and suggested that lowering the policy rate further in the context of elevated inflation readings could be misinterpreted as implying diminished policymaker commitment to the 2% inflation objective.”

Finally, the Minutes confirmed that participants judged that reserve balances had "declined to ample levels" - making it appropriate to initiate purchases of shorter-term Treasury securities to maintain an ample supply of reserves over time.

For now, the markets are unmoved by any of this with rate-cut odds unchanged and stocks aggressively going nowhere.

Read the full FOMC Minutes below: