Key Events This Very Busy Week: Jobs, Payrolls, CPI. Retail Sales And Central Banks Galore

With just days left in 2025, it's an extremely busy week for global markets, with a dense calendar of economic releases and major central bank decisions, including from the European Central Bank, the Bank of England and the Bank of Japan, which as DB's Jim Reid writes, all have a chance to be Scrooges or Santas in their meetings this week. Alongside these announcements, the data flow will be heavy: the US will finally publish delayed employment and inflation reports, while flash PMIs for December and will provide clues on global momentum. Meanwhile, overnight, China' econ data dump came in worse than expected with both fixed investment, IP and Retail sales both missing.

It’s also an interesting time for global markets with long-end yields at or around multi-month or even multi-year highs (e.g. Japan and 30yr Europe) at the same time as the weakest AI stories are increasingly being punished rather than the pre-September period when AI all went up together. If that wasn’t enough, another notable Fed story came late on Friday, as President Trump suggested that NEC Director Kevin Hassett and former Fed Governor Kevin Warsh were his two favored candidates for the Fed Chair role. Hassett has been viewed as the frontrunner in recent weeks but following Trump’s interview his Polymarket odds fell from around 73% late on Friday to 52% this morning. Warsh has gone from 13% before the interview to 40% this morning. So, it's fair to say there’s a lot of unfinished business going into the last full trading week of the year.

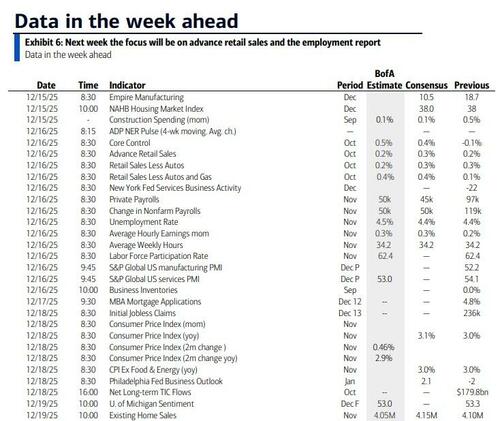

For this week specifically, in the United States, attention will focus on tomorrow’s twin employment reports for October and November, delayed by the recent government shutdown. October’s headline payrolls are expected to show a decline of around -60k, largely due to federal layoffs with all the early year buy-out offers coming off payroll in October. November should rebound modestly with a gain of +50k (per DB). Private sector hiring is likely to remain steady in both months at around +50k (DB), slightly below the recent trend. The unemployment rate is forecast to rise to 4.5 per cent in November from 4.4 per cent in September (we will never know October), while average hourly earnings should increase by 0.3 per cent in both months, keeping year-on-year nominal compensation growth near 4.4 per cent. Hours worked are expected to stabilise at 34.3. Given the distortions caused by the shutdown, the household survey could be noisy, echoing patterns seen after the 2013 episode. For a cleaner read on labor market conditions, Thursday’s jobless claims will be important and given our economists believe this will come in at around +225k, they believe underlying hiring trends remain intact.

Inflation will also be in focus with Thursday’s US CPI release. Because October data were not collected, the report will center on year-on-year changes. Headline CPI is expected to hold broadly steady at 3.03%, while core inflation remains at 3.02%. Monthly headline gains across October and November should average +0.24%, slightly below September’s pace with core slightly above at +0.26%. Within the details, core goods prices are likely to show modest increases in household furnishings and apparel, while used car prices continue to decline. Core services will attract particular attention, especially rents, which are expected to rebound after September’s anomalous weakness. Airline fares and lodging should soften from their recent highs, though health insurance may surprise on the upside. Beyond jobs and inflation, Tuesday’s retail sales report will offer insight into consumer spending. DB expects a headline decline of -0.3%, driven by autos and lower fuel prices, but retail control — the component used in GDP calculations — should rise by +0.3%, signalling resilience in underlying demand. Friday’s final reading of University of Michigan consumer sentiment is expected at 54.0, with inflation expectations likely to matter more than the headline figure.

On policy, last week’s FOMC meeting delivered a 25bps rate cut and signaled a “wait and see” approach, while also launching $40BN in monthly T-Bill purchases, much sooner than expected. Chair Powell struck a dovish tone, emphasizing labo rmarket risks over inflation. This week’s Fedspeak will reinforce that message, with Governor Miran and New York Fed President Williams speaking today, followed by Governor Waller and Williams again on Wednesday. Atlanta Fed President Bostic closes the week on Friday. Miran, who dissented in favor of a larger cut, is expected to reiterate his view that shelter inflation will collapse in coming quarters.

In Europe, Thursday brings a cluster of central bank decisions. The ECB is expected to keep rates unchanged at 2 per cen , while the Bank of England is forecast to deliver its sixth cut of the cycle, lowering Bank Rate to 3.75 per cent on a narrow 5-4 vote. The Riksbank and Norges Bank will also decide on policy on the same day with both likely to stay on hold. Ahead of the BoE meeting, UK labor market data on Tuesday and CPI on Wednesday will be closely watched. Headline inflation is forecast to ease to 3.51% year-on-year, while core ticks up slightly to 3.46% (see our economist’s preview here). Retail sales and consumer confidence on Friday will round out the UK calendar. In Germany, the Ifo survey on Wednesday and consumer confidence on Friday will provide further insight into regional conditions as fiscal spending starts to ramp up. Across the Atlantic, Canadian inflation is out today which is interesting given the sharp move from pricing in a slightly easing bias earlier this month to almost a full hike by the end of 2026 now.

Across Asia, the Bank of Japan meets on Friday and is expected to raise rates by 25bps to 0.75 per cent, with a 94% probability priced in by markets. See our economist’s thoughts here. Japan’s nationwide CPI for November will also be released on Friday, with core inflation forecast to slow to 2.9% and core-core to 3.0%. Global flash PMIs for December, covering the US, UK, Japan, Germany and France, will be published tomorrow and will offer early signals on fourth-quarter growth trends.

Day-by-day calendar of events

Monday December 15

- Data: US December Empire manufacturing index, NAHB housing market index, China November retail sales, industrial production, investment, home prices, Germany November wholesale price index, Italy October general government debt, Eurozone October industrial production, Canada November CPI, existing home sales, housing starts, October manufacturing sales

- Central banks: Fed’s Miran and Williams speak

Tuesday December 16

- Data: US, UK, Japan, Germany, France and the Eurozone December PMIs, US November and October jobs reports, October retail sales, December New York Fed services business activity, September business inventories, UK October average weekly earnings, unemployment rate, November jobless claims change, Japan November trade balance, October core machine orders, Germany December Zew survey, Italy October trade balance, Eurozone December Zew survey, October trade balance

- Earnings: Lennar

Wednesday December 17

- Data: UK November CPI, RPI, PPI, October house price index, Germany December Ifo survey, Eurozone Q3 labour costs, Canada October international securities transactions, New Zealand Q3 GDP

- Central banks: Fed’s Waller, Williams and Bostic speak

- Earnings: Micron Technology

- Auctions: US 20-yr Bond (reopening, $13bn)

Thursday December 18

- Data: US November CPI, December Philadelphia Fed business outlook, Kansas City Fed manufacturing activity, October total net TIC flows, initial jobless claims, Japan November national CPI, France December business confidence, Eurozone October construction output

- Central banks: ECB, BoE, Riksbank and Norges bank decide on rates

- Earnings: Nike, FedEx, Accenture

- Auctions: US 5-yr TIPS (reopening, $24bn)

- Other: European Council (through December 19)

Friday December 19

- Data: US November existing home sales, December Kansas City Fed services activity, UK December GfK consumer confidence, November retail sales, public finances, Germany November PPI, January GfK consumer confidence, France November PPI, retail sales, Italy October current account balance, industrial sales, December consumer confidence index, economic sentiment, ECB October current account, Eurozone December consumer confidence, Canada October retail sales

- Central banks: BoJ decision, ECB’s Wunsch and Kocher speak

Finally, looking at just the US, the key economic data releases this week are the November employment report and the October retail sales report on Tuesday and the CPI report on Thursday. There are several speaking engagements by Fed officials this week, including events with Governor Miran on Monday and Governor Waller on Wednesday.

Monday, December 15

- 08:30 AM Empire State manufacturing survey, December (consensus +10.0, last +28.7)

- 09:30 AM Fed Governor Miran Speaks; Fed Governor Stephen Miran will participate in a moderated conversation with former Fed Vice Chair Richard Clarida at Columbia University's Institute of Global Politics. On November 21, Miran said, "All the information that we got [between the October and December FOMC meetings] should push one in the dovish direction." Governor Miran dissented against the Committee's decision at the December FOMC meeting, preferring to cut the Fed Funds rate by 50bp rather than 25bp.

- 10:00 AM NAHB housing market index, December (consensus 39, last 38)

- 10:30 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will deliver keynote remarks during an event organized by the New Jersey Bankers Association. Speech text and Q&A are expected. On November 21, Williams said, "My assessment is that the downside risks to employment have increased as the labor market has cooled, while the upside risks to inflation have lessened somewhat." He also said, "I view monetary policy as being modestly restrictive, although somewhat less so than before our recent actions."

- 11:00 AM Fed Governor Miran speaks: Fed Governor Stephen Miran will appear on CNBC.

Tuesday, December 16

- 08:30 AM Nonfarm payroll employment, November (GS +55k, consensus +50k, last +22k [September]); Nonfarm payroll employment, October (GS +10k); Private payroll employment, November (GS +50k, consensus +40k, last +83k [September]); Private payroll employment, October (GS +70k); Average hourly earnings (MoM), November (GS +0.35%, consensus +0.3%, last +0.2% [September]); Average hourly earnings (MoM), October (GS +0.30%); Unemployment rate, November (GS 4.5%, consensus 4.5%, last 4.4% [September]):

- We estimate nonfarm payrolls increased 10k in October and 55k in November. On the positive side, big data indicators showed a moderate pace of private sector job growth: we forecast private payroll growth of 70k in October and 50k in November. On the negative side, we expect a large drag from the DOGE deferred resignation program. That said, a surprisingly moderate increase in federal government separations in last week’s JOLTS report suggests that the hit to nonfarm payrolls could be more limited than we had previously expected. We now assume a 70k hit to October payrolls and an additional 10k hit to November. After factoring in increases in state and local government employment but a modest additional drag on federal hiring from the ongoing hiring freeze, we expect a 60k decline in government payrolls in October and a 5k increase in November.

- The BLS did not collect responses for the household survey for October and therefore will not produce an unemployment rate for October. We estimate that the unemployment rate edged up to 4.5% in November, a low bar from the unrounded 4.44% in September. Continuing claims have rebounded slightly, and some furloughed federal workers who did not work during the reference week could be counted as unemployed even though the government shutdown had ended part of the way through the week.

- We estimate average hourly earnings rose 0.30% month-over-month in October and 0.35% in November, reflecting neutral and positive calendar effects, respectively.

- 08:30 AM Retail sales, October (GS flat, consensus +0.1%, last +0.2%); Retail sales ex-auto, October (GS +0.3%, consensus +0.2%, last +0.3%); Retail sales ex-auto & gas, October (GS +0.4%, consensus +0.4%, last +0.1%); Core retail sales, October (GS +0.5%, consensus +0.4%, last -0.1%): We estimate core retail sales rebounded 0.5% in October (ex-autos, gasoline, and building materials; month-over-month SA), reflecting improvement in alternative measures of consumer spending and a slight tailwind from potential residual seasonality. We estimate headline retail sales were unchanged, reflecting a decline in auto sales and lower gasoline prices.

- 09:45 AM S&P Global US manufacturing PMI, December preliminary (consensus 52.3, last 52.2); S&P Global US services PMI, December preliminary (consensus 54.0, last 54.1)

- 10:00 AM Business inventories, September (consensus +0.2%, last flat)

Wednesday, December 17

- There are no major economic data releases scheduled.

- 08:15 AM Fed Governor Waller speaks: Fed Governor Christopher Waller will speak on the economic outlook at Yale University. Q&A and a livestream are expected. On November 17, Waller said, "I worry that restrictive monetary policy is weighing on the economy, especially about how it is affecting lower-and middle-income consumers. A December cut will provide additional insurance against an acceleration in the weakening of the labor market and move policy toward a more neutral setting."

- 09:05 AM New York Fed President Williams (FOMC voter) speaks: New York Fed President John Williams will deliver opening remarks during the FX Market Structure Conference organized by the New York Fed. A livestream is expected.

- 12:30 PM Atlanta Fed President Bostic (FOMC non-voter) speaks: Atlanta Fed President Raphael Bostic will participate in a moderated discussion at the Gwinnett County Chamber of Commerce. Q&A is expected. On November 12, Bostic said, "It's definitely a close call. But in the final analysis, I view the signals from the labor market as ambiguous and difficult to interpret. They are not clear enough to warrant an aggressive monetary policy response when weighed against the more straightforward risk of ongoing inflationary pressures." He went on to say, "In these circumstances, moving policy near or into accommodative territory risks pumping fresh blood into the inflation beast and threatening to untether the inflation expectations of businesses and consumers."

Thursday, December 18

- 08:30 AM Initial jobless claims, week ended December 13 (GS 225k, consensus 225k, last 236k); Continuing jobless claims, week ended December 6 (consensus 1,938k, last 1,838k)

- 08:30 AM CPI (MoM, two-month average), November (GS +0.20%); Core CPI (MoM, two-month average), November (GS +0.21%); CPI (YoY), November (GS +2.91%, consensus +3.1%, last +3.01% [September]); Core CPI (YoY), November (GS +2.88%, consensus +3.0%, last +3.02% [September]): We estimate that the core CPI increased by 0.21% month-over-month on average across October and November, which would lower the year-over-year rate to 2.9% on a rounded basis in November (vs. 3.1% in September and 3.0% consensus for November). While the BLS will not produce an October core CPI due to the government shutdown and therefore month changes will not be recoverable for October or November, our forecast reflects an estimated 0.25% month over month increase in October and a 0.16% increase in November. Our two-month forecast reflects an increase in used car prices reflecting the signal from auction prices (+0.5% on average across October and November), a slight increase in new car prices (+0.2%) reflecting an increase in dealer incentives, and a slight decline in car insurance prices (-0.1%) based on premiums in our online dataset. We forecast a net increase in airfares (+1%), reflecting a drag from seasonal distortions but an increase in underlying airfares based on our equity analysts’ tracking of online price data. We have penciled in upward pressure from tariffs on categories that are particularly exposed (such as communication, household furnishings, and recreation) worth +0.08pp on core inflation on average across October and November but downward pressure from delayed data collection on categories that typically experience steep holiday discounting in late November (such as apparel, household furnishings, and personal care) worth -0.04pp. We expect a rebound in the shelter components on net after an outlier-driven slowdown in the prior month (primary rent +0.24% on average across October and November vs. +0.20% in September; OER +0.23% vs. +0.13%). We estimate that the headline CPI increased 0.20% month-over-month on average across October (0.14% MoM) and November (0.27% MoM), reflecting higher food prices (+0.3% month-over-month on average across October and November) but lower energy prices (-0.1%).

- 08:30 AM Philadelphia Fed manufacturing index, December (GS 5.0, consensus 3.4, last -1.7)

Friday, December 19

- 10:00 AM Existing home sales, November (GS +1.5%, consensus +1.2%, last +1.2%)

- 10:00 AM University of Michigan consumer sentiment, December final (GS 53.6, consensus 53.5, last 53.3): University of Michigan 5-10-year inflation expectations, December final (GS 3.2%, last 3.2%)

Source: DB. Goldman