Key Events This Busy Week: Fed, JOLTs, Central Banks Galore; Oracle & Broadcom Earnings

It's a busy week for both economic news and central banks, with all roads pointing to Wednesday’s FOMC, where overwhelming consensus is for the Fed to deliver a final and third 25bps rate cut for 2025, making it 6 cuts and 175bps in this easing cycle since September 2024 (there was a very painful path to get here with several communication mix ups by Fed officials).

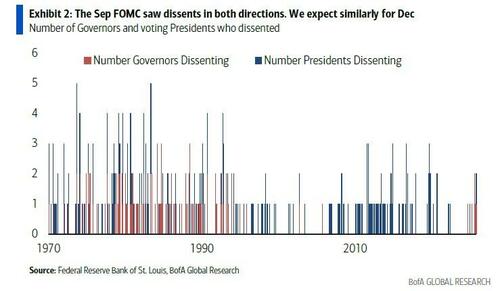

The decision is unlikely to be unanimous, with dissent anticipated from both hawkish and dovish members. Should four or more officials break ranks, it would mark the largest split since 1992 (Polymarket odds of 4+ dissents is at 22%).

Beyond the headline move, the tone of Chair Powell’s press conference and the accompanying statement will be critical. DB's Jim Reid says he expects Powell to "emphasize that the hurdle for further cuts in early 2026 is high, signalling a near-term pause. This guidance will be key to maintaining credibility ahead of likely softer labor market data due later in December."

Beyond the Fed, the global calendar features several other central bank decisions and important data releases. Maybe tech earnings from Oracle (Wednesday) and Broadcom (Thursday) will be the most interesting, with the two names diverging considerably over the last couple of months. The former is down -34% over this period with the latter only -3% off its all-time-high seen a couple of weeks ago.

In terms of central banks, the Reserve Bank of Australia meets tomorrow, where policymakers are expected to hold rates steady, but with a hawkish tilt likely after recent inflation increases. The January 7th inflation data could encourage markets to price in a hike as soon as February. The Bank of Canada follows on Wednesday, with the Swiss National Bank on Thursday with both expected to stay on hold. Canada saw a +16bps rise in 2yr yields on Friday after another strong labor market release with traders now suddenly, and fully, pricing in a hike by October next year. Meanwhile, the SNB are trying to avoid negative rates next year with rates now around zero.

Elsewhere, UK monthly GDP for October will be released on Friday, alongside German industrial production today and trade figures on Tuesday. China inflation is released on Wednesday where our economists expect CPI inflation to rise by 0.5ppt to 0.7% YoY and PPI to improve by 0.2ppt to -1.9% YoY. Nordic inflation prints are also due midweek, with Denmark and Norway publishing November CPI reports. Also watch out for the BoJ Ueda who speaks in London tomorrow ahead of a fascinating BoJ meeting next Friday just as the market winds down for Xmas.

Expanding further on the FOMC now, according to DB economists (we will have a full preview tomorrow), the updated Summary of Economic Projections (SEP) should show only modest revisions. Growth forecasts for 2025 and 2026 are likely to be nudged higher, consistent with the October staff update, while inflation projections should be trimmed for this year and next. The unemployment path is expected to remain broadly unchanged. The dot plot should continue to point to one cut per year over the next two years, reinforcing the message that policy is approaching the neutral range (3.5–3.75%). The baseline remains that the Fed stays on hold through the first half of 2026, with risks skewed towards another cut in Q1 if labor market weakness persists. Under new leadership later in the year, they anticipate a September cut as disinflation resumes, taking the trough in the fed funds rate to around 3.3%.

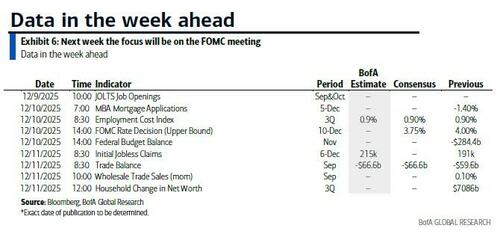

While the Fed dominates, a handful of other releases could provide additional nuance. Tomorrow brings combined September–October JOLTS data, offering a backward-looking snapshot of hiring and quits trends. Recent figures have underscored a “low hiring/low firing” dynamic, with private hiring at multi-year lows and quits subdued. Wednesday’s Employment Cost Index for Q3 is forecast at DB to hold steady at +0.9%, keeping annual growth around 3.6%. Thursday rounds out the docket with September trade numbers (-$69.6bn expected vs. -$59.6bn prior) and initial jobless claims (225k vs. 191k), the latter likely to increase after holiday distortions.

Courtesy of DB, here is a day-by-day calendar of events

Monday December 8

- Data: US November NY Fed 1-yr inflation expectations, China November trade balance, Japan November Economy Watchers survey, M2, M3, Germany October industrial production

- Central banks: ECB's Cipollone and Villeroy speak, BoE's Taylor and Lombardelli speak

- Auctions: US 3-yr Notes ($58bn)

Tuesday December 9

- Data: US November NFIB small business optimism, September and October JOLTS report, Japan November machine tool orders, PPI, Germany October trade balance

- Central banks: RBA decision, ECB's Nagel speaks, BoJ’s Ueda speaks

- Earnings: thyssenkrupp

- Auctions: US 10-yr Notes (reopening, $39bn)

Wednesday December 10

- Data: US Q3 employment cost index, November federal budget balance, China November CPI, PPI, Italy October industrial production, Sweden October GDP indicator, Denmark November CPI, Norway November CPI

- Central banks: Fed’s decision, BoC decision, ECB's Lagarde speaks

- Earnings: Oracle, Adobe, Synopsys

- Other: UK Chancellor Reeves appears before the Treasury Select Committee

Thursday December 11

- Data: US September trade balance, wholesale trade sales, initial jobless claims, UK November RICS house price balance, Italy Q3 unemployment rate, Canada September international merchandise trade, Australia November labour force survey

- Central banks: SNB decision, BoE’s Bailey speaks

- Earnings: Broadcom, Costco, Lululemon

- Auctions: US 30-yr Bond (reopening, $22bn)

Friday December 12

- Data: UK October monthly GDP, Japan October capacity utilisation, Germany October current account balance, Canada October building permits, wholesale sales ex petroleum, Q3 capacity utilisation rate

- Central banks: Fed's Paulson and Hammack speak, BoE inflation attitudes survey for November

* * *

Finally, looking at the just the US, Goldman writes that the key economic data releases this week are the JOLTS job openings report on Tuesday and the employment cost index on Wednesday. The December FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM.

Monday, December 8

- There are no major economic data releases scheduled.

Tuesday, December 9

- 06:00 AM NFIB small business optimism, November (consensus 98.3, last 98.2)

- 10:00 AM JOLTS job openings, October (GS 7,100k, consensus 7,150k, last 7,227k [August])

Wednesday, December 10

- 08:30 AM Employment cost index, Q3 (GS +0.8%, consensus +0.9%, last +0.9%): We estimate the employment cost index rose by 0.8% in Q3 (quarter-over-quarter, seasonally adjusted), which would leave the year-on-year rate unchanged at 3.6% (year-over-year, not seasonally adjusted). Our forecast reflects a sequentially slower pace of wage and salary growth—reflecting the signals from the Atlanta Fed’s wage tracker and average hourly earnings—but a slight rebound in ECI benefit growth after a weak increase in Q2.

- 02:00 PM FOMC statement, December meeting: As discussed in our FOMC preview, we expect the FOMC to lower the fed funds rate by 25bp to 3.5-3.75% at its December meeting, though the meeting will likely be contentious. We continue to expect two more 25bp cuts to 3-3.25% in 2026. In the dot plot, we expect five participants to register soft dissents by submitting 3.875% as the appropriate 2025 funds rate. We also expect the median projection to show one rate cut in 2026 to 3.375% and one more in 2027 to 3.125%, as it did in September, though it is a close call. In the economic projections, we expect the median GDP growth forecast to rise for 2025 (+0.4pp to 2%) and 2026 (+0.2pp to 2%), and the median core inflation forecast to decline by 0.1pp to 3% for 2025 and 2.5% for 2026, above our forecast of 2.2% for 2026.

Thursday, December 11

- 08:30 AM Initial jobless claims, week ended December 6 (GS 230k, consensus 220k, last 191k): Continuing jobless claims, week ended November 29 (consensus 1,945k, last 1,939k)

- 08:30 AM Trade balance, September (GS -$69.0bn, consensus -$63.2bn, last -$59.6bn): We estimate that trade deficit widened by $9.4bn to $69.0bn, driven mainly by an increase in gold imports.

Friday, December 12

- There are no major economic data releases scheduled.

- 08:00 AM Philadelphia Fed President Paulson speaks: Philadelphia Fed President Anna Paulson will speak on the economic outlook at the Delaware State Chamber of Commerce in Wilmington. Speech text and audience Q&A are expected. On November 20th, President Paulson said that “each rate cut raises the bar for the next cut, [and] that’s because each rate cut brings us closer to the level where policy flips from restraining activity a bit to the place where it is providing a boost.”

- 08:30 AM Cleveland Fed President Hammack speaks: Cleveland Fed President Beth Hammack will speak at the University of Cincinnati Real Estate Center Roundtable Series. Q&A is expected. On November 20th, President Hammack said that she thinks “we need to continue to keep policy somewhat restrictive to bring inflation back to target.”

- 10:35 AM Chicago Fed President Goolsbee speaks (FOMC voter): Chicago Fed President Austan Goolsbee will speak at the Chicago Fed Annual Economic Outlook Symposium. On November 20th, President Goolsbee said that he is “a little uneasy about front-loading too many rate cuts and just assuming that the inflation we have seen is going to be transitory.”

Source: DB, Goldman