Futures Flat On Last Trading Day Of 2025, Silver Slides

Stocks are ending a third straight year of double-digit gains in subdued fashion as an expected seasonal rally fails to gain traction. Silver’s volatile ride extended to another session, with the metal tumbling after the CME hiked margins for the second time in three days. As of 8:15am ET, S&P 500 futures fell 0.1% and well off session lows, after a stretch of post-Christmas losses pared the benchmark’s advance for 2025 to 17%, just shy of the 20%+ gains 2021, 2023 and 2024. Nasdaq 100 contracts were down 0.3%.Both indexes have drifted lower for the past three days amid a rotation out of growth and momentum stocks and into value and quality names in seasonally. Silver plunged as a run of price moves of 5% or more entered a fourth day. The dollar is steady as it heads for an annual decline of about 8%, the steepest since 2017. Treasury yields are ticking lower after Tuesday’s FOMC minutes offered nothing to shake expectations rates will be left unchanged when policymakers meet again in January, with further cuts likely later in the year. The only economic data on today's calendar is the weekly initial claims which printed far below expectations at 199K (est.218K).

In premarket trading, Mag 7 stocks were mostly lower (Nvidia +0.4%, Tesla +0.3%, Microsoft -0.1%, Apple -0.2%, Amazon -0.1%, Meta -0.1%, Alphabet -0.3%). With a 66% year-to-date rally, Alphabet leads the group in 2025.

- Nike (NKE) is up 2.6% after CEO Elliott Hill reported the purchase of about $1 million in shares.

- Vanda Pharmaceuticals (VNDA) jumps 21% after the biopharmaceutical company said the US FDA has approved Nereus (tradipitant) for the prevention of vomiting induced by motion.

In corporate news, Warner Bros. Discovery Inc. plans to once again reject a takeover bid from Paramount Skydance Corp., according to people familiar with the company’s thinking. Among the board’s concerns, Paramount has yet to increase its offer, which Warner Bros. earlier rejected as inferior to Netflix’s offer. Michael Burry, the money manager made famous in The Big Short, denied betting against Tesla shares, despite calling the company “ridiculously overvalued” earlier this month.

Investors have reaped strong returns this year in a market that has been powered by optimism about the vast economic potential of artificial intelligence. Of course, as Bloomberg notes, it hasn’t been a smooth ride, though, with traders weathering swings triggered by US trade policies, geopolitical tension and concern over lofty valuations. And while many expected a Santa rally, the year’s momentum faded in the final days of December, as traders delay big decisions until after the holiday period, having already banked strong returns. The post-Christmas losses pared the S&P's 2025 advance to 17%, just shy of the 20%+ gains 2021, 2023 and 2024.

“After an excellent year in equity markets, and with positioning close to highs in late November, portfolio and fund managers may have been closing their bets and realigning them to benchmark,” said Roberto Scholtes, head of strategy at Singular Bank. “Our base case is for the bull run to continue, albeit with more volatility and resulting in mid-single digit returns.”

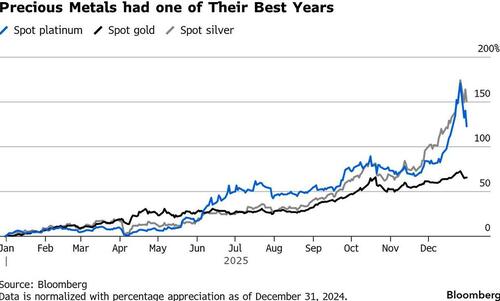

While things remain subdued in equities, silver’s gyrations continue. Wild price swings are prompting CME Group to raise margins on precious-metal futures for the second time in a week. After an almost unstoppable rise, the two metals have recorded a series of swings in December and erased some gains as investors booked profits. Both commodities remain on track for their best year since 1979.

Elsewhere, Xi Jinping said China is set to meet its economic targets for 2025, with growth expected to reach “about 5%” even though in reality it is a fraction of that. China also blasted Western criticism of its most intrusive military drills ever around Taiwan as its armed forces appeared to wrap up the maneuvers.

The end of 2025 also means that Warren Buffett’s famed tenure as CEO of Berkshire Hathaway is officially coming to a close, as the 95-year-old hands over the reins to successor Greg Abel into the new year.

In Europe, the CAC 40 is down 0.6% while the FTSE 100 drops 0.2%, with both indexes set to close early. Bourses in Germany and Italy are shut all day. Mining and technology stocks are leading declines on the Stoxx 600.

Asian equities wrapped up their best year since 2017 on a more hesitant note. Most regional indexes are under pressure, with Hang Seng Tech and ChiNext leading the retreat. Taiex is a bright spot following an almost 1% rally. Several markets are already shut for the year, including Japan and South Korea.

In FX, the dollar is steady as it heads for an annual decline of about 8%, the steepest since 2017, rattled first by Trump’s tariffs then by Fed rate cuts. The recent advance did little to prevent the greenback from heading toward its worst annual retreat in eight years, with investors saying more declines are coming if the next chief of the Federal Reserve opts for deeper interest-rate cuts than currently expected. The kiwi is the weakest of the G-10 currencies, falling 0.4% against the greenback

In rates, treasuries weakened after of the final economic data release of 2025, with the 10-year yield rising 3 basis point to 4.15% after earlier falling 2bps. Applications for US unemployment unexpectedly tumbled to just 199K in the week ended Dec. 27, far below estimates of 218K.

Meanwhile, Bitcoin traded near $88,800. The digital currency has settled into a range of roughly $85,000 to $95,000 following a crash in October that has put it on pace for a first annual loss in three years. After kicking off 2025 with a rally that was spurred by optimism about the crypto-friendly policies of the second Trump administration, Bitcoin was hit by the uncertainty surrounding US tariffs.

In commodities, silver drops 6% to around $72/oz after the CME Group said they will raise margins on precious-metal futures for the second time in the space of a week. Gold falls 0.7%. Oil headed for its steepest annual loss since the start of the pandemic in 2020, in a year that has been dominated by steadily rising supplies across the globe. Brent steadied close to $62 a barrel, with traders’ near-term focus on an OPEC+ meeting at the weekend, a bearish US industry report and American policies toward Russia, Iran and Venezuela.

Market Snapshot

- S&P 500 mini -0.3%

- Nasdaq 100 mini -0.4%

- Russell 2000 mini -0.3%

- Stoxx Europe 600 -0.2%

- CAC 40 -0.6%

- 10-year Treasury yield -1 basis point at 4.11%

- VIX +0.6 points at 14.88

- Bloomberg Dollar Index little changed at 1204.03

- euro -0.1% at $1.1733

- WTI crude +0.3% at $58.14/barrel

Top Overnight News

- OpenAI Is Paying Employees More Than Any Major Tech Startup in History: WSJ

- Drugmakers raise US prices on 350 medicines despite pressure from Trump: RTRS

- Xi Touts China’s AI, Chip Wins In Triumphant New Year’s Speech: BBG

- Xi Declares China’s Economy Set to Hit 5% Growth Goal in 2025: BBG

- From battleships to buildings: Trump's name is everywhere: RTRS

- Bankers Are Gearing Up for Another Onslaught of Monster Deals in 2026: WSJ

- Meta created ‘playbook’ to fend off pressure to crack down on scammers, documents show: RTRS

- US Virgin Islands sues Meta over ads for scams, dangers to children: RTRS

- Meta tolerates rampant ad fraud from China to safeguard billions in revenue: RTRS

- World’s Richest Added a Record $2.2 Trillion in Wealth This Year: BBG

- Oil Tanker Pursued by U.S. Seems to Claim Russian Protection: WSJ

- Boston Went Big on Luxury Condos. The Buyers Didn't Show Up: WSJ

- Finland Takes Control of Ship Suspected of Undersea Cable Damage: BBG

- Trump’s Latest Venezuela Tactic: Revealing a Secret Strike to the World: WSJ

- Palestinian Authority Sparks Fury by Cutting Prisoner Payments: BBG

US Event Calendar

- 8:30 am: Dec 27 Initial Jobless Claims 199k, est. 218k, prior 214k

- 8:30 am: Dec 20 Continuing Claims 1866k, est. 1901.74k, prior 1923k