Metals tarnished; Stocks sell off on weak Chinese PMIs and stalled NVIDIA investment - Newsquawk EU Market Open

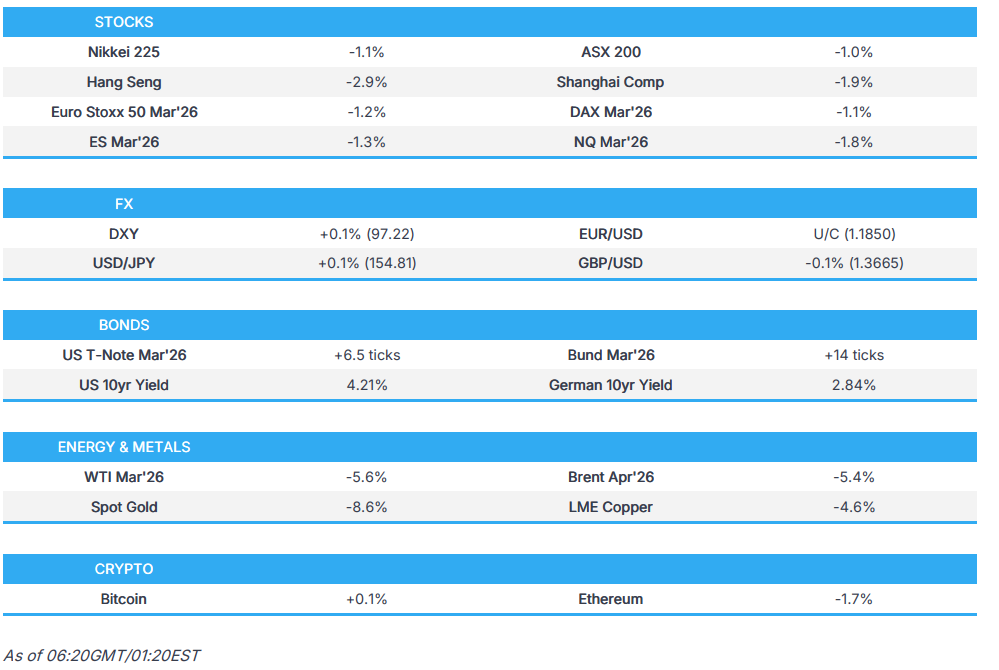

- APAC stocks pressured with several bearish factors weighing, incl. the partial US shutdown, weak Chinese PMIs & NVIDIA's OpenAI investment stalling.

- DXY rangebound, EUR firmer but below 1.19. USD/JPY initially benefited from Takaichi's remarks, though subsequent clarification unwound this.

- Fixed benchmarks mixed, JGBs benefit from the latest election polling.

- Crude benchmarks hit alongside APAC stocks, OPEC+ maintained the pause as expected. Spot gold continued to falter, base peers hit by the Chinese data.

- Bitcoin hit a trough just below USD 75k before finding a floor.

- Looking ahead, highlights include Global Final Manufacturing PMIs (Jan), US ISM Manufacturing PMI (Jan), Speakers including BoE’s Breeden & Fed’s Bostic, Treasury Refunding Announcement, Earnings from Palantir & NXP Semiconductors.

- Click for the Newsquawk Week Ahead.

Newsquawk in 3 steps:

1. Subscribe to the free premarket movers reports

2. Listen to this report in the market open podcast (available on Apple and Spotify)

3. Trial Newsquawk’s premium real-time audio news squawk box for 7 days

US TRADE

EQUITIES

- US stocks were choppy as participants digested what Trump's nomination of Kevin Warsh as Fed Chair would mean. That assessment is likely to continue for some time until Warsh issues a more up-to-date view on current conditions, given his lack of appearances in recent times. Warsh has been viewed as hawkish in the past on his approach to the balance sheet, showing concerns over QE, while in 2025, he advocated for lower rates. Nonetheless, stocks ultimately finished the session in the red, with the downside led by Materials amid a large correction in precious metals, followed by Tech. Furthermore, Apple (AAPL) ended the day relatively flat despite reporting top and bottom line beats, as some desks noted concern over lacklustre services revenue and future expenses tied to memory shortages, while defensives such as Consumer Staples and Healthcare showed resilience.

- SPX -0.43% at 6,939, NDX -1.28% at 25,552, DJI -0.36% at 48,892, RUT -1.55% at 2,614.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump warned of a very substantial response if Canada enacts a trade agreement with China, while he added that the US does not want China to take over Canada, which would happen with the deal that they are looking to make.

- South Korean Industry Minister Kim said they will speed up the implementation of investment legislation after returning from talks with the US, which he said cleared up misunderstandings regarding tariffs.

- EU industry association said on Friday that China proposed final anti-subsidy duties on EU dairy products at lower levels than in provisional duties with the final Chinese anti-subsidy tariffs on EU dairy products to go up to 11.7% vs. a maximum 42.7% in provisional duties.

NOTABLE HEADLINES

- US President Trump said Fed Chair nominee Warsh may get Democrat votes, and he hopes that Warsh will lower interest rates. In relevant news, Trump said on Friday that Warsh did not commit to cutting rates and he will probably talk about cutting rates with Warsh, while Trump also stated that Warsh will cut rates without White House pressure.

- Fed's Musalem (2028 voter) said on Friday that further interest rate cuts are not advisable and policy is now neutral, while he added that the economy does not need stimulus. Musalem also commented that risks are balanced and further rate cuts are only needed if the job market were to decay or inflation falls.

- Fed’s Bowman (voter) said on Friday that she supported a rate pause as inflation remains elevated, while she added that downside risks to the labour market have not diminished and that policy is modestly restrictive. Bowman also said that they should not imply that they expect to maintain the current stance of policy for an extended period of time, and noted she projected three rate cuts for 2026 in the December SEPs.

- US Senate voted 71-29 to pass the USD 1.2tln government funding deal, and the House is expected to vote as soon as Monday on the plan after a brief government shutdown.

- US President Trump picked Brett Matusmoto to head the BLS, according to WSJ.

- US Commerce Secretary Lutnick was reported to have planned a visit to Epstein’s island with his family, according to the latest Epstein files released by the DoJ.

- NVIDIA's (NVDA) plan to invest USD 100bln in OpenAI was said to have stalled as discussions broke down amid concerns from within NVIDIA regarding the transaction, according to unidentified sources cited by WSJ. It was separately reported that NVIDIA CEO Huang said they will definitely invest in OpenAI, which will probably be their biggest investment, although he responded 'no, no, nothing like that' when asked if the investment would be over USD 100bln.

APAC TRADE

EQUITIES

- APAC stocks were pressured amid several recent bearish themes, including the partial US government shutdown and surprise contraction in Chinese official PMIs over the weekend, while sentiment was also not helped by the recent historic collapse in precious metals and with tech-related weakness after reports that NVIDIA's plan to invest USD 100bln OpenAI stalled.

- ASX 200 retreated with underperformance in the mining sector after a tumble in metal prices, including last Friday's biggest intraday drop for gold in four decades, while sentiment was not helped by wide consensus for a looming RBA rate hike.

- Nikkei 225 initially bucked the trend with early support from a weaker currency and with the Takaichi trade in play after a poll showed that the ruling LDP is likely on course for a landslide victory at the snap election this upcoming Sunday. However, the index gradually wiped out its gains and more alongside the broad risk-off mood across the region.

- Hang Seng and Shanghai Comp suffered after disappointing PMI data over the weekend, which showed official manufacturing and non-manufacturing PMI unexpectedly slipped into contraction territory, while the private sector RatingDog manufacturing PMI data matched estimates and continued to show an expansion, but failed to inspire risk sentiment. Furthermore, Chinese telecom names were among the worst performers after Beijing notified about raising telecom services VAT to 9% from 6%.

- US equity futures declined on several bearish factors, including tech-related headwinds after reports that NVIDIA's USD 100bln plan to invest in OpenAI stalled, while Bitcoin prices slumped over the weekend and briefly dipped below USD 75k.

- European equity futures indicate a negative cash market open with Euro Stoxx 50 futures down 0.8% after the cash market closed with gains of 1.0% on Friday.

FX

- DXY traded rangebound with demand constrained amid the partial US government shutdown, which is not expected to last long after the US Senate voted 71-29 to pass the USD 1.2tln government funding deal on Friday, and with the House expected to vote as soon as today on the plan. Participants also lacked conviction heading into an event-packed week, which includes several central bank rate decisions, the latest BLS jobs report and a Japanese snap election.

- EUR/USD eked slight gains but remained beneath the 1.1900 handle amid a lack of pertinent catalysts to spur the single currency and with the ECB expected to maintain policy settings at its meeting later in the week.

- GBP/USD lacked direction after a failure to sustain the 1.3700 status in uneventful FX trade and with the BoE expected to stand pat on Thursday after having just cut rates at the last meeting in December through a sharply divided vote split.

- USD/JPY initially climbed higher following comments from Japanese PM Takaichi on Saturday in which she seemingly lauded the effects of yen weakness, although she attempted to clarify the following day that her remarks were not intended to stress the advantages of a weaker currency.

- Antipodeans were subdued following the disappointing official Chinese PMI data over the weekend and amid the mostly downbeat risk appetite, while the RBA also began its 2-day policy meeting, where the central bank is expected to hike rates for the first time in over two years.

- PBoC set USD/CNY mid-point at 6.9695 vs exp. 6.9710 (Prev. 6.9678)

FIXED INCOME

- 10yr UST futures gained amid a flight to quality as risk assets took a hit but with upside capped after the recent Warsh Fed nomination and the current partial government shutdown, while participants also looked ahead to a busy week of events, including several central bank rate decisions and the latest Non-Farm Payrolls report.

- Bund futures marginally trickled lower amid light pertinent newsflow and with German Retail Sales data scheduled later, while demand was also not helped by looming Bund issuances totalling EUR 5.5bln over the next two days.

- 10yr JGB futures slipped at the open in a resumption of the recent bond rout but then gradually rebounded with the 'Takaichi trade' in early play after polls showed the ruling LDP is on course for a landslide victory at the snap election this Sunday.

COMMODITIES

- Crude futures slumped from the reopen amid the risk-off condition, with the demand side of the equation not helped by the partial US government shutdown and the surprise contractions in Chinese official PMIs. Furthermore, eight OPEC+ members unsurprisingly agreed to maintain the output hike pause for March and Russia eased some gasoline export restrictions, while it was also reported that the US and Iran could hold talks in Turkey this week.

- Eight OPEC+ members agreed on Sunday to maintain the pause in oil output hikes in March.

- US President Trump said he welcomes investment from China and India in Venezuelan oil, while he announced that they have already made a deal for India to buy Venezuelan oil.

- Russia will permit gasoline exports for fuel producers through to end-July to avoid overstocking, although it extended the ban on exports for non-producers, as well as the ban on diesel and other types of fuel for non-producers until end-July.

- Carlyle is in discussions for potential UAE partners amid the acquisition of Lukoil assets.

- Spot gold extended on last Friday's biggest intraday drop in four decades, which was triggered by the nomination of former Fed Governor Warsh for the Fed Chair role.

- CME raised gold and silver margins on Friday following a historic slump with Comex gold futures margins to increase from 6% to 8% of the value of the underlying contract for a non-heightened risk profile and will rise from 6.6% to 8.8% for elevated risk profile margins, while silver margins will increase from 11% to 15% for non-heightened risk profiles and will rise from 12.1% to 16.5% for heightened risk profiles.

- Copper futures retreated alongside the broad downbeat mood in the region and after official Chinese data showed a worsening in factory activity for the red metal's largest buyer, while the selling in the metals complex was further exacerbated as SHFE and LME trade got underway.

CRYPTO

- Bitcoin extended on the declines seen during the weekend after prices fell beneath the USD 80k level and eventually slipped to a trough below USD 75k before clawing back some of the losses.

NOTABLE ASIA-PAC HEADLINES

- Chinese President Xi called for China’s renminbi to attain global reserve currency status, according to FT.

- BoJ's Summary of Opinions from the January 22nd-23rd meeting noted that one member said financial conditions remain accommodative even after a rate hike in December, and a member said no need to worry too much about the impact on corporate profits as long as the rate hike pace is not too fast. A member said it was appropriate to continue raising the policy rate if economic and price projections materialise, and a member said current financial conditions were still significantly accommodative, judging from economic strength and fallout from the recent weak yen. Furthermore, a member said the bank has been examining the response of economic activity, prices and financial conditions to each rate hike and it is appropriate to continue to do so, while a member said they should raise the policy rate at intervals of a few months.

- Japanese PM Takaichi said in a speech on Saturday that the yen’s recent depreciation boosted exporters and returns from the government’s foreign exchange fund, while she failed to address concerns regarding the effect on consumer prices. However, she attempted to clarify on Sunday that she was referring solely to the need to build an economic structure that can withstand currency fluctuations, and not to stress the advantages of a weaker currency.

- Japan’s ruling LDP party is likely to win a landslide victory and exceed a majority of 233 seats, while the ruling bloc may win more than 300 seats in the 465-seat parliamentary snap election on February 8th, according to an Asahi survey.

- India increased infrastructure spending in its annual budget with the capital spending target for the upcoming fiscal year lifted by around 9% to INR 12.2tln, while it proposed to boost manufacturing in strategic sectors including rare earths and semiconductors, as well as proposed a tax holiday up to 2047 for foreign cloud companies making data centre investments in India. Furthermore, it strongly emphasised fiscal restraint and targeted reducing the debt-to-GDP ratio to 50% (+/-1%) from 56% by 2030/2031 and estimates the fiscal deficit will decline to 4.3% from 4.4% of GDP, while it is to raise the Securities Transaction Tax on futures and options trading.

DATA RECAP

- Chinese Manufacturing PMI (Jan) 49.3 vs Exp. 50.1 (Prev. 50.1)

- Chinese Non-Manufacturing PMI (Jan) 49.4 vs Exp. 50.3 (Prev. 50.2)

- Chinese Composite PMI (Jan) 49.8 (Prev. 50.7)

- Chinese RatingDog Manufacturing PMI (Jan) 50.3 vs. Exp. 50.3 (Prev. 50.1)

GEOPOLITICS

MIDDLE EAST

- Iranian Supreme Leader Khamenei warned that if the US launches a war, it won’t stay confined to Iran and would likely escalate into a broader regional conflict, according to Iran International. It was separately reported that Iran renewed its threat to strike Israel in which Iranian army chief Major-General Amir Hatami warned that “If the enemy makes a mistake, it will without doubt endanger its own security, the security of the region, and the security of the Zionist regime”.

- US officials said a meeting between the US and Iran could take place in Turkey this week, according to Axios’s Ravid.

- US State Department approved arms sales to Israel and Saudi Arabia valued at a total of nearly USD 16bln.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said Ukraine is ready for substantive discussions and is interested in results, while he announced the next trilateral peace talks between the US, Russia and Ukraine will take place in Abu Dhabi on Feb. 4th-5th.

- US envoy Witkoff said he held constructive talks with Russian special envoy Dmitriev on Saturday in Florida as part of the US effort to end the war in Ukraine.

- Russia’s Medvedev said victory will come soon in the Ukraine war, but it is equally important to think about how to prevent new conflicts, while he also commented that US President Trump is an effective leader who seeks peace and that they never found the two nuclear submarines Trump spoke about deploying closer to Russia.

- Russia’s Defence Ministry said Russia gained control over two villages in Ukraine’s Kharkiv and Donetsk region, according to TASS.

OTHER

- US President Trump said the US will make a deal with Cuba, while he said they have started negotiations regarding Greenland and that he thinks it’s pretty well agreed to.

EU/UK

NOTABLE HEADLINES

- UK PM Starmer said the UK should consider re-entering talks for a defence pact with the EU, while he added that Europe needs to step up and do more to defend itself in certain times, according to The Guardian.

- UK and Japan agreed to deepen defence and security cooperation.

- S&P affirmed Italy at 'BBB+' rating; Outlook Revised to Positive from Stable, while it affirmed the European Stability Mechanism at AAA; Outlook Stable.