Futures Flat, Precious Metals Rebound On Last Full Trading Session Of 2025

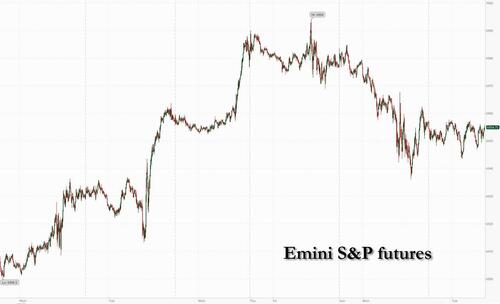

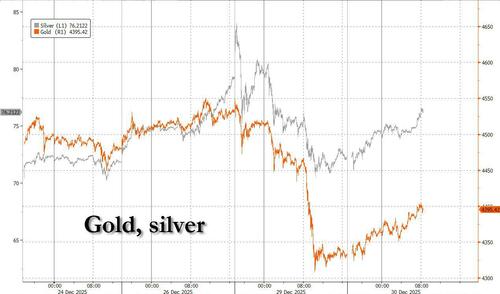

Stock struggled to find direction amid a year-end lack of catalysts and the traditional lull in trading in the final trading days of the year. After suffering one of the biggest one-day drops on record, silver and gold regained their footing after sliding from all-time highs. As of 8:15am, the S&P 500 was set to open flat, while Nasdaq futures fractionally in the red after back-to-back losses. In premarket trading, Mag 7 stocks are mixed while US silver and gold stocks are higher as the precious metals rebound from Monday’s drop with gainers including Hecla (HL) +2.4%, Coeur (CDE) +2.8% and Barrick (B) +2.4%. European stocks outperformed as rising metal prices boosted miners, while a gauge of Asian shares nudged lower. In the most notable overnight FX move, China’s onshore yuan strengthened past the key 7-per-dollar level for the first time since 2023. The greenback remained on course for its worst month since August. Treasuries fell across the curve, with the 10-year yield rising three basis points to 4.14%. Today's US economic data calendar includes the weekly ADP employment change (8:15am), the Case-Shiller home price index (9am), December MNI Chicago PMI (9:45am) and the December Dallas Fed services activity (10:30am). The Fed is set to release minutes of the December FOMC meeting at 2 p.m

In premarket trading, Mag 7 stocks were mixed (Tesla +0.7%, Nvidia +0.1%, Alphabet little changed, Microsoft -0.2%, Amazon -0.1%, Meta Platforms -0.2%, Apple -0.2%)

- Silver and gold mining stocks are higher as the precious metals rebound, with gainers including Hecla (HL) +2.4%, Coeur (CDE) +2.8% and Barrick (B) +2.4%

- Freeport-McMoRan (FCX) rises 1.9% as copper headed for the longest winning run since 2017 in a December rally powered by the prospect of more stress in the supply chain.

- OceanFirst Financial (OCFC) slips less than 1% on light trading after agreeing to buy Flushing Financial.

- T1 Energy Inc. (TE) climbs 5% after the solar equipment manufacturer announced the completion of a $160 million sale of Section 45X production tax credits.

In corporate news, Citigroup expects to post a roughly $1.1 billion after-tax loss on the sale of its remaining business in Russia to Renaissance Capital. And Meta agreed to buy Singapore-based startup Manus, an AI agent that can complete general tasks including screening resumes, creating trip itineraries and analyzing stocks in response to basic instructions. The deal values Manus at more than $2 billion. Tesla published a compilation of analyst estimates for vehicle deliveries to its website, and the averages for the current quarter are more pessimistic than those gathered by Bloomberg.

Global equities are on track for a third straight annual gain in a year when European and Asian stocks trounced the S&P 500. With news flow and trading volumes generally low, investors will focus on the release of minutes from the Federal Reserve’s December meeting for clues about the interest-rate path for 2026. Tuesday also marks the last trading session of the year for many equity markets, including Germany, Japan and South Korea.

“The overriding theme is that global stock indices have lost momentum into year-end,” wrote Kathleen Brooks, research director at XTB. “There are plenty of reasons for this, including decent returns for 2025, and investors waiting to make big trading decisions until after the Christmas break.”

Still, as Bloomberg notes, investors have reason to be optimistic heading into the new year. MSCI’s gauge for global stocks has climbed an average 1.4% in January over the last 10 years and advanced in six of those instances, Bloomberg data show.

The dollar and Treasury yields are marking time before the 2 p.m. ET release of minutes from the Fed’s December meeting, which saw a third consecutive cut. Amid signs of growing division about where policy heads next, rates may remain on hold until a new chair is in place. Trump teased that he has a preferred candidate to succeed Jerome Powell, but is in no hurry to make an announcement. Wall Street rate strategists, with several notable exceptions, anticipate stable-to-higher Treasury yields in 2026, even with the Fed expected to cut rates as many as three more times.

For another session, precious metals were in focus after trading turned volatile in the last few days. Silver rebounded 5% after tumbling 9% in the previous session. Gold was up 1.5% after losing more than 4%. Among other metals, copper headed for the longest winning streak since 2017 in a rally boosted by the prospect of more stress in the supply chain. Nickel hit the highest since March after top producer Indonesia flagged plans to cut supply.

Meanwhile, President Donald Trump said that he has a preferred candidate to be the next chair of the Federal Reserve, but is in no hurry to make an announcement. He also mused that he might fire Jerome Powell.

In geopolitics, Trump’s campaign to end the war in Ukraine hit fresh problems on Monday when Putin said he would revise Russia’s negotiating position, claiming Ukrainian drones targeted his residence. Zelenskiy dismissed Russia’s allegation as a “new lie” and warned that Moscow could be using it as a pretext to prepare an attack on government buildings in Kyiv. Oil prices are extending Monday’s gains as traders weigh geopolitical tensions from Russia to Venezuela and Iran against concern about a glut. Crude remains on course for a steep annual drop because of worries that global production will eclipse demand after OPEC and its allies ramped up output to try to recapture market share.

In Europe, the Stoxx 600 is up 0.4% and on course for a record close. Mining stocks are outperforming, tracking gains across most of the metals complex. Banks also outperform. Here are some of the biggest movers on Tuesday:

- Fresnillo shares climb as much as 3.7% after Citigroup Inc. analysts boosted their price target on the company while maintaining a buy rating, to take account of higher silver and gold prices.

Earlier in the session, Asian equities edged lower, snapping a seven-day winning streak, as losses in Taiwan and Japan offset gains in Hong Kong. The MSCI Asia Pacific index fell 0.1%, with TSMC and Hon Hai Precision Industry Co. among the biggest drags. Tuesday marked the last trading day of the year for several Asian markets, including Japan, South Korea and Thailand. The Philippines remained closed for a holiday. Some of the region’s tech shares tracked a selloff in US peers ahead of the year-end. China’s new round of military drills around Taiwan also weighed on investor sentiment. Meanwhile, it was a busy day for stock market listings in Hong Kong, with some of the debuts trading mostly higher. Insilico Medicine Cayman TopCo, an AI drug discovery startup, jumped as much as 48%.

In FX, the Bloomberg Dollar Spot Index is little changed. The euro is flat with little reaction seen after Spanish harmonized CPI slowed as expected.

In rates, treasuries are trading near session lows as US trading gets under way for the year’s final full session; cash and futures markets plan early closes for Wednesday, when the Bloomberg Treasury index will rebalance at 1 p.m. New York time with a 0.06-year duration extension estimated. Yields are higher by about 2-3bp across tenors, the 10-year near 4.14%, with curve spreads little changed. Bunds are a touch lower while gilts inch higher. Treasuries are headed for a small monthly loss amid signs of US economic resilience, yet still on pace for their best annual performance since 2020 following three Fed interest-rate cuts in response to weakening labor-market conditions. Swap contracts for predicting Fed moves price in low probability of a rate cut for the next policy decision on Jan. 28 but fully price one in by mid-year and two by year-end.

In commodities, spot silver rises 4% while gold and most base metals are also in the green. WTI crude futures climb 0.4% to $58.30 a barrel.

US economic data calendar includes weekly ADP employment change (8:15am), October FHFA house price index and S&P Cotality home price gauges (9am), December MNI Chicago PMI (9:45am, several minutes earlier for subscribers) and December Dallas Fed services activity (10:30am). The Fed is set to release minutes of the December FOMC meeting at 2 p.m.; the decision to cut interest rates by a quarter point drew two dissents in favor of no action and one in favor of a bigger reduction.

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini little changed

- Russell 2000 mini +0.2%

- Stoxx Europe 600 +0.4%

- DAX +0.3%

- CAC 40 +0.3%

- 10-year Treasury yield +1 basis point at 4.12%

- VIX +0.3 points at 14.47

- Bloomberg Dollar Index little changed at 1200.33

- euro little changed at $1.1774

- WTI crude +0.5% at $58.35/barrel

Top Overnight News

- Trump Says US Forces Struck Narcotics Loading Docks in Venezuela: BBG

- Russia says its negotiating stance on Ukraine will toughen after accusing Kyiv of attack: RTRS

- China encircles Taiwan in massive military display: RTRS

- China’s Push to Master the Arctic Opens an Alarming Shortcut to U.S: WSJ

- Emboldened Activist Investors Are Circling U.S. Banks: WSJ

- Russia shows off deployment of nuclear-capable Oreshnik missiles in Belarus: RTRS

- Russia attacks Ukraine's Black Sea ports, damages civilian ship, Kyiv says: RTRS

- Facing Alawite backlash, Syria’s new leaders take controversial steps to win loyalty: RTRS

- Silver Jumps in Choppy End to Year for Metals: WSJ

- Meta Buys AI Startup Manus for More Than $2 Billion: RTRS

- AI Trade’s Next Leg Is All About Tech’s ‘Pick-and-Shovel’ Stocks: BBG

- Saudi Ultimatum Deepens Its Rift With Gulf Rival U.A.E.: WSJ

- Cancer’s Soaring Cost Wrecks Patients’ Finances in a Broken System: BBG

- Caterpillar’s Surging Stock Is Fueled by AI, Not Yellow Excavators: WSJ

- NYC Subway Says Goodbye to MetroCard, But Many Riders Already Did: BBG

US Event Calendar

- 9:00 am: Oct FHFA House Price Index MoM, est. 0.1%, prior 0%

- 9:00 am: Oct S&P Cotality CS 20-City YoY NSA, est. 1.1%, prior 1.36%

- 9:00 am: Oct S&P Cotality CS U.S. HPI YoY NSA, prior 1.29%

- 9:45 am: Dec MNI Chicago PMI, est. 40, prior 36.3

- 2:00 pm: Dec 10 FOMC Meeting Minutes