JPY reverses earlier losses ahead of the BoJ rate decision - Newsquawk Asia-Pac Market Open

- US and China have signed off on a deal to sell TikTokʼs US business to a consortium of mostly US investors led by Oracle and Silverlake, Semafor reported.

- Ukrainian President Zelensky said there will be a trilateral meeting of US, Russian and Ukrainian officials, commencing on Friday in the UAE and continuing into Saturday.

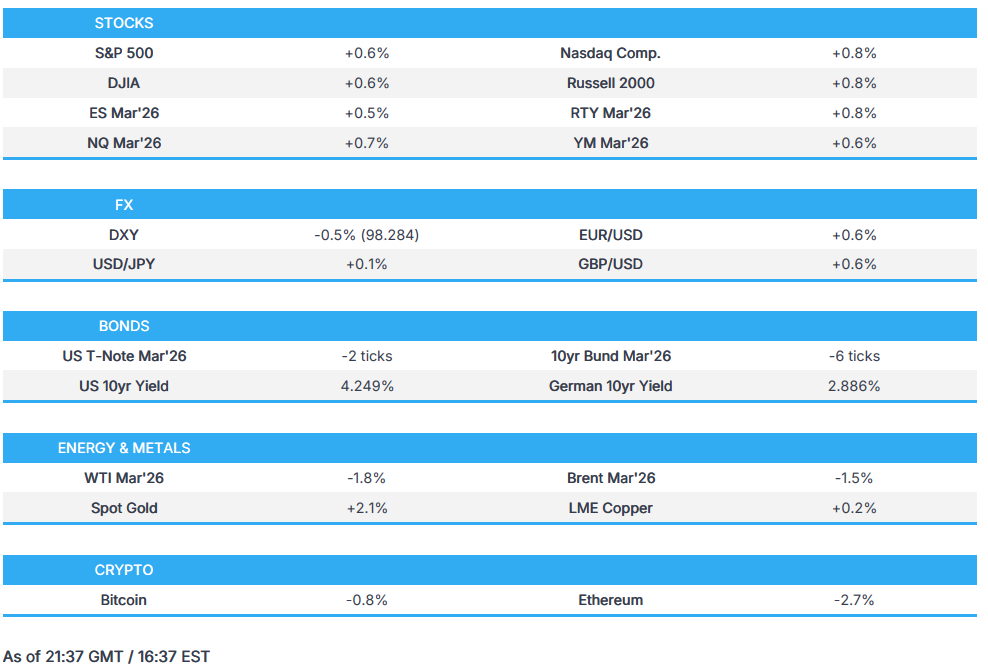

- DXY was lower on Thursday, as geopolitics, whether that be Greenland or Russia/Ukraine, continue to dominate.

- Looking ahead, highlights include Japanese CPI (Dec), S&P PMIs Final (Jan), UK GfK Consumer Confidence (Jan) and the BoJ Policy Announcement.

More Newsquawk in 2 steps:

1. Subscribe to the free premarket movers reports

2. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

SNAPSHOT

US TRADE

- US stocks closed in the green, extending on Wednesday's gains driven by Trump backing off from imposing additional tariffs on EU nations over Greenland. A few details emerged surrounding the US-NATO deal. Trump said there will be total access, and he will not be paying anything. This, however, does oppose a late-Wednesday NYT report that the deal would involve small pockets of land. Nonetheless, risk sentiment improved and outweighed a chunky selloff after the open.

- Communications outperformed due to a Meta (META, +5.7%) rally after it received positive commentary at Jefferies. Tesla's (TSLA, +4.2%) rollout of Robotaxis in Austin, with no safety monitor, supported Discretionary gains, while Real Estate and Utilities lagged.

- SPX +0.55% at 6,913, NDX +0.76% at 25,518, DJI +0.63% at 49,384, RUT +0.76% at 2,719.

TARIFFS/TRADE

- US Treasury Secretary Bessent said China buying more soybeans isn't required; China's President Xi and US President Trump could meet four times this year.

- India's PM Modi is scheduled to speak with Brazilian President Lula, expressing optimism after reviewing strong momentum in the India-Brazil trade partnership.

- Argentine President Milei on US trade deal said they are working and will have good news.

- US Commerce Secretary Lutnick said they remain committed to implementing the US-EU trade agreement.

- European Parliament Trade Committee is to return to the matter of the EU-US trade deal on Monday.

- RTE's Connelly highlights conflicting views over whether the EU-Mercosur deal should be applied provisionally, despite the European Parliament referring it to the ECJ. Argentina, Brazil, Paraguay and Uruguay.

- Switzerland's Parmelin via X said he had very constructive talks with USTR Greer. First round of talks at technical level in Bern as soon as possible.

- UK Business Secretary Kyle said the European customs union is not currently on the radar of the UK government.

- China's Commerce Ministry said China is concerned with the EU excluding some Chinese tech suppliers.

NOTABLE US HEADLINES

- US President Trump announces intention to bid for the World Expo 2035; will create thousands of jobs and add growth.

- Big northern European investors are reportedly increasingly wary of the risks of holding US assets in the face of geopolitical tensions, according to reports.

- Elon Musk said AI costs are plummeting and will be lower in the near term. Plans to launch a solar-powered AI satellites in the coming years, impacting renewable energy sector. Added that tariffs are a barrier for solar power in the US.

- US President Trump said he will probably be issuing a dividend if they win the tariff case; will be paying off debt if win SCOTUS tariff case.

- US President Trump on healthcare said they are in negotiation. Said he doesn't want health and insurance companies to get the money. Would like to see another reconciliation plan.

- US President Trump said there will be more military equipment purchases.

- NEC Director Hassett said recent inflation data have been very promising; US may get two quarters of growth above 5%.

- US President Trump said he thinks investors in the US will be "extremely happy" with those investments.

- US House GOP leaders are struggling to strike a deal with Republican hard-liners tonight that would allow the final government funding package to advance, Politico reported. "The Rules Committee recessed Wednesday evening without a solution. Senior Rs hope to reconvene the panel by 9 pm".

DATA RECAP

- US PCE Price Index MoM (Nov) M/M 0.2% vs. Exp. 0.2% (Prev. 0.2%).

- US Core PCE Price Index MoM (Oct) M/M 0.2% (Prev. 0.2%).

- US Core PCE Price Index MoM (Nov) M/M 0.2% vs. Exp. 0.2% (Prev. 0.2%).

- US PCE Price Index YoY (Oct) Y/Y 2.7% (Prev. 2.8%).

- US PCE Price Index YoY (Nov) Y/Y 2.8% vs. Exp. 2.8% (Prev. 2.7%).

- US Core PCE Price Index YoY (Oct) Y/Y 2.7% (Prev. 2.8%, Low. 2.6%, High. 3.1%).

- US Personal Spending MoM (Oct) M/M 0.5% (Prev. 0.3%).

- US Personal Income MoM (Oct) M/M 0.1% (Prev. 0.4%).

- US Personal Income MoM (Nov) M/M 0.3% vs. Exp. 0.4%.

- US Personal Spending MoM (Nov) M/M 0.5% vs. Exp. 0.5%.

- US PCE Price Index MoM (Oct) M/M 0.2% (Prev. 0.3%).

- US GDP Sales QoQ Final (Q3) Q/Q 4.5% vs. Exp. 4.6% (Prev. 7.5%).

- US Real Consumer Spending QoQ Final (Q3) Q/Q 3.5% vs. Exp. 3.5% (Prev. 2.5%).

- US GDP Price Index QoQ Final (Q3) Q/Q 3.7% vs. Exp. 3.7% (Prev. 2.1%).

- US GDP Growth Rate QoQ Final (Q3) Q/Q 4.4% vs. Exp. 4.3% (Prev. 3.8%).

- US PCE Prices QoQ Final (Q3) Q/Q 2.8% vs. Exp. 2.8% (Prev. 2.1%).

- US Continuing Jobless Claims (Jan/10) 1,849K (Prev. 1,875K, Rev. From 1,884K).

- US Jobless Claims 4-week Average (Jan/17) 201.5K (Prev. 205.25K, Rev. From 205K).

- US Initial Jobless Claims (Jan/17) 200K vs. Exp. 212K (Prev. 199K, Rev. From 198K).

- US Core PCE Prices QoQ Final (Q3) Q/Q 2.90% vs. Exp. 2.9% (Prev. 2.60%, Rev. From 2.6%).

- US Corporate Profits QoQ Final (Q3) Q/Q 4.7% vs. Exp. 4.4% (Prev. 0.2%).

- Atlanta Fed GDPNow (Q4) GDP: 5.4% (Prev. 5.3%).

NOTABLE US EQUITY HEADLINES

- US and China have signed off on a deal to sell TikTok’s US business to a consortium of mostly US investors led by Oracle and Silverlake, Semafor reported. The final deal closing is intended to meet a January 22nd deadline outlined by the Trump administration in an executive order that granted a 120-day stay on the enforcement of the federal ban. It was unclear how much ByteDance received for the US business. Chew’s December memo said the new independent entity will control data protection, content moderation and algorithm security and that the entity would be “governed by a new seven-member majority-American board of directors.”

- Apple's (AAPL) CEO Cook not expected to step down as CEO imminently; Apple's Ternus adds design duties in new sign of CEO candidacy.

- Tesla watcher Sawyer Merritt posted on X "Tesla (TSLA) has officially started FSD Unsupervised Robotaxi rides for the general public in Austin with no safety monitors in the car, marking a historic milestone for the company".

- US President Trump said restrictions on defence companies are 'very free market'; Defence companies have not complained about restrictions.

- GE Aerospace (GE) Q4 2025 (USD): EPS from cont ops 2.31, Q4 adj, EPS 1.57 (exp. 1.44), revenue 12.7bln (exp. 11.20bln). Q4 total orders +74% at USD 27bln. Q4 FCF USD 1.8bln. Q4 Commercial Engines and Services sales USD 9.47bln (+24%), orders USD 22.84bln (+76%). GUIDANCE: Sees FY26 adj. revenue up by low-single digits. Sees FY26 FCF between USD 8.0-8.4bln. Sees FY26 operating profit between USD 9.85-10.25bln.

- Intel (INTC) Q4 2025 (USD): Adj. EPS 0.15 EPS (exp. 0.08), Revenue 13.70bln (exp. 13.40bln).

- CSX (CSX) Q4 2025 (USD): Adj. EPS 0.42 (exp. 0.41), Revenue 3.51bln (exp. 3.55bln).

- China's Commerce Ministry, when asked if NVIDIA (NVDA) H200 chips require special approval, said, "I am not aware of the situation you mentioned."

CENTRAL BANKS

- ECB Minutes (Dec): Overall, the ECB was currently in a good place from a monetary policy point of view, but this did not mean the stance was to be seen as static.

- CBRT cuts Repo Rate by 100bps to 37.00% vs exp. 36.50% (prev. 38.00%).

- Norges Bank Interest Rate Decision 4.00% vs. Exp. 4.00% (Prev. 4.00%); "... if the economy evolves broadly as currently envisaged, the policy rate will be reduced further in the course of the year.". The Committee judges that a restrictive monetary policy is still needed. Inflation is still too high. If the policy rate is lowered too quickly, inflation could remain above target for too long. On the other hand, an overly tight monetary policy stance could restrain the economy more than needed to bring inflation down to target. If growth in business costs remains elevated for longer, or the krone proves weaker than projected, inflation could remain elevated for longer than projected in December.

- Governor Bache: “We are not in a hurry to reduce the policy rate further. Inflation is still too high. Inflation excluding energy prices has been close to 3 percent since autumn 2024”. “The current geopolitical situation is tense and is causing uncertainty, including about the economic outlook.”

- Bundesbank said economy to get spending boost later this year; GDP seen rising only moderately in Q1.

- PBoC Governor Pan said China has room this year to cut RRR and interest rates, pledging flexible use of tools.

FX

- The Dollar was lower on Thursday, as geopolitics, whether that be Greenland or Russia/Ukraine, continue to dominate the tape. The main update for the former, of course, came last night as Trump said they’ve agreed a framework of a deal. On the latter, Trump/Zelensky had a “good” meeting today, and have set up a trilateral meeting with Russia on Friday-Saturday, which will also see Trump meet Putin prior to that.

- G10 FX, ex-JPY, saw gains across the board and profited from the Dollar selling. The Yen was the clear laggard and saw losses, which saw USD/JPY print a peak of 158.89 ahead of the BoJ rate decision. Despite the Yen weakness, given ongoing domestic political concerns, it did see some reprieve after Bloomberg reported that Japan now forecasts the primary balance to be in a deficit (prev. forecast surplus) in FY26, which perhaps eased some fears of a deeper deficit.

- GBP saw strength, but did see weakness in the European morning amid reports that UK Labour MP Andrew Gwynne is set to stand down as MP, clearing the way for Andy Burnham. However, the Pound pared some weakness as Sky's Coates highlights, with reference to UK Labour Mayor Burnham, that there is a high threshold for the mayor to step down with the intention of becoming an MP.

FIXED INCOME

- T-notes flattened as US data stirs little reaction.

- US sold USD 21bln of 10yr TIPS; tails 2bps. High Yield: 1.940% (prev. 1.734%); WI: 1.960%. Tail: 2bps (prev. 5bps). B/C: 2.38x (prev. 2.20x). Dealer: 12.2% (prev. 17.8%). Direct: 20.4% (prev. 26.1%). Indirect: 67.42% (prev. 56.1%).

- US sold 4-week bills at a high rate of 3.630%, B/C 2.86x; sold 8-week bills at a high rate of 3.630%, B/C 2.84x.

COMMODITIES

- Oil prices saw pressure amid the continued positive rhetoric regarding Greenland, and also Russia/Ukraine.

- Petrobras (PBR) refineries expected to operate at about 95% of capacity in 2026 (prev. 92% in 2025).

- Trump administration has required the majority of Venezuelan oil to be sold to the US and China can buy the oil at 'fair market prices'. Allowing China to purchase Venezuelan oil but not at "unfair, undercut" prices that Maduro sold oil to China to pay debts.

- EIA Weekly Refinery Utilization Rates (Jan/16) -2.0% (Prev. 0.6%)

- US EIA Cushing Crude Oil Stocks Change (Jan/16) 1.478 (Prev. 0.745).

- US EIA Gasoline Stocks Change (Jan/16) 5.977M vs. Exp. 1.7M (Prev. 8.977M).

- US EIA Crude Oil Stocks Change (Jan/16) 3.602M vs. Exp. 1.1M (Prev. 3.391M).

- US EIA Distillate Stocks Change (Jan/16) 3.348M vs. Exp. -0.2M (Prev. -0.029M).

- US EIA Natural Gas Stocks Change (Jan/16) -120Bcf vs. Exp. -106Bcf (Prev. -71Bcf).

- Copper production at a Capstone Copper Corp. mine in northern Chile has halted amid a nearly three-week labour strike, Bloomberg reported.

- Venezuela proposes oil law reform which includes flexible royalty payments.

- French President Macron said the French Navy boarded an oil tanker coming from Russia, subject to international sanctions and suspected of flying a false flag.

- Vitol is reportedly making preparations to begin fuel oil exports from Venezuela, according to sources.

- Russia's Deputy PM Novak said Russian oil output amounted to 512mln tonnes in 2025; Russia's LNG production reached ~32mln tonnes in 2025; Russia's coal output at 440mln tonnes in 2025. US sanctions against Russian oil companies disrupt the sustainability of global energy resources, increase volatility on global oil markets.

- US President Trump said he has a great relationship with the new leaders of Venezuela. Nation is opening up to US oil firms. Highlights that Venezuela has a "lot" of oil, but very little production.

- US Energy Secretary Wright said global oil production would need to more than double to meet rising demand and prevent energy poverty.

- US President Trump is reportedly personally controlling the release of funds generated from Venezuela's oil, Semafor reported citing an official.

- PBoC is to strengthen the supervision of the gold market.

- Japanese copper smelters reportedly remain in discussions over charges for 2026 with miners.

- China's UBS SDIC silver futures fund will be suspended from market open until 10:30 am local time (2:30am GMT) on the 23rd January.

- MMG (1208 HK) reported Q4 copper production of 108.6k/T of output, -7% Y/Y.

GEOPOLITICAL

MIDDLE EAST

- France said the board of peace charter does not correspond with UN Gaza resolution, some elements contrary to UN charter; will not join board of peace for now.

- Israel's Air Force Chief said the entirety of their air force is ready and alert.

- US President Trump said if Hamas does not give up its weapons then it will be the end of them, only "little fires" left with reference to Gaza. Will hold talks with Iran. Something needs to be done regarding Hezbollah and Lebanon. Threats are "really calming down". Need to speak with Spain about their NATO spending level.

- A Palestinian source said there is an understanding between Hamas and the US administration that the organisation will hand over its weapons and tunnel maps in exchange for recognition as a political organisation, via Sky news.

RUSSIA-UKRAINE

- Ukraine President Zelensky said territorial issue not solved yet.

- Ukraine's President Zelensky said both Russia and Ukraine should compromise.

- Ukrainian President Zelensky said there will be a trilateral meeting of US, Russian and Ukrainian officials, commencing on Friday in the UAE and continuing into Saturday.

- Ukraine President Zelensky criticises Europe for not using frozen Russian assets; why can Trump stop tankers and seize oil and Europe can't do this with Russian oil. Europe needs united armed forces. Europe loves to discuss future but avoids action. Ready to help protect Greenland from Russian ships. Discussed air defense for Ukraine with Trump. Documents are now even better prepared with US. Urges to act against Russian missiles in Belarus. Would have been cheaper for allies to cut Russia's access to components from missiles instead of PURL. Europe advises Ukraine not to mention tomahawks to US. Europe's problem is its mindset. Europe can and should be a global force.

- Ukraine's President Zelensky said meeting with Trump went very well.

- US President Trump said Zelensky meeting was good and message to Putin is the war has to end.

- Ukraine President Zelensky aide Lytvyn said the Trump meeting was 'good'.

- US President Trump said he will have a meeting with Russian President Putin on Thursday or Friday; thinks they are getting close.

- US envoy Witkoff said a lot of progress has been made on Ukraine, getting to the end. Believes tariff-free zone would be a gamechanger.

GREENLAND

- NATO's top commander said one of the more concerning things in Arctic has been increased cooperation between China and Russia. Organisation is constantly looking at ways to enhance its posture in the Arctic.

- NATO's Rutte said 7 high North countries will cooperate in the Arctic; Greenland's sovereignty was not discussed with US President Trump. Said decision on territory is up to Ukraine.

ASIA-PAC

NOTABLE HEADLINES

- Japan's Economy Minister said they are closely watching both domestic and foreign market moves.

- Japan reverses FY26 primary balance surplus view to a deficit, via Bloomberg; Japan had expected to achieve formerly key fiscal goal in FY26. Primary deficit is now projected to show a deficit of around JPY 0.8tln of GDP, in the year starting April. The Government had previously forecasted a surplus of approx. JPY 3.6tln in August.

- Japanese PM Takaichi said she will look at the budget balance over the next few years, instead of focusing on balance in a single year.

- China's Commerce Minister urges pharmaceutical retailers to pursue horizontal mergers and restructuring.

- Fitch said weak Chinese domestic demand will limit growth to 4.1% in 2026. "China’s economic data point to a continued two-speed economy in 2026, with strong external demand balanced against subdued domestic demand". "We believe domestic demand will remain constrained by sluggish consumer confidence, deflationary pressures, and investment headwinds that have broadened beyond the property-sector correction and are amplified by the local-government debt overhang.". "Policy efforts to reignite investment and shift towards greater consumption are likely to intensify, but on an incremental basis, providing modest support to economic activity.".

- Japanese supermarket reportedly called for a 5-year minimum tax cut, via Nikkei.

EU/UK

NOTABLE HEADLINES

- Sky's Coates highlights, with reference to UK Labour Mayor Burnham, that there is a high threshold for the mayor to step down with the intention of becoming an MP.

- UK Labour MP Andrew Gwynne set to stand down as MP, clearing way for Andy Burnham, The Times reports; announcement possible this afternoon.

DATA RECAP

- EU Consumer Confidence Flash (Jan) -12.4 (Prev. -13.1).

- UK CBI Distributive Trades (Jan) -17 vs. Exp. -35 (Prev. -44).

- UK PSNB Ex Banks (Dec) 11.58B vs. Exp. 14B (Prev. 10.94B, Rev. From 11.65B).

- UK CBI Industrial Trends Orders (Jan) -30 vs. Exp. -33 (Prev. -32).

NOTABLE EUROPEAN EQUITY HEADLINES

- BASF (BAS GY) FY (EUR): Sales 59.7bln (exp. 60.7bln), Adj. EBITDA 6.6bln (exp. 6.87bln), EBIT 1.6bln, Net income 1.6bln, FCF 1.3bln. Guidance:. FY FCF -600mln. FY adj. EBITDA 6.6bln (exp. 7.35bln).