Reddit Army's Beyond Meat Squeeze Implodes As WallStreetBets Apes Panic

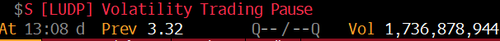

Update (Lunchtime Wednesday in New York):

After a series of volatility halts, the Reddit-fueled squeeze in Beyond Meat shares has completely reversed, collapsing 68.5% from premarket highs and returning to yesterday's close.

The wild Reddit-fueled day trader squeeze of short hedge funds since last Friday has been nothing short of eye-popping, with gains exceeding 1,200% at one point. Reddit traders piled in, hoping for the next GameStop-style short squeeze.

But were greeted with selling instead...

And again. https://t.co/WdKuxWvQCj

— zerohedge (@zerohedge) October 22, 2025

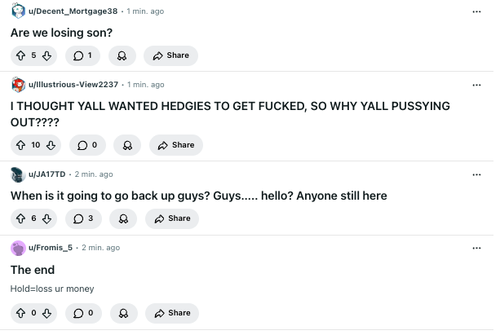

Panic from r/WallStreetBets.

But as we warned earlier, the company's debt-for-equity swap with creditors is expected to dilute shareholders by hundreds of millions of shares. The question now is whether day traders and others still playing this casino can absorb that supply and keep the squeeze going. If not, it's the classic pump-and-dump playing out. Thanks for playing.

* * *

Update (Wednesday):

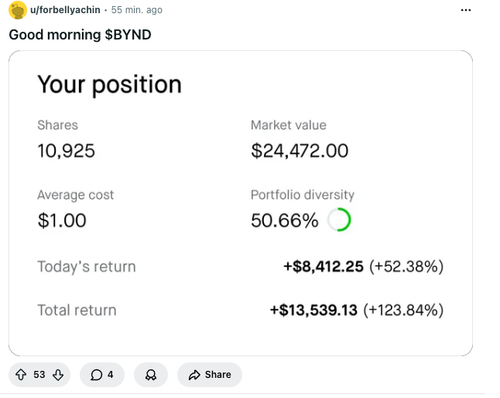

Heavily shorted fake food company Beyond Meat jumped again in premarket trading as the Reddit army of day traders squeezed hedge funds. The only problem is, and we've seen how this party ends, the struggling company's debt-for-equity swap will, at some point, substantially dilute shareholders.

In premarket trading, shares touched as high as $8.55, representing about a 1,222% increase since last Thursday. Around 06:30 ET, shares were up 100%, trading near $7.14.

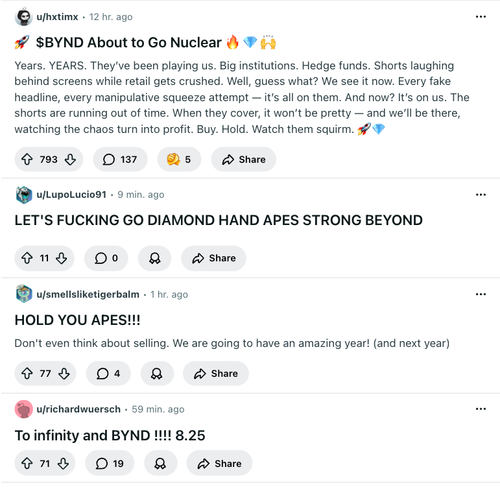

While Tuesday's Walmart news about expanded distribution was viewed as a catalyst, Reddit's r/WallStreetBets had already been strategizing how to make the heavily shorted stock (with the latest data showing more than 50% of the float short) go "nuclear" to "fight the evil short sellers."

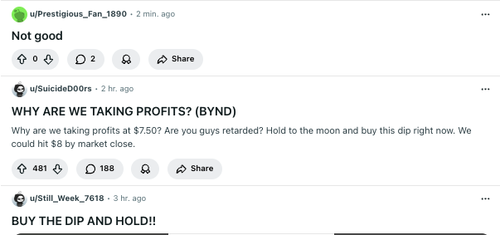

Latest comments on r/WallStreetBets...

Also fueling the fire:

Shares of Beyond Meat jumped 127% on Monday and 146% on Tuesday after Roundhill Investments included the stock in its newly revamped Roundhill Meme Stock ETF (NYSE:MEME). The addition set off a gargantuan short squeeze, as over 63% of the firm's tradable shares were shorted prior to the announcement, based on FactSet data cited by CNBC. Roundhill's move to re-launch the MEME ETF in early October, after earlier closing it because of lack of interest, seems to have caught up with a re-emergence of speculative trading. -Benzinga Newswire

Meanwhile, rest of Meme stock world...

But as we noted on Tuesday, caveat emptor. We've seen how this story ends.

In recent weeks, BYND completed a debt for equity swap involving the exchange of over $1.1 billion in convertible notes for new debt and more than 326 million shares of common stock.At the expense of Redditors, the creditors who completed the debt-for-equity swap were handed a massive liquidity event.

Thanks for playing.

* * *

Fake food company Beyond Meat, once endlessly promoted by globalist corporate media trying to convince the nation that cow farts are bad and fake meat is good, has been locked in a near five-year bear market. It seems that Redditors and the company's press release are squeezing shares higher. However, a recent debt swap for equity will substantially dilute shareholders. We've seen this story before, and it never ends well.

News this morning that Beyond Meat plans to expand its fake food products to over 2,000 Walmart stores nationwide sent shares up 60% in premarket trading. The surge is likely due to a combination of the Reddit army of day traders catching on that hedge funds have been heavily shorting the stock.

Beyond Meat's latest short interest data show that 54% of the company's publicly available shares are short, or about 39.59 million shares. Based on the average daily volume of around 9 million shares traded per day, it would take 4.44 days for shorts to cover.

Meanwhile, day traders on Reddit's WallStreetBets page are all about BYND...

Hmm.

Caveat emptor:

The surge comes one week after nearly all creditors agreed to a debt-swap deal that massively dilutes equity shareholders.

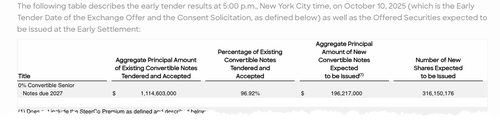

BYND wrote in a recent press release (read report) that 96.92% of holders of its 0% Convertible Senior Notes due 2027 agreed to participate in the debt-equity swap offer, clearing the 85% threshold required for the deal to proceed.

Under the terms, BYND will issue up to $202.5 million of new 7% Convertible Senior Secured Second Lien PIK Toggle Notes due 2030 and up to 326.2 million new shares of common stock. The exchange aims to reduce leverage and extend debt maturities.

And now you understand why there's a squeeze and pump.

Liquidity is needed. Reddit kids are that liquidity. Never ends well.

* * * Don't Drink Carcinogens

- Countertop RO System (can buy with additional filters)

- Medium-Flow RO System (7-stage filtration)

- High-Flow RO System (11-stage filtration, comes with 2-year filter supply)

- Countertop Gravity Water Filter (2.25 gallon)

- Camping Gravity Filter Kit (add to your emergency supplies)

- 6-Pack Water Straws (removes 99.9% of bacteria)