New Home Sales Exploded Higher In August, But Prices Soared

With mortgage rates lower (but rising very recently), and mortgage applications spiking (though flat this week), and following record July cancellations, new home sales were expected to decline very modestly in August. The analysts could not have been more wrong as new home sales exploded 20.5% higher MoM (-0.3% exp) and are up 15.4% YoY.

That is the biggest MoM spike since August 2022...

Source: Bloomberg

The total new home sales SAAR surged to 800k (its highest since Dec 2021) and completely decoupled from existing home sales...

Source: Bloomberg

The surge was driven almost entirely sales in the South region...

Source: Bloomberg

The median new home price rose 1.9% y/y to $413,500, but the average selling price soared near record highs at $534,100...

That was the 3rd biggest monthly jump (+11.7%) in average home price since Lehman...

Source: Bloomberg

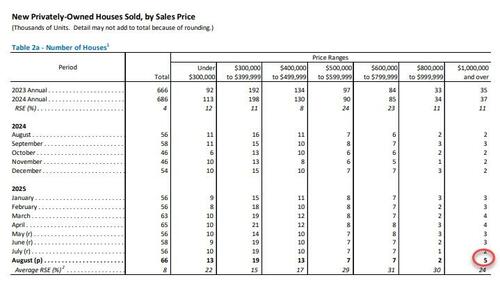

It appears the surge in sales was dominated by the most expensive homes...

But, even with the jump in median new home prices, they are still well below the existing home price...

Source: Bloomberg

Additionally, houses for sale in Aug. fell 1.4% m/m to 490,000 pushing the months’ supply at 7.4 in Aug. compared to 9.0 prior month.

Did homebuilders finally capitulate?

Is the sales jump sustainable?

“Lower borrowing costs supported a surge in new home sales in August, and could drive further increases in the coming months, given the continued decline in mortgage rates since then,” Thomas Ryan, North America economist at Capital Economics, said in a note.

Source: Bloomberg

The data suggest US homebuilders are successfully luring buyers off the sidelines with aggressive sales incentives. This month, 39% of builders reported cutting prices in a survey by the National Association of Home Builders and Wells Fargo, a post-pandemic high.

Homebuilder Lennar Corp. recently reported offering sales incentives equal to 14.3% of its average sale price, more than double its usual 5% or 6%

Despite the improved August numbers, US homebuilders are contending with lingering affordability concerns. Many buyers still can’t afford today’s prices and financing costs, and are increasingly nervous about the nation’s labor market.