JPY softer following cooler inflation; Crude edges higher as Trump threatens Iran for a deal - Newsquawk EU Market Open

- APAC stocks followed suit to the predominantly negative mood on Wall Street, where risk appetite was subdued amid private credit fund concerns and geopolitical risks.

- Hang Seng retreated on return from the Lunar New Year holidays, with the big tech names leading the declines in the index, while mainland markets and the Stock Connect remained shut and won't open until next Tuesday.

- USD/JPY lingered near the prior day's best levels north of 155.00, with some mild support seen as the cooling of Japanese inflation essentially provides the BoJ additional policy space.

- US President Trump said 15 days is the maximum deadline to reach an agreement with Iran; otherwise, it will be very unfortunate for them, according to Al Jazeera; US President Trump reportedly weighs a limited strike to force Iran into a nuclear deal, WSJ reported.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.5% after the cash market closed with losses of 0.7% on Thursday.

- Looking ahead, highlights include ECB EZ Indicator of Negotiated Wages; UK Retail Sales (Jan), PSNB (Jan), German PPI (Jan), Global Flash PMIs (Feb), Canadian Retail Sales (Jan), US PCE/GDP (Dec/Q4). Speakers include Fed’s Logan & Bostic, Earnings from Anglo American.

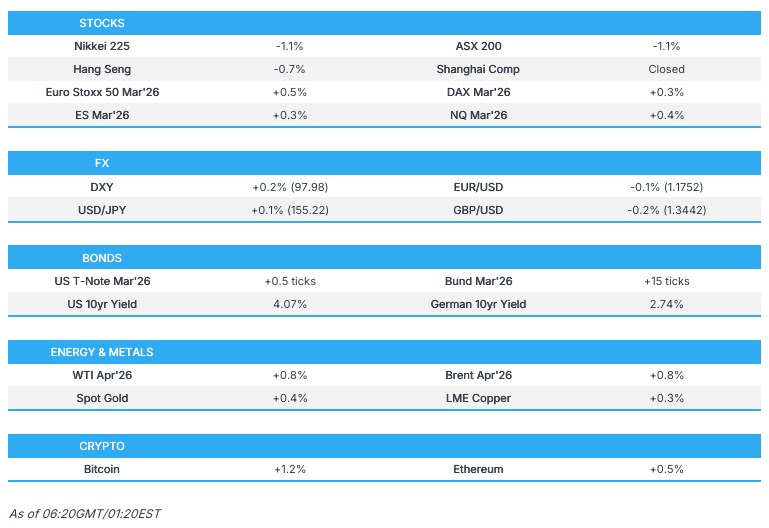

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were lower, as were most sectors, with Financials the laggard and not helped after it was reported that Blue Owl halted redemptions at its private credit fund, which sparked fresh selling in other private equity names like Blackstone, Apollo, and KKR. There was a slew of data releases from the US, including initial jobless claims, which were below expectations but continued claims printed above, while Philly Fed was strong on the headline but was accompanied by mixed internals, a deeper trade deficit than expected, and pending home sales surprisingly fell M/M. Energy sat at the top of the sectorial breakdown and was once again buoyed by gains in the crude complex amid heightened US/Iran tensions and fears of a US strike, as President Trump stated "We had good talks with Iran", but added, "bad things will happen to Iran if no deal is made".

- SPX -0.28% at 6,862, NDX -0.41% at 24,797, DJI -0.54% at 49,395, RUT +0.24% at 2,665.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said steel tariffs have been a game-changer, while he accused China of flooding the US market with subsidised goods and said that Canada has ripped the US off for many years, but not anymore.

- US President Trump posted "..Companies are thriving because of TARIFFS. The United States of America has taken in Hundreds of Billions of Dollars, and quadrupled (at least) National Security, all as a result of the Economy Saving TARIFFS!"

- White House announced that a trade agreement with Indonesia was signed on Thursday, while it released the Fact Sheet on finalising the trade deal with Indonesia, which it stated will provide Americans unprecedented market access and unlock major breakthroughs for US manufacturing, agriculture, and digital sectors.

- Japanese Trade Minister Akazawa said they have not set the timing on the second set of US investment projects, while he added that they want to make sure PM Takaichi's US trip in March is fruitful.

NOTABLE HEADLINES

- Fed's Miran (voter) now sees a less accommodative rate path and would reverse his December shift toward easier policy if he is still at the Fed by the March meeting, citing firmer labour data and renewed goods inflation. Furthermore, Miran suggested that if he had to submit a rate projection for 2026 on current data, he would pencil in 100bps of cuts this year, instead of the 150bps he submitted at the December forecast round, according to an interview in The Peg.

- Fed's Daly (2027 voter) said policy is in a good place and the labour market is in a better position after 75bps of cuts, while she added that inflation continues to decline outside the goods sector. Furthermore, she said they have more work to do to get inflation down, but don't want to get behind or get over our skis.

- US Senate Banking Committee is to hold a hearing with the Fed's Vice Chair of Supervision and FDIC's Hill on February 26th.

- US President Trump said he 'solved it' regarding affordability and will talk about inflation in the State of the Union.

- US President Trump wants to ban investors that own more than 100 homes from buying more, which could potentially ban hundreds of investment firms, according to WSJ

APAC TRADE

EQUITIES

- APAC stocks followed suit to the predominantly negative mood on Wall Street, where risk appetite was subdued amid private credit fund concerns and geopolitical risks related to the US and Iran following Trump's latest threat and 10-15 day ultimatum.

- ASX 200 was lacklustre amid underperformance in the tech, telecoms and consumer sectors, while participants continued to digest a slew of earnings, although downside was stemmed by resilience in utilities and the top-weighted financial industry.

- Nikkei 225 stumbled back beneath the 57,000 level with the index pressured despite recent currency weakness and the softer inflation data, which essentially provides the BoJ with more policy space, while tech and autos were among the industries notably represented in the list of worst-performing stocks.

- Hang Seng retreated upon returning from the Lunar New Year holidays with the big tech names leading the declines in the index, while mainland markets and the Stock Connect remained shut and won't open until next Tuesday.

- US equity futures eked mild gains but with price action contained after the prior day's choppy performance and with key US data on the horizon, including US GDP for Q4 and the Fed's preferred PCE inflation metric.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.5% after the cash market closed with losses of 0.7% on Thursday.

FX

- DXY was marginally firmer in rangebound trade amid ongoing geopolitical tensions in the Middle East and after the recent slew of data. There were also relatively hawkish remarks from Fed Governor Miran, who now sees a less accommodative rate path and said he would pencil in 100bps of cuts this year, instead of the 150bps he submitted at the December forecast round, while the attention turns to upcoming key data, including Q4 GDP and the December PCE Price Index.

- EUR/USD remained lacklustre after trickling beneath the 1.1800 handle, with the single currency not helped by recent weaker-than-expected Consumer Confidence data and with Eurozone PMIs scheduled later.

- GBP/USD languished at its lowest levels in almost a month at sub-1.3500 territory, with UK Retail Sales and PMI data on the horizon. There were also some recent mixed comments from BoE's Mann who provided very little to inspire the pound as she stated they are getting close to some sense of where monetary policy is balanced between the inflation objective and full employment, but added that the unemployment rate has gone up which is very much of a concern, and that January inflation data are good numbers from a headline perspective, although core inflation was not quite as good as hoped.

- USD/JPY lingered near the prior day's best levels north of 155.00, with some mild support seen as the cooling of Japanese inflation essentially provides the BoJ additional policy space.

- Antipodeans underperformed and breached through the prior day's trough amid headwinds from the mostly downbeat risk appetite, while it was also reported that Westpac cut its fixed home loan rates in New Zealand across three-, four- and five-year terms following the RBNZ's dovish pause earlier this week.

FIXED INCOME

- 10yr UST futures lacked conviction following the recent two-way trade alongside mixed data releases, geopolitical risks, and with private credit concerns reignited after Blue Owl was reported to have halted redemptions from its retail credit fund. However, it later stated that it is not halting investor liquidity in OBDC II, while the attention now turns to upcoming US data.

- Bund futures extended on their recent rebound with little to derail momentum heading into today's German PPI data.

- 10yr JGB futures gained following the mostly softer-than-expected Japanese CPI data, which showed a deceleration across the headline, core and core-core inflation readings, with the headline slipping beneath the central bank's price target for the first time in almost four years, while the core (Ex. Fresh Food CPI) matched estimates to print a 2-year low at the 2% goal.

COMMODITIES

- Crude futures took a breather and held on to the prior day's gains after advancing again as US/Iran tensions continued to dominate price action amid fears of a US strike due to US President Trump's ultimatum for a meaningful deal with Iran, otherwise something bad will happen, and suggested that they have 10-15 days.

- US EIA Crude Oil Stocks Change (Feb 13th) -9.0mln vs. Exp. 2.1mln (Prev. 8.5mln)

- US President Trump said 50mln bbls of Venezuelan oil are on the way to Houston and US-Venezuela energy cooperation is going well. It was also reported that Venezuela's refineries were at ~35% of capacity or 450k bpd of crude processing.

- Spot gold traded indecisively with prices oscillating around the USD 5,000/oz level ahead of key US data, including GDP and the Fed's preferred inflation gauge.

- Copper futures kept afloat following the prior session's intraday rebound, but with upside capped amid the subdued risk tone.

CRYPTO

- Bitcoin was higher after returning to above USD 67,000, where it then proceeded sideways for most of the session.

NOTABLE ASIA-PAC HEADLINES

- Japanese PM Takaichi said there is a dearth of domestic investment in Japan and that they will stop the trend of austerity and lack of investment, while she pledged to drive significant investment via multi-year budgets and long-term funding strategies, but also affirmed commitment to prudent fiscal policies to maintain market confidence. Furthermore, she aims for swift approval of crucial legislation, including tax reform, by the end of FY26/27, and said the government will unveil an investment roadmap for 17 strategic sectors beginning next month.RBNZ Governor Breman suggested that although the central bank remains forward-focused, monetary policy will adapt based on new information instead of following a predetermined path, while she added that the path back to 2% inflation has been bumpy, but expects inflation to be within the target range in Q1. Furthermore, she said the central bank is confident inflation will return to the 2% midpoint over the next 12 months and stated that NZD is not too far from fair value right now.

DATA RECAP

- Japanese National CPI YY (Jan) 1.5% vs Exp. 1.6% (Prev. 2.1%)

- Japanese National CPI Ex. Fresh Food YY (Jan) 2.0% vs Exp. 2.0% (Prev. 2.4%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Jan) 2.6% vs Exp. 2.7% (Prev. 2.9%)

GEOPOLITICS

MIDDLE EAST

- US President Trump said 15 days is the maximum deadline to reach an agreement with Iran, otherwise it will be very unfortunate for them, according to Al Jazeera.

- US President Trump said they will get a deal on Iran one way or the other and really bad things will happen if there is no Iran deal, while Trump also said that he would love to have China and Russia involved in diplomacy.

- US President Trump reportedly weighs a limited strike to force Iran into a nuclear deal and considers a range of military options but says he still prefers diplomacy, according to WSJ. Trump is considering an initial limited military strike on Iran to force it to meet his demands for a nuclear deal, in an attempt to pressure Tehran into an agreement, but fall short of a full-scale attack that could see a major retaliation. Sources stated that the opening fire, which if authorised, could come within days, and would target a few military or government sites. Furthermore, if Iran still refused to comply with Trump’s directive to end its nuclear enrichment, the US would respond with a broad campaign against regime facilities.

- US President Trump appears ready to attack Iran as the US strike force takes shape, although it remains unclear whether Trump has approved military action, according to sources cited by the Washington Post. One consideration, some said, is the ongoing Winter Olympics, which concludes this Sunday, while diplomats now believe that Iran is not prepared to budge from its “core positions,” including its right to enrich uranium, following the talks on Tuesday.

- Iran told the UN Secretary-General and Security Council members that if they are attacked, all bases, facilities and assets of a hostile force in the region will constitute legitimate targets within the framework of Iran's defensive response.

- Iran is alleged to have covertly repositioned strike drones during joint drills with Russia in the Strait of Hormuz and is said to be a 'calculated escalation' against the US, according to a defence expert cited by Fox News.

- Israeli warplanes launched a raid on the Al Tufar neighbourhood in Gaza City, according to Palestinian media.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said he scheduled a special meeting with the negotiating team for Friday regarding their next steps and decisions, while they will also define the further framework of their dialogue with the US, Europeans, and Russia.

- New Zealand provided a Russia sanctions update which included a designation of 23 individuals, 13 entities, and 100 vessels, while it lowered the oil price cap on Russian oil from USD 47.60/bbl to USD 44.10/bbl.

- NORAD detected and tracked two Tu-95s, two Su-35s and one A-50 operating in the Alaskan Air Defence Identification Zone on February 19th, while it launched several aircraft to intercept and positively identify, and escort the aircraft until they departed the Alaskan ADIZ.

OTHER

- China is monitoring US military aircraft movements over the Yellow Sea, according to Global Times.

- Mexico's navy intercepted a submarine with four tonnes of cocaine in the Pacific Ocean.

EU/UK

NOTABLE HEADLINES

- ECB's Lagarde said her baseline is finishing the ECB term, while she added that she has accomplished a lot but needs to make sure it is solid, according to WSJ.