Futures Fall On Friday The 13th As CPI Looms

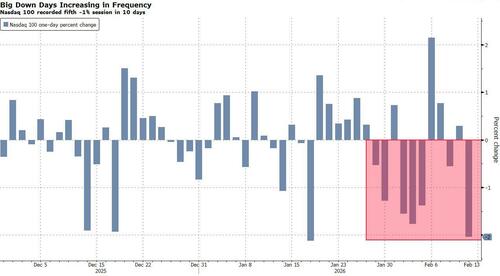

US equity futures are lower in a scary start this Friday the 13th, having given up modest overnight gains, as Investors - already on high alert for any further signs of the "AI scare trade" - braced for Friday’s inflation reading and any clues it holds on what happens next for interest rates. As of 8:00am ET, S&P and Nasdaq futures are down by 0.2%, having flipped between gains and losses after a three-day S&P 500 losing streak and especially Thursday's brutal 1.6% cash-market slump, which DB's Jim Reid described as "Friday 13th coming a day early for risk assets yesterday." In pre-market trading, Mag-7 all names are weaker ahead of the long weekend, but there are some bright spots within Energy / Mats / Fins but, so far, pre-mkt trading does not point to another significant de-risking. Bond yields climb 1-2bps across the curve with the belly underperforming and USD rallying. Commodities are retracing some of yesterday’s losses led by precious metals. Crude oil futures fell on a report that some OPEC+ nations see scope for output hikes. Today’s macro focus is on CPI and if any new AI "Obsolescence" trades emerge.

In premarket trading, Mag 7 stocks are all lower (Alphabet -0.7%, Amazon -1.0%, Apple -0.4%, Nvidia -0.3%, Meta -0.8%, Microsoft -0.6%, Tesla -0.8%).

- Airbnb (ABNB) is up around 4.8% after the travel-booking platform’s first-quarter revenue forecast exceeded the average analyst estimate.

- Applied Materials (AMAT) is up 11% after the semiconductor capital equipment company reported first-quarter results that beat expectations and gave an outlook for adjusted earnings that is above the analyst consensus.

- DraftKings (DKNG) slides 15% after the sports betting company’s revenue forecast for 2026 missed the average analyst estimate.

- Dutch Bros (BROS) jumps 13% after the coffee chain reported adjusted earnings per share for the fourth quarter that surpassed Wall Street estimates.

- Pinterest (PINS) is down around 20% after the social media company’s first-quarter forecast was weaker than expected.

- Tri Pointe Homes (TPH) rose 27% after Sumitomo Forestry says it will acquire the company for around $4.28 billion.

In corporate news, Goldman Sachs’ top lawyer, Kathy Ruemmler, is leaving the firm following a cache of Department of Justice documents showing her links with sex offender Jeffrey Epstein.

The sharp swings this week have highlighted how quickly shifts in sentiment around AI can reverberate far beyond the technology sector. The so-called AI scare trade has seen knee-jerk selloffs in sectors from logistics to software providers amid fear the technology will hurt their businesses. Meanwhile, investors are watching Friday’s January inflation print to see if it reinforces strong jobs numbers earlier in the week, which prompted traders to curb bets on interest-rate cuts by the Federal Reserve. The median forecast predicts a year-over-year increase of 2.5% for the core consumer price index.

“What could help the market is if inflation comes in softer than expected,” said Joachim Klement, head of strategy at Panmure Liberum. “The strong labor market data earlier this week has reduced hopes for rate cuts by the Fed, yet if inflation continues to cool off, we think the Fed might be willing to add more rate cuts in the mix.”

Punishment has turned “brutal” for any stocks perceived to be at risk from AI disruption, according to Joel Kulina, managing director for TMT trading at Wedbush Securities.The worries over AI-fueled disruption underscore a sea change in market sentiment. Enthusiasm for the technology drove the lion’s share of stock market gains over the last few years. That’s been replaced by concerns that the newest tools released by Google, closely held AI developer Anthropic and a slew of lesser-known startups are already good enough to threaten a wide array of companies, many far outside the umbrella of technology.

“The number one issue for the market: AI has now become a net negative, pressuring equities,” Kulina says. “‘Sell first, ask questions later’ has been the mentality on a day-to-day basis this month. Megacaps remain capital intense, likely leading to less free cash flow and buybacks on one hand, while decimating legacy industries due to fears of severe disruption on the other.” In the latest such episode, Algorhythm Holdings, a former karaoke company turned AI developer with a stock-market value of only $6 million, announced a logistics platform that triggered a 6.6% slide in the Russell 3000 Trucking Index on Thursday.

Volatility, already stirring, may flare up further as traders square off positions to cut risk before the Presidents’ Day holiday on Monday and Lunar New Year holidays in China and several other Asian markets next week. After Wednesday’s surprisingly strong jobs report prompted traders to pare bets on rate cuts by the Fed, inflation data numbers due at 8:30 a.m. ET have added significance. “The CPI tends to run hot in January as businesses often hike prices in the beginning of the year, a phenomenon that statistical adjustments can’t completely strip out,” according to Bloomberg Economics chief economist Anna Wong. She expects headline consumer prices to rise 0.20% month-on-month, slower than the 0.31% increase in December. Remove volatile food and energy prices, and core consumer prices are predicted to rise 0.31% in January, up from 0.24% the previous month.

European stocks extend declines from the prior session. Stoxx 600 down 0.5% technology stocks outperform as a selloff in sectors deemed at risk from artificial intelligence eases, while basic resources lag on reports the Trump administration is planning to scale back some tariffs on steel and aluminum goods. FTSE 100 and the DAX slightly outperforming.Here are some of the biggest movers on Friday:

- Safran shares rise as much as 8% to a record high, after the French engine manufacturer improved its guidance for 2026 and lifted its outlook for 2028, expecting a strong civil engines aftermarket and momentum on defense.

- RELX shares rise as much as 5.9%, the most since April, after BofA Securities said the information and analytics provider is one of its top stocks for this year and that this week’s results shows the recent de-rating is overdone.

- DataWalk shares surge as much as 7.2%, bucking a broader selloff on the Warsaw Stock Exchange, after the Polish data processing company’s accelerated book-building saw shares priced above Thursday’s closing level.

- Kalmar shares gain as much as 8.2%, hitting a record high, after releasing its fourth-quarter results and announcing a “major order” from Maher Terminals for 30 hybrid straddle carriers.

- NatWest shares swing between gains and losses on Friday after the UK lender posted a strong profit beat, currently trading 1.5% down as Shore Capital analysts flag its outlook is yet to take the recently announced deal to buy Evelyn into account.

- L’Oréal shares drop as much as 7%, the most since October, after the beauty company reported like-for-like sales for the fourth quarter that missed the average analyst estimate.

- Tomra shares drop as much as 9.3%, the most since October, after the recycler reported fourth quarter revenues below consensus and DNB Carnegie said it sees “muted” collections.

- SSAB shares slide as much as 8.9%, leading a drop in European miners after the Financial Times reported the Trump administration is planning to scale back some tariffs on steel and aluminum goods, which would ease market disruptions.

- Norsk Hydro shares fall as much 6.6%, the most since 2023, as analysts called the company’s guidance weak, due to soft pricing and pressure in the aluminum extrusions business.

- Elkem shares fall as much as 13% in Oslo, the most since July, after the company agreed to sell the majority of its silicones division to Bluestar — a deal in which “many investors might have thought there would be a sale for cash,” Morgan Stanley analysts write.

- Huhtamaki shares decline as much as 5.5% following the Finnish consumer packaging firm’s fourth-quarter results, which DNB Carnegie noted showed organic sales continuing to decline.

Earlier in the session, Asian stocks fell, as the region’s AI-driven rally took a breather after US tech shares tumbled overnight. Shares in Hong Kong led losses ahead of the Lunar New Year holiday. The MSCI Asia Pacific Index fell as much as 1.5%, snapping five days of gains. Still, the gauge is on track for its best week since September 2024, after hitting fresh records every day this week through Thursday. Equity benchmarks in Japan, South Korea and mainland China also fell. Despite the near-term pullback, Asian stocks have demonstrated resilience against the broad selloff driven by Wall Street’s fears of business disruption caused by artificial intelligence. The region is seeing more foreign demand as investors rotate away from crowded US trades and seek exposure in Asia’s AI supply chain. Equity markets in mainland China and Taiwan will remain shut all of next week, while Hong Kong is closed for three of the days.

Citigroup is raising the pay of CEO Jane Fraser to $42 million for 2025, making her among the best compensated US banking heads. Clear Street, a Wall Street broker built on cloud computing technology, postponed its IPO after cutting the target by nearly two thirds. And Coinbase Global showed how quickly a cooling crypto market can pressure even one of the industry’s most diversified exchanges. Revenue in the fourth quarter tumbled a more-than-estimated 20% to $1.8 billion as falling token prices drained trading activity across digital assets.

“Today’s pullback looks like a healthy pause within a broader upward trend,” said Tareck Horchani, head of sales trading, prime brokerage at Maybank Securities in Singapore. “Near term, I expect choppier price action driven by global tech sentiment and positioning flows, but the underlying earnings trajectory, especially in semiconductors, and sustained foreign inflows should continue to provide support once liquidity normalizes.”

In FX, the Bloomberg Dollar Spot Index up 0.2%, with yen and the Aussie dollar underperforming. Russia’s central bank cut rates by 50bps versus expectation for a hold.

In rates, treasuries are little changed in early US session, holding most of Thursday’s curve-flattening gains as focus shifts to January US CPI report at 8:30am New York time. Yields remain within 1bp of Thursday’s closing levels, the 10-year near 4.11%, lagging bunds and gilts in the sector by 2bp-3bp. 2s10s spread is near 65bp, about 6bp flatter on the week.

In commodities, WTI crude oil futures fell on a report that some OPEC+ nations see scope for output hikes. Gold is steadying short of $5,000/oz.

Friday's US economic calendar slate includes January CPI at 8:30am. No Fed speakers are scheduled

Market Snapshot

- S&P 500 mini -0.2%

- Nasdaq 100 mini -0.2%

- Russell 2000 mini -0.2%

- Stoxx Europe 600 little changed

- DAX +0.1%

- CAC 40 -0.2%

- 10-year Treasury yield +2 basis points at 4.12%

- VIX -0.4 points at 20.47

- Bloomberg Dollar Index +0.1% at 1183.57

- euro -0.1% at $1.1857

- WTI crude +0.2% at $62.99/barrel

Top Overnight News

- The US and Taiwan signed a trade deal to cut tariffs and boost access for American products in Asia, including a pledge by Taipei to buy more than $44 billion worth of LNG and crude. BBG

- Ukraine and Russia peace talks process remain stuck, primarily over territorial concessions and security guarantees. Politico

- OpenAI told US lawmakers that DeepSeek used unfair methods to extract results from leading rival models to train its next-gen chatbot. BBG

- The Central Intelligence Agency released a new video on Thursday seeking to capitalize on upheaval at the top of China’s armed forces to recruit potential spies. WSJ

- Trump is planning to scale back some tariffs on steel and aluminum goods as he battles an affordability crisis that has sapped his approval ratings ahead of November’s midterm elections. FT

- Bank of Japan policy board member Naoki Tamura floated the possibility that the bank could soon declare that its price target has been achieved, as the nation’s inflation is becoming stickier. WSJ

- The Pentagon is sending the Navy’s largest and most advanced aircraft carrier to the Middle East, as the U.S. steps up plans for a potential attack on Iran, two U.S. officials said. WSJ

- Tech and banking trade groups are among others that are urging the Trump administration to not change the federal framework they have been using to safely deploy AI: Axios

Trade/Tariffs

- China and the US held an anti-drug intelligence exchange meeting on February 10th-12th, Xinhua reported; both sides agreed to promote healthy and practical anti-drug cooperation.

- China's Ministry of Commerce holds a roundtable with German firms; hopes that German companies can increase investment in China.

- US President Trump plans to roll back tariffs on metal and aluminium goods, according to FT.

- Japan's Trade Minister Akazawa engaged with US Commerce Secretary Lutnick on US-bound investment initiatives and confirmed progress on talks to launch the USD 550bln investment.

- Taiwan President Lai said trade deal with US marks a pivotal moment for Taiwan's economy and industries, adds we secured significant benefits for Taiwan's industries and overall economy, and we solidified the Taiwan-US high-tech strategic partnership.

- US Department of Commerce increases duties on Chinese battery-grade graphite to 160% related to Novonix (NVX).

- US and Taiwan sign a reciprocal trade agreement with Taiwan to eliminate or reduce 99% of tariff barriers on US goods, while US confirms 15% tariff rate on Taiwanese goods.

- US and North Macedonia agreed to a trade framework with the US to impose 15% tariff on North Macedonian goods, while North Macedonia is to eliminate all tariffs on US goods.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower as the region took its cue from the losses stateside, where tech underperformed as AI-disruption concerns re-emerged, and logistics/industrials stocks were also pressured after Algorhythm Holdings (RIME) released its AI freight scaling tool. ASX 200 was dragged lower by losses in tech stocks, and as participants also digested earnings releases. Nikkei 225 retreated at the open after recent currency strength and with focus also on earnings reports, including from SoftBank, which returned to profit in Q3 but missed expectations, while its shares were also not helped by its AI exposure. Hang Seng and Shanghai Comp suffered alongside the broad downbeat mood in the region, and despite reports that President Trump paused some China tech bans ahead of his summit with Xi in April, while it is also the last trading day in the mainland before the Lunar New Year and Spring Festival holiday closures.

Top Asian News

- Chinese New Yuan Loans (Jan) 4710B vs. Exp. 5000B (Prev. 910B).

- Chinese M2 Money Supply YoY (Jan) Y/Y 9% vs. Exp. 8.4% (Prev. 8.5%).

- Chinese Total Social Financing (Jan) 7220B vs. Exp. 7050B (Prev. 2210B).

- Chinese Outstanding Loan Growth YoY (Jan) Y/Y 6.1% vs. Exp. 6.2% (Prev. 6.4%).

- Chinese House Price Index MM (Jan) Y/Y -0.4% (Prev. -0.4%).

- Chinese House Price Index YoY (Jan) Y/Y -3.1% (Prev. -2.7%).

European bourses (STOXX 600 -0.1%) are trading mixed as the end of the week nears. SMI (+0.6%) leads its European peers, closely followed by the AEX (+0.5%). On the other hand, the CAC 40 (-0.2%) is the slight laggard following a mixed bag of earnings coming out of France. European sectors are mixed. Technology (+1.3%) sits comfortably at the top of the pile, followed by Insurance (+0.6%) and Industrial Goods and Services (+0.5%). Upside in Tech follows on from the earnings by Applied Materials, which posted positive earnings and Q2 forecasts. Sitting at the bottom lies Basic Resources (-1.3%), as miners react to the selloff in metals prices. Consumer Products and Services (-0.7%) is weighed on by L'Oreal (-3.5%) post-earnings.

Top European News

- UK PM Starmer is set to call for multinational defence initiative to cut costs of rearmament, according to FT

FX

- DXY is currently trading with very mild gains and trades at the midpoint of a 96.89-97.15 range. Really not much driving things for the index this morning, with traders awaiting the US CPI report later. On that, the headline is expected to rise +0.3% M/M (prev. 0.3%), and core rising at a rate of 0.3% M/M (prev. 0.2%). UBS said easing inflation should keep the Fed on track for rate cuts despite strong jobs data, forecasting two 25bps reductions in June and September, while FOMC projections indicate one additional cut this year. In terms of recent price action, ING notes that there has been a strong inclination to sell USD rallies this week, as such, analysts “struggle to see the dollar recover substantially from here”.

- G10s are mixed against the USD, with the NZD and CAD holding around the unchanged mark, whilst the CHF, AUD and JPY hold towards the foot of the pile, with the latter the clear underperformer. EUR was little moved by the EZ GDP 2nd estimates and Employment change, which printed more-or-less in-line with expectations.

- Really not much driving things for the JPY this morning, with the weakness potentially a slight paring of a four-day winning streak seen following PM Takaichi’s landslide victory. Focus has been on Takaichi’s remarks that she will adhere to fiscal responsibility, with attention also on comments via FinMin Katayama, who noted that the foodstuff tax cut could be funded by foreign reserves. On the monetary policy side of things, markets now see the chance of faster BoJ normalisation; on that, BoJ’s Tamura (Hawk) suggested inflation is becoming “sticky”, and flagged the chance of a rate hike “this spring”. On the neutral rate, he suggested that the policy rate is “very distant” from the neutral rate. USD/JPY was little moved by his comments, and currently trades at the upper end of a 152.63-153.66 range.

- CHF is slightly lower this morning, in the aftermath of the region’s inflation data; the Y/Y metric printed in-line with the consensus, whilst the M/M metric was a touch below the prior and surprisingly fell into negative territory. The CHF initially weakened on the report, before scaling back much of the pressure thereafter. It is worth reminding that SNB’s Schlegel suggested that the Bank is willing “look through negative months of inflation”, adding that the bar to negative rates is high.

Central Banks

- Fed's Miran (voter) said some of the concern he has on labour markets is a little less than he had before, adds a range of policies are pushing out the supply of the economy and will increase economic growth in a non-inflationary way. said:. Fed is one of the biggest risks to growth. Monetary policy has passively tightened. We may be underestimating how restrictive monetary policy actually is.

- BoJ's Tamura said he feels Japan's recent inflation is becoming sticky and reiterates will keep raising rates if outlook is met, adds we may be able to judge that BoJ's price goal has been achieved as early as this spring. Added that even if the BoJ raises the policy rate further, monetary conditions will remain accommodative.

- Japan's PM Takaichi is to meet with BoJ Governor Ueda on February 16th at 17:00JST / 08:00GMT.

- Japanese PM Takaichi's advisor Honda suggests the BoJ may consider raising interest rates later this year, but noted the unlikelihood of a hike in March.

- ECB's Kazaks said the ECB has yet to see full impact of EUR appreciation; he worries strong EUR reflects dollar weakness; said now is not the time for ECB to move interest rates; said ECB officials are on monitoring mode on EUR strength.

- PBoC's new emphasis on overnight money market rate has reportedly sparked speculation it could become the main policy target.

- Riksbank's Jansson said January inflation confirmed the picture of downside risks to inflation. Figures for GDP and consumption have been a little weaker recently.

- Russian Federation Interest Rate Decision 15.50% vs. Exp. 16% (Prev. 16.00%).

Fixed Income

- Another contained start for fixed income into US CPI and before Monday's US holiday, which coincides with the Chinese New Year holiday period.

- USTs on the backfoot, but only marginally, going into US CPI to round off a packed week of data. Currently, at the low-end of a 112-21 to 112-28 band, and while in the red as it stands, the upper-end of that band is a new marginal WTD peak.

- Bunds are also contained, though the benchmark finds itself firmer by a handful of ticks, but off best in 128.93 to 129.12 confines. The firmer APAC bias came from gains towards the end of the European day after German Chancellor Merz said he is not in favour of joint eurobonds, in addition to the read-across from a strong US 30yr auction.

- Gilts opened higher by nine ticks, catching up to the strength seen on that US auction. Since, the benchmark has retreated into the red with losses of c. five ticks in 91.34 to 91.51 parameters. Ahead of US CPI today but, more pertinently for the UK, next week's packed data docket that will likely determine if the BoE cuts in April as markets currently forecast, or if March comes into consideration.

- JGBs came under pressure to a 131.52 low after BoJ's Tamura said even if they tighten, monetary conditions will remain accommodative.

- Japan sold JPY 649.5bln in 10yr, 20yr and 30yr JGBs in enhanced liquidity auction; b/c 2.95 vs. Prev. 2.58. Highest accepted spread -0.014% vs. Prev. +0.018%. Allotment of bids at highest spread 2.5490% vs. Prev. 86.2119%.

- PBoC is to issue CNY 30bln in 3-month and 1-year bills in Hong Kong.

- Australia sold AUD 1bln 2.50% May 2034 bonds, b/c 3.44, avg. yield 4.2898%.

Commodities

- Crude benchmarks are trading relatively flat following yesterday’s slump after dollar strength and weak risk sentiment, sparked by AI disruption woes. Adding to further downside pressure were comments from US President Trump yesterday evening that the US must make a deal with Iran and that they could reach a deal over the next month. Not much in terms of fresh catalysts thus far in the European session, as traders await US CPI. WTI and Brent are trading at the lower end range of USD 62.54-63.17/bbl and USD 67.22-67.89/bbl, respectively.

- Precious metals are rebounding after yesterday’s decline, which was driven by a stronger US dollar following strong jobs data surpassing market expectation. There is no fresh catalyst behind today’s recovery, though some analysts attribute the move to dip-buying after the recent sell-off. Spot gold is currently trading near the upper end of USD 4,885.89–4,997.53/oz range, while silver is holding at the upper range of USD 73.745–79.085/oz.

- Copper trades slightly lower triggered by downbeat sentiment in Wall Street and APAC, although Europe fares somewhat better. The red metal trades at the lower end range of 12,800-13,021/t. Other relevant news in the metal space includes the Shanghai Weekly updating their Warehouse changes before the Chinese holiday: Copper +9.47%, Nickel +2.29%, Aluminium +21.3%.

- Indonesia's Mining Minister said we are studying a plan to ban exports on a number of raw materials next year, which includes tin.

- India's Reliance has reportedly been awarded general authorisation from the US to buy Venezuelan Oil.

- Three people reportedly burnt at Exxon's (XOM) Beaumont facility.

- Shanghai Weekly Warehouse Changes: Copper +9.47%, Nickel +2.29%, Aluminium +21.3%.

- ANZ revises gold price forecast, now sees gold hitting USD 5,800/oz in Q2 vs. previous forecast of USD 5,400/oz.

- Qatar hikes April term price for Al Shaheen oil to USD 0.87/bbl over Dubai quotes, according sources.

- Shenzhen financial regulator issues public notice to further standardise gold market operations.

Trade/Tariffs

- China and the US held an anti-drug intelligence exchange meeting on February 10th-12th, Xinhua reported; both sides agreed to promote healthy and practical anti-drug cooperation.

- China's Ministry of Commerce holds a roundtable with German firms; hopes that German companies can increase investment in China.

- US President Trump plans to roll back tariffs on metal and aluminium goods, according to FT.

- Japan's Trade Minister Akazawa engaged with US Commerce Secretary Lutnick on US-bound investment initiatives and confirmed progress on talks to launch the USD 550bln investment.

- Taiwan President Lai said trade deal with US marks a pivotal moment for Taiwan's economy and industries, adds we secured significant benefits for Taiwan's industries and overall economy, and we solidified the Taiwan-US high-tech strategic partnership.

- US Department of Commerce increases duties on Chinese battery-grade graphite to 160% related to Novonix (NVX).

- US and Taiwan sign a reciprocal trade agreement with Taiwan to eliminate or reduce 99% of tariff barriers on US goods, while US confirms 15% tariff rate on Taiwanese goods.

- US and North Macedonia agreed to a trade framework with the US to impose 15% tariff on North Macedonian goods, while North Macedonia is to eliminate all tariffs on US goods.

Geopolitics: Ukraine

- Russia's Kremlin said that new round of peace talks with Ukraine will take place next week; adds that its unlikely that discussions will move beyond talks before the conflict in Ukraine is settled.

- US, Russia and Ukraine are planning to meet again next week, possibly in Miami or Abu Dhabi, POLITICO reported.

Geopolitics: Middle East

- US aircraft carrier U.S.S Gerald R. Ford will be sent to the Middle East from Venezuela, according to officials cited by NYT.

Geopolitics: Other

- Russia's Deputy Foreign Minister Ryabkov said Russia will provide Cuba with material assistance, TASS reported.

- Russia's Kremlin said they did not decide to stop using the dollar but that the US imposed restrictions, dollar will have to compete with other currencies if the US lifts restrictions.

- Japan seizes a Chinese fishing boat off the Nagasaki coast, according to Japanese press.

US Event Calendar

- 8:30 am: United States Jan CPI MoM, est. 0.3%, prior 0.3%

- 8:30 am: United States Jan Core CPI MoM, est. 0.3%, prior 0.2%

- 8:30 am: United States Jan CPI YoY, est. 2.5%, prior 2.7%

- 8:30 am: United States Jan Core CPI YoY, est. 2.5%, prior 2.6%

DB's Jim Reid concludes the overnight wrap

Friday 13th came a day early for risk assets yesterday and although the sell-off is continuing this morning in Asia, US futures are more stable as I type. It’s perhaps indicative of the state of markets at the moment that a $6 million market cap company that until recently specialised in Karaoke helped wipe tens of billions off logistics stocks to add to the weakness. I've seen some shocking Karaoke performances in my time but this perhaps tops them all. Overall the S&P 500 (-1.57%) slid to a third consecutive decline. Once again, software stocks in the index were one of the worst hit, falling -1.49%, but it was a rough day for tech in general, with the Magnificent 7 (-2.24%) and the NASDAQ (-2.03%) both losing significant ground. Matters weren’t helped by some weaker US data, which added to the risk-off tone, leading to clear signs of financial stress across several asset classes. Indeed, Bitcoin (-2.92%) fell for a 4th consecutive session, credit spreads widened on both sides of the Atlantic, and silver (-10.67%) posted another sharp decline.

Tech stocks were in the driving seat of yesterday’s selloff, although unlike some sessions recently, the move was a broad-based one as investors reckoned with the AI-led disruption of various industries. In terms of the movers, Cisco Systems (-12.32%) was one of the worst performers, posting its worst daily performance since 2022 as investors reacted to its latest earnings. On some days, that would make the worst performer in the entire S&P, but there were 7 companies that saw a double-digit decline yesterday, which just shows the adjustment taking place. One of those double-digit declines was CH Robinson Worldwide (-14.54%), as global logistic companies were the latest industry to see artificial intelligence concerns as a very small AI logistics company called Algorhythm Holdings (formerly a Karaoke company) said its SemiCab platform helped customers scale freight volumes by 300% to 400% without a corresponding increase in headcount. The Russell 3000 trucking index fell -6.64% as companies of all size reacted to the news.

Old fears were rekindled within commercial real estate as well as CBRE (-8.84%), a commercial real estate company, saw large losses for a second day following comments from their CEO saying “If there are less office workers in the long run as a result of AI, there will be less demand for office space. That would be a long-term trend to unfold.” So, the market continues to price in further AI disruption across industries, sometimes in the most abstract way.

S&P Financials (-1.99%) also saw a sharp decline, as the KBW Bank Index (-3.21%) posted its worst performance since October. And there were signs of the selloff broadening out, with the equal-weighted S&P 500 (-1.31%) falling back from its record high the previous day, whilst Europe’s STOXX 600 (-0.49%) also fell back from Wednesday’s record. European credit markets were relatively steady as EUR IG was unchanged at 75bps, while EUR HY spreads were just 1bp wider to 264bps. USD IG spreads were 2bps wider to 77bps and USD HY spreads moved 12bps wider to 275bps.

Looking forward, attention will today turn to the US CPI print for January, which is a couple of days later than expected because of the partial government shutdown. This is an important one, because markets are still expecting further rate cuts under a new Fed Chair, but stronger data like the jobs report on Wednesday has led to a bit more doubt as to whether that’s still possible. So another hawkish print today would further push in that direction, particularly given this quarter is already seeing a decent fiscal impulse from the Trump tax cuts.

In terms of what to expect, our US economists forecast that monthly headline CPI would be at +0.26% in January, down from +0.31% in December. And if realised, that would take the year-on-year CPI rate down to +2.5%. However, they think that headline inflation would be weighed down by a -2.4% decline in motor fuel prices, meaning that core CPI should be relatively strong at +0.35% on the month.

Otherwise, they’re keeping an eye on tariff-related strength in core goods, as they expect a continued impact in categories like household furnishings and supplies, as well as apparel. For more details, click here for their preview and to register for their subsequent webinar.

Ahead of that release, Treasury yields fell across the curve, driven by the wider risk-off move as well as some weaker US data. For instance, the weekly initial jobless claims were a bit higher than expected, coming in at 227k in the week ending February 7 (vs. 223k expected). Meanwhile, existing home sales were down to an annualised rate of 3.91m in January (vs. 4.15m expected). So that further dampened sentiment, and expectations for Fed rate cuts this year moved back up again. For instance, the amount of cuts priced in by the December meeting was up +5.3bps on the day to 53bps. And in turn, yields on 2yr Treasuries (-5.4bps) fell back to 3.456%, whilst the 10yr Treasury yield (-7.4bps) fell to 4.098%. Yields have moved back up +1 to +1.5bps across the curve this morning.

Oil prices had already been moving lower along with other risk assets, but the selloff gained momentum amid a bevy of headlines that pointed to greater supply. Brent crude futures closed -2.71% lower on the day, finishing at $67.52/bbl. First, there were comments from US Energy Secretary Wright that China had bought crude from the US that was previously purchased from Venezuela. This was followed by comments later in the day from Interior Secretary Burgum, who said during an event in Washington that the US would be selling Venezuelan oil to China at global market price levels. Bloomberg reported that Venezuelan officials are set to grant more oil permits to Chevron and Repsol, adding credence to the potential for further supply in the medium term. Staying with the US, President Trump reiterated his preference to “reach a deal” with Iran and said that it could come together “over the next month, something like that.” Additionally, there was reporting from Bloomberg that showed Russia had included returning to the dollar settlement system as part of a greater re-framing of the US-Russia economic relationship.

Staying in commodities, gold saw a sharp sell-off of their own despite its traditional haven status. The story of Russia returning to the dollar payment system probably contributed. Gold prices fell -3.19% to $4922/oz, while silver (-10.67%) and copper (-3.02%) also saw outsized moves. As noted above there was more crypto weakness as bitcoin fell -2.92% and is under 5% away from last week’s lows, which was the lowest level since October 2024.

Earlier in Europe, the main highlight yesterday was the EU leaders summit in Belgium. At the summit, EU leaders sought to move forward with reforms to bolster Europe’s economy and improve regional coordination. There were many proposals with various champions. French President Macron pushed a “Buy European” agenda, which remains on the table as European Council president Costa said, “ I feel that there is a broad agreement on the need to use (European preference) in the selected strategic sectors, in the proportional and targeted way.” German Chancellor Merz and Italian PM Meloni called for greater deregulation, with PM Meloni saying that the EU “ cannot continue to hyperregulate…there's no time to lose.” On the matter of greater joint debt, most leaders were calling for greater stimulus, however Merz seemed unmoved saying, “We have taken on European debt in exceptional situations -- but those were exceptional situations…We have to make do with the money we have."

Across the Channel, UK gilts outperformed after the latest UK GDP print came in softer than expected. It showed Q4 GDP up by +0.1% (vs. +0.2% expected), which left annual GDP growth for 2025 at +1.3%. So with the downside surprise in the Q4 number, investors priced in more rate cuts from the Bank of England this year, and the 2yr gilt yield (-2.1bps) fell to just 3.60%, its lowest level since August 2024, whilst the 10yr gilt yield (-2.4bps) fell to 4.45%. And elsewhere in Europe, there was a smaller decline that left yields on 10yr bunds (-1.3bps), OATs (-1.5bps) and BTPs (-1.3bps) lower as well.

In Asia, the AI related sell-off continues, albeit after a strong week in the region. The Hang Seng (-2.10%) stands out as the largest underperformer, with the CSI (-0.92%) and the Shanghai Composite (-0.85%) also lower. The Nikkei (-1.22%) is also weak but its gains so far this week are close to +5.5% post the election results. Elsewhere the S&P/ASX 200 (-1.37%) is also lower after a firmer week with the KOSPI (-0.23%) outperforming. S&P 500 and Nasdaq futures are down jus over a tenth of a percent with European ones back up a similar amount. As we go to print the FT is reporting that the US is planning to roll back some steel and aluminium tariffs that nods to our view that the tariffs headlines this year, whilst very noisy, will likely lean in a dovish direction ahead of mid-terms where the cost of living issue is likely to be decisive.

Early morning data revealed that China’s new home prices continued their decline in January, reflecting weak demand that is likely to further burden the country’s financially constrained developers. Prices decreased by -0.4% month-on-month, matching the decline observed in the previous month.

Looking at the day ahead, data releases include the US CPI print for January, and the second estimate of Euro Area GDP for Q4. Otherwise, central bank speakers include ECB Vice President de Guindos, and the BoE’s Pill.