Global fixed income slips, lead by JGBs; US equity futures in the red amid heightened US-EU trade tensions - Newsquawk US Opening News

- Global fixed income in the red, taking lead from marked pressure in JGBs on fiscal concerns driving JPY action.

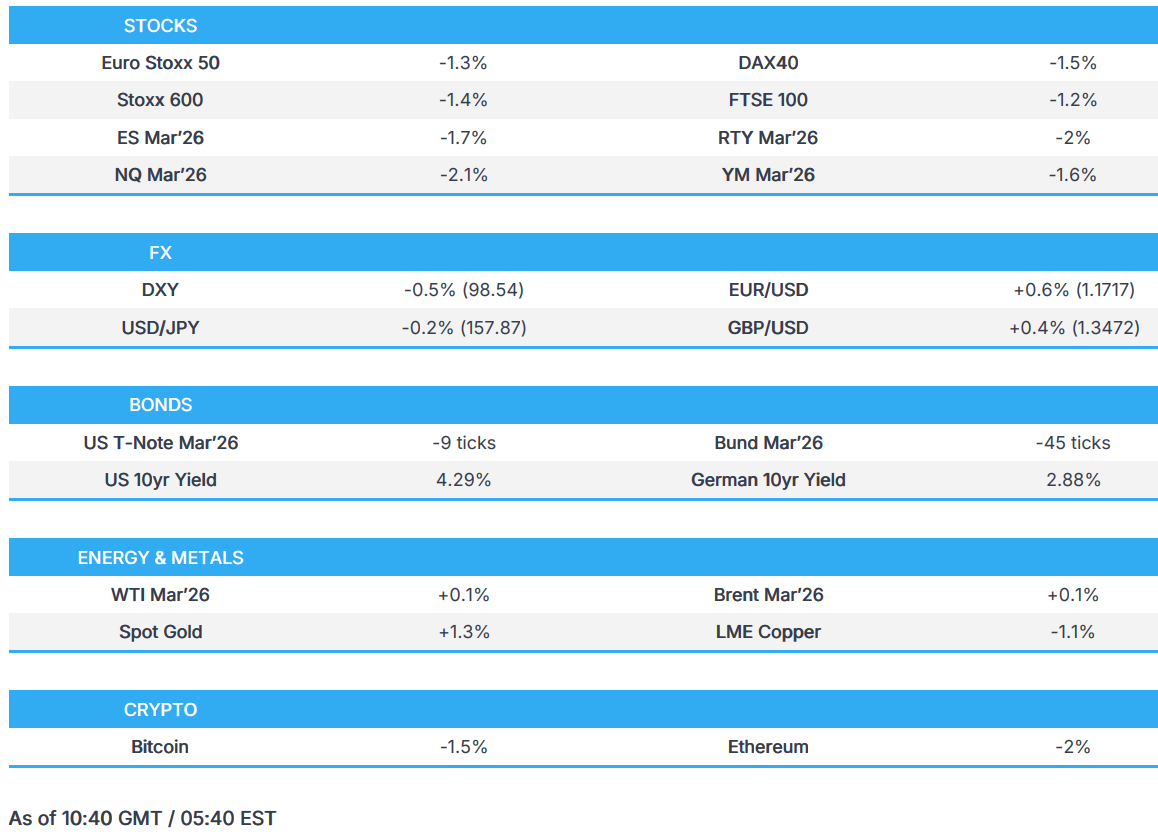

- European bourses are entirely in the red, with sentiment hit on renewed trade tensions; US equity futures also pressured, NQ -2.1%.

- DXY hampered and currently at lows, CHF leads whilst EUR/USD tops 1.1700.

- Crude choppy with specifics light, XAU and XAG continue to make ATHs.

- US President Trump threatened to impose 200% tariffs on French wines and Champagne following France's intention to decline the invitation to join his 'Board of Peace'.

- US President Trump said he had a good phone call with NATO Secretary General Rutte about Greenland, and has agreed to meet various parties in Davos.

- Looking ahead, highlights include ADP Employment Change Weekly, US Treasury Secretary Bessent, ECBʼs Nagel, SNBʼs Schlegel, and earnings from Netflix.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European equities (STOXX 600 -1.3%) are trading on the back foot, with sentiment remaining under pressure as trade tensions between the US and Europe continue to escalate. The latest development came overnight, when US President Trump threatened to impose a 200% tariff on French wine and champagne. However, Treasury Secretary Bessent spoke on EU-US relations, saying that he is confident that leaders will not escalate and things will work out.

- European sectors are largely trading in the red; Media leads whilst Industrials and Utilities underperform.

- US equity futures are lower with downside in all major indices. The NQ (-2.1%) underperforms vs peers (ES -1.7%), with the Tech-heavy index pressured by the risk-tone and elevated yields. This follows on from the downside seen in heavyweight tech names in Asia, namely Samsung (-2.3%) and SK Hynix (-2.3%).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is on a weak footing this morning, and currently trades at the bottom end of a 98.46-99.13 range. To recap, overnight, President Trump threatened a 200% tariff on French wines/champagne after French President Macron rejected his invitation to join his latest peace initiative. Thereafter, Trump said the UK is acting with “great stupidity”, following the Chagos deal.

- The largest bout of pressure for the Dollar was after Treasury Secretary Bessent called for calm and reminded markets that US-EU relations have been strained before, but eventually worked out. This seemingly poured some cooler water on the situation, and the index fell from around 98.85 to a current session low of 98.46.

- The recent pressure in the USD has helped to push G10s higher across the board; CHF tops the leaderboard, the EUR resides near highs beyond the 1.1700 mark, whilst USD/JPY has slipped below the 158.00 mark to make a trough at 157.58. Overnight, the JPY was shunned, alongside aggressive selling in JGBs, spurred by increased bets of unsustainable fiscal policy after PM Takaichi called snap elections and the fiscal commentary from parties since.

- Elsewhere, Cable sits towards session highs and within a 1.3410-1.3491 range. Earlier, the November jobs report showed a tick higher in the unemployment rate, whilst the wage components remained elevated. A knee-jerk lower was seen in the Pound, but this pared almost immediately, given the narrative around a summer-cut has not really shifted for the BoE.

FIXED INCOME

- Fixed on the backfoot as yields climb in catch-up to Monday's US holiday and with Japan at record levels.

- JGBs down to a 130.66 base, c. 80 ticks below the close on Monday. Pressure driven by the Takaichi trade being in force into the formal election announcement on Friday, and then the polls on 8th February. Pressure that appears to be driven by scrutiny of the fiscal plans of both the government and the combined opposition, as they outline plans to postpone/remove various tax measures.

- Action that has driven Japanese yields to highs. The 40yr above 4.23% (+40bps), the 30yr above 3.90% (+41bps), 20y to 3.48% (+32bps), 10yr to 2.38% (+20bps). With the curve markedly steeper.

- Macquarie's Berry wrote, "if the selloff continues, and especially if it spreads globally, then we should see the BoJ dust it [bond buying tool] off and put it to work - maybe as early as tomorrow morning's daily operations".

- Evidently, we have seen the selloff spread globally. USTs are pressured down by around 9 ticks, and currently resides at the bottom end of the day's range; Gilts (-70 ticks) and Bunds (-45 ticks) also follow suit. The latter took a leg lower on the region's ZEW metrics, whereby the Expectations figure topped expectations and improved from the prior.

- Japan sold JPY 800bln 20-year JGBs; b/c 3.19x (prev. 4.10x, 12-month avg. 3.44x), average yield 3.2510% (prev. 2.916%). Tail 25bps (prev. 3bps).

COMMODITIES

- Crude on the backfoot but only marginally so. Spent the APAC session in a narrow range with complex-specific newsflow somewhat light as the market focus remains on Greenland and the tariffs stemming from it. Early morning trade saw some mild selling in the complex, but this has since reversed to trade towards highs of USD 59.59/bbl and USD 64.27/bbl.

- Spot gold at highs, printed another ATH of USD 4737/oz given the risk tone and despite the morning's significant yield strength.

- Base peers in the red. 3M LME Copper down to USD 12.8k/T, within reach of Friday's USD 12.7k/T base and back towards opening levels from early-January.

- China announces plans to expand high-level opening of nonferrous metals future markets by steadily including eligible futures and options in foreign access.

- China raises both gas and diesel prices by CNY 85 per tonne from the 21st January.

- Venezuela's Acting President said plans to boost gold and iron output in 2026, and attract metals investment for FX.

- China's Shanghai Futures Exchange to adjust margin requirements and daily price limits for selected copper, aluminium, gold and silver futures contracts from the 22nd of January settlements.

TRADE/TARIFFS

- US President Trump: "I will impose 200% tariff on French wines and champagne, and President Macron will join the Board of Peace".

- China said they hit its US soy purchase target of 12mln tonnes, Bloomberg reported citing traders.

- Taiwan's Vice President said we will balance the trade deficit between Taiwan and the US.

- South Korea is reportedly to hold off on USD 20bln worth of US trade investment, due to KRW impact.

NOTABLE EUROPEAN HEADLINES

- US Treasury Secretary Bessent said the US is experiencing a capex boom, which always leads to an employment boom. The narrative of EU nations discussing selling USTs is false; there is no talk of this, it is mis-reporting. On trade:. said the worst thing countries can do is heighten trade tension with the US. The narrative of EU nations discussing selling USTs is false. There is no talk of this, it is mis-reporting. Swiss-US agreement is well along the road. On EU-US relations, said there is no need to jump to the worst case scenario at this point. Reminds that trade ties have been strained before, and it worked out. Is confident that leaders will not escalate and that it will work out. On Economy:. Expects economic growth to be strong this year, at around 4-5% real GDP growth. They will see substantial refunds of up to USD 1000 per worker in Q1.

- Citi downgrades Continental Europe to Neutral from Overweight; rising tensions and tariff uncertainties undermine the short-term outlook for European equities.

NOTABLE EUROPEAN DATA RECAP

- German ZEW Current Conditions (Jan) -72.7 vs. Exp. -75.5 (Prev. -81.0); Expectations (Jan) 59.6 vs. Exp. 50.0 (prev. 45.8)

- German PPI MoM (Dec) M/M -0.2% vs. Exp. -0.2% (Prev. 0.0%).

- German PPI YoY (Dec) Y/Y -2.5% vs. Exp. -2.4% (Prev. -2.3%).

- EU ZEW Expectations (Jan) 40.8 vs Exp. 36.7 (prev. 33.7)

- UK HMRC Payrolls Change (Dec) -43K (Prev. -38K).

- UK Unemployment Rate (Nov) 5.1% vs. Exp. 5% (Prev. 5.1%). ONS “the number of employees on payroll has fallen again…” and “Meanwhile unemployment remains at the rate reported last month, up on the quarter and the year”.

- UK Employment Change (Nov) 82K vs. Exp. 27K (Prev. -16K).

- UK Average Earnings incl. Bonus (3Mo/Yr) (Nov) 4.7% vs. Exp. 4.6% (Prev. 4.8%, Rev. 4.7%).

- UK Claimant Count Change (Dec) 17.9K vs. Exp. 15.6K (Prev. -3.3K, Rev. 20.1K).

- UK Average Earnings excl. Bonus (3Mo/Yr) (Nov) 4.5% vs. Exp. 4.5% (Prev. 4.6%).

- EU Current Account (Nov) 12.6B (Prev. 33B, Rev. 32B).

- Swiss Producer & Import Prices YoY (Dec) Y/Y -1.8% (Prev. -1.6%).

- Swiss Producer & Import Prices MoM (Dec) M/M -0.2% vs. Exp. 0.2% (Prev. -0.5%).

CENTRAL BANKS

- US Treasury Secretary Bessent on new Fed chair said they have four excellent candidates and that an announcement could come as imminent as next week.

NOTABLE US HEADLINES

- US President Trump: "I know who I want to be Fed Chair, will announce sometime".

- US President Trump is to deliver a special address at Davos at 13:30GMT / 08:30EST on Wednesday 21st.

GEOPOLITICS

RUSSIA-UKRAINE

- Ukrainian President Zelensky might go to Davos if he has a bilateral meeting with Trump to sign "prosperity deal".

- Russia's Lavrov said they yet to receive documents following recent US and European talks on Ukraine.

- Russia's Lavrov said they are ready for contact with the US on Balkans.

OTHERS

- European Commission President von der Leyen says the bloc's response will be united, proportional and unflinching. The territorial integrity of Greenland is non-negotiable and they will be working on wider Arctic security measures.

- UK Government, in response to Trump's remarks on Diegeo Garcia, said "the deal secures the operations of the joint US-UK base on Diego Garcia..." and "It has been publicly welcomed by the US...".

- US President Trump posted "Thank you to Mark Rutte, the Secretary General of NATO!".

- US President Trump posted "the United Kingdom, is currently planning to give away the Island of Diego Garcia..." adds that this "is another in a very long line of National Security reasons why Greenland has to be acquired.".

- US President Trump, on Truth Social, said he had a good phone call with NATO Secretary General Rutte about Greenland, and have agreed to meet various parties in Davos.

- US President Trump said he will talk about Greenland in Davos, does not think the EU will push back too much on Greenland.

- US President Trump conceded in a weekend phone call with UK PM Starmer that he was given bad information regarding troop deployments from European countries to Greenland, CNN reported citing senior UK official.

CRYPTO

- Bitcoin extends losses below USD 91k, with Ethereum also pressured and eyes USD 3k.

APAC TRADE

- APAC stocks traded mostly in the red, except the KOSPI, as the tech sector led the declines.

- ASX 200 continued to fall away from its 2026 peak of 8915, despite the positivity seen in the metals space as BHP upgraded its FY26 copper production guidance.

- Nikkei 225 neared 53,000, falling from its ATH of 54,522, as traders assess the policies put forward by the LDP and Centrist Reform Alliance going into the February 8th elections.

- KOSPI was set to snap its 5-day winning streak, falling from its ATH at 4924, as the tech sector weighs on sentiment. Samsung Electronics and SK Hynix briefly led losses, with shares down as much as 3% each before price gradually rebounded but remained in the red.

- Hang Seng and Shanghai Comp traded with modest losses, and little follow-through from the PBoC unsurprisingly holding LPRs steady. Global equities continue to price in the re-escalation of tariffs between the US and EU.

NOTABLE ASIA-PAC HEADLINES

- Citi sees the potential of 3 rate hikes in 2026 by the BoJ if JPY weakness continues.

NOTABLE APAC DATA RECAP

- New Zealand Composite NZ PCI (Dec) 53.7 vs. Exp. 49.6 (Prev. 48.8).

- New Zealand Services NZ PSI (Dec) 51.5 vs. Exp. 48 (Prev. 46.9).