Markets stabilise following recent losses, but with trade tentative ahead of Trump at Davos - Newsquawk US Opening News

- US President Trump said Iran will be "wiped off the face of the Earth" if Iran attempts to carry out an assassination threat against him, NewsNation reported.

- US President Trump said having Greenland makes a much more effective golden dome, will probably be able to work something out with Europe at Davos.

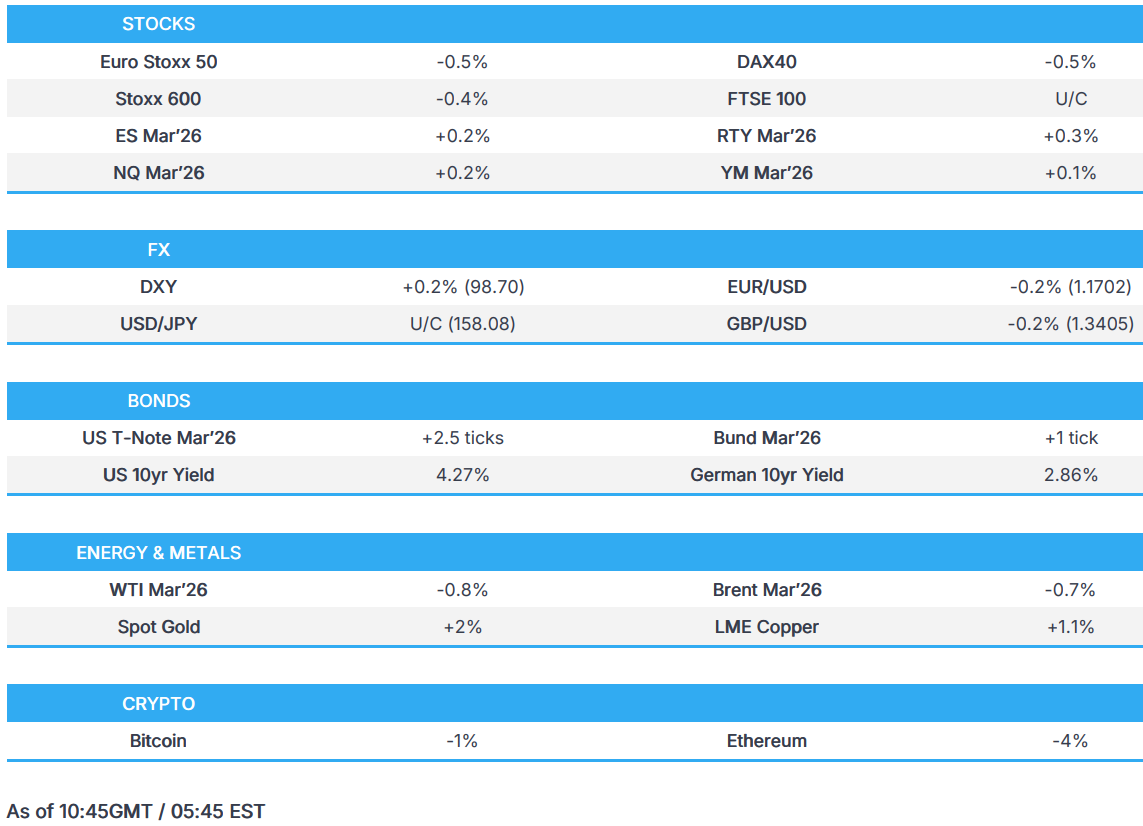

- European bourses are broadly in the red whilst US equity futures attempt to stabilise following significant losses in the prior session.

- DXY is flat awaiting the delayed arrival of US President Trump, G10s mixed with Antipodeans leading whilst CHF lags.

- Fixed benchmarks initially firmer in a recovery from Tuesday's JGB driven pressure; complex has slipped off best levels in recent trade, with Bunds now flat.

- Crude on the backfoot as attention returns to Ukraine, XAU at another ATH beyond USD 4.8k/oz.

- Looking ahead, US Atlanta Fed GDP, Japanese Trade Balance (Dec), SCOTUS US President Trump vs Fed's Cook. Speakers include ECB's Nagel; US President Trump. Supply from the US. Earnings from Kinder Morgan, Johnson & Johnson, Ally Financial and Charles Schwab.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.2%) are mostly trading lower as uncertainty over trade tensions, sparked by developments surrounding Greenland, continues to weigh on sentiment.

- European sectors are mixed. Leading are Basic Resources (+3.1%), Automobiles & Parts (+0.9%) and Chemicals (+0.9%). Basic Resources is the clear outperformer, supported by stronger metal prices, with gold hitting a fresh all-time high during the APAC session and copper rebounding. Movers in the early morning trade include Burberry (+4.8%) after the Co. announced a strong Q3 trading update.

- US equity futures are mildly firmer, and attempting to stabilise following significant pressure seen in the prior session. Pre-market movers today include Netflix (-5.6%) which slips following metrics which featured a tepid outlook and after it paused buybacks amid its deal with Warner Bros Discovery.

- OpenAI has started to offer its new chatbot ads to dozens of advertisers and will charge based on ad views, The Information reported.

- Netflix (NFLX) Q4 2025 (USD): EPS 0.56 (exp. 0.55), Revenue 12.05bln (exp. 11.97bln); to pause buybacks to fund pending Warner Bros. (WBD) deal.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

FX

- DXY is essentially flat this morning, with the Dollar attempting to stabilise following selling pressure in the prior session; currently holding within a narrow 98.45 to 98.64 range, sitting below its 100 DMA at 98.69. Focus remains centred on President Trump and his speeches in Davos. The Greenland situation remains tense, with EU leaders pushing back on the recently imposed US tariffs. As it stands, the subject matter of Trump’s speech is unknown, but could touch on a multitude of different factors, including Ukraine/Russia, Greenland, trade/tariffs, Fed independence, defence spending and credit card caps. Trump is pencilled in to speak at 13:30 GMT, but could be subject to change as Trump’s plane to Davos was delayed by around 3 hours.

- G10s broadly are mixed vs the Dollar, with mild outperformance in the Antipodeans (AUD +0.3%, NZD +0.3%), whilst the CHF (-0.3%) lags vs peers. Nothing behind the pressure in the Swiss Franc, but perhaps some paring of the outperformance seen in the prior session as the risk tone attempts to improve today. That aside, SNB's Schlegel said they could have negative inflation this year, though it is not a problem in the short-term. Elsewhere, attention this week has been on the JPY – which is currently posting very mild gains vs the USD. Stabilisation in the JPY comes as the recent JGB weakness subsided overnight.

- GBP is currently flat vs the USD. Earlier, a mixed inflation report will do little to shift the dial at the BoE in the near-term. Headline topped expectations, but was subject to caveats, whilst the Core Y/Y metrics printed either in line or cooler-than-expected. ING opines that despite the uptick in the headline figure, UK inflation should still fall to 2% in April, and see cuts in both March and June. Cable currently trades within a 1.3414 to 1.3456 range.

FIXED INCOME

- A firmer start for fixed benchmarks. A move that is largely a rebound from the significant selling pressure seen on Tuesday. Once again, JGBs in focus with overnight commentary helping the benchmark pare yesterday's downside and is back to the 131.45 region. However, in recent trade global paper dipped off best levels, but lacked a clear driver.

- USTs in the green, posting gains of six ticks at most, but have slipped off best levels in recent trade. The docket for the US is firmly focused on Davos, where President Trump will be speaking. However, due to a flight issue, he is around three hours delayed; the original schedule had him down for 13:30GMT/08:30ET. Hit 111-19 at best, firmer but well within yesterday's 111-09 to 111-30+ band. Trump aside, today's docket also turns to the SCOTUS, where arguments in Fed Governor Cook's case will be heard. Furthermore, we could get an opinion on the tariff matter, though, as usual, this is not known in advance.

- Bunds following suit, as high as 128.25, which marginally took the benchmark above Tuesday's 128.19 peak, but unsurprisingly still someway shy of the week's 128.32 opening level. Though the broader complex took a hit, which took Bunds to a session low of 127.94. The German auction thereafter, was mixed, but ultimately spurred little action in the benchmark.

- Gilts gapped higher by 26 ticks before extending to just above the 92.00 mark, hitting a 92.03 peak with gains of 45 ticks at most. Though, as above, this is still shy of Monday's 92.50 opening mark. A move driven by Gilts catching up to the relative recovery seen in benchmarks overnight. Additionally, impetus may have been derived from the morning's CPI series as, while the headline was above consensus, that is caveated by fiscal/one-off related impacts, while the Services and Core figures were in-line or cooler-than-expected, depending on the provider. Overall the report will not shift much for the BoE in the near term.

- Japan's SMFG (8316 JT) plans big JGB purchases after selloff, Bloomberg reported.

- Germany sells EUR 0.776bln vs exp. EUR 1.0bln 2.90% 2056 & EUR 0.786bln vs exp. EUR 1.0bln 2.60% 2041.

COMMODITIES

- Crude curtailed by a pickup in the USD and after the geopolitical remarks re. Ukraine on Tuesday. US Envoy Witkoff, on Tuesday, said that discussions with Russian counterpart Dmitriev were "very positive". A remark that seemingly sparked a bout of pressure in Crude, causing the benchmarks to drift into the early APAC session before stabilising and then dipping once again to troughs of USD 59.22/bbl and USD 63.61/bbl for WTI and Brent, respectively. Currently, the complex holds around USD 0.60/bbl off those lows, but remains in the red by around USD 0.50/bbl on the session.

- A familiar story for spot gold, at another ATH of USD 4888/oz. The narrative for the yellow metal is much the same as in recent sessions.

- Base peers in the green, 3M LME Copper firmer by over 1%. Action spurred by the stabilisation of the risk tone seen in some regions overnight and amid gains in China, though the region's strength lacked a specific fundamental driver.

- Chevron (CVX) aims to finalise the sale of its oil assets in Singapore in Q1.

- IEA OMR: raises 2026 average oil demand growth forecast to 930k bpd (prev. forecast 860k bpd). Sees total world oil supply 3.69mln bpd higher than demand in 2026 in monthly report (prev. report 3.84mln bpd). Estimates OPEC+ supply growth at 1.3 mln b/d in 2025. Further decline in global oil supply in December continued to narrow surplus.

- Thai's Central Bank Chief said they will introduce a daily cap on gold trading at 50mln or 100mln Baht from the 29th of January.

- US Southern Command announced and published footage of its seventh boarding and seizure of a sanctioned crude oil tanker, reportedly the Liberian-flagged, in the Caribbean Sea.

TRADE/TARIFFS

- USTR Greer said EU trade agreement focuses on trade rather than national security; however, relationship with EU negotiator remains great. Are in a good spot with China. It is important to talk with Congress on export controls.

- US Treasury Secretary Bessent said there are no US-UK talks scheduled at the moment.

- US Treasury Secretary Bessent speaking at Davos said free trade should be fair trade.

- US President Trump said tariff revenue replacing income tax is an option.

- South Korean President Lee said he is not worried about the current talks on US chip tariffs, could accelerate US inflation.

- USTR Greer and US Treasury Secretary Bessent are highly likely to meet their Chinese counterparts before April, Fox News reported.

NOTABLE EUROPEAN DATA RECAP

- UK CPI YoY (Dec) Y/Y 3.4% vs. Exp. 3.3% (Prev. 3.2%); All Services 4.5% (prev. 4.4%). ONS. "Inflation ticked up a little in December, driven partly by higher tobacco prices, following recently introduced excise duty increases.". "Airfares also contributed to the increase with prices rising more than a year ago, likely because of the timing of return flights over the Christmas and New Year period.". "... partially offset by a fall in rents inflation and lower prices for a range of recreational and cultural purchases.".

- UK Services CPI (Dec) Y/Y 4.5% vs. Exp. 4.6% (prev. 4.4%).

- UK Core CPI YoY (Dec) Y/Y 3.2% vs. Exp. 3.2% (Prev. 3.2%, Low. 3.1%, High. 3.4%).

- UK Core CPI MoM (Dec) M/M 0.3% vs. Exp. 0.3% (Prev. -0.2%, Low. 0.2%, High. 0.5%).

- UK CPI MoM (Dec) M/M 0.4% vs. Exp. 0.4% (Prev. -0.2%, Low. 0.1%, High. 0.6%).

- UK PPI Output MoM (Dec) M/M 0% vs. Exp. 0.1% (Prev. 0.1%).

- UK PPI Input YoY (Dec) Y/Y 0.8% (Prev. 1.1%).

- UK PPI Input MoM (Dec) M/M -0.2% vs. Exp. -0.1% (Prev. 0.5%, Rev. From 0.3%).

- UK PPI Core Output MoM (Dec) M/M -0.1% (Prev. 0.1%, Rev. From 0%).

- UK PPI Core Output YoY (Dec) Y/Y 3.2% (Prev. 3.6%, Rev. From 3.5%).

- UK PPI Output YoY (Dec) Y/Y 3.4% (Prev. 3.4%).

- UK Retail Price Index YoY (Dec) Y/Y 4.2% vs. Exp. 4% (Prev. 3.8%, Low. 3.9%, High. 4.4%).

- UK Retail Price Index MoM (Dec) M/M 0.7% vs. Exp. 0.5% (Prev. -0.4%, Low. 0.4%, High. 0.9%).

- UK November ONS House Price Index 2.5% Y/Y (prev. 1.7% Y/Y).

OTHER

- South African Inflation Rate MoM (Dec) M/M 0.2% (Prev. -0.1%).

- South African Core Inflation Rate MoM (Dec) M/M 0.1% (Prev. 0.1%).

- South African Core Inflation Rate YoY (Dec) Y/Y 3.3% (Prev. 3.2%).

- South African Inflation Rate YoY (Dec) Y/Y 3.6% vs. Exp. 3.6% (Prev. 3.5%).

CENTRAL BANKS

- Mizhou (8411 JT) CEO said they see the next opportunity for the BoJ to hike is in April; sees the terminal rate at 1.50%.

- ECB's Kocher said using trade policy threats as a tool for political pressures increases risk to the global economy for all parties involved in the medium and long term.

- ECB's Lagarde said monetary policy is in a "good place". Europe would be stronger if non-tariff barriers were removed within the region.

- SNB Chairman Schlegel said that they could have negative inflation this year, which is not a problem in the short term, however geopolitical tension remains a risk. Adds that the CHF has been stable over the last few months.

NOTABLE US HEADLINES

- US Treasury Secretary Bessent said his understanding is that President Trump will be delayed by around three hours.

- Air Force One carrying US President Trump has turned back to Joint Base Andrews due to a 'minor electrical issue' on the aircraft, Axios reported; Trump will board another plane and continue towards Davos.

- US President Trump will be interviewed on NewsNation at 22:00 EST / 03:00GMT.

- US President Trump said he thinks it will be a successful trip to Davos.

- The White House releases President Trump's executive order to restrict Wall Street firms from buying single-family homes.

GEOPOLITICS

RUSSIA-UKRAINE

- A planned announcement of an USD 800bln 'prosperity plan' between Ukraine, Europe and the US has been delayed due to Europe's opposition from President Trump to acquire Greenland, the FT reported citing officials.

- US special envoy Witkoff reports significance progress on Ukraine and Russia in recent weeks. Adds that land deal remains the sticking point. Scheduled to meet Putin on Thursday. On the Middle East: Hamas is receptive to the idea of demilitarisation. Not negotiating with Iran right now but says its hard to tell if Iran is still killing protestors.

MIDDLE EAST

- Iran's Foreign Minister warns Washington that any all-out confrontation with Iran would be fierce and engulf the entire region, Sky News Arabia reported.

- US President Trump said Iran will be "wiped off the face of the Earth" if Iran attempts to carry out an assassination threat against him, NewsNation reported.

- US President Trump is still pressing aides for "decisive" military options on Iran, WSJ reported citing officials.

OTHERS

- NATO's Rutte said the allies must defend the Arctic region amid rising Chinese and Russian activity.

- EU's von der Leyen said the EU is fully prepared to act over Greenland if necessary.

- France and Germany reportedly appear to agree on placing the ACI on the table, though not necessarily activating it, Politico reported citing sources; a shift as Germany is now reportedly willing to at least explore the concept of using the ACI.

- The French Presidency announces it has requested NATO exercise in Greenland and said it is ready to participate.

- US President Trump said having Greenland makes a much more effective golden dome, will probably be able to work something out with Europe at Davos.

- The US is to pull 200 military personnel from NATO and its advisory groups amid escalating EU-US tensions, the FT reported citing sources.

- US Interior Secretary Burgum said that markets have it wrong today about Greenland; the US would build up Greenland in a similar fashion to Alaska if it was owned.

- US reportedly plans to reduce involvement in some NATO advisory groups, WaPo reported.

CRYPTO

- Bitcoin is on the backfoot and trades around USD 89k; Ethereum underperforms and slips towards USD 2.95k.

APAC TRADE

- Asia-Pac stocks traded mixed, with initial downside paring back as the session continued.

- ASX 200 held onto earlier losses, with downside in IT and Financials counteracting the gains seen in miners following the rise in metals.

- Nikkei 225 continued its recent weakness for a fifth straight session, weighed on by banks and exporters, as worries over Japan’s fiscal sustainability hit Japanese markets.

- KOSPI chopped throughout the session, as the South Korean market traded on either side of the unchanged mark.

- Hang Seng and Shanghai Comp. traded with slight gains, albeit very modestly, but limited with a lack of catalysts.

NOTABLE ASIA-PAC HEADLINES

- New Zealand's PM Luxon called for the General Election to be held on November 7th.

NOTABLE APAC DATA RECAP

- Australian Westpac Leading Index MoM (Dec) M/M 0.1% (Prev. 0%).