Futures Blast Off On First Day Of 2026 With Europe, Asia At Records

Stocks are set to break a four-day losing streak as markets start the new year with a bang across global markets, boosted by the same drivers that dominated much of 2025.As of 8:00am ET, S&P 500 futures were 0.6% higher with Nasdaq 100 contracts rallying 1% outperforming on renewed optimism around artificial intelligence.Nvidia rose 1.6% in premarket trading to lead gains among the Magnificent Seven, which were all green in premarket trading. Trading is likely to remain much lighter than usual, with many market participants not returning to their desks until Monday. As BBG notes, the setup has a familiar feel: Europe is green across the board and on course for a record high, while Asian stocks already hit a record, driven by gains in AI and chipmakers. The Bloomberg Dollar Spot Index is up 0.1% while the Aussie dollar is the best G-10 performer, rising 0.3% against the greenback; the euro underperforms and falls 0.3%. Treasuries inch higher, pushing US 10-year yields down 1bp to 4.15%. European yield curves bear steepen. Silver and gold are resuming their march higher, and copper is extending gains as miners in Chile go on strike. Aluminum touched $3,000 a ton for the first time in more than three years on expectations of tighter supply. And the dollar, following its worst year in eight, remains lackluster. US economic calendar includes December final S&P Global US manufacturing PMI at 9:45am. No Fed speakers are scheduled.

In premarket trading, Mag 7 stocks are all higher (Nvidia +1.6%, Tesla +1.3%, Alphabet +1.1%, Amazon +0.9%, Meta +0.6%, Apple +0.5%, Microsoft +0.4%)

- Shares in RH (RH) gain 4.4% and Wayfair (W) advances 2.4% after President Donald Trump delayed tariff increases on upholstered furniture, kitchen cabinets and vanities.

- ASML ADRs (ASML) gain 4.8% as Aletheia Capital double upgrades the chip equipment maker’s European shares to buy from sell due to investment expansions and capacity upgrades.

- Baidu ADRs (BIDU) jump 11% after the company submitted a proposal to Hong Kong’s exchange to list its artificial-intelligence chip unit Kunlunxin.

- NIO Inc. US-listed shares (NIO) rise 4.7% after the EV-maker reported deliveries for December that showed 33% growth month-over-month.

- Outlook Therapeutics (OTLK) falls 60% after the FDA issued a complete response letter to the ONS-5010/LYTENAVA (bevacizumab-vikg) biologics license application resubmission, indicating that it cannot approve the application in its present form for the treatment of wet age-related macular degeneration.

- Sable Offshore (SOC) jumps 19% after the company gets a go-ahead to restart a controversial California pipeline.

- Vertiv Holdings (VRT) gains 4.3% as Barclays upgrades the power equipment company to overweight from equal-weight, saying its shares currently offer a good entry point following recent volatility.

- China’s BYD met full-year sales targets and likely surpassed Tesla to become the world’s largest electric-vehicle maker in 2025. Its shares rallied 3.6% in Hong Kong.

In other corporate news, First Brands founder Patrick James said he’d likely plead his Fifth Amendment right against self-incrimination if compelled to answer questions from Jefferies at an upcoming deposition, citing a federal criminal investigation into the bankrupt auto parts supplier.

Friday’s upbeat mood is defying historic trends after the S&P 500 recorded declines on the first trading days of the previous three years. Since 1953, the S&P 500’s median change to kick off a new year has been a 0.3% drop, with gains less than half the time, according to a note by Bespoke Investment Group.

A strong debut in Hong Kong for chip designer Shanghai Biren Technology helped to set the buoyant tone early in the day. Baidu rallied after its AI chip unit confidentially filed for an IPO. Meanwhile, DeepSeek published a paper outlining a more efficient approach to developing AI. Tech and AI were among the dominant themes for stock investors in 2025, helping power the S&P 500 to a third year of double-digit gains. Forecasts signal more of the same for 2026 despite lingering wariness over already stretched valuations and fears that vast amounts of capital expenditure could fail to pay off.

“What we are seeing today is a continuation of the run higher in equities, with AI and tech again at the forefront,” said Tim Waterer, chief market analyst at KCM Trade. “Traders are still in a buying mood, with many of the bullish themes from 2025 carrying forward into 2026.”

At Barclays, strategists are warning equity markets could get choppy as they enter 2026 at record highs that are “over reliant on AI success.” But the team still expects further gains this year, thanks to resilient corporate earnings and a favorable trade off between growth and monetary policy.

“The first trading day has been an incredibly poor guide in recent times to how the rest of the year plays out,” wrote Deutsche Bank AG strategists including Henry Allen. In fact, “2022 saw an all-time high on the first day, before the index fell into a bear market and its worst year since 2008. Whatever happens today, we really shouldn’t overegg the day one moves.”

The strategists noted that several key themes apart from AI will shape markets in 2026, including new developments in US trade policies and specifically a Supreme Court case that will rule on the legality of levies. The Fed will be another major focus, with President Donald Trump expected to name a successor to Jerome Powell early in the year.

“The scope for further gains driven purely by valuation expansion in 2026 may be limited,” wrote Linh Tran, an analyst at XS.com. “Shocks related to interest rates, earnings, or policy could therefore trigger faster and more pronounced corrections than in earlier phases of the cycle.”

In Europe, the Stoxx 600 is up 0.4% and on course for a record close. Technology stocks are leading gains as they did in Asia after a fresh burst of optimism around artificial intelligence. Miners also outperform as metals rise across the board. The FTSE 100 earlier crossed 10,000 for the first time. Here are some of the biggest movers on Friday:

- ASML shares gain as much as 3.9% in Amsterdam, the most since late November, as Aletheia Capital double upgrades the chip equipment maker to buy from sell and boosts its price target to a Street high due to investment expansions and capacity upgrades.

- Vestas gains as much as 4%, reaching the highest since June 2024, as JPMorgan says the firm is set to deliver orders above expectations in the fourth quarter, supporting view that fundamentals for the wind industry are improving.

- Munters shares gains as much as 11% after the Swedish industrial ventilation and cooling company received from the US its largest data center technologies order ever.

- Bumech shares jump as much as 26% after a Polish government pledge offering support and job guarantees helped to end a workers’ strike at the machinery firm’s Silesia mine.

- BE Semiconductor shares climb as much as 9.8%, the most since October, following a rally in Asian chipmakers and artificial intelligence-related stocks.

- BAT shares fall as much as 2.7% after its Indian subsidiary ITC dropped in response to the government’s move to sharply raise excise duty on cigarettes.

Asian equities also advanced, led by gains in tech-heavy markets such as Taiwan and South Korea, as most regional markets reopened after a holiday. Hong Kong stocks also moved higher. The MSCI Asia Pacific Index advanced 1.1%, marking its best start to the year since 2012. Tencent, Samsung Electronics and TSMC were among the biggest contributors to the benchmark’s advance. Equities in South Korea and Hong Kong each climbed more than 2%. The Hang Seng China Enterprises Index gained more than 2.8%, posting its best start to a year since 2018. At the start of the year, investors rotated back into familiar leaders in artificial intelligence and technology, pushing the sector’s sub-index to a record high. Markets in Japan, mainland China, New Zealand and Thailand remained closed. Asian markets are edging higher today, but thin liquidity is exaggerating moves as many investors remain on the sidelines, Dilin Wu, a strategist at Pepperstone said.

“We are seeing a continuation of the run higher in equities, with AI and tech again at the forefront,” said Tim Waterer, chief market analyst at KCM Trade Global. “Asian indices delivered the goods in terms of gains in 2025, and there is reason to believe that this momentum will carry forward into the new year.”

In FX, the Bloomberg Dollar Spot Index is up 0.1% following its worst year in eight, while the Aussie dollar is the best G-10 performer, rising 0.3% against the greenback. The euro underperforms and falls 0.3%.

In rates, treasuries inch higher, pushing US 10-year yields down 1bp to 4.15%. US yields are richer by up to 2bp in intermediate sectors, steepening 5s30s spread by around 1bp on the day. 10-year is near 4.155% after peaking at 4.19% during London morning. European bonds lag Treasuries, with bunds and gilts cheaper by around 3bp and 3.5bp in the 10-year sector

In commodities, spot silver climbs 4% to above $74/oz while gold and most base metals are also green. Aluminum touched $3,000 a ton for the first time in more than three years on expectations of tighter supply. Oil, which suffered its steepest annual loss for five years in 2025, gave back early gains. This weekend, OPEC and its allies are expected to confirm plans to pause supply hikes. Oil traders are also watching developments in Venezuela, Ukraine and Iran. Trump says the US will “rescue” protesters if Iran shoots or kills them, according to a post on Truth Social.

Treasuries hold small gains, leaving yields slightly richer across the curve, after erasing declines that occurred during Asia session, when Australia’s bond market was hit as traders positioned for the possibility the Reserve Bank of Australia will raise rates to quell inflation. Scheduled events during Friday’s US session include only S&P Global US manufacturing PMI revision.

Bitcoin is on a firmer footing and holds just short of the $90k mark, with Ethereum also posting gains above $3k.

The US economic calendar includes December final S&P Global US manufacturing PMI at 9:45am. No Fed speakers are scheduled. Tesla is expected to report that it delivered about 440,900 vehicles in the fourth quarter, down 11% from a year earlier.

Market Snapshot

- S&P 500 mini +0.6%

- Nasdaq 100 mini +1%

- Russell 2000 mini +0.7%

- Stoxx Europe 600 +0.4%

- DAX little changed

- CAC 40 +0.2%

- 10-year Treasury yield -1 basis point at 4.16%

- VIX -0.1 points at 14.83

- Bloomberg Dollar Index little changed at 1204.54

- euro -0.3% at $1.1716

- WTI crude little changed at $57.37/barrel

Top Overnight News

- Trump threatens Iran over protest crackdown as deadly unrest flares: RTRS

- Threat of California Billionaire Tax Draws Criticism From Ultrawealthy: WSJ

- The Next Class of Senators Won’t Be Able to Dodge the Social Security Crunch: WSJ

- European factory activity ends 2025 in deeper contraction: RTRS

- Tesla Closes Out Brutal Year in Europe With Sales Declines: BBG

- U.S. Slashes Proposed Tariffs on Italian Pasta: WSJ

- Russia says it can prove that Ukraine tried to strike Putin residence: RTRS

- The Condo Market Hasn’t Been This Bad in Over a Decade: WSJ

- Maduro suggests serious talks between Venezuela and US: RTRS

- Venezuelan Exiles Root for U.S. Military Action. Those Left Behind Oppose It: WSJ

- Bezos, Catz, Dell Cashed Out Billions as Top Insider Sellers of 2025: BBG

- Zelenskiy offers chief of staff post to military intelligence boss: RTRS

- Ozempic Users Actually Spend More Dining Out. Smart Restaurants Are Adapting; BBG

- China taxes condoms, contraceptive drugs in bid to spur birth rate: RTRS

- How Kraft Heinz Lost Its Lock on Mac and Cheese—and American Shoppers: WSJ

- China AI chipmaker Biren soars in Hong Kong debut as IPO wave builds: RTRS

- Oil steadies after biggest annual loss since 2020: RTRS

Trade/Tariffs

- US President Trump signed a New Year’s Eve proclamation titled “AMENDMENTS TO ADJUSTING IMPORTS OF TIMBER, LUMBER, AND THEIR DERIVATIVE PRODUCTS INTO THE UNITED STATES”. This included a delay in tariff increases on upholstered furniture, kitchen cabinets and vanities for a year, which keeps the tariff levels for the aforementioned goods at 25%, instead of raising it to 30% for upholstered furniture and 50% for kitchen cabinets and vanities, citing ongoing trade talks, according to Associated Press.

- Italy's Foreign Ministry announced on Thursday that the US sharply lowered the proposed duties on several Italian pasta makers from the additional 92% duty proposed in October, with the tariff for La Molisana set to 2.26% and for Garofalo set to 13.98%, while 11 other producers will face tariffs of 9.09%.

- US granted TSMC (2330 TT) an annual licence to import US chipmaking tools for its facilities in China's Nanjing.

- China’s Ministry of Commerce called the EU’s carbon border tax unfair and discriminatory, while it vowed to take countermeasures to defend the country’s interests, according to a statement on Thursday cited by Bloomberg.

- China set quotas on beef imports as it seeks to protect domestic farmers and producers, in a blow to Brazil and other major shippers, including Australia and Argentina, while shipments exceeding the limits will be subject to a 55% duty, according to the Ministry of Commerce.

- India extended tariffs on steel imports for three years with import levies of 11%-12% proposed for some products, according to Bloomberg. It was also reported that India imposed anti-dumping duties of USD 60.89-130.66/ton on low-ash met coke imports for six months.

A more detailed look at global markets courtesy of Newsquawk

ASX 200 posted mild gains of 0.2% in quiet trade, with hefty losses in gold miners hampering the gains from Energy and Financials. KOSPI jumped about 2% to a fresh record high, helped by a roughly 6% rise in Samsung Electronics, after reports said customers praised its HBM (high memory bandwidth) chips. Hang Seng surged ~2.6%, with gains led by education stocks, while AI chip designer Shanghai Biren gained in excess of 100% following a HKD 5.58bln Hong Kong IPO, which was said to be heavily oversubscribed.

Top Asian News

- Chinese President Xi said in his annual New Year’s Eve speech that the year 2025 marked the completion of China's 14th Five-Year Plan for economic and social development, while he added that they have pressed ahead with enterprise and fortitude, and overcome many difficulties and challenges. Xi added that they met the targets in the Plan and made solid advances on the new journey of Chinese modernisation, as well as noted that economic output has crossed thresholds one after another, and is expected to reach CNY 140tln for the year. Furthermore, he said their economic strength, scientific and technological abilities, defence capabilities, and composite national strength all reached new heights, while he also vowed to reunify China and Taiwan.

- China’s State Council said it studied measures for facilitating cross-border trade, while it will promote green and cross-border e-commerce. Furthermore, it will speed up the review and approval of breakthrough therapeutic drugs, as well as boost investment in water network projects.

- China’s industrial hubs are to lower power prices to support the economic recovery, with the eastern province of Jiangsu, which surrounds Shanghai, to cut rates by 17% vs 2025, while the southern province of Guangdong had recently announced to reduce power prices by 5%.

- Chinese automakers’ market share of Europe’s electric-vehicle market in November reached a record 12.8%, despite the cost of European Union tariffs, according to Bloomberg.

- South Korean President Lee plans to discuss economic ties and peace efforts in the Korean Peninsula during his upcoming summit talks with Chinese President Xi scheduled for early next week.

- Japanese PM Takaichi and US President Trump may hold talks, via telephone on Friday night at earliest, according to Kyodo News citing sources.

European bourses (STOXX 600 +0.6%) began the session around the unchanged mark before rising to session highs soon after the cash open, without a clear driver. Since, indices have dipped off best levels, paring some of the earlier upside. European sectors hold a positive bias, led by Basic Resources (+1.7%), Technology (+1.8%), and Energy (+1.7%). The former is supported by higher metal prices, with gains in gold and copper. On the downside, Food Beverage & Tobacco (-0.3%), Real Estate (-0.3%) and Construction (-0.1%) lag.

Top European News

- UK PM Starmer promised to "defeat the decline and division offered by others" in his new year message and insisted that people would feel a "positive change" in their lives in 2026, according to BBC.

- French President Macron called for unity, strength and hope during his New Year's Eve address, while he pledged to work until the 'last second' of his mandate and guard the 2027 presidential election from foreign interference.

FX

- DXY resides closer to the upper end of a tight 98.14-98.42 in early European hours, following a rather subdued APAC session.

- In terms of today's trade, price action has been relatively muted as volume returns to the market from the holiday period. AUD and NZD outperform amid the broader risk-on sentiment, with the AUD also underpinned by a rebound in gold amid a myriad of geopolitical factors, including US President Trump's warning to Iran this morning that the US is "locked and loaded and ready" to rescue peaceful protesters if Iran opens fire on them. Elsewhere, JPY is flat in a narrow 156.77-157.00 intraday range. Meanwhile, EUR and GBP saw little immediate move from their respective final Manufacturing PMIs.

- 2025 recap: 2025 proved a tough year for the index, which saw its sharpest annual drop in eight years, whilst most majors rallied. The JPY saw gains of under 1% over 2025, in a year rattled by political instability, fiscal woes, BoJ hawkish bias and haven flows. Antipodeans saw the AUD climb nearly 8% over 2025 (best since 2020) and the NZD gained almost 3% to snap a three-year losing streak. The EUR was up 13.5% in 2025 and GBP +7.7% (both their strongest yearly gains since 2017).

Fixed Income

- A softer start for fixed benchmarks.

- Bunds and USTs lower by 20 and a tick, respectively. Specifics are fairly light aside from Final PMIs which, thus far, have not had any real impact. USTs in the red but at the upper-end of a 112-05 to 112-13 band. If a move into the green occurs, resistance factors at 112-25. A similar picture for Bunds, in the red but just off highs in 127.08-49 parameters. Resistance at 127.57 and 127.83.

- For Gilts, a softer open but the benchmark has since climbed off lows and is, as above, towards highs in 90.74-91.33 parameters. 91.37 would take Gilts back to unchanged on the day, thereafter resistance at 91.47.

Commodities

- WTI and Brent trades slightly lower, with prices towards the lower ends of USD 57.08-57.93/bbl and USD 60.51-61.38/bbl, respectively. Focus for the complex lies more on oversupply risks as opposed to any geopolitical risks from the above, with traders also setting sights on this weekend's OPEC+ confab. OPEC+ is expected to reaffirm its production pause through Q1, maintaining the halt to further supply increases, according to Bloomberg sources. The stance reflects concerns over a looming global oversupply backdrop, with crude prices sharply lower over 2025 and forecasters warning of a potential glut in 2026. Delegates indicate little appetite to resume hikes at this stage, according to reports. Recent Saudi–UAE geopolitical tensions have generated headlines, but are widely viewed as noise rather than a threat to OPEC unity, with no expectation that they will spill over into production policy.

- Spot Gold kicked off 2026 on the front foot, with spot prices currently +1.5% intraday towards the upper end of a 4,326.28-4,397.84/oz range at the time of writing. The yellow metal printed a record high at ~USD 4,550/oz on Dec 26th before declining in the subsequent three sessions to a USD 4,274.03/oz trough on 31st Dec, with a near-USD 250/oz drop seen on Dec 29th.

- Geopolitical updates have kept the precious metals complex underpinned, with US President Trump's warning to Iran this morning that the US is "locked and loaded and ready" to rescue peaceful protesters if Iran opens fire on them. Further, tensions flared between OPEC members Saudi Arabia and the UAE, primarily due to an open military and diplomatic confrontation in Yemen, with the two nations now actively backing rival factions and engaging in direct hostilities. In terms of Russia-Ukraine, Ukrainian President Zelensky said they are 10% away from a deal to end the war with Russia, but not at any cost, according to The Independent. That being said, Ukrainian authorities in Zaporizhzhia on the morning of January 2nd noted over 700 Russian attacks on the territory of the province.

- North Sea Buzzard oil field recommenced production on 1st January 2026, according to CNOOC.

- Rail line in Australia used by Glencore (GLEN LN) requires a significant repair job.

Geopolitics: Ukraine

- Ukrainian President Zelensky said they are 10% away from a deal to end the war with Russia but not ‘at any cost’, according to The Independent. Zelensky also announced that a meeting with national security advisors “focused on peace” will be held on January 3rd, and there will be meeting with the military chiefs of general staff on January 5th where the main issue is security guarantees for Ukraine, while he said there will be a meeting with European leaders and the leaders of the Coalition of the Willing on January 6th.

- Ukrainian President Zelensky denied allegations made by Russia that Ukraine launched a drone attack on one of Russian President Putin's residences last Sunday, and accused Moscow of trying to derail peace talks. Furthermore, Russia recently handed over to the US what it claimed was proof of the attempted strike on Putin’s residence, although it was separately reported that US officials determined that the Russian allegation that Ukraine targeted Putin in a drone strike is false, according to WSJ.

- Ukraine's military said on Thursday that it struck Russia's Ilsky oil refinery and the Almetevskaya oil preparation facility, while Ukraine also announced that a Russian drone attack damaged power infrastructure, according to Reuters.

- Russian-installed governor of Ukraine’s Kherson region said at least 24 were killed and over 50 were injured from a Ukrainian drone strike on a hotel and cafe during New Year celebrations, according to Reuters.

- US envoy Witkoff said on Wednesday that he held a “productive call” with European allies on the next steps in the peace process, while he said they “also spent time on the prosperity package for Ukraine – how to continue defining, refining and advancing these concepts, so Ukraine can be successful, resilient and truly thrive once the war is over”.

- Ukrainian authorities in Zaporizhzhia on January 2nd noted of over 700 Russian attacks on the territory of the province "in the past hours", according to Al Jazeera.

Geopolitics: Middle East

- US President Trump posted "If Iran shots and violently kills peaceful protesters, which is their custom, the United States of America will come to their rescue. We are locked and loaded and ready to go. Thank you for your attention to this matter!".

- Israeli Defence Minister Katz urged the IDF to be ready for a potential ‘Oct.7-style’ mass attack on West Bank settlements and called for the reestablishment of northern West Bank military bases which were evacuated as part of a US-backed deal, according to Times of Israel.

- Iran’s defence export agency offered to sell ballistic missiles, drones and other advanced weapons systems to foreign governments in exchange for cryptocurrency and barter, according to FT.

- UAE announced on Tuesday that it was pulling out its remaining forces in Yemen, after Saudi Arabia bombed the Yemeni port city of Mukalla following accusations that two ships from the UAE had delivered weapons and combat vehicles to separatist forces. It was separately reported that Yemen’s government imposed restrictions on flights between Yemen and the UAE to mitigate the ongoing escalation in the country, according to a Saudi source cited by Reuters.

Geopolitics: Others

- US Treasury Department announced new sanctions related to Venezuela, targeting crude oil tankers.

- Russia requested that the US stop pursuing an oil tanker identified as Bella 1, which was headed to Venezuela and was fleeing the US Coast Guard in the Atlantic Ocean, according to The New York Times on Thursday.

- Taiwanese President Lai vowed to defend the nation’s sovereignty in his New Year’s speech days after China fired dozens rockets towards the island and deployed warships and aircraft near Taiwan as part of military drills and a show of force, while he stated that 2026 is a very critical year for Taiwan and that they must stand shoulder to shoulder with democratic countries.

- China's Taiwan Affairs Office said Lai’s New Year's address was riddled with 'falsehoods and reckless assertions, hostility and malice', while it was also reported that China's Defence Ministry said the PLA's drills are completely justified and necessary.

US Event calendar

- 9:45 am: Dec F S&P Global U.S. Manufacturing PMI, est. 51.8, prior 51.8

DB's Jim Reid concludes the overnight wrap

Happy new year and hope you all had a relaxing break. We’ll shortly look at what’s coming up in 2026, but as we usually do at the new year, we’ve just released our review looking at how markets fared in 2025. It was a strong year overall thanks to continued economic growth, optimism around AI, and more central bank rate cuts. So that meant global equities, bonds, credit and EM assets all advanced for the most part. However, those headline gains masked huge volatility, particularly in April when the Liberation Day tariff announcements sparked the 5th biggest two-day slump for the S&P 500 since WWII. Meanwhile, Germany’s fiscal stimulus announcement in March saw the biggest daily jump for the 10yr bund yield since German reunification in 1990. See the full review here for more details on the year just gone.

In terms of the last week-and-a-half whilst we’ve been away, it’s been a story of two halves for markets. Just before Christmas, the S&P 500 moved up to record highs on both Dec 23 and Dec 24, aided by some very strong US data. That included the Q3 GDP print, which was delayed because of the government shutdown, and showed the US economy grew at an annualised pace of +4.3% (vs. +3.3% expected). That was the fastest quarterly growth in two years, and the so-called “core GDP” measure of real final sales to private domestic purchasers was up by a robust +3.0% as well. So that led to a lot of optimism about the economy’s momentum into next year, and the Atlanta Fed’s GDPNow measure for Q4 currently stands at +3.0%.

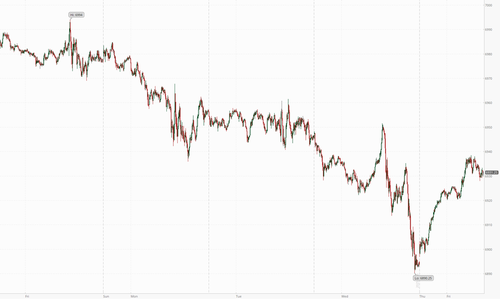

However, after Christmas the tone became more negative, with the S&P 500 posting four consecutive declines that’s left the index -1.25% beneath its Christmas Eve record. So that took a bit of the shine off the full-year performance, with the index ending the year up +16.4% (and +17.9% in total return terms), falling short of the gains above +20% seen in 2023 and 2024. Meanwhile, there’s been some huge volatility in precious metals, with silver prices up +10.30% on Dec 26, marking their biggest daily jump since September 2008 in the week of Lehman Brothers’ collapse. And after the weekend, they then slumped by -9.00% on Dec 29, the biggest loss since 2020, before there were further swings of more than 5% each way on Dec 30 and Dec 31. That caps off a huge surge in precious metals prices over 2025, with both gold and silver experiencing their strongest annual gains since 1979, up +65% and +148% respectively.

This morning in Asia, markets have got 2026 off to a decent start in the places they've reopened. For instance, the KOSPI (+1.87%) is currently on track for a record high, whilst the Hang Seng (+2.18%) has also surged. Moreover, US equity futures are pointing to a strong start as well, with those on the S&P 500 (+0.43%) and the NADAQ 100 (+0.65%) both higher this morning. However, we shouldn’t extrapolate too far, as the first trading day has been an incredibly poor guide in recent times to how the rest of the year plays out. Indeed, 2023-25 each started with a negative session for the S&P 500, before the index then saw a double-digit annual gain. By contrast, 2022 saw an all-time high on the first day, before the index fell into a bear market and its worst year since 2008. So whatever happens today, we really shouldn’t overegg the day one moves.

When it comes to the year ahead, several themes will be high up the agenda for markets in 2026. First, there are still lots of tariff developments yet to come, most notably with the US Supreme Court case, who are set to rule on the legality of the tariffs imposed under the International Emergency Economic Powers Act (IEEPA). As a reminder, roughly half of the tariff increases under Trump have used IEEPA authority, and the legal challenges so far have been successful in the lower courts, but were appealed by the Trump administration. So we’re now awaiting the ruling from the Supreme Court. Our US economists think there’s a reasonable possibility the IEEPA powers are struck down, but they also expect that if they are, then the administration would pursue other legal avenues to impose its tariff policies. For instance, the sectoral tariffs under section 232 (e.g. to steel and aluminium) aren’t covered by this court challenge. Or another option could be Section 122 of the 1974 Trade Act, which permits temporary 15% tariffs for 150 days. So there are several options the Trump administration still have.

Aside from the court case, there are also a couple of other 2026 trade deadlines. One is the scheduled review of the USMCA agreement, six years after it first came into force in July 2020. The other is the US-China trade truce, which was extended by a year after the meeting between Presidents Trump and Xi back in October. So as it stands, the current US tariff reduction on China only runs until November 10, 2026. Nevertheless, there have been a few tariff reductions in recent weeks, particularly as concerns about affordability have risen up the agenda. So we’ve already seen exemptions for products like coffee and beef, and it was also announced on New Years’ Eve that higher tariffs planned on Jan 1 for upholstered furniture and kitchen cabinets were being delayed by a year until Jan 1 2027. Remember as well that the midterm elections are happening in November, so the political incentive to keep inflation down will rise as they approach.

Second, another key theme for 2026 will be the Federal Reserve, and Trump said on Monday that there’d be an announcement on Chair Powell’s replacement in “January sometime”. For reference, Powell’s term as Chair concludes in May, so the new Chair would be in place by the June FOMC decision, and futures are pricing in another 57bps of rate cuts by the December meeting. In terms of who the new Chair will be, the Polymarket odds continue to have NEC Director Kevin Hassett as the frontrunner (42%), followed by former Fed Governor Kevin Warsh (33%) and current Governor Christoper Waller (15%). Otherwise, the Supreme Court are also set to hear arguments on January 21 about President Trump’s attempt to remove Governor Lisa Cook from the Fed’s Board of Governors. So it’s a big year ahead for the Fed.

Third, we’ve got lots happening on the fiscal side in 2026, as we’ll see the fiscal impulse from the German stimulus, as well as from the One Big Beautiful Bill Act in the United States. All this comes at an interesting time, as 2025 saw periodic market flareups over loose fiscal policy, with sovereign bonds repeatedly seeing large losses before recovering again. That happened in May around the time of the US credit rating downgrade by Moody’s, which pushed the 30yr Treasury yield above 5%. And it was a similar story in Europe too, with a sharp selloff for UK gilts last summer when the government U-turned on welfare cuts, alongside losses for French OATs after PM Bayrou left office and new PM Lecornu resigned after 26 days, before he was reappointed again. So bond markets have been jittery across the board, and last year even saw the biggest jump for Japan’s 10yr yield since 1994 as the BoJ kept hiking rates and the new government under PM Sanae Takaichi announced a further stimulus package.

Fourth, on the political side we have a few elections to look out for. The biggest we know about is probably the US midterm elections, although they’re not until November 3. That will see the full House of Representatives up for election, along with a third of the Senate, and currently on Polymarket, the Democrats are the 81% favourites to retake the House. That would be in keeping with the historic pattern (link here), whereby the incumbent President’s party tend to lose House seats in the midterm votes. Meanwhile in the Senate, the Republicans are 66% favourites on Polymarket to keep control. However, the new Congress doesn’t come into office until January 2027, so in policy terms, that’s more of a story for next year.

Here in the UK, we also have a large set of local elections on May 7, which will be one of the most important midterm electoral tests for the political parties. Although that won’t change the government, PM Starmer’s position has been under increasing pressure, so these elections will be a crucial benchmark for whether he might face a challenge from within the Labour Party. Then in France, the presidential election isn’t until April 2027, but we know that 2026 will be the year that campaigning begins in earnest, with candidates announcing, so we’ll get a much better sense of the state of that race. And over in Japan, a general election isn’t due until 2028, but speculation has been rising about a potential snap election given PM Sanae Takaichi’s approval ratings.

Finally of course, it’s not a single event, but ongoing developments around AI will be critical for the path of markets in 2026. After all, as Jim has written previously, the concentration of the Mag 7 group in US equities means that global markets are incredibly sensitive to their performance. And we shouldn’t forget that AI developments have already led to big reactions in 2025, with the NASDAQ down over -3% on the day that markets reacted to DeepSeek’s new AI model last January. So any loss of momentum or signs that a bubble is bursting risk unwinding the positive wealth effects we’ve seen, as well as the wider surge in capital expenditures that’s helped to support growth.

Looking at the day ahead, there’s not much happening, but data releases include the December manufacturing PMIs from the US and Europe, along with the Euro Area M3 money supply for November.