Key Events This Week: Payrolls, CPI And Retail Sales

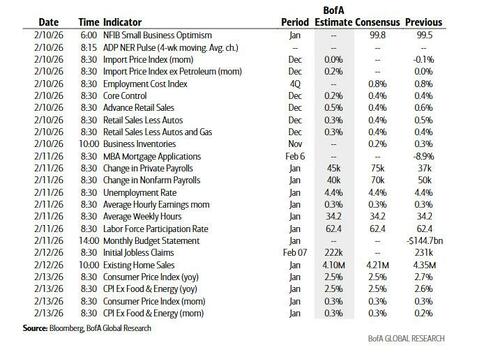

The next five days will feature an unusual pairing of major US data releases: the January employment report on Wednesday and the January CPI report on Friday, two reports which usually never appear in the same week. Ahead of those, markets will digest December retail sales and the Q4 employment cost index tomorrow, alongside a heavy schedule of Fed speakers, many of them current voters. Global inflation updates from China (Wednesday) and several European economies will add to the momentum, while the UK’s Q4 GDP (Thursday) will also be released. Corporate earnings remain in full swing, even if six of the Mag-7 have now reported, thus reducing some potential volatility until Nvidia report on February 25th.

For the employment report (which we will preview fully tomorrow), DB economists expect headline and private payrolls to rise by 75k (consensus at +69k and +75k respectively), a modest improvement relative to recent trend rates. If this holds, they anticipate the unemployment rate staying at 4.4%. They also expect average hourly earnings to increase 0.3%, with hours worked unchanged at 34.2, leaving the year over year growth rate of our payroll based nominal compensation proxy drifting up to 4.5% from 4.3%.

This month’s release will include the usual benchmark revisions to the establishment survey, though the population control adjustment to the household survey has been postponed to next month. The preliminary benchmark revision of roughly 0.6% to March 2025 employment was already unusually large, and the BLS is also introducing more frequent updates to the birth death model. While it’s impossible to know exactly how these higher frequency adjustments will influence recent data, even small changes could matter given that January typically shows the largest non seasonally adjusted job losses of the year. The final benchmark revision may also shift again, as it often deviates from the preliminary estimate once updated QCEW data are incorporated. All of this raises the uncertainty around Wednesday’s figures.

Turning to inflation (which we will also preview fully later this week), DB economists expect headline CPI to increase 0.26%, held down by an expected 2.4% drop in motor fuel prices, while core CPI should rise 0.35%. On this basis, headline CPI would slow to 2.46% year over year (from 2.68%), and core to roughly 2.55% (still rounding to 2.6%). The January release will include updated relative importances and new seasonal factors, which could affect individual components and possibly lead to firmer readings when last year’s data are re-examined. This could prompt some Fed officials to reassess the near term path of inflation.

Elsewhere in the data flow, tomorrow’s retail sales report should mirror evidence of solid holiday demand. Economists expect headline sales to rise 0.4%, with ex autos and retail control up 0.4% and 0.5%, respectively. That would leave Q4 retail control growing at a 4.5% annualized pace for the seventh straight quarter above 4%, supporting a firm consumption contribution in the Q4 GDP report due later this month. They also expect a 0.8% rise in the Q4 ECI, bringing the year over year pace down to 3.5%, still above its pre-pandemic average. Thursday’s jobless claims should ease back toward 226k after last week’s weather related spike.

Fed communication will be constant throughout the week. Governor Waller, Governor Miran, and Atlanta’s Bostic speak today, followed by Cleveland’s Hammack and Dallas’s Logan tomorrow. Vice Chair of Supervision Bowman speaks Wednesday, where regulatory topics and the balance sheet outlook may surface. Discussions around balance sheet strategy are gaining attention amid the nomination of Kevin Warsh for Fed Chair, given his previously stated preference for a smaller balance sheet. Logan, Miran, and Kansas City’s Schmid will offer additional views later in the week, including first reactions to the jobs report.

In Europe, economic indicators due include Q4 GDP in the UK on Thursday as well as CPI prints in Denmark, Norway (both tomorrow) and Switzerland (Friday). In geopolitics there will be notable focus on the Munich Security conference to be held Friday through Sunday. Remember that last year's summit was home to the extraordinary speech by JD Vance which was partly credited as responsible for the huge rearmament drive in Europe.

In Asia, we also have the January inflation reports in China due Wednesday. Our economists forecast producer prices to further rebound to -1.6% YoY from -1.9% in December 2025. In contrast, CPI inflation will likely slow to 0.4% YoY from 0.8% (see more here). Japanese PPI is out on Thursday.

Rounding out with earnings, this week’s lineup features tech names including Cisco, Applied Materials and Shopify as well as US consumer firms Coca-Cola and McDonald’s.

A busy week for European large caps includes results from AstraZeneca, Hermes, Siemens and L’Oreal. Other highlights feature energy firms TotalEnergies and BP as well as Unilever, AB InBev and Ferrari among consumer stocks.

Courtesy of DB, here is a day-by-day calendar of events

Monday February 9

- Data: US January NY Fed 1-yr inflation expectations, Japan January Economy Watchers survey, M2, M3, bank lending, December BoP trade balance and current account balance, labour cash earnings, Norway Q4 GDP

- Central banks: Fed's Waller and Bostic speak, ECB's Lagarde, Nagel and Lane speak, BoE's Mann speaks

- Earnings: UniCredit, DBS, Apollo, ON Semiconductor

Tuesday February 10

- Data: US January NFIB small business optimism, Q4 employment cost index, December retail sales, import price index, export price index, November business inventories, Japan January machine tool orders, Denmark January CPI, Norway January CPI

- Central banks: Fed's Hammack and Logan speak

- Earnings: Coca-Cola, AstraZeneca, Gilead Sciences, S&P Global, Welltower, Spotify, BP, CVS Health, Barclays, Marriott International, Williams, Robinhood, Cloudflare, Ferrari, Ford, Datadog, Kering, Fiserv

- Auctions: US 3-yr Notes ($58bn)

Wednesday February 11

- Data: US January jobs report, federal budget balance, China January CPI, PPI, Japan January PPI, Italy December industrial production, Canada December building permits

- Central banks: ECB's Cipollone and Schnabel speak, BoC Summary of Deliberations

- Earnings: Cisco, McDonald's, T-Mobile US, Shopify, AppLovin, TotalEnergies, Siemens Energy, EssilorLuxottica, NetEase, Equinix, Vertiv, Heineken, Deutsche Boerse, Commerzbank, Dassault Systemes, Kraft Heinz, Humana, Albemarle

- Auctions: US 10-yr Notes ($42bn)

Thursday February 12

- Data: US January existing home sales, initial jobless claims, UK Q4 GDP, January RICS house price balance, Germany December current account balance

- Central banks: ECB's Radev, Lane, Stournaras, Nagel and Cipollone speak, BoC’s Rogers speaks

- Earnings: Applied Materials, Hermes, Siemens, L'Oreal, Arista Networks, SoftBank, Unilever, Anheuser-Busch InBev, British American Tobacco, Vertex, Agnico Eagle Mines, Howmet Aerospace, Airbnb, Vale, Mercedes-Benz, RELX, Zoetis, Adyen, Legrand, Expedia, PG&E, DSM-Firmenich

- Auctions: US 30-yr Bonds ($25bn)

Friday February 13

- Data: US January CPI, China January home prices, Q4 BoP current account balance, Germany January wholesale price index, Eurozone December trade balance, Q4 employment, Switzerland January CPI

- Central banks: Fed's Miran and Logan speak, BoJ's Tamura speaks, BoE's Pill speaks

- Earnings: Safran, NatWest, Cameco, Capgemini, Norsk Hydro, Moderna

- Other: Munich Security Conference (through January 15)

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the retail sales report on Tuesday, the employment report on Wednesday, and the CPI report on Friday. There are several speaking engagements by Fed officials this week, including events with Fed Governors Waller and Miran on Monday and the Fed Vice Chair for Supervision Bowman on Wednesday.

Monday, February 9

- No major data releases are scheduled.

- 01:30 PM Fed Governor Waller Speaks: Fed Governor Christopher Waller will speak on digital assets at an event organized by the Global Independence Center. Q&A is expected. On January 30, Waller said, “I dissented at the most recent meeting of the Federal Open Market Committee (FOMC) after concluding that cutting the policy rate by 25 basis points was the appropriate stance of policy.” He added that the reasons for his dissent are that “the labor market remains weak” and “though inflation is elevated from tariff effects, appropriate monetary policy is to look through these effects as long as inflation expectations are anchored, which they are.”

- 02:30 PM Fed Governor Miran Speaks: Fed Governor Stephen Miran will participate in a moderated conversation at Boston University. Q&A is expected. On January 5, Miran said, “I’m looking for about a point and a half of cuts [in 2026]” because “underlying inflation is running within noise of our target, and that’s a good indication of where overall inflation is going to be in the medium term.”

- 03:15 PM Atlanta Fed President Bostic (FOMC non-voter) Speaks: Atlanta Fed President Raphael Bostic will participate in a moderated conversation with Bill Watts, editor of Pro Farmer. Q&A is expected. On February 2, Bostic said, “We are still too high in inflation, so I think we need to be somewhat restrictive.” He added that “I do feel the downside risk—that a catastrophe is going to happen in employment—is much further away from us than it was even a month ago, and that gives me some confidence we can be patient.”

- 05:00 PM Fed Governor Miran Speaks: Fed Governor Stephen Miran will be interviewed on WBUR Podcast in Boston. Q&A is expected.

Tuesday, February 10

- 08:30 AM Import price index, December (consensus +0.1%, last flat); Export price index, December (consensus +0.1%, last flat)

- 08:30 AM Retail sales, December (GS +0.4%, consensus +0.4%, last flat); Retail sales ex-auto, December (GS +0.3%, consensus +0.4%, last +0.4%); Retail sales ex-auto & gas, December (GS +0.4%, consensus +0.4%, last +0.5%); Core retail sales, December (GS +0.3%, consensus +0.5%, last +0.8%): We estimate core retail sales increased 0.3% in December (ex-autos, gasoline, and building materials; month-over-month SA), reflecting solid alternative data but a headwind from potential residual seasonality. We estimate headline retail sales increased 0.4%, reflecting an increase in auto sales but lower gasoline prices.

- 12:00 PM Cleveland Fed President Hammack (FOMC voter) Speaks: Cleveland Fed President Beth Hammack will speak on the banking and economic outlook at the 2026 Ohio Bankers League Economic Summit. Speech text and Q&A are expected. On December 12, Hammack said, “I see rates as right around a neutral level, [and] I would prefer to be on a slightly more restrictive stance to help put more pressure on inflation that remains too high.”

- 01:00 PM Dallas Fed President Logan (FOMC voter) Speaks: Dallas Fed President Lorie Logan will deliver remarks and participate in moderated Q&A at the 2026 Asset Management Derivatives Forum in Austin, Texas. Speech text is expected.

Wednesday, February 11

- 08:30 AM Nonfarm payroll employment, January (GS +45k, consensus +69k, last +50k); Private payroll employment, January (GS +45k, consensus +75k, last +37k); Average hourly earnings (MoM), January (GS +0.35%, consensus +0.3%, last +0.3%); Unemployment rate, January (GS 4.4%, consensus 4.4%, last 4.4%): We estimate nonfarm payrolls increased 45k in January. On the negative side, we estimate that the birth-death model—which will be updated with this report, more details below—could contribute 30-50k fewer jobs to payroll growth (on a seasonally adjusted basis) than in recent months and big data indicators suggested a modest pace of private sector job growth. Additionally, we expect unchanged government payrolls—reflecting a 10k decline in federal government payrolls that is offset by a 10k increase in state and local government payrolls. On the positive side, the pace of layoffs—a particularly important determinant of net job growth in January—remained subdued. However, the seasonal factors have evolved to expect smaller declines in employment in recent Januarys, limiting the potential boost from this channel. We do not expect a drag from winter Storm Fern, which formed about a week after the reference week.

- We estimate that the unemployment rate was unchanged at 4.4% in January, but we see the risks as skewed to a decline: the bar for rounding down to 4.3% is not high from an unrounded 4.38% in December and the January unemployment rate appears to suffer from modestly negative residual seasonality (the unrounded unemployment rate has declined in each of the last three Januarys). We estimate average hourly earnings rose 0.35% month-over-month in January, reflecting positive calendar effects.

- This month’s report will be accompanied by the annual benchmark revision to the establishment survey and a methodological update to the birth-death model. The BLS's preliminary estimate of the benchmark payrolls revision indicated that cumulative payroll growth between April 2024 and March 2025 would be revised 911k lower. We estimate that the final downward revision will likely be somewhat smaller—in the range of 750-900k—as job growth in the QCEW, which informs the revision, has been revised up since the BLS issued the preliminary estimate. The BLS will also update the net birth-death forecasts in the post-benchmark period (April 2025-December 2025) to incorporate information from the QCEW and the monthly payrolls survey. A downward revision to the post-benchmark period appears likely, reflecting the continued slowdown in the QCEW and weak private payroll growth during the post-benchmark period. Starting with this month’s report, the birth-death model will incorporate current sample information each month.

- 10:00 AM Kansas City Fed President Schmid (FOMC non-voter) Speaks: Kansas City Fed President Jeff Schmid will speak at the Economic Forum of Albuquerque in Albuquerque, New Mexico. Speech text and Q&A are expected. On January 15, Schmid said, “I believe that there is a risk that lowering rates could do more harm to the inflation side of our mandate than benefit on the employment side.” He added that “I see little reason at this point to further lower the policy rate, though of course, I will be watching the data closely for signs that growth is losing momentum or that the labor market is weakening more substantially.”

- 10:15 AM Fed Vice Chair for Supervision Bowman Speaks: Fed Vice Chair for Supervision Michelle Bowman will participate in a virtual moderated conversation at Keefe, Bruyette & Wood 33rd Annual Winter Financial Services Conference. Q&A is expected. On January 16, Bowman said, “Absent a clear and sustained improvement in labor market conditions, we should remain ready to adjust policy to bring it closer to neutral.” She added that while monetary policy is not on a preset course, "we should also avoid signaling that we will pause without identifying that conditions have changed."

- 04:00 PM Cleveland Fed President Hammack (FOMC voter) Speaks: Cleveland Fed President Beth Hammack will participate in a leadership dialogue at Ohio State University. Q&A is expected.

Thursday, February 12

- 08:30 AM Initial jobless claims, week ended January 31 (GS 220k, consensus 224k, last 231k); Continuing jobless claims, week ended January 24 (consensus 1,850k, last 1,844k)

- 10:00 AM Existing home sales, January (GS -2.5%, consensus -3.2%, last +5.1%)

- 07:00 PM Dallas Fed President Logan (FOMC voter) Speaks: Dallas Fed President Lorie Logan will give opening and closing remarks at an event with Governor Stephen Miran. Speech text is expected.

- 07:05 PM Fed Governor Miran Speaks: Fed Governor Stephen Miran will participate in a moderated discussion at the Dallas Fed. Q&A is expected.

Friday, February 13

- 08:30 AM CPI (MoM), January (GS +0.24%, consensus +0.3%, last +0.1%); Core CPI (MoM), January (GS +0.33%, consensus +0.3%, last +0.2%); CPI (YoY), January (GS +2.44%, consensus +2.5%, last +2.7%); Core CPI (YoY), January (GS +2.52%, consensus +2.5%, last +2.6%): We estimate a 0.33% increase in January core CPI (month-over-month SA), which would lower the year-over-year rate by 0.1pp to 2.5% on a rounded basis. Our forecast reflects upward pressure from seasonal distortions on the communications (GS forecast: +0.4%) and private transportation (+1.5%) categories. We expect a modest boost from start of the year price resets in categories like medical care commodities (GS forecast: +0.7%), and upward pressure from tariffs on categories that are particularly exposed (such as recreation) worth +0.07pp. We expect firm travel services inflation (airfares: +2%; hotels: +1%), reflecting signals from alternative price data. We expect softer autos inflation, reflecting a 1.5% decline in used car prices, unchanged new car prices, and a moderate increase in the car insurance category (+0.4%). We forecast a slight slowdown in the shelter categories (rent: +0.24%, OER: +0.25%), reflecting a continued slowdown in their underlying trend. We expect unchanged medical services prices, reflecting a continued decline in medical insurance prices (-0.7%) but increases in other medical care services categories. We estimate a 0.24% rise in headline CPI, reflecting higher food prices (+0.4%) but lower energy prices (-1.3%).

- In this month’s report, the BLS will release recalculated seasonal factors that reflect the price movements of 2025—which could reduce the impact of seasonal distortions that explained some of the month-to-month variation in core inflation last year—as well as updated weights. The annual seasonal factor revisions tend to cause monthly inflation readings to be revised toward the annual average. In other words, higher inflation readings for the year tend to be revised lower and lower readings tend to be revised higher. On average over the last decade, about 20% of the relative strength of a month’s initial core inflation vintage has been revised away in its first annual revision. Last year, monthly core CPI inflation was particularly elevated in January (23bp above the 2024 average) and particularly low in March-May (8bp below).

Source: Goldman, DB