Futures Flat Ahead Of Final Macro Data Dump Of 2025

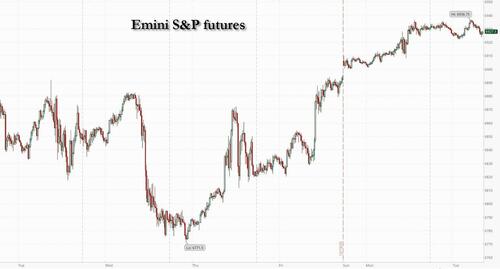

US equity futures are flat, pointing to a muted open off the overnight session highs on the last full trading session before Christmas, as traders await the last remaining data sets of 2025 to see whether they could materially change expectations for Federal Reserve interest-rate cuts. As of 8:0am ET, the S&P 500 is little changed after a three-day rally that has pushed the benchmark within reach of a new all-time high; Nasdaq futures are down 0.1% with Mag 7 names mixed. European stocks are buoyed by a 7% surge in the shares of Novo Nordisk after the Danish firm won US approval to sell a pill version of its obesity drug Wegovy. US Treasuries steadied after days of losses, with the 10-year yield declining two basis points to 4.15%. The dollar fell to the lowest level since October. Gold extended its record-breaking run, setting sights on $4,500 an ounce. Copper rose past $12,000 a ton for the first time. Bitcoin fell again, failing to stage even a modest rebound. The US calendar includes ADP weekly employment change (8:15am), 3Q GDP (8:30am), November industrial production (9:15am), December Richmond Fed manufacturing index, consumer confidence (10am).

In premarket trading, Mag 7 stocks are mixed: (Tesla +0.4%, Alphabet is little changed, Microsoft +0.07%, Apple -0.05%, Amazon -0.1%, Meta is little changed, Nvidia -0.4%)

- Gold, silver and copper mining and royalty stocks climb as the metals continued to hit record highs amid rising geopolitical tensions. Barrick Mining (B) rises 1% while Hudbay Minerals (HBM) gains 1%.

- Invivyd (IVVD) climbs 1% after the FDA granted a fast track designation for the biotech’s investigational vaccine-alternative monoclonal antibody candidate for Covid prevention in individuals with underlying risk factors for severe Covid.

- Sable Offshore Corp. (SOC) soars 25% after the company said that the US Department of Transportation Pipeline and Hazardous Materials Safety Administration approved the firm’s Las Flores pipeline restart plan.

- Zim Integrated Shipping Services (ZIM) climbs 8% after the company said it is evaluating proposals from multiple potential buyers. The review of strategic alternatives is in advanced stages.

In corporate news, department stores group Saks, facing limited options ahead of a more than $100 million debt payment due at the end of this month, is considering Chapter 11 bankruptcy as a last resort, according to people with knowledge of the situation. Johnson & Johnson was ordered to pay about $1.56 billion to a Maryland woman who blamed the company’s talc-based baby powder for causing her asbestos-linked cancer, the largest such jury verdict for an individual in 15 years of litigation. And Nvidia’s biggest Southeast Asian chip customer is facing a smuggling investigation.

The latest three-day rally pushed US stocks fractionally into positive territory for the month after a turbulent start to December. Preserving those gains until the end of December would extend this winning streak to an eighth month, the longest such run since 2018.

Meanwhile, volatility is collapsing. With the VIX index at 14.11, implied volatility for US equities over the coming 30 days is near the lowest in more than a year. That reflects enduring investor optimism around strong earnings growth, slowing inflation and a soft landing for the economy.

“Volatility is sitting at the lows of the year, while credit spreads are among the most compressed we’ve seen in decades,” said Alberto Tocchio, portfolio manager at Kairos Partners. “That dynamic is helping sustain the current market bonanza, especially in an environment where trading volumes are falling sharply and many discretionary players are already on the sidelines.”

The VIX may be snoozing around a 12-month low, but investors added new short bets across US stock futures last week, leaving net positioning near neutral levels, according to Citigroup strategists. Exposure to the Russell 2000 index of small caps is now bearish.

While Tuesday’s delayed third-quarter US gross domestic product print will likely be too dated to offer a clear read on current conditions, traders will also focus on consumer data after November showed a sharp slump in confidence.

In Europe, the Stoxx 600 edges up 0.2% to touch a new all time high with the health care sector leading gains. Novo Nordisk shares rally after the Danish drugmaker won approval to sell a pill version of its blockbuster obesity shot Wegovy in the US. Meanwhile, banks underperform. Here are some of the biggest movers on Tuesday:

- Novo Nordisk shares rise as much as 7.9%, the most since August, after the Danish drugmaker won approval to sell a pill version of its blockbuster obesity shot Wegovy in the US.

- SIG Group shares gain as much as 6.8%, the most in over a month, after the Swiss food packaging maker disclosed that Swedish activist investor Cevian Capital acquired a 3.1% stake.

Asian stocks were on course to advance for a third day, helped by gains in Japan amid expectations for further interest rate hikes. The MSCI Asia Pacific Index rose as much as 0.7%, with TSMC and Sony Group among the major contributors to the climb. Equities gained in Vietnam, Taiwan and Australia, while those in Indonesia fell. Speculation that the Bank of Japan may raise borrowing costs even more buoyed Japan’s financial stocks. Analysts said the yen’s continued weakness remains a tailwind for equities, even though the currency gained slightly overnight following comments by the finance minister. The onshore benchmark CSI 300 Index climbed 0.2%, despite a downgrade by Citi on Chinese equities to neutral from overweight on less favorable earnings revisions and a lackluster macro outlook.

In FX, the Bloomberg Dollar Spot Index is down 0.4%, falling for a second day and trading at the lowest since early October. The kiwi has overtaken the yen as the G-10 outperformer, rising 0.8% against the greenback. The yen is up 0.7%, dragging USD/JPY back below 156 after another round of jawboning from Japan’s Finance Minister. The Hungarian forint falls 0.2% after Economy Minister Nagy renewed his calls for lower interest rates.

Those moves came as the dollar headed for its weakest annual performance in eight years, with the options market signaling that traders are bracing for further losses. The currency is down 8.3% this year, on track for its biggest slide since 2017. Another modest dip would mark its worst year in at least two decades. Options pricing has also turned more negative, with so-called risk reversals, which track positioning and sentiment, showing options traders are the most bearish in three months.

“The structural drivers of US dollar weakness remain intact,” wrote Patrick Brenner, chief investment officer of multi-asset at Schroders Plc. “Institutional credibility continues to erode, fiscal deficits are widening, and global reserve managers remain steady buyers of gold rather than US dollar assets.”

In rates, treasuries advance, pushing US 10-year yields down 2 bps to 4.14%. European government bonds outperform.US yields richer by 1bp to 3bp across the curve in a bull flattening move, tightening 2s10s and 5s30s spreads by 1bp and 1.2bp on the day. Treasury 10-year yields trade around 4.14%, richer by 2.5bp on the day with bunds and gilts outperforming by an additional 1.5bp and 2bp in the sector. The Treasury is selling $70 billion 5-year notes at 1pm New York, with this week’s issuance concluding with $44 billion 7-year notes Wednesday. Ahead of today’s sale, the WI 5-year yield is about 3.705% which is ~14bp cheaper than the November stop-out

In commodities, gold and silver rise 0.9% each, having notched fresh record highs earlier. Copper also hits a record above $12,000 a ton. Brent was near $62 a barrel after rising about 5% over the previous four sessions as the US continued its blockade of crude shipments from Venezuela.Bitcoin falls 0.5%.

Today's economic calendar includes ADP weekly employment change (8:15am), 3Q GDP (8:30am), November industrial production (9:15am), December Richmond Fed manufacturing index, consumer confidence (10am

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini little changed

- Russell 2000 mini little changed

- Stoxx Europe 600 +0.2%

- DAX +0.2%

- CAC 40 -0.1%

- 10-year Treasury yield -2 basis points at 4.15%

- VIX little changed at 14.04

- Bloomberg Dollar Index -0.4% at 1201.58

- euro +0.3% at $1.1796

- WTI crude little changed at $58.03/barrel

Top Overnight News

- Pill Version of Wegovy Is Approved for Use in the US: WSJ

- Japan issues sternest intervention warning, says yen deviating from fundamentals: RTRS

- China’s Sprint for Tech Dominance Can’t Hide an Economy Full of Holes: WSJ

- Car Payments Now Average More Than $750 a Month. Enter the 100-Month Loan: WSJ

- Copper Hits $12,000 for First Time as Tariff Trade Upends Market: BBG

- Silver rises above $70/oz for the first time ever, gold rises to record $4500

- Russian air attack on Ukraine kills three and sparks sweeping outages: RTRS

- Ukraine's Zelenskiy says several draft documents ready after Miami talks: RTRS

- South Africans dragged into Russia's war in Ukraine dig trenches, dodge bullets: RTRS

- Russian Oil Stuck at Sea Booms as Tanker Logjams in Asia Expand: BBG

- Trump is mulling giving 775 acres of federal wildlife refuge to SpaceX: NYT.

- DOJ Releases Fresh Tranche of Epstein Files as Pressure Mounts: BBG

- A Small Nebraska Town Is Reeling From the Exit of Meatpacking Giant Tyson: WSJ

- Retail investors to have more sway over Wall Street after record year: RTRS

- The AI Boom Is Making Real-Estate Investors Rich—and Exposing Them to Risk: WSJ

- Trump’s First-Term Trust Buster Is Now Working to Get Paramount Its Deal: WSJ

A more detailed look at global markets courtesy of Newsquawk

APAC stocks eventually traded mixed after initially taking their cue from Wall Street, although volumes and news flow remained subdued as markets wound down for the holiday period. ASX 200 was underpinned by strength in gold miners after the yellow metal printed a fresh all-time high near USD 4,500/oz, supported by a softer USD and ongoing geopolitical tensions. Nikkei 225 initially saw shallower gains than peers as a firmer yen, following official jawboning, capped upside for the index, whilst further gains in the JPY later took the index into the red. KOSPI extended its tech-led rally, with Samsung Electronics shares pushing toward near all-time highs. Hang Seng and Shanghai Comp initially tracked the broader risk tone, while fresh region-specific catalysts remained scarce. Hang Seng later gave up earlier gains.

Top Asian News

- Japanese Finance Minister Katayama declines to comment on forex levels or interest rates, and said Japan will take appropriate action and reiterates they have a "free hand" to respond to excessive moves in the JPY. FX moves after the BoJ press conference are speculative and not reflecting fundamentals. The market has stabilised somewhat since yesterday.

European bourses are mixed, with macro newsflow light. On the micro side, Novo Nordisk (+6.7%) said its oral Wegovy pill has been approved in the US for weight management after showing 16.6% weight loss in the OASIS 4 trial, and it plans a US launch in January 2026. European sectors have opened mixed with a slight positive bias. Health Care (+1.1%), to no surprise, leads due to gains in Novo Nordisk (+6.7%) after US approval of its weight-management drug. Utilities (+0.4%) and Food, Beverage and Tobacco (+0.4%) are also near the top, however, this is likely a rebound from yesterday’s underperformance. Banks (-0.3%), Consumer Products & Services (-0.3%) and Construction (-0.2%) lag, with little fresh newsflow driving moves.

Top European News

- EU is preparing checks on imported plastics and other measures to shore up its recycling industry, according to FT.

- European Car Sales +2.4% to 1.08mln vehicles in November, according to Bloomberg citing ACEA.

- Novo Nordisk (NOVOB DC) said Wegovy pill is approved in the US as the first oral GLP-1 treatment for weight management after showing 16.6% weight loss in the Oasis 4 trial, and said it plans to launch the drug in the US in January 2026. US-listed NOVO shares +5% after market. Eli Lilly -1.2% after market.

- US President Trump said he told French President Macron that France has to raise its drug prices.

Central Banks

- RBA Minutes: Board discussed whether a rate increase might be needed at some point in 2026; holding the cash rate steady for some time could be sufficient to keep the economy in balance. October CPI suggested a risk that Q4 inflation could also be higher than forecast. The board discussed whether a rate increase might be needed at some point in 2026. Recent data suggested risks to inflation had lifted to the upside. The board judged it was too early to know whether the rise in inflation would prove persistent. The board said it would take a little longer to assess the persistence of inflation. Holding the cash rate steady for some time could be sufficient to keep the economy in balance. Policy would be assessed at future meetings, with Q4 inflation data available before the February meeting. Some board members felt conditions were no longer restrictive, while others felt they were a little restrictive. The impact of the recent rise in bond yields on financial conditions needed to be assessed. The economy was operating with excess demand and it was not clear if financial conditions were tight enough. The labour market was judged to still be a little tight, with the output gap positive. The full impact of policy easing earlier in the year was yet to be felt. Measures of capacity utilisation pointed to supply constraints. Little immediate action in AUD or ASX 200.

FX

- DXY is lower and trades at the bottom end of a 97.88 to 98.23 range; really not much driving things for the USD recently, with newsflow exceptionally light, but perhaps facilitated by a strong JPY (see below). Nonetheless, traders will keep a keen eye out for Q3 GDP Advance/PCE, as well as Durable Goods (Oct), due at the same time.

- JPY is amongst the outperformers, with the strength seemingly a continuation of the price action seen following fresh jawboning from Finance Minister Katayama; as a reminder, she said that they have a “free hand” to take bold action in the FX market if needed. USD/JPY drifted lower from an overnight high of 157.07, down below the 156.00 mark, where the pair currently resides.

- Antipodeans also gained throughout overnight trade and into the European session, boosted by ongoing strength in metals prices (XAU now eyeing USD 4.5k/oz to the upside). Earlier, the Aussie showed little reaction to the RBA minutes, which indicated the Board debated whether a rate increase might be required at some point in 2026. Elsewhere, for the Kiwi specifically, NZD/USD breached 0.58 to the upside, which allowed the pair extend beyond the level, which can explain some of the outperformance this morning.

- The GBP and EUR are steady vs the broadly weaker USD. Really not much driving things for either at the moment; the single currency really only has geopolitical updates to digest heading into the Christmas holidays. For Cable, the pair extended beyond the 1.3500 mark to make a peak of 1.3518; the next level to the upside includes the October 1 high at 1.3527.

Fixed Income

- 10yr JGB futures outperformed, firmer by over 40 ticks at best, while the yen simultaneously reversed its early-week weakness following verbal jawboning from Japanese Finance Minister Katayama. JGB futures then rose further after Japanese PM Takaichi said Japan's national debt is still high, and rejected any "irresponsible bond issuance or tax cuts", via a Nikkei interview.

- USTs follow JGBs higher, with a lack of domestic newsflow helping things for the benchmark. Currently trading higher by a handful of ticks, and towards the upper end of a 112-11+ to 112-15+ range. Ahead, focus turns to some key US data points, which include US GDP Advance/PCE (Q3) and Durable Goods.

- Bunds, Gilts and OATs also follow suit. For the latter, OATs remain in focus after yesterday's cabinet meeting made the use of Article 49.3 more likely. For the near-term fiscal needs, the Assembly and Senate are set to finish debating and then adopt text to allow the government to continue financing basic public services into early-2026, despite the absence of a 2026 budget deal. A point that has contributed to OAT strength, as the benchmark marginally outmuscles Bunds, causing the OAT-Bund 10yr yield spread to probe 70bps to the downside.

- China's Finance Ministry expects aggregate government bond issuance to remain "elevated" in 2026, according to Reuters citing sources.

Commodities

- WTI and Brent chop around USD 58/bbl and USD 62/bbl, respectively, in tight ranges as crude benchmarks consolidate following Monday’s bid higher. Geopolitics has resurfaced in recent sessions as the near-term driver for crude prices, with tensions between the US and Venezuela rising and a potential escalation between Israel and Iran. However, a lack of updates throughout the APAC session has led to a muted start to Tuesday’s session.

- Spot XAU has followed on from Monday's trend, peaking just shy of USD 4500/oz as the European morning gets underway, with rising geopolitical tensions acting as a new driver for the yellow metal. The recent US-Venezuela developments, specifically the blockaded oil tankers, have urged investors to look for safer places to place their investments.

- 3M LME Copper traded muted in a tight c. USD 60/t band throughout APAC trade, seemingly not benefiting from the further extension in gold and silver prices. As the European session gets underway, the red metal lifted as the positive risk tone in equities fed through into copper. Thus far, 3M LME Copper trades just shy of the ATH formed in Monday’s session, currently at USD 11.98k/t.

- China crude steel output in November 69.6mln tonnes, -10.9% Y/Y; global crude steel output in November 140.1mln tonnes, -4.6% Y/Y, via WorldSteel.

- Thai Central Bank Chief said there will be a set maximum trading volumes per major gold trader.

- Thailand's Finance Minister is looking to implement a tax on gold trading online.

Geopolitics

- Russia's Ryabkov said Russia and US held new round of talks on 'Irritants'; main issues remain unresolved, via IFX. New round of contacts may take place in early spring.

- Polish Armed Forces said they have scrambled jets following Russian strikes on Ukraine.

- Russia is again attacking Ukraine’s energy infrastructure, according to Ukraine’s energy ministry.

- Russia conducts airstrikes on Ukrainian capital Kyiv, according to Ukraine's military.

- Ukrainian President Zelensky said "Negotiations to end the war are "close to achieving a result", according to Sky News Arabia.

- Russia's Kremlin states Ukraine peace talks over the weekend did not achieve breakthrough.

- Russia needs to understand to what extent the US work with Ukraine and Europe on peace plan corresponds to spirit of earlier Putin-Trump Alaska summit, via TASS.

- Odesa regional governor said Russian forces launch new evening drone attack on Ukraine's Odesa, damaging port facilities and civilian ship.

- "Israel's Channel 12: Israel fears miscalculation with Iran, assures Washington that it will not take risks", via Sky News Arabia.

US Event Calendar

- 8:30 am: US Oct. Durable Goods Orders, est. -1.5%, prior 0.5%

- 8:30 am: US 3Q GDP Annualized QoQ, est. 3.2%, prior 3.8%

- 8:30: US 3Q GDP Price Index, est. 2.7%, prior 2.1%

- 8:30 am: US 3Q Personal Consumption, est. 2.7%, prior 2.5%

- 10 am: US Dec. Richmond Fed Index, est. -10, prior -1

DB's Jim Reid concludes the overnight wrap

This is the last EMR of 2025, before we resume normal service again on January 2. Many thanks for reading and for your interactions this year and wishing you all a Merry Christmas and a Happy New Year.

Markets broadly saw another risk-on move yesterday, with the S&P 500 (+0.64%) posting a third consecutive gain that left the index less than half a percent beneath its record high. However, the global bond sell-off showed few signs of relenting either, with yields reaching new milestones across several countries. The biggest story was undoubtedly the Japanese move, where the 10yr yield (+6.2bps) closed at 2.07% yesterday, the highest since 1999. But that was echoed around the world and yesterday saw 10yr bund yields (+0.2bps) inch above their March peak to close at 2.90%, marking their highest level since October 2023. That ratchet higher for yields is a significant story given that the fiscal picture is likely to remain a big theme in 2026, with many countries running budget deficits on a scale that’s rare outside of wars or major recessions.

As a reminder on Japan, yields increased sharply after the Bank of Japan’s 25bp rate hike on Friday morning, given they signalled that more rate hikes were still to come. Interestingly though, we then saw a decent bout of FX weakness, which in turn led to uncertainty about even more hikes, given the potential need to offset that inflationary impulse. However, that FX weakness began to stabilise yesterday, as finance minister Satsuki Katayama said in a Bloomberg interview yesterday that Japan had a “free hand” to take action in the FX markets, and that “The moves were clearly not in line with fundamentals but rather speculative”. So the yen strengthened after those headlines came out and was up +0.44% against the US dollar yesterday, and this morning it’s the top-performing G10 currency, strengthening a further +0.66% against the US dollar. Our FX strategist Mallika Sachdeva has written more about what happens now in Japan and she says that it makes sense for policymakers to look for measures to stabilise FX

This morning, we’ve seen some of those bond moves begin to ease as well, with yields on 10yr Japanese (-4.4bps) and Australian (-3.2bps) yields coming down, alongside those on 10yr Treasuries (-0.8bps). That comes as Japan’s PM Takaichi said in an interview today that she wouldn’t implement “irresponsible” tax cuts. Meanwhile, there’ve been further equity gains across Asia, with the CSI 300 (+0.51%), the Shanghai Comp (+0.34%) the Hang Seng (+0.18%) and the KOSPI (+0.30%) all advancing. The one exception has been the Nikkei (-0.27%) amidst an underperformance from tech stocks, but other Japanese indices like the TOPIX (+0.19%) are still higher this morning.

Otherwise yesterday, the bond sell-off was a big story outside of Japan too. For instance, in Europe 10yr bund yields (+0.2bps) hit their highest since October 2023 at 2.90%, taking them above their peak in March shortly after the fiscal stimulus announcements. They had been even higher at the intraday peak, but that was pared back after we heard from Isabel Schnabel of the ECB’s Executive Board. She said that “At the moment, no interest-rate increase is to be expected in the foreseeable future”. That was significant, because it was Ms. Schnabel who’d said earlier this month that she was “rather comfortable” with expectations about the next move being a hike, which led investors to price in a growing probability that would happen as soon as 2026. But after the latest interview, investors dialled back the likelihood of a 2026 rate hike even further, and the more policy-sensitive 2yr German yield (-0.6bps) ultimately closed slightly lower.

For US Treasuries, it was mostly a similar story of higher yields yesterday. That came as futures slightly dialled back their expectations for rate cuts next year, now pricing in 58bps by the Dec 2026 meeting, down from 60bps on Friday. In part, that was thanks to the ongoing rebound in oil prices, as that renewed concerns about inflationary pressures, with Brent crude (+2.65%) posting a 4th consecutive increase to $62.07/bbl. And we’d also heard from Cleveland Fed President Hammack over the weekend, who said her base case was that “we can stay here for some period of time until we get clearer evidence that either inflation is coming back down to target, or the employment side is weakening more materially”. So by the close, the 10yr yield (+1.6bps) was up to 4.16%, and notably, the 10yr real yield (+2.5bps) was up to 1.91%, its highest level in 4 months.

Yet despite that rise in nominal and real yields, which normally dampen investor appetite for precious metals that pay no interest, the rally for gold and silver continued to power forward yesterday. By the close, gold (+2.41%) had hit a new record of $4,444/oz, and silver (+2.80%) was also at a new peak of $69.04/oz. Moreover, both have seen further gains this morning, with gold up another +0.78% to $4,478/oz, whilst silver (+0.53%) is up to $69/40/oz. So that now brings their YTD gains to 71% and 140% respectively, which in both cases is their strongest annual performance since 1979.

In the meantime, US equities put in a decent performance as well, with the S&P 500 (+0.64%) back into positive territory for December again. So that currently leaves it on track for an 8th consecutive monthly gain for the first time since January 2018. The advance yesterday was its third consecutive move higher, and it was a broad-based move that saw over three-quarters of the index advance. Moreover, the Magnificent 7 (+0.54%) also posted a third consecutive gain to close just over 1% beneath its own record high. However, in Europe, the picture wasn’t quite as rosy, with the STOXX 600 (-0.13%) posting a modest decline.

Looking forward, today we’ll see the last batch of US data before Christmas. That includes the delayed Q3 GDP print, although that’s backward-looking and covers the period before the shutdown. However, a more recent piece of data will be the Conference Board’s consumer confidence reading for December. Remember that in November, the last reading was the lowest since the Liberation Day turmoil in April, so that will be in the spotlight given the recent downtick in sentiment indicators.

Finally on the day ahead, aside from the Q3 GDP and the Conference Board reading, today’s US data releases include industrial production for November, preliminary durable goods orders for October, and the Richmond Fed’s manufacturing index. Otherwise from central banks, the Bank of Canada will publish their summary of deliberations for the December policy decision.