Markets expected to open positively in Europe as highly-anticipated NFP and possible tariff ruling awaits - Newsquawk EU Market Open

- APAC stocks followed suit to the mixed performance on Wall Street with the regional bourses predominantly in the green, albeit with traders bracing for the US Non-Farm Payrolls report and a potential Supreme Court's ruling on tariffs.

- US President Trump warned that the US will hit Iran hard if they kill rioters.

- US President Trump said companies will spend at least USD 100bln in Venezuela, and he will be meeting oil executives today.

- Big tech was spared strict rules in the EU digital rule overhaul, with big tech to be subject to a voluntary framework.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.4% after the cash market closed with losses of 0.3% on Thursday.

- Looking ahead, highlights include German Industrial Output (Nov), Norwegian CPI (Dec), US Jobs Report (Dec), Potential SCOTUS tariff decision, University of Michigan Sentiment Prelim (Jan), Canadian Jobs Report (Dec), Speakers include ECB's Lane, Fed's Kashkari & Barkin.

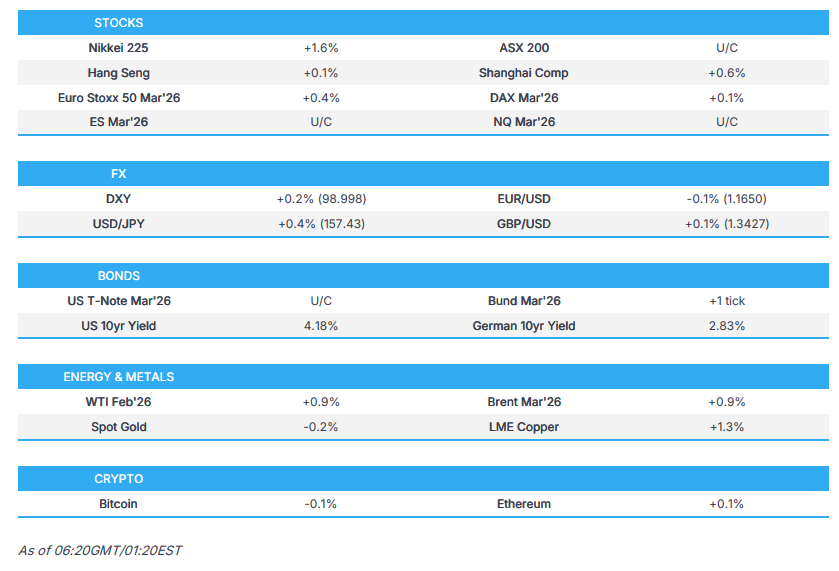

SNAPSHOT

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were mixed on Thursday, and NVDA lagged its Mag 7 peers, with other AI-exposed names also hit, despite little newsflow to support the downside, as seemingly profit-taking drove the moves. Specifically, Micron (MU) was lower by 3.7%, and Sandisk (SNDK) dropped over 5%. As such, Tech was the worst-performing sector while Energy and Staples outperformed. Russell 2000 was lifted thanks to strong gains in Bloom Energy (BE, +13%) after it signed a deal with AEP, while Kratos (KTOS) also contributed to index gains after Trump sparked a rally in defence names, arguing military spending should be increased by USD 500bln to 1.5tln in 2027.

- SPX +0.01% at 6,921, NDX -0.57% at 25,507, DJI +0.55% at 49,266, RUT +1.11% at 2,604.

- Click here for a detailed summary.

TARIFFS/TRADE

- US Treasury Secretary Bessent said for the first time, the Chinese seem to be getting serious about fentanyl because of IEEPA tariffs, while he added that IEEPA tariffs have brought Mexico and Canada to the negotiating table.

- Japanese food and alcohol products are reportedly seeing customs delays in China, according to Nikkei.

- French President Macron said France will vote against the EU-Mercosur deal.

NOTABLE HEADLINES

- US President Trump posted that the data shows the US has the lowest trade deficit since 2009, and is going even lower, while GDP is predicted to come in at over 5%, and the success of the country is due to tariffs. Furthermore, Trump said he hopes the Supreme Court is aware of the "Historic, Country saving achievements prior to the issuance of their most important (ever!) Decision."

- US President Trump said he has a decision in mind on the Fed Chair pick, but hasn't spoken to anyone about the decision.

- US President Trump said he is instructing representatives to buy USD 200bln in mortgage bonds to drive down mortgage rates and make cost of owning a home more affordable.

- US FHFA Director Pulte said President Trump's USD 200bln mortgage bond order can be executed quickly and that Fannie Mae and Freddie Mac have cash to buy.

- US Treasury Secretary Bessent reiterated the administration’s desire for lower interest rates and said that they are key to future economic growth. Bessent also stated that interest rates remain well above neutral and policy should not be restrictive, as well as noted that models suggest 2.5% to 3.25% for the FFR. He also said they haven't interviewed Rick Rieder yet, and there are still four candidates to succeed Powell, while he thinks Trump will decide on the Fed Chair in January.

- US House voted 230-196 to pass the Democratic-backed bill to renew health insurance subsidies for three years.

- CBO estimated US GDP growth is to accelerate to 2.2% in 2026; unemployment to be 4.6% in 2026 and 4.4% in 2028; and the EFFR to decrease to 3.4% in 2026.

APAC TRADE

EQUITIES

- APAC stocks followed suit to the mixed performance on Wall Street with the regional bourses predominantly in the green, albeit with traders bracing for the US Non-Farm Payrolls report and a potential Supreme Court's ruling on tariffs.

- ASX 200 was ultimately flat as strength in energy and consumer stocks was offset by losses in financials, tech and mining, while Rio Tinto shares fell by more than 6% after reports that the Co. and Glencore revived merger talks.

- Nikkei 225 outperformed following the stronger-than-expected Household Spending data from Japan, which showed surprise Y/Y growth of 2.9% (exp. -0.9%), while the gains were led by index heavyweight Fast Retailing after it posted higher profits and upgraded its guidance.

- Hang Seng and Shanghai Comp were indecisive after mixed inflation data from China and the substantial weekly liquidity drain by the PBoC, while there was a mixed reaction in tech stocks following reports that China is to approve some NVIDIA (NVDA) H200 purchases as soon as this quarter.

- US equity futures were uneventful with participants lacking commitment with the key US jobs data on the horizon.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.4% after the cash market closed with losses of 0.3% on Thursday.

FX

- DXY remained firmer after gaining yesterday as US data pointed to no imminent meltdown in the labour market, with the 4-week initial claims average hitting its lowest level since April 2024, while Revelio estimated growth of 71k jobs ahead of today's Non-Farm Payrolls report.

- EUR/USD languished near the prior day's trough beneath the 1.1700 handle after giving up ground to the firmer buck, and with the single currency not helped by recent data releases from the bloc, which were ultimately mixed.

- GBP/USD lacked direction following the prior day's choppy performance and mild downward bias, while there were reports that UK PM Starmer will exclude the City of London from his push for “closer alignment” with the EU, following lobbying by financial services firms against a return to EU rule.

- USD/JPY extended above the 157.00 level alongside a firmer dollar and the outperformance in Japanese stock markets.

- Antipodeans were little changed in the absence of data from both sides of the Tasman and as participants digest mixed Chinese inflation numbers.

- PBoC set USD/CNY mid-point at 7.0128 vs exp. 6.9832 (Prev. 7.0197)

FIXED INCOME

- 10yr UST futures lingered near the prior day's lows after the recent slew of data stateside, which was largely hot and continued to ease labour market concerns, while participants now await the looming BLS jobs data.

- Bund futures lacked conviction after retreating yesterday, with demand hampered following stronger-than-expected German Factory Orders and a deluge of mixed EU releases, including PPI data and confidence surveys.

- 10yr JGB futures mildly retreated amid the outperformance in Japanese stocks and with yields firmer following stronger-than-expected Japanese Household Spending data.

COMMODITIES

- Crude futures were firmer after rallying yesterday, despite few catalysts behind the strong rebound and with newsflow pertaining to the return of Venezuelan crude, with US Energy Secretary Wright anticipating that Venezuela's oil production could be up 50% in the next 18 months. Nonetheless, there was some support seen following US President Trump's warning against Iran, in which he threatened to hit Iran hard if they kill rioters.

- US President Trump said companies will spend at least USD 100bln in Venezuela, and he will be meeting oil executives today.

- US Energy Secretary Wright said the US can market oil at a better price than Venezuela and they are not going to cut off China, while he added that Venezuela's oil production could be up 50% in the next 18 months.

- US Interior Secretary Burgum said the US is ending the discount on Venezuelan oil for China and they are knocking Russia out of the Venezuelan oil market, as well as noted that Venezuela won't use Russian diluent anymore.

- Foreign embassies in Venezuela began arranging visits next week for US and European oil companies.

- US shale chiefs warned that Venezuelan oil will hobble US drillers and that US President Trump's efforts to reduce crude prices will hurt the sector struggling to sustain production growth, according to FT.

- Spot gold marginally softened after yesterday's choppy, but ultimately positive trajectory, while focus turns to NFPs.

- Copper futures were choppy after suffering a two-day decline, with demand contained amid mixed Chinese inflation data and pre-NFP cautiousness.

CRYPTO

- Bitcoin traded indecisively with prices oscillating through the USD 91,000 level.

NOTABLE ASIA-PAC HEADLINES

- TikTok is splitting its US staff into different companies as it prepares for a sale and told some US staff that they will work for a new global entity that is not part of the new joint venture, according to Business Insider.

- South Korean President Lee plans to visit Japan January 13-14th, and will be meeting with Japanese PM Takaichi on the first day of the visit.

DATA RECAP

- Chinese CPI MM (Dec) 0.2% vs. Exp. 0.0% (Prev. -0.1%)

- Chinese CPI YY (Dec) 0.8% vs. Exp. 0.9% (Prev. 0.7%)

- Chinese PPI YY (Dec) -1.9% vs. Exp. -2% (Prev. -2.2%)

- Japanese Household Spending MM (Nov) 6.2% vs. Exp. 2.7% (Prev. -3.5%)

- Japanese Household Spending YY (Nov) 2.9% vs. Exp. -0.9% (Prev. -3.0%)

GEOPOLITICS

VENEZUELA/LATIN AMERICA

- US President Trump said they will start hitting cartels on land and he has asked Venezuela to free political prisoners, while Trump also commented that Cuba is in trouble and is hanging by a thread.

- US Senate voted 52-47 to advance the resolution that would bar President Trump from taking further military action against Venezuela without authorisation from Congress. However, the White House said President Trump would veto the Venezuela war powers resolution, while he criticised Republicans who voted with Democrats on the Venezuela war powers resolution and said a more important Senate vote will take place next week on the subject.

- US Treasury Secretary Bessent said the US will be removing sanctions from some Venezuelan entities, while he noted strong interest from independent oil companies and "wildcatters" in swift investments in Venezuela and stated the largest oil companies are likely to move slower in Venezuela.

MIDDLE EAST

- US President Trump warned that the US will hit Iran hard if they kill rioters.

- Israel reportedly continued raids on various areas of the Gaza Strip, according to Sky News Arabia

- Israel rejected Lebanon's claim that Hezbollah has been disarmed, while it stated the effort is far from sufficient and that the group is rearming with Iranian support.

RUSSIA-UKRAINE

- Russian drone attack on Kyiv caused explosions and triggered a fire, according to the mayor.

- US President Trump said regarding the US-Russia nuclear treaty that "If it expires, it expires" and doesn't need to follow international law, according to a New York Times interview.

OTHER

- US President Trump said the strike on Nigeria could be a one-off, or repeated if Christians are killed.

- US President Trump’s administration is discussing sending lump sum payments to Greenlanders as part of a plan to annex the island, according to sources. US officials have discussed offering Greenlanders USD 10,000–100,000 each to support secession from Denmark and possible US affiliation, while the plan is part of broader White House deliberations, which also include military options or a Compact of Free Association.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer will exclude the City of London from his push for “closer alignment” with the EU, following lobbying by financial services firms against any return to Brussels rule, according to FT.

- Big tech was spared strict rules in the EU digital rule overhaul, with big tech to be subject to a voluntary framework, unlike telecom companies facing stricter rules, while the rule revamp is to set out the duration of licensing and pricing methodology for spectrum sales.