Investment Risk Is Underappreciated

Authored by Lance Roberts via RealInvestmentAdvice.com,

Investment Risk Is Underappreciated

There’s an old parable worth remembering, especially when it comes to investment risk and the markets. Once upon a time, there was a young shepherd who was tasked with watching over a flock of sheep. Eventually, bored and craving attention, he runs into the village shouting, “Wolf!” The villagers drop everything to help, only to find there’s no danger. He laughs, amused by everyone’s reaction. Later, he does it again. Once again, the villagers fall for it. Unfortunately, when a wolf does indeed appear, he cries for help. But not wanting to be fooled again, the villagers ignore him, and the flock is quickly slaughtered.

The lesson is simple: lie often enough, and no one believes you when it matters. In investing, we see this regularly with pundits and YouTubers who continually claim that market crashes and devastation are imminent as the bull market continues its climb. Eventually, those individuals get tuned out. It is the same with permabulls who see upside in every dip. When the real turning point comes, few are listening. That’s how risk blindsides the crowd.

The financial markets do one thing very well: lull investors into a false sense of security and complacency. Rallies stretch longer than logic allows, optimism builds on hope rather than data, and eventually risk becomes ignored, just as the boy who “cried wolf.” Today, investors are leaning hard into a bullish narrative, while ignoring key warning signs, from slowing earnings to inflated valuations. The market’s investment risk profile is rising, but few are listening.

Earnings and Profit Margin Expectations Are Very Optimistic

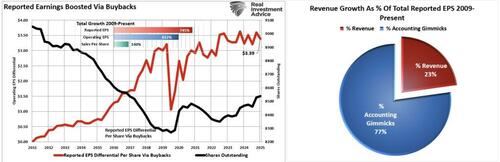

Recent quarters have delivered strong earnings surprises, but much of that upside came from aggressive cost-cutting and financial engineering rather than organic revenue growth. We can see this in the breakdown of earnings between accounting gimmicks and actual revenue growth.

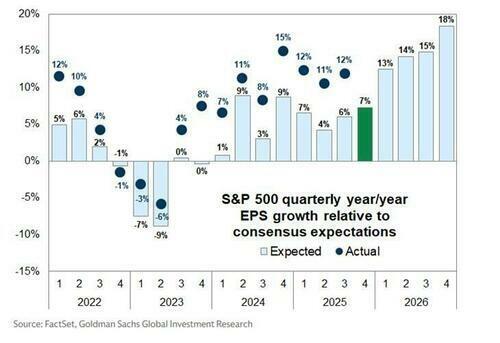

As shown below, Wall Street is increasingly confident of earnings growth in 2026, with a faster growth rate than in any of the last several years.

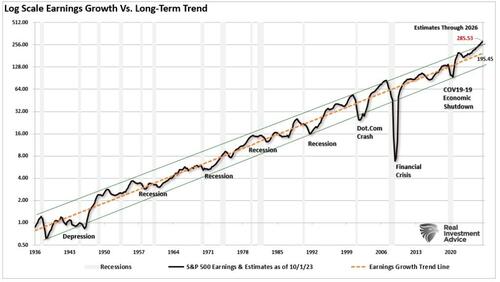

However, consumer demand is softening, input costs are sticky, savings rates are declining, and employment remains weak. Furthermore, the post-pandemic pricing power that companies once enjoyed is now fading. That certainly isn’t the recipe for a rather exuberant surge in earnings, particularly when earnings are already very deviated above the historical growth trend.

Despite the obvious risk, investors are treating earnings as a certainty rather than a variable. However, that assumption breaks down quickly when growth slows and margins compress. Currently, many Wall Street analysts have been slow to lower earnings estimates. While that is typical, the investment risk to individuals is that by the time revisions hit the wires, markets have already adjusted. This lag creates a false sense of security. Therefore, if earnings begin to disappoint in the next few quarters, stocks priced for perfection will get punished.

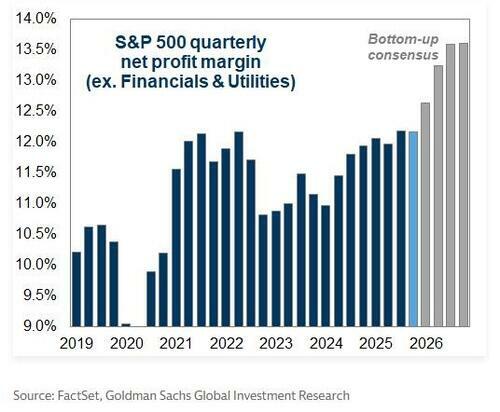

The same analysis applies to corporate profit margins, which expanded massively during the stimulus-driven recovery. However, despite the reversal of that stimulus, Wall Street expects profit margins to surge to record levels in 2026. While during the pandemic, companies could raise prices while holding labor and input costs low, that cycle is reversing. Wage inflation remains sticky, and commodity costs (silver, copper, and other metals) are surging. With companies now competing more on price again, profit margins are an investment risk that shouldn’t be dismissed.

While the bullish consensus is, well, very bullish, companies can’t maintain wide margins if they can’t pass along cost pressures. Is this guaranteed to happen? No. However, investors betting on sustained profitability could be caught offside given that the markets are priced for perfection. Of all the investment risks, this is one of the clearest red flags being ignored right now.

The Reflation Narrative Is Built on Assumptions

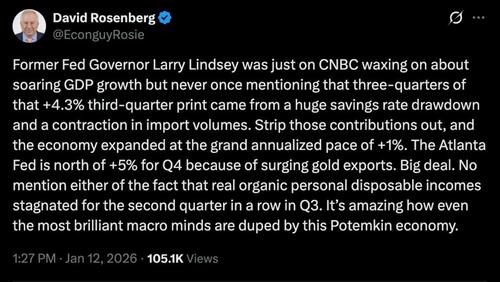

As I discussed at the 2026 Investment Summit last weekend, the prevailing market narrative is simple: inflation is falling, the economy is growing, and central banks will continue to cut rates. In other words, 2026 is a year of “reflation.” However, none of these assumptions is guaranteed. Inflation is proving sticky, central banks are closer to pausing rate cuts, and, most importantly, economic growth is currently a function of one-off issues, as David Rosenberg recently noted.

Furthermore, the labor market remains tight, and consumer spending is uneven, with the top 10% of income earners accounting for nearly 50% of spending.

While markets tend to move ahead of policy, the investment risk arises when policy doesn’t match the forecast. If the reflation narrative takes hold and economic growth increases, inflation will likely rise. Such would put the Federal Reserve in a difficult position. If the Fed pauses, or worse, lifts rates as a response, the equity risk premium shrinks. That means valuations must adjust downward, and investors believing in a smooth landing and a quick pivot to rate cuts are leaning too far into hope.

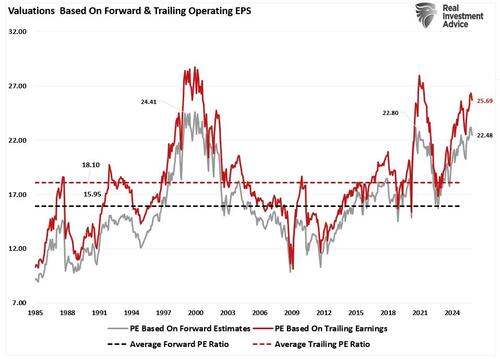

Valuations Are Still Stretched

Of course, this ties back to the one investment risk that is well known, and currently ignored: Valuations. Valuations are the “boy who cried wolf.” For several years, Wall Street, YouTubers, and the media have all decried valuations as expensive, predicting an imminent correction. Unfortunately, valuations don’t work that way. Now, after several years of false alarms, investors feel valuations are “the boy who cried wolf.”

However, valuations are the one investment risk that should not be ignored, but understood. As discussed previously, valuations are a terrible timing indicator, but rather a measure of sentiment in the near term. The current trailing twelve-month price-to-earnings ratio sits at 26, near historic extremes. The Shiller CAPE ratio, which adjusts for inflation and smooths cycles over a decade, stands near 39. Forward P/E estimates for 2026 earnings are in the 23 range. By almost every measure, equities are priced at levels that historically limit future returns.

However, this is also the investment risk that investors need to prepare for. At current valuation levels, stocks don’t need a crisis to fall; they only need disappointment. If growth falls short, or if the Fed doesn’t deliver the cuts the market expects, equities face pressure. In other words, a “recession” is not the risk; it is just anything that is “less than perfect.”

The Risks Are Interconnected

Each of these risks, earnings, margins, the reflation narrative, and valuations feeds into the others. If earnings disappoint, margin assumptions fall apart. If inflation re-accelerates, the Fed stays hawkish, hurting valuations. These feedback loops increase the risk to investors, leaving them exposed to negative outcomes. With the market currently built on “narratives,” rather than fundamentals, when the story changes, price will follow. It’s not a matter of if sentiment will shift, but when. Therefore, positioning yourself ahead of that shift is critical.

There’s no magic bullet, but there are steps you can take to reduce risk without giving up opportunity.

Diversify across asset classes. That means holding stocks, bonds, and cash.

Tilt your equity exposure toward quality. Look for companies with strong balance sheets, consistent earnings, and pricing power.

Reduce exposure to over-valued names. Focus on valuation. History tells us that buying “cheap” protects capital in downturns.

Use defensive sectors like healthcare and consumer staples as ballast.

Review your position sizes. Don’t let a few names dominate your portfolio.

Lastly, raise some cash. Not as a market call, but as a tool to take advantage of lower prices later.

Most importantly, the key to navigating investment risks this year will be remaining data-driven. Ignore the headlines, disregard narratives, and watch real indicators like earnings revisions, margin trends, inflation reports, and Fed guidance. Don’t forecast. React to changes as they occur.

Risk doesn’t disappear. Investors ignore it at their peril. If you want to survive the next market shock, prepare now. Hope is not a strategy. Discipline is.

Bulls Remain In Control

This week’s price action reflected growing short‑term volatility and technical signals that traders use to gauge potential risk and reward. After a politically driven selloff early in the week, market internals weakened before recovering mid‑week. The CBOE Volatility Index (VIX) surged above 20.0 on Tuesday, then quickly retraced back toward 17.0 by Friday, highlighting swings in fear and complacency among traders. A high, then rapid drop in VIX suggests short‑term traders may be reducing hedges after the headline shock passed, but volatility could remain elevated in the weeks ahead. As MarketWatch observed, “a recent spike in the fear gauge was swiftly erased after tariff threats were softened,” yet analysts warn that sustained volatility remains likely.

Breadth measures are also telling a mixed story. Major indexes like the S&P 500 and Nasdaq closed the week with only modest net movement, but many breadth indicators remain tepid. Recent market breadth data showed that a smaller proportion of S&P 500 stocks are making new highs even as the index approaches record levels, signaling a more narrow leadership. This pattern often precedes a larger corrective phase if broader participation does not improve, and recent analysis pointed to ongoing breadth weakness despite headline strength.

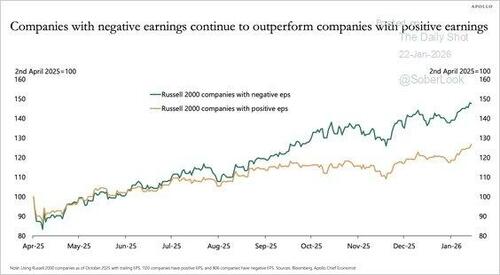

Rotation is evident beneath the surface. Small‑cap stocks and cyclical sectors have outperformed as of late, pushing the Russell 2000 to a series of record highs and outperforming megacaps year‑to‑date. However, small-caps are now very overbought and extended, suggesting a near-term rotational risk is becoming more likely. Furthermore, this shift away from the largest, momentum tech names, which generate a significant share of earnings growth, to more economically and non-profitable companies is a risk if economic “reflation” fails to mature.

Such a rotation into small capitalization companies can be constructive, but only if it broadens rather than temporarily lifts market averages.

🔑 Key Catalysts Next Week

The market arrives at a turning point as January wraps up into a week that will define near‑term risk appetite. Volatility remains elevated, and the narrative has shifted decisively from political headline swings to earnings and economic fundamentals. Last week’s tariff tensions triggered sharp moves across major tech names and drove the CBOE Volatility Index back above 20 before it retraced. Investors now turn to hard data and earnings from key bellwethers on whether the growth and inflation story supporting 2026 valuations can hold up. The backdrop is a market pricing in expectations of continued strength in consumer and business demand, but also significant sensitivity to guidance and Fed policy signals.

The Fed’s January meeting on the 28th looms large as a pivotal catalyst. With inflation still above target and short‑term yields higher, any shift in language on rate cuts or growth expectations could move stocks and bonds sharply. Early-week economic reports, such as durable goods orders and consumer confidence, will set the tone, but it is the big tech earnings mid‑week that have traders bracing for impact. Microsoft, Tesla, Apple, and Meta Platforms are reporting results that will deeply influence the narrative on sector rotation, growth sustainability, and the pricing of risk assets. Stocks with wide exposure to consumer demand, cloud and AI adoption, and discretionary spending will be heavily scrutinized, with guidance statements likely to matter more than quarterly beats or misses. Given the market’s recent sensitivity to earnings guidance, any signs of softening demand or caution in capex could quickly alter the technical landscape.

With the market closing at 6,915 on Friday, here are key technical support and resistance levels to watch going into next week:

Resistance Levels

Primary resistance: 7,000 — First initial resistance following any attempt to break out to new all-time highs.

Secondary resistance: 7,100 — First initial Fibonacci extension level.

Extended resistance: 7,200 — Third Fibonacci extension level

Support Levels

Primary support: 6,913 — 20-day moving average.

Secondary support: 6,836 — 50‑day moving average and recent lows.

Key support: 6,378 — 100-day moving average

These levels are critical guides. A breakout to new all-time highs on strong volume could signal continuation of the broader uptrend, whereas a break below 6,836 would shift short‑term momentum toward deeper correction risk. Traders should continue to monitor portfolio risk and rebalance as needed until the market provides better direction with a trend in one direction or the other.