Insider Trading? New Polymarket Account Made 12x Gain On Venezuela Intervention

As the dust settles on President Trump's Friday-night blitz on Venezuela, suspicions of insider trading on the secret operation are rising, after a brand-new Polymarket account scored a huge profit by betting on a US military attack just before it happened. As a result, a US House representative is already preparing to introduce a bill that would prohibit government officials from using inside info to profit in prediction markets.

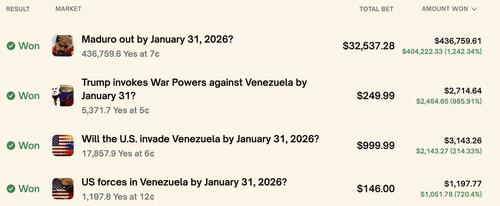

The account in question was created on Dec. 27, and quickly placed roughly $34,000 in bets on US intervention in Venezuela and Maduro's ouster both happening by January 31. On the Maduro prediction alone, the account scored a 1,242% gain, turning $32,537 into $436,760. At the time of the bets, the market placed the probability of intervention in January at just 6%.

The list of suspects could be quite a long one, given the military was poised to strike for days. "We were going to do this four days ago but the weather was not perfect," Trump said after the attacks and Maduro's extraction. "And then all of a sudden it opened up and we said go." Military officials were said to have contemplated a Christmas-day attack. What's more, given officials' public talk about rehearsals of the operation, preparations likely spanned weeks, following months of a build-up of assets in the region.

That said, one can't entirely rule out the possibility of someone outside government reading headlines and placing a big bet, and the mystery account wasn't the only one placing bets on US intervention. According to the Wall Street Journal, more than $56 million had been placed on Maduro's ouster, with $11 million betting he'd be gone by Jan. 31. Another $40 million in losing bets had been placed on him leaving by Nov. 30 or Dec. 31. This X user claimed to have made $80,000 by translating a surge in Pentagon-area pizza traffic into imminent military action:

How i made 80,000$ in a single night using @Polymarket

— Sweetcheeks (🌲,🌲) (@SweetcheeksReal) January 3, 2026

Basically ever since the US brought their largest aircraft carrier i knew a strike was 100% going to happen, but i did not know when. So i built a vibe coded bot to track the dominos pizza orders around the pentagon because… https://t.co/Jx1ODEGtJ2

Regardless of who owns all those accounts, Democratic New York Rep. Ritchie Torres is planning to target officials' potential to profit from access to government secrets. According to Jake Sherman of Punchbowl News, Torres will introduce the "Public Integrity in Financial Prediction Markets Act of 2026." Here's how Sherman's source describes it:

This bill prohibits federal elected officials, political appointees, and Executive Branch employees from engaging in certain transactions involving prediction market contracts when they either possess material nonpublic information relevant to the transaction or could reasonably obtain such information through their official duties. The restriction applies to buying, selling, or exchanging prediction market contracts tied to government policy, government action, or political outcomes on platforms engaged in interstate commerce.

Torres is targeting a narrow universe of people, leaving plenty of opportunity for other people in government to profit from inside information -- such as a staff sergeant at the Pentagon, or his girlfriend. Outside government, staffers at the Washington Post and New York Times also had an opportunity to profit on the Venezuela operation, as Semafor reports that both outlets learned of the operation shortly before it took place, but refrained from publishing the news to avoid putting US forces in peril.

Responding to news of Torres' upcoming bill, Polymarket rival Kalshi said its rules prohibit trading by anyone inside or outside of government who "has access to material non-public information that is the subject of an Underlying of any Contract or that has the ability to exert any influence on the subject of an Underlying of any Contract." Of course, platform rules are one thing and federal laws are another. The Block notes that Donald Trump Jr has advisory roles on both prediction platforms.

It was Baron Trump.

— Cornelius Vanderbilt (@supplychainldr) January 3, 2026