Global "Everything Rally" Pushes US Futures HIgher As "AI Disruption" Fears Fade

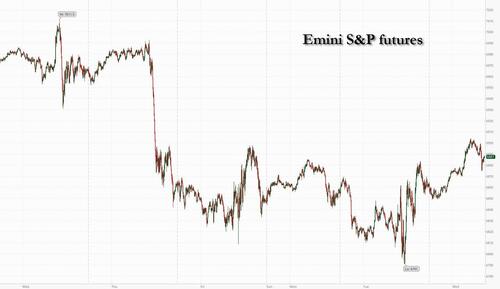

US equity futures trade near session highs, after rising much of the overnight session amid muted volumes. Yesterday, US stocks recovered their early losses starting just after the EU close and that momentum has carried through to global markets today with what appears to be re-grossing in EU and continued momentum in the Japan trade. As of 8:15am ET, S&P futures are 0.4% while Nasdaq 100 contracts rise 0.5% with broad premarket gains across software names and tech heavyweights. Mag7 names are mostly higher (NVDA +1.8%, AMZN +1.4%) and most sectors are higher pointing to what JPMorgan calls an "Everything Rally" today as the market tries to find a bottom and was less reactive to AI headlines yesterday than we have seen most of the year. Europe’s Stoxx 600 hit a record high following a slate of positive earnings. Bond yields are +1-2bp with a USD that has caught a bid. In commodities, all 3 complexes are higher with precious metals leading; brent crude is headed for the highest level in a week. Overnight we learned that Japan would $36bn (of $550bn commitment) into US infra (natgas, crude export, and synthetic diamond production). Today’s macro data focus is on Cap / Durable Goods, Housing Starts, regional Fed indicators, TIC data, and the latest Fed Minutes.

In premarket trading, Mag 7 stocks are all higher: Nvidia (NVDA) rises 1.9% after Meta Platforms Inc. agreed to deploy “millions” of its processors over the next few years, tightening an already close relationship between two of the biggest companies in the artificial intelligence industry (Amazon +1.3%, Microsoft +0.4%, Alphabet +0.2%, Apple +0.06%, Meta unch, Tesla +0.3%)

- Applied Digital (APLD) falls 8% after Nvidia reported exiting its stake in a 13F filing.

- Axcelis Technologies (ACLS) declines 13% after the semiconductor manufacturing company gave a first-quarter forecast that is weaker than expected.

- Cadence Design Systems (CDNS) climbs 6% after the electronic design automation software company reported fourth-quarter results that beat expectations and gave an outlook that is seen as positive.

- Caesars Entertainment (CZR) rises 5% after the casino operator reported same store adj. Ebitda for the fourth quarter that beat the average analyst estimate.

- Global-e Online (GLBE) rises 18% after the application software company reported fourth-quarter results that beat expectations and gave a positive forecast.

- Mister Car Wash (MCW) climbs 17% after agreeing to be taken private by Leonard Green & Partners at $7 per share in cash.

- New York Times Co. (NYT) rises 3% after Berkshire Hathaway built a stake in the publisher.

- Palo Alto Networks (PANW) tumbles 7% after the security software company gave a forecast for adjusted earnings that was weaker than expected for both the third quarter and the full year.

- Pitney Bowes Inc. (PBI) climbs 7% after the shipping and mailing software firm posted fourth-quarter earnings that topped expectations and management provided a strong 2026 profit forecast.

- Rush Street (RSI) rises 18% after the gaming company reported revenue for the fourth quarter that beat the average analyst estimate.

- Sandisk (SNDK) falls over 3% as Western Digital is selling a stake in the the flash-memory unit that it spun off.

- SimilarWeb (SMWB) falls 23% after the web services company’s fourth-quarter results missed expectations and it gave an outlook that analysts described as disappointing.

- Vita Coco (COCO) rises 6% after the beverage firm provided a strong forecast for 2026 net sales.

After months of gains fueled by optimism over AI, equity markets have turned cautious amid a clash between disruption fears and doubts that heavy spending will yield meaningful returns. The setbacks in US stocks have prompted investors to look elsewhere, with European and Asian benchmarks far outpacing the S&P 500 this year.

“It’s hard to know where the floor on valuation is going to be,” Sophie Huynh, portfolio manager at BNP Paribas Asset Management, told Bloomberg TV. “So I think there’s going to be some temptation to buy on dips.”

Apple has decoupled from the Nasdaq amid the recent AI angst: It’s seen as a safer bet because it isn’t participating in the capex bonanza and doesn’t have a major business line that’s threatened by AI. Rotation is also cropping up among regions — with renewed interest in European equities — and in the latest batch of 13F filings. Berkshire Hathaway slashed its stake in Amazon by more than 75% in the fourth quarter, while also building a stake in the New York Times, in Warren Buffett’s last new bet as chief executive officer of the conglomerate.

Rotation is also cropping up among regions — with renewed interest in European equities — and in the latest batch of 13F filings. Berkshire Hathaway slashed its stake in Amazon by more than 75% in the fourth quarter, while also building a stake in the New York Times, in Warren Buffett’s last new bet as chief executive officer of the conglomerate.

Digging into earnings estimates suggests that AI’s impact on corporate growth is seen as limited outside of Big Tech. Earnings growth estimates for the Mag 7 in 2026 have gone up to 18% from 14% in the aftermath of last year’s tariff-related selloff. For the remaining 493 companies in the S&P 500, expectations have fallen to 11% from 12.5%, according to data compiled by Bloomberg Intelligence. In other AI news, Meta agreed to deploy “millions” of Nvidia processors over the next few years, tightening an already close relationship between the pair. ION Group’s founder said investors are punishing the wrong companies after more than $2 trillion was wiped off the value of software firms in recent weeks.

Other interesting observations in 13F filings include Third Point increasing its weighting in healthcare while reducing exposure to consumer staples. Pershing Square cut its position in Alphabet and boosted its stake in Amazon, while Meta represented its biggest new buy in the fourth quarter.

In central banks, some Fed officials have begun suggesting that productivity growth from AI could mean higher rates, a view that would put them at odds with the Trump administration. The FT reported that Christine Lagarde plans to leave the ECB before her eight-year term ends in October 2027. An ECB spokesperson said that Lagarde “is totally focused on her mission and has not taken any decision regarding the end of her term.”

Analog Devices, Moody’s and Global Payments are among companies expected to report results before the market opens. Moody’s outlook for 2026 will be in focus following S&P Global’s worse-than-expected profit forecast earlier this month. Earnings from Carvana and Molson Coors follow later in the day.

In Europe, the Stoxx 600 is up 0.9%, rising for a third day and on track for a record close. Miners lead gains after Glencore reported solid full-year earnings, while chemical stocks lag as a disappointing report from IMCD weighs on the sector. BAE Systems shares jump after the defense firm predicted continued solid sales and earnings growth for the year. Bank and energy also outperform.Here are some of the biggest movers on Wednesday:

- BAE shares gain as much as 6.3% after full-year results analysts called solid and where cash flow stood out.

- Puig shares rise as much as 6.6%, the most since October, as the Spanish company’s full-year revenue beat estimates, with analysts pointing to a strong performance in its main fragrances and fashion business.

- Mediobanca shares rise as much as 9%, the most since last April, after Banca Monte dei Paschi di Siena’s board approved a plan to pursue delisting the investment bank. Paschi shares advance as much as 4.8%.

- Glencore shares rally as much as 3.5% in London after the miner reported adjusted Ebitda for the 2025 full year that beat the average analyst estimate.

- Amrize shares climb as much as 6.1%, with the building materials company hitting the highest on record since its June 2025 IPO, on strong cash returns and positive guidance.

- IMCD shares slump as much as 13%, their biggest drop in almost seven months, after the specialty chemicals maker missed expectations across all metrics.

- Bayer shares slide as much as 7.9%, reversing Tuesday’s gain following the German conglomerate’s class-action settlement plan in relation to the Roundup weedkiller litigation.

- Genmab shares fall as much as 6.9% after the biotech firm forecast full-year revenue which analysts say implies a downside to expectations.

- Carrefour shares drop as much as 5% after delivering full-year results which are seen as slightly weaker than expected.

- EssilorLuxottica shares drop as much as 3.3% to the lowest since July after Bloomberg reported that Apple is accelerating development on new wearable devices, including smart glasses.

- EFG International shares fall as much as 9.4% after an additional legal provision and rising costs “spoilt” the bank’s results by causing earnings to miss expectations.

Resurgent optimism about Europe and the benefits of German stimulus is driving investment flows into the region’s equity markets and fueling an outperformance that is expected to last. The positivity is visible in overall positioning, according to the latest Bank of America survey of the region’s fund managers. A net 35% are overweight European equities relative to global markets, up from 9% just three months earlier. “The AI scare trade is creative destruction in the making, and when one doesn’t know how it will unfold, one diversifies,” said Nicolas Domont, fund manager at Optigestion in Paris. “Investors are particularly interested in companies which have predictable order books and revenues, such as in defense.”

Asian stocks advanced, led by a rebound in Japanese shares, as many markets around the region remain shut for Lunar New Year holidays.

The MSCI Asia Pacific Index rose 0.5%, snapping a three-day losing streak. Mitsubishi UFJ and Tokyo Electron were among the biggest boosts to the index. Equities also gained in India, Australia, New Zealand and Indonesia. The announcement of Japan’s $36BN investment in US projects as part of a trade deal bolstered optimism in Tokyo. Easing trade tensions have helped support shares across the region, along with improving earnings in markets including India. Confirmation of the investment plans by Japan is positive for overall sentiment, said Tomoaki Kawasaki, a senior analyst at Iwaicosmo Securities. “If these investments help boost the US economy, that could also drive up US yields, which is a plus for financials.” Recent volatility fueled by investor concerns over the impact of AI on corporate spending and business survival has been exacerbated by low trading volumes this week. Markets in South Korea, Singapore and Malaysia reopen Thursday, while trading resumes Friday in Hong Kong.

In FX, the dollar edged higher against most major peers. The euro held its modest loss after the Financial Times reported that Christine Lagarde is expected to leave the European Central Bank before her term as president expires in October 2027. An ECB spokesperson said Lagarde hasn’t yet made a decision regarding the end of her tenure. The kiwi is the weakest of the G-10 currencies, falling 0.7% against the greenback after a dovish hold by the RBNZ. Cable is flat.

In rates, Treasuries dip, pushing US 10-year yields up 1 bp to 4.07%. Gilts outperform after UK inflation dropped to its lowest level since March 2025. UK 10-year borrowing costs fall 1 bp to 4.37%.

The Federal Reserve is due to release the minutes of its January meeting later on Wednesday. Bloomberg Economics expects the notes to show a broad consensus to hold interest rates steady after three cuts. Money markets continue to price in at least two cuts for the rest of the year. Even so, progress on inflation could give the Fed room to ease policy by 100 basis points in 2026, Bloomberg Economics said.

In commodities, brent crude futures rise 1.9% to near $68.70 a barrel, paring Tuesday’s fall. Spot silver rises 3% toward $76/oz.

Today's US economic data calendar includes December preliminary durable goods orders and housing starts and February New York Fed services gauge (8:30am), January industrial production (9:15am) and December Treasury International Capital flows (4pm). Fed speakers scheduled include Governor Bowman (1pm), and minutes of January FOMC meeting, at which rate cuts were paused, are slated for 2pm release.

Market Snapshot

- S&P 500 mini +0.4%,

- Nasdaq 100 mini +0.5%,

- Russell 2000 mini +0.4%

- Stoxx Europe 600 +0.7%,

- DAX +0.6%,

- CAC 40 +0.4%

- 10-year Treasury yield +1 basis point at 4.07%

- VIX -0.9 points at 19.38

- Bloomberg Dollar Index little changed at 1184.37,

- euro -0.2% at $1.1834

- WTI crude +0.6% at $62.68/barrel

Top Overnight News

- The Trump administration is closer to a major war with Iran than people realise, a military operation would likely be a massive, weeks long campaign that will be a joint US-Israeli attack: Axios

- US-brokered meetings in Geneva between Russia and Ukraine broke up after barely 90 minutes as Ukrainian President Volodymyr Zelenskiy accused Moscow of attempting to prolong the process: BBG

- US envoys juggle two crisis talks, raising questions about prospects for success: RTRS

- Epstein tried to build web of powerful ties across Middle East, documents show: RTRS

- A senior U.S. official on Tuesday revealed what he said were new details of an underground nuclear test blast that China allegedly conducted in June 2020. Assistant Secretary of State Christopher Yeaw said that a remote seismic station in Kazakhstan measured an "explosion" of magnitude 2.75 located 450 miles (720 km) away at the Lop Nor test grounds in western China on June 22, 2020: RTRS

- ECB President Christine Lagarde is expected to step down from her role before her term ends in October 2027. Lagarde wants to leave before the French presidential election in April next year, which would allow French President Emmanuel Macron and German Chancellor Friedrich Merz to find her replacement together: FT

- ECB’s Cipollone has no indication President Lagarde plans early resignation: RTRS

- UK inflation dropped to its lowest level since March 2025, with consumer prices rising 3% in January from a year earlier. The latest figures keep the Bank of England on track for a spring rate cut, with money markets pricing two quarter-point reductions this year: BBG.

- ‘Woke’ AI Feud Escalates Between Pentagon and Anthropic: WSJ

- Microsoft said it is on pace to invest $50 billion by the end of the decade to help expand AI to countries across the 'Global South': RTRS

- Sanae Takaichi was formally reappointed as Japan’s Prime Minister following her electoral win, allowing her to focus on budget deliberations and a trade deal with US President Donald Trump. Takaichi announced the first batch of projects as part of Japan’s $550 billion investment commitment under the trade deal, including a natural gas facility and a synthetic industrial diamond manufacturing facility: BBG

- Uber to invest over $100 million in autonomous vehicle charging amid robotaxi push: RTRS

- Land Grab for Data Centers Is One More Obstacle to Much-Needed Housing: WSJ

- UK inflation hits lowest in nearly a year at 3.0%, strengthening bets on a BoE rate cut: RTRS

- Nine Skiers Missing After Northern California Avalanche: WSJ

- Americans believe Epstein files show the powerful get a pass, Reuters/Ipsos poll finds

- Fed minutes could highlight shift in balance of risks as policymakers put rates on hold: RTRS

Trade/Tariffs

- Japanese PM Takeichi confirms to have agreed with the US on the first set of investment projects

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded higher in continued thin conditions as many regional bourses remained closed for holidays. ASX 200 mildly gained amid outperformance in real estate, tech and financials, with the latter helped by gains in Big 4 bank NAB post-earnings, although miners, materials and resources were at the other end of the spectrum after the prior day's commodities-related pressure. Nikkei 225 rallied back above the 57,000 level with sentiment in Japan underpinned by the better-than-expected trade data for January, which showed the fastest pace of increase in exports in more than three years.

Top Asian News

- Japanese PM Takaichi affirms will consider revision of constitution and wants to pass budget and tax reform bill quickly, adds to consider revision of imperial household law.

- Japan's Finance Minister Katayama said will carry out responsible fiscal policy, while keeping in mind the IMF's preliminary policy recommendation.

- IMF said if volatility hits market liquidity, the BoJ should be ready for targeted interventions, such as emergency bond buying, and that Japan should avoid cutting consumption tax as it would weaken fiscal space and raise fiscal risks.

European bourses (STOXX 600 +0.7%) are trading entirely in the green, with the IBEX (+1.1%) leading gains, closely followed by the FTSE MIB (+0.9%) and the FTSE 100 (+0.7%). European sectors are broadly in the green, with Basic Resources (+1.9%) and Banks (+1.5%) leading the way while Chemicals (-1.1%) lags. A rebound in metals prices and positive Glencore (+3.3%) earnings are helping lift the Basic Resources sector, while the Board of Monte dei Paschi approved a plan to fully integrate Mediobanca and delist the bank while preserving the brand.

Top European News

- UK Chancellor Reeves reiterates that the UK will take defense spend past 2.6% in future budgets.

FX

- G10s are mostly lower across the board; GBP remains afloat following above-expected Core and Services metrics, whilst the NZD is the clear laggard in the aftermath of the RBNZ’s decision to keep rates steady (as expected), but held a dovish skew.

- DXY is mildly firmer this morning, and currently trades at the upper end of a 97.11-97.32 range, holding just above its 21 DMA at 92.20. Further upside could see a test of the prior day’s high at 97.54. Really not much driving things for the index this morning, but could face some volatility on a) geopols, b) US data, c) FOMC Minutes.

- GBP remains resilient vs the USD strength this morning, following the region’s inflation report, with particular focus on the hotter-than-expected Services and Core metrics. In more detail, the headline printed in line with the market consensus at 3.0% Y/Y, and as such, slightly hotter than the BoE's 2.9% forecast for the period. The headline was also accompanied by a hotter-than-expected core and services figure. M/M metrics were broadly as expected, unwinding the December base effects. Taking a look at food inflation, it fell to 3.6% (prev. 4.5%); ING suggests that hawks can become “a little more relaxed about the upside risks to inflation”. ING sticks with its call for a March cut and then another by June. Market pricing shifted a little dovishly, with the probability of a March cut now seen at 95% vs 84% pre-release. Cable initially knee-jerked lower, and then immediately reversed that move to print a session peak at 1.3577; the upside then gradually petered out, to now trade within a 1.3549-1.3577 range.

- NZD is the clear underperformer this morning, following the RBNZ’s decision to keep rates steady (as expected), though the accompanying commentary held a dovish skew. In brief, the Bank stated that the committee will continue to assess incoming data carefully and if the economy evolves as expected, monetary policy is likely to remain accommodative for some time. Furthermore, it stated that inflation is most likely returning to within the committee's 1–3% target band in the current quarter and that, conditional on the central economic outlook, the OCR is projected to remain around its current level in the near term before increasing from late 2026. NZD/USD currently trades around the 0.60 mark (coincides with its 21 DMA), within a 0.5989-0.6053 range.

Central Banks

- RBNZ keeps the OCR at 2.25%, as expected, while it stated that the committee will continue to assess incoming data carefully. If the economy evolves as expected, monetary policy is likely to remain accommodative for some time. Committee is confident that inflation will fall to the 2% midpoint over the next 12 months due to spare capacity in the economy, modest wage growth, and core inflation within the target band. Inflation is most likely returning to within the committee's 1–3% target band in the current quarter.

- RBNZ Governor Breman said OCR trajectory is aligned with the anticipated evolution of the economy, adds OCR track indicates there is a possibility of a hike towards the end of the year but noted Q4 hike is not fully priced in to the OCR track.

- RBNZ Governor Breman said forward path reflects stronger economic outlook.

- Fed's Daly (2027 voter) said models show productivity gains are lifting the neutral rates, labour market shows less churn and dynamism, adds impact on neutral rate is unlikely in the near term and growth is solid, but firms cite uncertain demand.

- ECB's Villeroy said the ECB has won the battle against inflation, domestic French inflation is undershooting on temporary factors but it is not too low.

- ECB President Lagarde is expected to leave the ECB, before her eight-year term ends in October 2027, according to FT citing a person familiar with her thinking. However, ECB said that Lagarde remains committed to her role and has not made a decision on her departure.

Fixed Income

- A bearish start for fixed income, though only modestly with USTs lower by a handful of ticks in a narrow 112-30+ to 113-05+ band. US specifics thus far are a little light as we continue to digest the better-than-expected data on Tuesday and Fed speak that was a little hawkish from voter Barr, weighing on the complex. More insight will be derived from the FOMC Minutes this evening, which follows a 20yr auction and Fed's Bowman.

- The main focus point this morning is Gilts, though the benchmark is little changed as things stand. Opened lower by 17 ticks and then fell one more to a 92.03 trough in reaction to the morning's CPI data, while the headline Y/Y was in-line with market consensus, it was hotter than the BoE's view; additionally, core and services figures came in hotter than the market forecast. However, the net takeaway from the release is that it doesn't definitely solve the March vs April debate, with the decision in March looking like another 5-4 with Bailey to tie-break.

- Bunds are little moved in a 129.15-39 band, no move to the morning's Final French CPI series. The main point of focus for the EZ is reporting in the FT, among others, that ECB President Lagarde could step down before her term ends in October 2027. The FT outlines, citing sources, that this would ensure both French President Macron and German Chancellor Merz are in power and have a significant say in appointing a successor. No move to a tepid 2036 Bund auction.

- Germany sells EUR 4.238bln vs exp. EUR 5.5bln 2.90% 2036 Bund: b/c 1.46x (prev. 1.65x), average yield 2.73% (prev. 2.85%), retention 22.9% (prev. 23.3%).

- Kenya reportedly intends to issue additional USD denominated noted, potentially in multiple series, Bloomberg reported.

- Australia sold AUD 1.2bln 4.25% October 2035 bonds, b/c 3.90, avg. yield 4.7439%.

Commodity

- Crude prices are nursing prior day losses following yesterday's geopolitical development between the US and Iran, which ended on a more positive note, though caution remains. Thus far, officials suggest that talks were substantive and some issues were clarified, but highlighted that talks were difficult. Thereafter, the crude complex notched session highs following an Axios report, which suggested that the Trump administration is closer to a major war with Iran than people realise. Brent Apr'26 moved higher from USD 67.74/bbl to a high of USD 68.08/bbl over six minutes.

- In the metal space, spot gold and silver made gradual strides higher during the APAC session. XAU trades above the USD 4,900/oz within a USD 4869.95-4961.4/oz range, whilst XAG trades just above USD 75/oz within the 72.2305-57.783 range. Newsflow has been light for precious metals thus far in the European session.

- Copper prices are also rebounding, nursing prior day losses and in tandem with the improving risk tone. 3LME copper trades in the upper end range of USD 12.649-12.731.2k/t. Reminder that China, the largest market for copper, remains closed due to the Chinese new year’s.

- Hungary seeks EU approval to import Russian seaborne crude, says the Hungarian Minister of Foreign Affairs and Trade.

- Slovakia has declared an oil emergency and will release oil from its state reserves.

- US Energy Secretary Wright said they are looking to end Iran's progress towards nuclear weapons and want IEA nations to focus on energy security.

- Study shows that US has enough raw copper to meet domestic demand and can meet 146% of annual demand using raw copper from overseas and domestic mines and from scrap, while China 40% of its demand, according to Benchmark Mineral Intelligence cited by FT.

Geopolitics: Ukraine

- Ukraine's President Zelensky tells reporters that they've agreed to continue peace discussions, adds that talks were difficult and positions are different for now.

- Head of Ukrainian delegation says negotiations were substantive and there was progress; a number of issues were clarified.

- Update of new round of Ukraine talks is that there's been no concrete date set, IFX reported.

- The top Russian negotiator said the talks were difficult but business-like, RIA reported.

- Ukraine talks in Geneva have ended, new round of talks will be held soon, RIA reported.

- US Special Envoy Witkoff said US facilitated the third trilateral meeting between Ukraine and Russia, adds Ukraine and Russia agreed to update leaders and pursue an agreement.

Geopolitics: Middle East

- The Trump administration is closer to a major war with Iran than people realise, Axios reports citing sources; a military operation would likely be a massive, weeks long campaign that will be a joint US-Israeli attack.

- US Energy Secretary Wright said they are looking to end Iran's progress towards nuclear weapons and want IEA nations to focus on energy security.

- Iran and Russia are reportedly said to conduct navy drills in the Sea of Oman and Northern Indian Ocean on February 19th.

Geopolitics: Other

- US Secretary of State Rubio has been holding secret talks with the grandson of Cuba's Castro, Axios reported citing sources.

- US State Department senior official said the US would resume nuclear tests to match 'opaque' Chinese activity and flagged new details about a 2020 test the US recently accused China of secretly conducting, according to SCMP.

US Event Calendar

- 7:00 am: United States Feb 13 MBA Mortgage Applications, prior -0.3%

- 8:30 am: United States Dec P Durable Goods Orders, est. -2%, prior 5.3%

- 8:30 am: United States Dec P Durables Ex Transportation, est. 0.3%, prior 0.4%

- 8:30 am: United States Dec Housing Starts, est. 1303.5k

- 8:30 am: United States Dec P Building Permits, est. 1400k

- 9:15 am: United States Jan Industrial Production MoM, est. 0.4%, prior 0.4%

- 9:15 am: United States Jan Capacity Utilization, est. 76.5%, prior 76.3%

- 1:00 pm: United States Fed’s Bowman Speaks in Washington

- 2:00 pm: United States FOMC Meeting Minutes

- 4:00 pm: United States Dec Total Net TIC Flows, prior 212.04b

- 4:00 pm: United States Dec Net Long-term TIC Flows, prior 220.24b

DB's Jim Reid concludes the overnight wrap

As US markets returned from the holiday, volatility re-emerged across AI linked equities, with the VIX at one point nudging up towards YTD highs (just shy of 23). Around that time, the S&P 500 and the Magnificent 7 were down roughly -0.9% and -1.5% respectively, marking their intraday lows within an hour of the European close. However, both indices then staged a sharp rebound, closing +0.10% and +0.23% higher on the day.

The NASDAQ (+0.14%) and the Russell 2000 (-0.00%) were also little changed, but with sizeable dispersion underneath the headline stability. For instance, while the Philadelphia Semiconductor Index (-0.02%) recovered from being down more than -2.5% intraday, the software & services (-1.59%) segment still led the declines within the S&P 500. And some defensive sectors also struggled, with consumer staples down -1.51% as Walmart fell -3.76% from what had been a 20% gain YTD. Volatility was also evident across other high profile 2026 themes, with Brent crude (-1.79%), gold (-2.29%) and Bitcoin (-1.72%) all ending weaker, in part thanks to cautiously upbeat comments out of US-Iran talks.

In Europe, early signs of AI related concerns weighed on several indices, although sentiment improved into the close. The STOXX 600 finished +0.45%, with real estate, healthcare and banks outperforming, while the CAC 40 (+0.54%), FTSE 100 (+0.79%) and DAX (+0.80%) all outperformed.

Markets also digested a range of second tier US data. The Empire Manufacturing Index came in slightly better than expected at +7.1 (vs +6.2 consensus), while the NY Fed February employment index rose to +4.0 from -9.0 previously. Weekly ADP data showed 10,250 jobs added over the four weeks ending January 31, so consistent with slightly over 40k monthly job growth. Less positively, the NAHB Housing Market Index saw a slight decline in February to its lowest in six months (36 vs 38 expected).

Alongside the data, we received some patient-sounding Fed commentary. Fed President Goolsbee reiterated that further evidence of inflation moving back towards 2% would be required before easing, while Fed Governor Barr said that “it will likely be appropriate to hold rates steady for some time”. Markets slightly dialed down expectations for rate cuts, with 60bps of 2026 easing priced by yesterday’s close (-2.3bps on the day). In turn, 2yr Treasury yields edged higher (+2.7bps), while 10yr (+1.1bps) and 30yr (-0.6bps) saw muted moves, resulting in some curve flattening.

By contrast, government bonds rallied across Europe, with 10yr bund yields falling -1.6bps, OATs -2.8bps and BTPs -1.7bps. The main trigger for that was the February ZEW survey, which saw expectations unexpectedly decline (58.2 vs 59.6 prev. and 65.2 exp.). While the ZEW is often noisy, it does have some leading properties and the print will add attention to the upcoming PMI data on Friday and the Ifo survey on Monday.

Here in the UK, 10yr gilts (-2.4bps) also rallied following weaker labour market data, notably showing youth unemployment reaching its highest cyclical level since 2015 at 16.1%. Payrolled employees declined for a fifth consecutive month, with the January flash estimate pointing to an -11k fall, while the unemployment rate edged up to 5.2% (vs 5.1% expected). Overall, the data did little to ease concerns over the softness of the UK labour market and markets dialed up expectations for near-term BoE easing, with pricing of a March rate cut rising from 74% to 79%. As a reminder, our UK economist continues to expect two further rate cuts this year, likely by summer.

We also saw some dovish repricing in Canada, where CPI printed slightly below expectations, with headline inflation at +2.3% y/y (vs +2.4%) and trimmed core at +2.4% y/y (vs +2.6%). With inflation concerns continuing to ease, Canadian 2yr yields fell -2.3bps to a 10-week low of 2.45%.

Turning to geopolitics, oil prices initially extended recent gains amid reports that Iran had temporarily closed parts of the Strait of Hormuz during military drills, but prices then reversed course as it emerged that the latest US-Iran talks appeared constructive. Iran said it reached a “general agreement on a set of guiding principles” for a potential nuclear deal, with Bloomberg reporting later on that Iranian negotiators are due to return in two weeks’ time with a new proposal to address gaps that remain versus US demands. By the close, Brent crude declined by -1.79% to $67.42/bbl. The more encouraging geopolitical backdrop also weighed on gold (-2.29%) and silver (-4.03%), which extended declines that had emerged during yesterday’s Asia hours amid the Lunar New Year holiday.

Asian equity markets are higher this morning but with still low volumes due to the closure of markets in mainland China, South Korea, and Hong Kong. As I check my screens, Japanese stocks are recovering from losses incurred earlier this week, with the Nikkei and Topix indices both trading around +1.25% higher respectively. Elsewhere, the S&P/ASX 200 (+0.52%) is higher for the third session, while the S&P/NZD 50 (+1.54%) is up after three sessions of losses, following a less hawkish hold than expected from the RBNZ. The kiwi has declined by -0.81% to 0.60 against the dollar, while the yield on the 2-year policy-sensitive government bonds is down -9.8bps to 3.096%, the lowest level since mid-January.

Elsewhere in Asia time, S&P 500 (+0.20%) and NASDAQ 100 (+0.27%) futures are both higher with US Treasury yields up around a basis point across the curve. As we go to print the FT is reporting that ECB President Lagarde is looking to step down before her 8-year term ends in October next year, targeting a move before the French elections in April 2027, thus allowing her successor's appointment to be made by the current set of politicians. As I press send on this the ECB has said that Lagarde has not made any decision on the end of her term. So a live story to watch.

Looking ahead, upcoming data include US January industrial production, capacity utilisation, the leading index and December durable goods orders. Elsewhere, UK January CPI, RPI and PPI data are due, alongside Canada’s January existing home sales. Central bank events include the release of the FOMC meeting minutes and speeches from ECB members Villeroy and Schnabel. Notable earnings include Analog Devices and Booking, while the US Treasury will auction $16bn of 20 year bonds.