Heavily Shorted USA Rare Earth To Soar After US Govt Takes 10% Stake

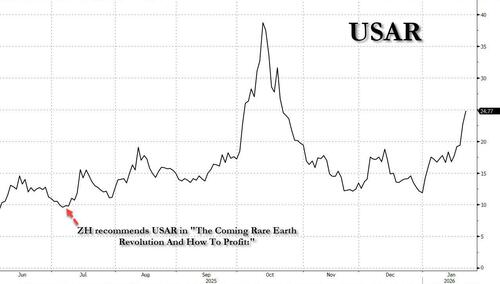

It was last July 9, when we told readers all about "The Coming Rare Earth Revolution And How To Profit: All You Need To Know About The "Ex-China Supply Chain." It was here that we said MP Materials (and to a lesser extent USA Rare Earth Corp) was best positioned to capitalize as global rare earth trade flows and pricing adjust over the coming years (also, as a reference, that's when USA Rare Earth was trading below $10/share).

One day later, anyone who listened to our advice made their year, when MP Materials soared 50% after the US shocked markets by announcing the Pentagon had become the largest shareholder in the rare earths company.

MP Materials Shares Surge 50% As Pentagon To Become Largest Shareholder https://t.co/qltUY1sHL3

— zerohedge (@zerohedge) July 10, 2025

Since then we had repeatedly pounded the table on USAR as the "other" major domestic REE company, pointing out repeatedly...

USA Rare Earth Shares Jump After Accelerating Timeline For Commercial Production By Two Years https://t.co/ufJ9i27s6e

— zerohedge (@zerohedge) December 10, 2025

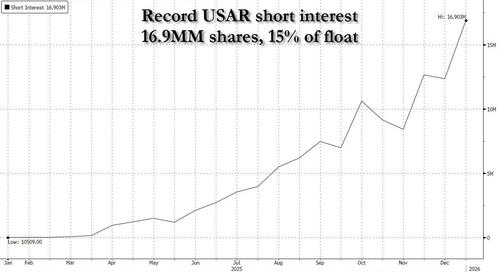

... both that USAR is next on the Trump Capital, LP investment list, and warning the record number of shorts in the name to take cover while they have the chance, culminating with our note from Friday in which we pointed out abnormal buying activity in USAR calls.

USA Rare Earth (USAR) gamma squeeze (or just takeover bet): more than 8k of June $43 calls were bought for up to ~$3

— zerohedge (@zerohedge) January 22, 2026

Less than 48 hours later we hit jackpot, after the FT reported that in its second major rare earth investment, the Trump administration would inject $1.6BN into USA Rare Earths, just as we had said all along - surpassing the "mere" $400 million preferred stock investment by the Pentagon in MP Materials - the largest US investment in the sector to date, as it scrambles to shore up supplies of key minerals.

In exchange for the investment, the US government will receive a 10% stake in the Oklahoma-based USA Rare Earth, which controls significant US deposits of heavy rare earths.

The government investment and a separate $1bn private financing deal are expected to be announced on Monday.

According to FT sources, the government would get 16.1 million shares in USA Rare Earth and warrants for another 17.6 million, both at a price of $17.17. The government agreed to pay $277mn for the equity, giving it an implied gain of $490mn for the equity and warrants based on the current share price of $24.77.

The deal marks the latest example of the Trump administration’s efforts to intervene in parts of the private sector viewed as critical to US national security, including taking a 10% stake in Intel, which we also called ahead of time.

The Pentagon took a stake in US rare earth miner MP Materials... when will it do the same with Intel

— zerohedge (@zerohedge) August 7, 2025

USA Rare Earth will also receive $1.3bn in senior secured debt financing at market rates from the government. The money will come from a finance facility created for the commerce department as part of the CHIPS and Science Act passed in 2022. A commerce official said the department completed the transaction directly with the company.

While the commerce department declined to discuss the deal, an official in the Chips office - a part of the commerce department housed at the National Institute of Standards and Technology that led the negotiations - said it was "focused on onshoring critical and strategic mineral essential to the semiconductor supply chain and US national security".

Or precisely what we said in July before the first MP Materials investment was disclosed

USA Rare Earth has separately tapped Cantor Fitzgerald, the Wall Street firm previously owned by commerce secretary Howard Lutnick and now run by his sons, to raise more than $1bn in fresh equity financing, the people said. It is not directly related to the deal with the government.

As the FT notes, a condition of the government investment in USA Rare Earth was that the company raise at least an additional $500mn from investors. It is on track to raise more than $1bn because of high demand for the financing deal, which uses a mechanism known as a private investment into a public equity, often called a “Pipe”.

Cantor’s involvement comes as the investment bank once led by Lutnick, one of Trump’s most prominent cabinet members, has expanded its investment banking capabilities to benefit from the president’s “America first” agenda. Cantor did not play a role in advising on the US government investment in USA Rare Earth.

USA Rare Earth, which has a market value of $3.7bn, is developing a huge mine in Sierra Blanca, Texas that it says contains 15 of the 17 rare earth elements underpinning production of cell phones, missiles and fighter jets. It also plans to open a magnet production facility in Stillwater, Oklahoma.

Last year, the Trump administration invested in at least six minerals companies, including MP Materials, Trilogy Metals and Lithium Americas. But its investment in USAR Is by far the biggest.

Shares in USA Rare Earth have more than doubled this year, helped by a 40% jump this week, and are up 150% since we first recommended the stock last July.

And now that the company has the explicit backing of the US government, if the Intel deal is any indication of what is coming, expect USAR stock to more than double from here, although when adding the record short interest in the equation...

... we just may see a historic surge in the stock when it opens for trading on Monday.