Japanese Yields Soar To All Time High After PM Takaichi Calls Snap Election Seeking More Spending, Less Taxes

In the rapidly approaching endgame for Japan's monetary experiment, overnight Japanese bond yields hit new record highs, with the long end surging as much as 10bps...

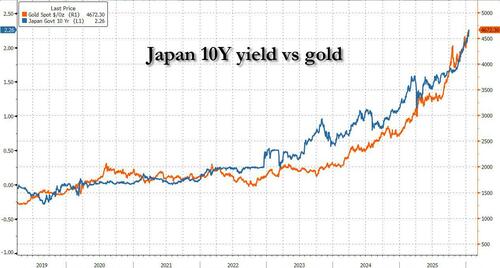

... which in turn helped send gold to fresh record highs above $4,600 (as we discussed previously)...

... after Prime Minister Sanae Takaichi said she will call a national election on February 8 to seek voter backing for everything that guarantees a bond market collapse, namely increased spending, tax cuts and a new security strategy that is expected to accelerate a defence build-up.

According to Reuters, Takaichi plans to dissolve parliament on Friday ahead of the snap vote for all 465 seats in the lower house of parliament, in her first electoral test since becoming Japan's first female premier in October.

"I am staking my own political future as prime minister on this election," Takaichi told a press conference on Monday. "I want the public to judge directly whether they will entrust me with the management of the nation."

Of course, that's not the story at all: she is promising more spending and less taxes, so of course she will get what she wants from the free shit army. The question is what happens when Japanese bond yields rise so high the country can no longer pretend it isn't facing the biggest bond crisis in history.

Takaichi has promised a two-year halt to a consumption tax of 8% on food, adding that her spending plans would create jobs, boost household spending and increase other tax revenues. And all for the low, low price of another 10-20% in debt/GDP.

Sure enough, the prospect of such a tax cut, which the government estimates would reduce its revenue by 5 trillion yen ($32 billion) a year, sent the yield on Japan's 10-year government bonds to a 27-year high earlier on Monday.

Calling an early election allows Takaichi to cement her political role and capitalize on strong public support to tighten her grip on the ruling Liberal Democratic Party and shore up her coalition’s fragile majority. The election will test voter appetite for higher spending - i.e., more handouts - at a time when the rising cost of living is the public's top concern. Then again, Takaichi can just blame the BOJ for not raising rates enough.

Having dealt with deflation for nearly 40 years, runaway prices are a new concept for Japan, yet that's precisely where the country is right now: prices are the main worry of 45% of the respondents in a poll released by public broadcaster NHK last week, followed by diplomacy and national security at 16%.

Making sure inflation rises even more, Takaichi's administration plans a new national security strategy this year after deciding to hasten a military build-up that will lift defence spending to 2% of GDP, a sharp break from decades in which Japan capped such outlays at around 1%. Translation: even more spending and even more debt monetization by the BOJ.

Takaichi has not set a new spending target beyond that level, but rising tension with China over Taiwan and disputed islands in the East China Sea, coupled with U.S. pressure for allies to spend more, are likely to push defence outlays higher. Last week, China banned exports of items destined for Japan's military that have civilian and military uses, including some critical minerals.

"China has conducted military exercises around Taiwan, and economic coercion is increasingly being used through control of key supply-chain materials," she said. "The international security environment is becoming more severe."

The LDP and Ishin go into the Feb 8 election, which coincides with a planned national election in Thailand, with a combined 233 seats. Takaichi said her target was for the coalition to retain its majority in the lower chamber.

Her main challenger will be the Centrist Reform Alliance, a new political party combining the largest opposition group, the Constitutional Democratic Party of Japan and Komeito, which ended its 26-year coalition with the LDP after Takaichi, a right-wing lawmaker, took over at the LDP. Together the parties hold 172 seats.

That new political group could propose to permanently abolish the 8% sales tax on food, a party official said earlier in the day.

"Now may be the best chance she has at taking advantage of this extraordinary popularity," said Jeffrey Hall, a lecturer in Japanese studies at Kanda University of International Studies. But with opposition parties joining forces to oppose her, victory might not be straightforward, he added.

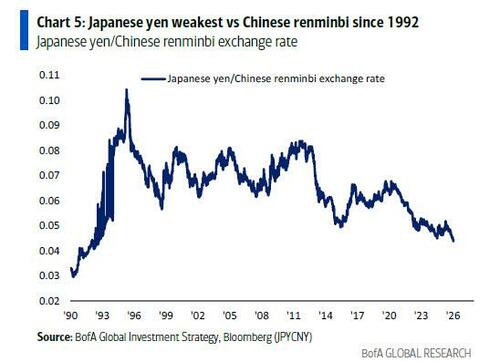

In any case, don't expect any major changes in Japan's political facade. Meanwhile the yen is trading near an all time low against the USD, and against that other export-focused currency, China's yuan...

... which in turn is keeping Japan's economy afloat, by pushing the price of its exports artificially lower. Still, at some point the BOJ will have to make a choice: contain inflation (and send the yen surging), or watch the world's second largest bond market (of which 60% of is held by the BOJ), disintegrate.