'K-Shaped' Economy? Core Retail Sales Surged In October

Amid the growing specter of a 'k-shaped' economy, BofA's (almost) omniscient analysts forecast strong retail sales for October - considerably stronger than Bloomberg's consensus of a marginal uptick.

BofA was wrong - very wrong - as the headline retail sales was unchanged MoM, which pulled sales down to +3.5% YoY (still relatively strong)...

Source: Bloomberg

However, Ex-Autos, and Ex-Autos and Gas both beat expectations.

The figures indicate consumer spending picked up steam in the early weeks of the holiday-shopping season as shoppers, many worried about their jobs and frustrated by the high cost of living, sought out deals.

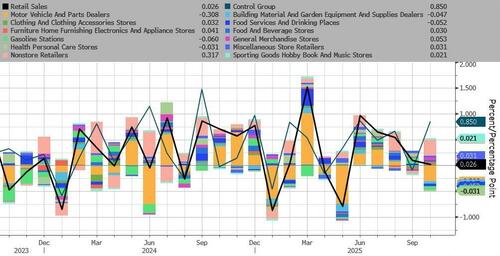

Eight out of 13 retail categories posted increases, including solid advances at department stores and online merchants.

Motor vehicles fell 1.6%, held down in part by the expiration of federal tax incentives on electric vehicles. Cheaper gasoline prices held down the value of gas station receipts.

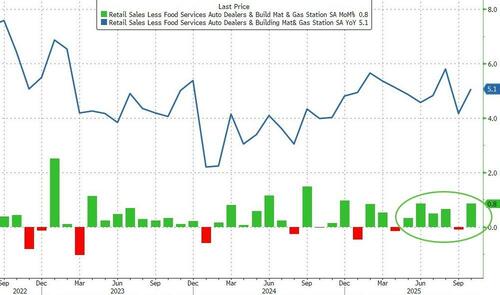

However, there is a silver lining, as the Retail Sales Control Group (which excludes food services, auto dealers, building materials stores and gasoline stations) - which feeds into the GDP calc - surged 0.8% MoM - double expectations and the biggest MoM jump since June...

Source: Bloomberg

That MoM jump leaves sales up a strong 5.1% YoY and while the 'k-shaped' economy continues to weigh on market sentiment, it is not evident in the aggregate data and supports solid Q4 GDP growth.