Mediocre 7Y Auction Tails Despite Solid Foreign Demand

After a solid 2Y, and a dismal 5Y auction, moments ago the Treasury completed the sale of the week's final coupon, and today's sale of $44BN in 7Y paper was appropriately enough, mediocre at best, not terrible, not great, in the parlance of our times.

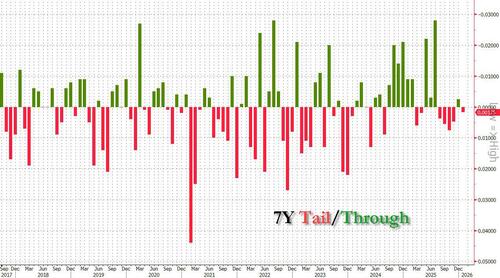

The auction priced at a high yield of 4.018%, the first 4%+ yield since July, and up from 3.930% in December. It also tailed then 4.014% When Issued by 0.4bps. This was the 5th tail in the last 6 auctions.

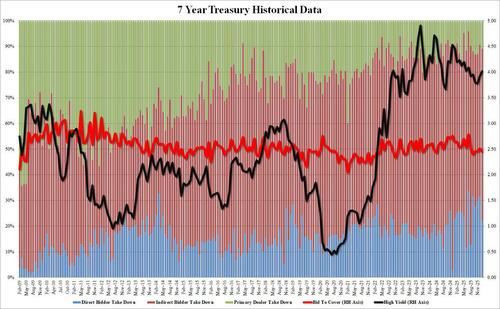

The bid to cover of 2.454 dropped from 2.509 in December, and was the lowest since September; it was also well below the six auction average of 2.516.

The internals were a fraction better: Indirects took down 66.9%, up from 59.04% and above the six auction average of 61.8%. And with Directs awarded 22.2%, down sharply from 31.6% last month, Dealers were left holding 10.9%, up from 9.3% last month and above the recent average of 10.2%.

Overall this was a mediocre, tailing auction and while it could have been worse (foreign demand for example was still quite solid), it certainly could have been better.